United HealthCare Insurance Company. Definity SM. Health Reimbursement Account. For. Rockingham County

|

|

|

- Ginger Chandler

- 7 years ago

- Views:

Transcription

1 United HealthCare Insurance Company Definity SM Health Reimbursement Account For Rockingham County Group Number: Effective Date: October 1, 2009 HRA SPD

2

3 Notice to Employees Definity SM Health Reimbursement Account This booklet describes the Employer-sponsored Definity SM Health Reimbursement Account (Definity SM HRA) for Rockingham County ("Plan") as of October 1, has entered into an agreement with United HealthCare Insurance Company ("UnitedHealthcare") under which UnitedHealthcare will process reimbursements and provide certain other administrative services to the Plan. References throughout this document to "we," "us," and "our" are references to the Plan Sponsor. UnitedHealthcare does not insure the benefits described in this booklet. HRA SPD

4 Table of Contents Plan Highlights...1 Who is Eligible and How to Enroll...1 Your Health Reimbursement Account...1 How Definity SM HRA Works...2 Requesting Reimbursement from Your HRA...2 When Participation Ends...3 Claims and Appeal Notice...4 HRA SPD

5 Plan Highlights About Definity SM HRA Definity SM HRA gives you choice and control over your health care decisions and expenditures by combining a high deductible medical plan design with an ancillary Health Reimbursement Account (HRA). An HRA is an account funded by your employer which helps you to cover medical plan expenses that require some element of cost-sharing, such as deductibles. Definity SM HRA is made up of three components: 1. An HRA funded by your employer and maintained by UnitedHealthcare. 2. A high deductible medical plan. 3. Health information, tools and support. Benefits available under your medical plan are described in your medical plan Certificate of Coverage (COC). Who is Eligible and How to Enroll Who is Eligible Eligibility to participate in the Definity SM Health Reimbursement Account is described in the group policy for your medical plan. Contact us if you have questions about eligibility. When You May Enroll You are enrolled in the Definity SM Health Reimbursement Account at the same time you enroll in your medical plan, as described in the medical plan COC. You will need to enroll each Plan year, even if you enrolled in Definity SM HRA the Plan year before. Your Health Reimbursement Account When you enroll in Definity SM HRA, your employer will place funds in your Health Reimbursement Account. The amount placed in your HRA will depend upon the level of coverage you enroll for. If you elect coverage for employee only, an annual amount of $500 will be placed in your HRA. If you elect coverage for employee plus one, an annual amount of $1000 will be placed in your HRA. If you elect family coverage, an annual amount of $1000 will be placed in your HRA. The funds in your HRA will be available to help you pay a portion of your out-of-pocket costs under the medical plan, including annual deductibles. If you do not use all of the funds in your HRA during the Plan year, and you re-enroll in Definity SM HRA for the following Plan year, the balance remaining in your HRA will roll over. If you choose not to re-enroll in Definity SM HRA for the following Plan year, you will continue to have access to any funds remaining in 1 HRA SPD

6 your HRA until December 31 following the end of the Plan year in which you are covered under this Plan for use with remaining prior year claims. If your employment terminates for any reason the funds in your HRA will revert back to us after your claim run-out period, unless you elect COBRA coverage as described in your medical plan COC. The HRA funds will remain available to assist you in paying your out-of-pocket costs under the medical plan while COBRA coverage is in effect. If you experience a change in status during the Plan year, and you are allowed to change your coverage level, any current balance in your HRA will remain unchanged; however, the amount placed in your HRA will change as shown below: If you decrease your coverage (e.g., from family to employee only), the amount placed in your HRA for that Plan year will not change. If you increase coverage, the additional amount placed in your HRA will increase. The increase will be the difference between what was placed in your HRA at the beginning of the Plan year and what would have been placed in your account if you had elected the additional coverage at that time. You may, while enrolled in Definity SM HRA, elect to participate in a Flexible Spending Account/Health Care Spending Account ("FSA"). If you choose to do so, you must exhaust your HRA first before you can submit claims for medical expenses to your FSA for reimbursement. How Definity SM HRA Works With Definity SM HRA, you have to meet the annual deductible (see your medical plan COC) before you are eligible for benefits under the Plan. This means that when you visit a provider, you are responsible for the costs associated with the visit until you meet your annual deductible. The money in your HRA can be used to help you satisfy some of the deductible for covered health services. If you receive services from a network provider, the provider will submit the bill to the Claims Administrator for payment. Funds from your HRA can be used to pay for covered health services until the funds in the HRA are exhausted. If you choose, you may receive services from a non-network provider; however, you will be responsible for submitting a claim to the Claims Administrator and requesting payment from the funds that remain available in your HRA. See your medical plan COC for additional information. If you deplete your HRA, you are responsible for payment of any costs incurred until you reach your annual deductible. Once your annual deductible has been met for the year, covered health services are payable at a certain percentage of eligible expenses, as shown in the benefit information portion of your medical plan COC. Requesting Reimbursement from Your HRA When you receive covered health services from a network provider, your eligible expenses will be submitted automatically to your HRA after medical claim processing has been completed. This also applies when you receive covered health services from a non-network provider who submits your claims directly to the Claims Administrator for medical claims processing. Claims for reimbursement of any medical expenses must be submitted no later than December 31 following the end of the Plan year in which you are covered under this Plan. If this information is not provided to us within this timeframe, your claim will not be eligible for reimbursement, even if there are funds available in your HRA. This time limit does not apply if you are legally incapacitated. 2 HRA SPD

7 If You Receive Covered Health Services from a Network Provider When you receive covered health services from a network provider, the funds in your HRA may be used to help you meet your annual deductible under your medical plan. Once the annual deductible is met, you are responsible for the difference between the amount of eligible expenses the medical plan pays and the total eligible expenses. Any funds left in your HRA may be used to assist you in paying this difference, up to the network out-of-pocket maximum. Filing a Claim for Covered Health Services from a Non-Network Provider If you have funds in your HRA and you receive covered health services from a non-network provider, you are responsible for filing a request for reimbursement. The request for claim reimbursement from your HRA funds may be made for claims incurred while you are considered a covered person under your medical plan. If there are funds available in your HRA, they will be used to help meet your annual deductible under your medical plan. You are responsible for the difference between the amount the non-network provider bills you and the percentage of eligible expenses paid under your medical plan. Required Information for Filing a Claim When you request reimbursement from your HRA, you must complete the Health Reimbursement Account (HRA) claim form and attach itemized documentation as described on that form. The HRA claim form is available on myuhc.com or by calling the Customer Care telephone number on your ID card. Claims and Appeals For additional information about claims and for information about appeals, see the claims and appeals sections of your medical plan COC. When Participation Ends You will cease to participate in the Plan as of the earlier of: The date on which the HRA terminates. The date your employer fails to make a required contribution under the terms of the Plan. The date you cease to be an eligible employee under the medical plan. The date your coverage would otherwise end as described in your medical plan COC. Once participation ends, any funds remaining in your HRA will revert back to us. Access to HRA funds may be available to you while you remain a covered person under the medical plan, including while COBRA continuation coverage remains in effect. Contact us for information about HRA funds during Continuation Coverage under Federal Law (COBRA). 3 HRA SPD

8 Claims and Appeal Notice This Notice is provided to you in order to describe our responsibilities under federal law for making benefit determinations and your right to appeal adverse benefit determinations. To the extent that state law provides you with more generous timelines or opportunities for appeal, those rights also apply to you. Please refer to your benefit documents for information about your rights under state law. Benefit Determinations Post-service Claims Post-service claims are those claims that are filed for payment of benefits after medical care has been received. If your post-service claim is denied, you will receive a written notice from the Claims Administrator within 30 days of receipt of the claim, as long as all needed information was provided with the claim. The Claims Administrator will notify you within this 30 day period if additional information is needed to process the claim, and may request a one time extension not longer than 15 days and pend your claim until all information is received. Once notified of the extension, you then have 45 days to provide this information. If all of the needed information is received within the 45-day time frame, and the claim is denied, the Claims Administrator will notify you of the denial within 15 days after the information is received. If you don't provide the needed information within the 45-day period, your claim will be denied. A denial notice will explain the reason for denial, refer to the part of the plan on which the denial is based, and provide the claim appeal procedures. If you have prescription drug benefits and are asked to pay the full cost of a prescription when you fill it at a retail or mail-order pharmacy, and if you believe that it should have been paid under the Plan, you may submit a claim for reimbursement in accordance with the applicable claim filing procedures. If you pay a copayment and believe that the amount of the copayment was incorrect, you also may submit a claim for reimbursement in accordance with the applicable claim filing procedures. When you have filed a claim, your claim will be treated under the same procedures for post-service group health plan claims as described in this section. Pre-service Requests for Benefits Pre-service requests for benefits are those requests that require notification or approval prior to receiving medical care. If you have a pre-service request for benefits, and it was submitted properly with all needed information, you will receive written notice of the decision from the Claims Administrator within 15 days of receipt of the request. If you filed a pre-service request for benefits improperly, the Claims Administrator will notify you of the improper filing and how to correct it within 5 days after the pre-service request for benefits was received. If additional information is needed to process the pre-service request, the Claims Administrator will notify you of the information needed within 15 days after it was received, and may request a one time extension not longer than 15 days and pend your request until all information is received. Once notified of the extension you then have 45 days to provide this information. If all of the needed information is received within the 45-day time frame, we will notify you of the determination within 15 days after the information is received. If you don't provide the needed information within the 45-day period, your request for benefits will be denied. A denial notice will explain the reason for denial, refer to the part of the Plan on which the denial is based, and provide the appeal procedures. If you have prescription drug benefits and a retail or mail order pharmacy fails to fill a prescription that you have presented, you may file a pre-service health request for benefits in accordance with the applicable claim filing procedure. When you have filed a request for benefits, your request will be treated under the same procedures for pre-service group health plan requests for benefits as described in this section. 4 HRA SPD

9 Urgent Requests for Benefits that Require Immediate Attention Urgent requests for benefits are those that require notification or a benefit determination prior to receiving medical care, where a delay in treatment could seriously jeopardize your life or health, or the ability to regain maximum function or, in the opinion of a Physician with knowledge of your medical condition, could cause severe pain. In these situations: You will receive notice of the benefit determination in writing or electronically within 72 hours after the Claims Administrator receives all necessary information, taking into account the seriousness of your condition. Notice of denial may be oral with a written or electronic confirmation to follow within 3 days. If you filed an urgent request for benefits improperly, the Claims Administrator will notify you of the improper filing and how to correct it within 24 hours after the urgent request was received. If additional information is needed to process the request, the Claims Administrator will notify you of the information needed within 24 hours after the request was received. You then have 48 hours to provide the requested information. You will be notified of a benefit determination no later than 48 hours after: The Claims Administrator's receipt of the requested information; or The end of the 48-hour period within which you were to provide the additional information, if the information is not received within that time. A denial notice will explain the reason for denial, refer to the part of the Plan on which the denial is based, and provide the appeal procedures. Concurrent Care Claims If an on-going course of treatment was previously approved for a specific period of time or number of treatments, and your request to extend the treatment is an urgent request for benefits as defined above, your request will be decided within 24 hours, provided your request is made at least 24 hours prior to the end of the approved treatment. The Claims Administrator will make a determination on your request for the extended treatment within 24 hours from receipt of your request. If your request for extended treatment is not made at least 24 hours prior to the end of the approved treatment, the request will be treated as an urgent request for benefits and decided according to the timeframes described above. If an on-going course of treatment was previously approved for a specific period of time or number of treatments, and you request to extend treatment in a non-urgent circumstance, your request will be considered a new request and decided according to post-service or pre-service timeframes, whichever applies. Questions or Concerns about Benefit Determinations If you have a question or concern about a benefit determination, you may informally contact the Claims Administrator's Customer Care department before requesting a formal appeal. If the Customer Care representative cannot resolve the issue to your satisfaction over the phone, you may submit your question in writing. However, if you are not satisfied with a benefit determination as described above, you may appeal it as described below, without first informally contacting a Customer Care representative. If you first informally contact Customer Care and later wish to request a formal appeal in writing, you should again contact Customer Care and request an appeal. If you request a formal appeal, a Customer Care representative will provide you with the appropriate address. If you are appealing an urgent claim denial, please refer to Urgent Appeals that Require Immediate Action below and contact Customer Care immediately. 5 HRA SPD

10 How to Appeal a Claim Decision If you disagree with a pre-service request for benefits determination or post-service claim determination after following the above steps, you can contact the Claims Administrator in writing to formally request an appeal. Your request should include: The patient's name and the identification number from the ID card. The date(s) of medical service(s). The provider's name. The reason you believe the claim should be paid. Any documentation or other written information to support your request for claim payment. Your first appeal request must be submitted to the Claims Administrator within 180 days after you receive the claim denial. Appeal Process A qualified individual who was not involved in the decision being appealed will be appointed to decide the appeal. If your appeal is related to clinical matters, the review will be done in consultation with a health care professional with appropriate expertise in the field, who was not involved in the prior determination. The Claims Administrator (first level appeals) and the Plan Administrator (second level appeals) may consult with, or seek the participation of, medical experts as part of the appeal resolution process. You consent to this referral and the sharing of pertinent medical claim information. Upon request and free of charge, you have the right to reasonable access to (including copies of) all documents, records, and other information relevant to your claim for Benefits. Appeals Determinations Pre-service Requests for Benefits and Post-service Claim Appeals You will be provided written or electronic notification of the decision on your appeal as follows: For appeals of pre-service requests for benefits as identified above, the first level appeal will be conducted and you will be notified of the decision within 15 days from receipt of a request for appeal of a denied request for benefits. The second level appeal will be conducted and you will be notified by us of the decision within 15 days from receipt of a request for review of the first level appeal decision. For appeals of post-service claims as identified above, the first level appeal will be conducted and you will be notified by the Claims Administrator of the decision within 30 days from receipt of a request for appeal of a denied claim. The second level appeal will be conducted and you will be notified by us of the decision within 30 days from receipt of a request for review of the first level appeal decision. For procedures associated with urgent requests for Benefits, see Urgent Appeals That Require Immediate Action below. If you are not satisfied with the first level appeal decision of the Claims Administrator, you have the right to request a second level appeal from us as the Plan Administrator. Your second level appeal request must be submitted to us within 60 days from receipt of the first level appeal decision. The Plan Administrator has the exclusive right to interpret and administer the Plan, and these decisions are conclusive and binding. 6 HRA SPD

11 Please note that our decision is based only on whether or not benefits are available under the policy for the proposed treatment or procedure. We don't determine whether the pending health service is necessary or appropriate. That decision is between you and your physician. Urgent Appeals that Require Immediate Action Your appeal may require immediate action if a delay in treatment could significantly increase the risk to your health, or the ability to regain maximum function, or cause severe pain. In these urgent situations: The appeal does not need to be submitted in writing. You or your physician should call the Claims Administrator as soon as possible. The Claims Administrator will provide you with a written or electronic determination within 72 hours following receipt by the Claims Administrator of your request for review of the determination, taking into account the seriousness of your condition. For urgent requests for benefits appeals, we have delegated to the Claims Administrator the exclusive right to interpret and administer the provisions of the Plan. The Claims Administrator's decisions are conclusive and binding. 7 HRA SPD

12 8 HRA SPD

13

14 /04/2009

Medical and Rx Claims Procedures

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

United Healthcare Appeal Notification. For Medical Appeals: Section 6: Questions and Appeals

United Healthcare Appeal Notification For Medical Appeals: Please refer to the following information below that is from your Archdiocese of St. Louis Summary Plan Description (SPD) for the United Healthcare

United Healthcare Appeal Notification For Medical Appeals: Please refer to the following information below that is from your Archdiocese of St. Louis Summary Plan Description (SPD) for the United Healthcare

SUMMARY PLAN DESCRIPTION. for. the Retiree Medical and Dental Benefits of the. Bentley University. Employee Health and Welfare Benefit Plan

SUMMARY PLAN DESCRIPTION for the Retiree Medical and Dental Benefits of the Bentley University Employee Health and Welfare Benefit Plan Effective January 1, 2015 Table of Contents page Introduction...

SUMMARY PLAN DESCRIPTION for the Retiree Medical and Dental Benefits of the Bentley University Employee Health and Welfare Benefit Plan Effective January 1, 2015 Table of Contents page Introduction...

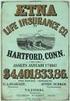

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

The Health Insurance Marketplace: Know Your Rights

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a Marketplace health plan. These rights include: Getting easy-to-understand information about what your plan

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a Marketplace health plan. These rights include: Getting easy-to-understand information about what your plan

How To Appeal An Adverse Benefit Determination In Aetna

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Certain exceptions apply to Hospital Inpatient Confinement for childbirth as described below.

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

9. Claims and Appeals Procedure

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Health Reimbursement Account (HRA) Frequently Asked Questions (FAQ)

Health Reimbursement Account (HRA) Frequently Asked Questions (FAQ) What is a Health Reimbursement Account (HRA)? The HRA is an employer-sponsored plan that can be used to reimburse a portion of you and

Health Reimbursement Account (HRA) Frequently Asked Questions (FAQ) What is a Health Reimbursement Account (HRA)? The HRA is an employer-sponsored plan that can be used to reimburse a portion of you and

EXTERNAL REVIEW CONSUMER GUIDE

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

Welcome to American Specialty Health Insurance Company

CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health

CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health

Appeals and Provider Dispute Resolution

Appeals and Provider Dispute Resolution There are two distinct processes related to Non-Coverage (Adverse) Determinations (NCD) regarding requests for services or payment: (1) Appeals and (2) Provider

Appeals and Provider Dispute Resolution There are two distinct processes related to Non-Coverage (Adverse) Determinations (NCD) regarding requests for services or payment: (1) Appeals and (2) Provider

HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

The Pennsylvania Insurance Department s. Your Guide to filing HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

RETIREE BENEFITS Health Reimbursement Arrangement (HRA).

RETIREE BENEFITS 1 RETIREE BENEFITS Health Reimbursement Arrangement (HRA). Benefits for Union Pacific s Medicare-eligible retirees and their Medicare- eligible spouses and/or dependents. 2 UNION PACIFIC

RETIREE BENEFITS 1 RETIREE BENEFITS Health Reimbursement Arrangement (HRA). Benefits for Union Pacific s Medicare-eligible retirees and their Medicare- eligible spouses and/or dependents. 2 UNION PACIFIC

Summary Plan Description for the North Las Vegas Fire Fighters Health and Welfare Trust Health Reimbursement Arrangement Plan

Summary Plan Description for the Health Reimbursement Arrangement Plan General Benefit Information Eligible Expenses All expenses that are eligible under Section 213(d) of the Internal Revenue Code, such

Summary Plan Description for the Health Reimbursement Arrangement Plan General Benefit Information Eligible Expenses All expenses that are eligible under Section 213(d) of the Internal Revenue Code, such

Health Care Flexible Spending Account (HCFSA) Plan Frequently Asked Questions

Health Care Flexible Spending Account (HCFSA) Plan Frequently Asked Questions General FSA Questions What is a Health Care Flexible Spending Account (HCFSA) Plan? The Health Care Flexible Spending Account

Health Care Flexible Spending Account (HCFSA) Plan Frequently Asked Questions General FSA Questions What is a Health Care Flexible Spending Account (HCFSA) Plan? The Health Care Flexible Spending Account

2015 HRA Account Frequently Asked Questions ("FAQs") Updated: December 17, 2014

2015 HRA Account Frequently Asked Questions ("FAQs") Updated: December 17, 2014 1. What is an HRA? An HRA is an IRS-approved tax-free benefit that reimburses plan members for out-of-pocket expenses not

2015 HRA Account Frequently Asked Questions ("FAQs") Updated: December 17, 2014 1. What is an HRA? An HRA is an IRS-approved tax-free benefit that reimburses plan members for out-of-pocket expenses not

User Guide. COBRA Employer Manual

Experience Excellence COBRA Manual User Guide COBRA Employer Manual COBRA Responsibilities and Deadlines Under COBRA, specific notices must be provided to covered employees and their families explaining

Experience Excellence COBRA Manual User Guide COBRA Employer Manual COBRA Responsibilities and Deadlines Under COBRA, specific notices must be provided to covered employees and their families explaining

Penn State Flexible Spending Account (FSA) Benefits

Penn State Flexible Spending Account (FSA) Benefits Eligibility and Enrollment Deadlines All regular, full-time faculty and staff members of the University are eligible to participate in the following

Penn State Flexible Spending Account (FSA) Benefits Eligibility and Enrollment Deadlines All regular, full-time faculty and staff members of the University are eligible to participate in the following

WELLNESS INCENTIVE (HRA) PLAN DESIGN GUIDE

WELLNESS INCENTIVE (HRA) PLAN DESIGN GUIDE Please fill out this form in its entirety and return to SelectAccount 45 days prior to your effective date in order for us to properly administer your plan. If

WELLNESS INCENTIVE (HRA) PLAN DESIGN GUIDE Please fill out this form in its entirety and return to SelectAccount 45 days prior to your effective date in order for us to properly administer your plan. If

Summary Plan Description FLEXIBLE SPENDING ACCOUNTS

Summary Plan Description FLEXIBLE SPENDING ACCOUNTS Effective 1/1/2013 FLEXIBLE SPENDING ACCOUNTS TABLE OF CONTENTS INTRODUCTION TO THE FLEXIBLE SPENDING ACCOUNTS 1 HOW FLEXIBLE SPENDING ACCOUNTS WORK

Summary Plan Description FLEXIBLE SPENDING ACCOUNTS Effective 1/1/2013 FLEXIBLE SPENDING ACCOUNTS TABLE OF CONTENTS INTRODUCTION TO THE FLEXIBLE SPENDING ACCOUNTS 1 HOW FLEXIBLE SPENDING ACCOUNTS WORK

Summary of Material Modifications (SMM) The Flexible Benefits Plan October 2015

Summary of Material Modifications (SMM) The Flexible Benefits Plan October 2015 This notice details changes and clarifications to your Summary Plan Description that are effective January 1, 2016, unless

Summary of Material Modifications (SMM) The Flexible Benefits Plan October 2015 This notice details changes and clarifications to your Summary Plan Description that are effective January 1, 2016, unless

FIDUCIARY UNDERSTANDING YOUR RESPONSIBILITIES UNDER A GROUP HEALTH PLAN. Health Insurance Cooperative Agency www.hicinsur.com 913.649.

UNDERSTANDING YOUR FIDUCIARY RESPONSIBILITIES UNDER A GROUP HEALTH PLAN Health Insurance Cooperative Agency www.hicinsur.com 913.649.5500 1 Content Introduction The essential elements of a group health

UNDERSTANDING YOUR FIDUCIARY RESPONSIBILITIES UNDER A GROUP HEALTH PLAN Health Insurance Cooperative Agency www.hicinsur.com 913.649.5500 1 Content Introduction The essential elements of a group health

STATE OF CONNECTICUT OFFICE OF THE STATE COMPTROLLER MEDICAL FLEXIBLE SPENDING ACCOUNT

STATE OF CONNECTICUT OFFICE OF THE STATE COMPTROLLER MEDICAL FLEXIBLE SPENDING ACCOUNT SUMMARY PLAN DESCRIPTION New 11/10 TABLE OF CONTENTS I ELIGIBILITY 1. What are the eligibility requirements for our

STATE OF CONNECTICUT OFFICE OF THE STATE COMPTROLLER MEDICAL FLEXIBLE SPENDING ACCOUNT SUMMARY PLAN DESCRIPTION New 11/10 TABLE OF CONTENTS I ELIGIBILITY 1. What are the eligibility requirements for our

The Health Insurance Marketplace: Know Your Rights

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a health plan in the Marketplace. These rights include: Getting easy-to-understand information about what your

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a health plan in the Marketplace. These rights include: Getting easy-to-understand information about what your

Health Reimbursement Arrangement (HRA).

Retiree benefits 1 Retiree benefits Health Reimbursement Arrangement (HRA). Benefits for Union Pacific s Medicare-eligible retirees and their Medicare- eligible spouses and/or dependents. 2 Union pacific

Retiree benefits 1 Retiree benefits Health Reimbursement Arrangement (HRA). Benefits for Union Pacific s Medicare-eligible retirees and their Medicare- eligible spouses and/or dependents. 2 Union pacific

Covered Person/Applicant Authorized Representative (please complete the Appointment of Authorized Representative section)

REQUEST FOR EXTERNAL REVIEW Instructions 1. If you are eligible and have completed the appeal process, you may request an external review of the denial by an External Review Organization (ERO). ERO reviews

REQUEST FOR EXTERNAL REVIEW Instructions 1. If you are eligible and have completed the appeal process, you may request an external review of the denial by an External Review Organization (ERO). ERO reviews

An Employer s Guide to Group Health Continuation Coverage Under COBRA

An Employer s Guide to Group Health Continuation Coverage Under COBRA The Consolidated Omnibus Reconciliation Act of 1986 U.S. Department of Labor Employee Benefits Security Administration This publication

An Employer s Guide to Group Health Continuation Coverage Under COBRA The Consolidated Omnibus Reconciliation Act of 1986 U.S. Department of Labor Employee Benefits Security Administration This publication

Newly-Eligible Medicare Advantage TRAIL Members FAQs What do I need to know about TRAIL as a newly-eligible annuitant or survivor?

Newly-Eligible Medicare Advantage TRAIL Members FAQs What do I need to know about TRAIL as a newly-eligible annuitant or survivor? TRAIL is a retiree healthcare program sponsored by the Teachers Retirement

Newly-Eligible Medicare Advantage TRAIL Members FAQs What do I need to know about TRAIL as a newly-eligible annuitant or survivor? TRAIL is a retiree healthcare program sponsored by the Teachers Retirement

Disability. Short-Term Disability benefits. Long-Term Disability benefits

Your plan provides you with disability coverage that gives you and your family protection against some of the financial hardships that can occur if you become disabled or injured. The benefits include:

Your plan provides you with disability coverage that gives you and your family protection against some of the financial hardships that can occur if you become disabled or injured. The benefits include:

EXAMPLE 2: Member has a health care flexible spending account through FedFlex. This member does not qualify for an HSA.

HRA Frequently Asked Questions 10/15 HRA Descriptions What is an HRA? How does it work? A health reimbursement arrangement (HRA) is an employer-provided tax-sheltered arrangement that allows individuals

HRA Frequently Asked Questions 10/15 HRA Descriptions What is an HRA? How does it work? A health reimbursement arrangement (HRA) is an employer-provided tax-sheltered arrangement that allows individuals

Appeals Provider Manual 15

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

Provider Manual. Utilization Management

Provider Manual Utilization Management Utilization Management This section of the Manual was created to help guide you and your staff in working with Kaiser Permanente s Utilization Management (UM) policies

Provider Manual Utilization Management Utilization Management This section of the Manual was created to help guide you and your staff in working with Kaiser Permanente s Utilization Management (UM) policies

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN. Amended and Restated

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN Amended and Restated Effective June 1, 2006 SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN Amended and Restated Effective June 1, 2006 SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE

OUTLINE OF MEDICARE SUPPLEMENT COVERAGE BENEFIT CHART OF MEDICARE SUPPLEMENT PLANS SOLD FOR EFFECTIVE DATES ON OR AFTER JUNE 1, 2010

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DESIGN GUIDE

FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DESIGN GUIDE Please complete this form and return to SelectAccount 45 days before your effective date so we can properly administer your plan. If you have any questions,

FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DESIGN GUIDE Please complete this form and return to SelectAccount 45 days before your effective date so we can properly administer your plan. If you have any questions,

Self-Funded Provider Manual Section 3 Member Eligibility and Benefits Determination Product Descriptions Drug Benefits and Formulary

Self-Funded Provider Manual Section 3 Member Eligibility and Benefits Product Descriptions Drug Benefits and Formulary Self-Funded Provider Manual 1 Table of Contents SECTION 3: ELIGIBILITY AND BENEFITS

Self-Funded Provider Manual Section 3 Member Eligibility and Benefits Product Descriptions Drug Benefits and Formulary Self-Funded Provider Manual 1 Table of Contents SECTION 3: ELIGIBILITY AND BENEFITS

HOW TO COMPLETE THIS FORM

HOW TO COMPLETE THIS FORM For your convenience, Sharp Health plan makes this reimbursement form available for your use. All requests for reimbursement received in writing shall be processed. 1. The Member

HOW TO COMPLETE THIS FORM For your convenience, Sharp Health plan makes this reimbursement form available for your use. All requests for reimbursement received in writing shall be processed. 1. The Member

UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS

April 2015 UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS ELIGIBILITY CLAIMS PROCEDURES Any participant (employee) or beneficiary (dependent), or an authorized representative

April 2015 UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS ELIGIBILITY CLAIMS PROCEDURES Any participant (employee) or beneficiary (dependent), or an authorized representative

BARTON COUNTY COMMUNITY COLLEGE EMPLOYEE HEALTH CARE PLAN. Summary Plan Description

BARTON COUNTY COMMUNITY COLLEGE EMPLOYEE HEALTH CARE PLAN Summary Plan Description PO Box 1090, Great Bend, KS 67530/ (620) 792-1779/ (800) 290-1368 www.bmikansas.com BARTON COUNTY COMMUNITY COLLEGE EMPLOYEE

BARTON COUNTY COMMUNITY COLLEGE EMPLOYEE HEALTH CARE PLAN Summary Plan Description PO Box 1090, Great Bend, KS 67530/ (620) 792-1779/ (800) 290-1368 www.bmikansas.com BARTON COUNTY COMMUNITY COLLEGE EMPLOYEE

Health Care Management Policy and Procedure

Utilization Management... 2 Pharmaceutical Management... 3 Member Clinical Appeal and Independent External Review ASO Groups Not Voluntarily Complying with the Illinois External Review Act (Federal)...

Utilization Management... 2 Pharmaceutical Management... 3 Member Clinical Appeal and Independent External Review ASO Groups Not Voluntarily Complying with the Illinois External Review Act (Federal)...

Agent Instruction Sheet for PriorityHRA Plan Document

Agent Instruction Sheet for PriorityHRA Plan Document Thank you for choosing PriorityHRA! Here are some instructions as to what to do with each PriorityHRA document. Required Documents: HRA Application

Agent Instruction Sheet for PriorityHRA Plan Document Thank you for choosing PriorityHRA! Here are some instructions as to what to do with each PriorityHRA document. Required Documents: HRA Application

Compliance Assistance Group Health and Disability Plans

Compliance Assistance Group Health and Disability Plans Benefit Claims Procedure Regulation (29 CFR 2560.503-1) The claims procedure regulation (29 CFR 2560.503-1) provides minimum procedural requirements

Compliance Assistance Group Health and Disability Plans Benefit Claims Procedure Regulation (29 CFR 2560.503-1) The claims procedure regulation (29 CFR 2560.503-1) provides minimum procedural requirements

FAQs: Health Savings Accounts

What is a Health Savings Account? A Health Savings Account (HSA) is a savings product that allows individuals to pay for current qualified medical expenses and save toward future medical expenses on a

What is a Health Savings Account? A Health Savings Account (HSA) is a savings product that allows individuals to pay for current qualified medical expenses and save toward future medical expenses on a

UnitedHealthcare Choice Plus. UnitedHealthcare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Health Savings Account (HSA) Plan 4X8 of Southern State Community College Enrolling Group Number: 755032

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Health Savings Account (HSA) Plan 4X8 of Southern State Community College Enrolling Group Number: 755032

Health Reimbursement Arrangement (HRA) Plan

3M Retiree Health Reimbursement Arrangement (HRA) Plan (Effective January 1, 2013) Summary Plan Description Table of Contents Introduction... 4 Customer Service... 5 Eligibility... 7 Retiree Eligibility...

3M Retiree Health Reimbursement Arrangement (HRA) Plan (Effective January 1, 2013) Summary Plan Description Table of Contents Introduction... 4 Customer Service... 5 Eligibility... 7 Retiree Eligibility...

Utilization Review Determinations Timeframe

Utilization Review s Timeframe The purpose of this chart is to reference utilization review determination timeframes. It is not meant to completely outline the UR process. See Policy: Prospective, Concurrent,

Utilization Review s Timeframe The purpose of this chart is to reference utilization review determination timeframes. It is not meant to completely outline the UR process. See Policy: Prospective, Concurrent,

Medical, RX, Dental and Vision SPD

Medical, Dental and Vision Benefit Provisions of the CITGO Petroleum Corporation Medical, Dental, Vision, & Life Insurance Plan For Hourly Employees Summary Plan Description As in effect January 1, 2013

Medical, Dental and Vision Benefit Provisions of the CITGO Petroleum Corporation Medical, Dental, Vision, & Life Insurance Plan For Hourly Employees Summary Plan Description As in effect January 1, 2013

Business Blue SM. Employee Booklet. Group and Individual Division. Bus.Blue book SMGRP-NGF (Rev. 1/12) High Deductible Ord.

Business Blue SM Employee Booklet Group and Individual Division Bus.Blue book SMGRP-NGF (Rev. 1/12) www.southcarolinablues.com Dear Member: I would like to take this opportunity to welcome you to Blue

Business Blue SM Employee Booklet Group and Individual Division Bus.Blue book SMGRP-NGF (Rev. 1/12) www.southcarolinablues.com Dear Member: I would like to take this opportunity to welcome you to Blue

Choice Plus Plan. UnitedHealthcare. with a HEALTH REIMBURSEMENT ACCOUNT. Medical. You can choose any doctor or hospital you want.

Medical UnitedHealthcare Choice Plus Plan with a HEALTH REIMBURSEMENT ACCOUNT welcometouhc.com Find a network doctor. Choose with confidence. Our UnitedHealth Premium designation program recognizes physicians

Medical UnitedHealthcare Choice Plus Plan with a HEALTH REIMBURSEMENT ACCOUNT welcometouhc.com Find a network doctor. Choose with confidence. Our UnitedHealth Premium designation program recognizes physicians

Simple. UnitedHealthcare Plan Benefits. Personal. Empowering. An easy-to-use guide to understanding your UnitedHealthcare benefits offered by Sprint.

UnitedHealthcare Plan Benefits Simple. Personal. Empowering. An easy-to-use guide to understanding your UnitedHealthcare benefits offered by Sprint. What s Inside: Introduction..........................

UnitedHealthcare Plan Benefits Simple. Personal. Empowering. An easy-to-use guide to understanding your UnitedHealthcare benefits offered by Sprint. What s Inside: Introduction..........................

LCRA Frequently Asked Questions: Medicare Health Plans and Retiree Reimbursement Accounts (RRAs)

LCRA Frequently Asked Questions: Medicare Health Plans and Retiree Reimbursement Accounts (RRAs) Medicare Health and Prescription Drug Plans 1. Q: Do I have to enroll in Medicare Part A and Part B? A:

LCRA Frequently Asked Questions: Medicare Health Plans and Retiree Reimbursement Accounts (RRAs) Medicare Health and Prescription Drug Plans 1. Q: Do I have to enroll in Medicare Part A and Part B? A:

Flexible Spending Accounts (FSAs)

Flexible Spending Accounts (FSAs) Frequently Asked Participant Questions (FAQ) GENERAL FSA What Is A Health Care Flexible Spending Account (FSA)? The Health Care FSA is an employer-sponsored plan, which

Flexible Spending Accounts (FSAs) Frequently Asked Participant Questions (FAQ) GENERAL FSA What Is A Health Care Flexible Spending Account (FSA)? The Health Care FSA is an employer-sponsored plan, which

Appeals: Eligibility & Health Plan Decisions in the Health Insurance Marketplace

Appeals: Eligibility & Health Plan Decisions in the Health Insurance Marketplace There are 2 kinds of appeals you can make once you ve applied and enrolled in coverage through the Health Insurance Marketplace:

Appeals: Eligibility & Health Plan Decisions in the Health Insurance Marketplace There are 2 kinds of appeals you can make once you ve applied and enrolled in coverage through the Health Insurance Marketplace:

TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

NYU HOSPITALS CENTER. Retirement Plan. Your Health & Welfare Plan Benefits

NYU HOSPITALS CENTER Retirement Plan Your Health & Welfare Plan Benefits 1 What s Inside Welcome to the NYU Hospitals Center Retiree Health & Welfare Program Retiree Health & Welfare Benefits At-A-Glance...

NYU HOSPITALS CENTER Retirement Plan Your Health & Welfare Plan Benefits 1 What s Inside Welcome to the NYU Hospitals Center Retiree Health & Welfare Program Retiree Health & Welfare Benefits At-A-Glance...

COMMUNITY HEALTHCARE SYSTEM, INC. EMPLOYEE HEALTH CARE PLAN

COMMUNITY HEALTHCARE SYSTEM, INC. EMPLOYEE HEALTH CARE PLAN Summary Plan Description PO Box 1090, Great Bend, KS 67530/ (620) 792-1779/ (800) 290-1368 www.bmikansas.com COMMUNITY HEALTHCARE SYSTEM, INC.

COMMUNITY HEALTHCARE SYSTEM, INC. EMPLOYEE HEALTH CARE PLAN Summary Plan Description PO Box 1090, Great Bend, KS 67530/ (620) 792-1779/ (800) 290-1368 www.bmikansas.com COMMUNITY HEALTHCARE SYSTEM, INC.

FREQUENTLY ASKED QUESTIONS ABOUT THE FSA DEBIT CARD

FREQUENTLY ASKED QUESTIONS ABOUT THE FSA DEBIT CARD How does the FSA Debit Card factor in? If you participated in the Flexible Spending Plan last plan year, you will not receive a new card for the current

FREQUENTLY ASKED QUESTIONS ABOUT THE FSA DEBIT CARD How does the FSA Debit Card factor in? If you participated in the Flexible Spending Plan last plan year, you will not receive a new card for the current

GRINNELL-NEWBURG SCHOOLS EMPLOYEE BENEFIT PROGRAMS 2015-2016. Summary Plan Description (SPD)

GRINNELL-NEWBURG SCHOOLS EMPLOYEE BENEFIT PROGRAMS 2015-2016 Summary Plan Description (SPD) PLAN SPONSOR The Plan Sponsor and Employer for Grinnell-Newburg Schools Benefits Plan is: Grinnell-Newburg Community

GRINNELL-NEWBURG SCHOOLS EMPLOYEE BENEFIT PROGRAMS 2015-2016 Summary Plan Description (SPD) PLAN SPONSOR The Plan Sponsor and Employer for Grinnell-Newburg Schools Benefits Plan is: Grinnell-Newburg Community

FREQUENTLY ASKED QUESTIONS ID CARDS / ELIGIBILITY / ENROLLMENT

FREQUENTLY ASKED QUESTIONS ID CARDS / ELIGIBILITY / ENROLLMENT BENEFIT INFORMATION CLAIMS STATUS/INFORMATION GENERAL INFORMATION PROVIDERS THE SIGNATURE 90 ACCOUNT PLAN THE SIGNATURE 80 PLAN USING YOUR

FREQUENTLY ASKED QUESTIONS ID CARDS / ELIGIBILITY / ENROLLMENT BENEFIT INFORMATION CLAIMS STATUS/INFORMATION GENERAL INFORMATION PROVIDERS THE SIGNATURE 90 ACCOUNT PLAN THE SIGNATURE 80 PLAN USING YOUR

FEHB Program Carrier Letter All Carriers

FEHB Program Carrier Letter All Carriers U.S. Office of Personnel Management Insurance Operations Letter No. 2010-20 Date: October 19, 2010 Fee-for-Service [16] Experience-rated HMO [16] Community-rated

FEHB Program Carrier Letter All Carriers U.S. Office of Personnel Management Insurance Operations Letter No. 2010-20 Date: October 19, 2010 Fee-for-Service [16] Experience-rated HMO [16] Community-rated

Frequently Asked Questions about Retiree Reimbursement Accounts (RRAs)

Frequently Asked Questions about Retiree Reimbursement Accounts (RRAs) 1. Do I need to do anything to sign up for an RRA? No. You re automatically enrolled in the RRA. If you want to use the online tools,

Frequently Asked Questions about Retiree Reimbursement Accounts (RRAs) 1. Do I need to do anything to sign up for an RRA? No. You re automatically enrolled in the RRA. If you want to use the online tools,

Health and Dental Insurance Questions/Answers for Retirees

Health and Dental Insurance Questions/Answers for Retirees What happens with my health insurance if I continue to work full-time beyond age 65? As an active full-time employee working beyond the age of

Health and Dental Insurance Questions/Answers for Retirees What happens with my health insurance if I continue to work full-time beyond age 65? As an active full-time employee working beyond the age of

An Employer s Guide to Group Health Continuation Coverage Under COBRA

An Employer s Guide to Group Health Continuation Coverage Under COBRA The Consolidated Omnibus Budget Reconciliation Act EMPLOYEE BENEFITS SECURITY ADMINISTRATION UNITED STATES DEPARTMENT OF LABOR This

An Employer s Guide to Group Health Continuation Coverage Under COBRA The Consolidated Omnibus Budget Reconciliation Act EMPLOYEE BENEFITS SECURITY ADMINISTRATION UNITED STATES DEPARTMENT OF LABOR This

COBRA & DIRECT PAY JOB AID

Table of Contents TABLE OF CONTENTS COBRA & DIRECT PAY JOB AID 1 2 10/2014 Table of Contents... 3 Direct Pay... 5 Invoicing & Terms of Payment... 5 Premium Remittance... 6 Non-Sufficient Funds and Stop

Table of Contents TABLE OF CONTENTS COBRA & DIRECT PAY JOB AID 1 2 10/2014 Table of Contents... 3 Direct Pay... 5 Invoicing & Terms of Payment... 5 Premium Remittance... 6 Non-Sufficient Funds and Stop

Summary Plan Description

Summary Plan Description Valparaiso University Flexible Spending Account Plan Effective: January 1, 2013 Group Number: 730347 FLEXIBLE SPENDING ACCOUNT PLAN Notice To Employees This booklet describes

Summary Plan Description Valparaiso University Flexible Spending Account Plan Effective: January 1, 2013 Group Number: 730347 FLEXIBLE SPENDING ACCOUNT PLAN Notice To Employees This booklet describes

External Review Request Form

External Review Request Form This EXTERNAL REVIEW REQUEST FORM must be filed with the Nebraska Department of Insurance within FOUR (4) MONTHS after receipt from your insurer of a denial of payment on a

External Review Request Form This EXTERNAL REVIEW REQUEST FORM must be filed with the Nebraska Department of Insurance within FOUR (4) MONTHS after receipt from your insurer of a denial of payment on a

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

CenturyLink United Healthcare PPO & MEDICARE SUPPLEMENT MEDICAL PLANS Legacy CenturyTel Retirees

CenturyLink United Healthcare PPO & MEDICARE SUPPLEMENT MEDICAL PLANS Legacy CenturyTel Retirees TABLE OF CONTENTS INTRODUCTION...7 CLAIMS ADMINISTRATORS...8 United Healthcare (UHC)...8 Express Scripts...8

CenturyLink United Healthcare PPO & MEDICARE SUPPLEMENT MEDICAL PLANS Legacy CenturyTel Retirees TABLE OF CONTENTS INTRODUCTION...7 CLAIMS ADMINISTRATORS...8 United Healthcare (UHC)...8 Express Scripts...8

Workforce Management Organization. 2015 COBRA Benefits Overview After Employment or Loss of Eligibility Options

Workforce Management Organization 2015 COBRA Benefits Overview After Employment or Loss of Eligibility Options Revised 7/2015 When Benefits Coverage Ends? Your benefit coverage will end at midnight on

Workforce Management Organization 2015 COBRA Benefits Overview After Employment or Loss of Eligibility Options Revised 7/2015 When Benefits Coverage Ends? Your benefit coverage will end at midnight on

Your Spending Arrangement Program

Your Spending Arrangement Program (Medicare Retirees, Medicare Surviving Spouses, Medicare Long-Term Disability Terminees, and/or Medicare Dependents) Revised: January 1, 2015 Program Summary Important

Your Spending Arrangement Program (Medicare Retirees, Medicare Surviving Spouses, Medicare Long-Term Disability Terminees, and/or Medicare Dependents) Revised: January 1, 2015 Program Summary Important

How To Get A Pension From The Boeing Company

Employee Benefits Retiree Medical Plan Retiree Medical Plan Boeing Medicare Supplement Plan Summary Plan Description/2006 Retired Union Employees Formerly Represented by SPEEA (Professional and Technical

Employee Benefits Retiree Medical Plan Retiree Medical Plan Boeing Medicare Supplement Plan Summary Plan Description/2006 Retired Union Employees Formerly Represented by SPEEA (Professional and Technical

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

UnitedHealthcare. with a HEALTH REIMBURSEMENT ACCOUNT (HRA) A national network to help lower your costs

Medical UnitedHealthcare Choice Plus Plan with a HEALTH REIMBURSEMENT ACCOUNT (HRA) Visit welcometouhc.com Find a network doctor. Estimate the cost of the plan. Find a network pharmacy. See recommended

Medical UnitedHealthcare Choice Plus Plan with a HEALTH REIMBURSEMENT ACCOUNT (HRA) Visit welcometouhc.com Find a network doctor. Estimate the cost of the plan. Find a network pharmacy. See recommended

State of New Hampshire Employee Health Benefit Program. Health Reimbursement Arrangement. Benefit Booklet

State of New Hampshire Employee Health Benefit Program Health Reimbursement Arrangement Benefit Booklet January 2014 Table of Contents INTRODUCTION... 4 I. Benefits & Eligibility... 4 1. What Benefits

State of New Hampshire Employee Health Benefit Program Health Reimbursement Arrangement Benefit Booklet January 2014 Table of Contents INTRODUCTION... 4 I. Benefits & Eligibility... 4 1. What Benefits

Member Handbook A brief guide to your health care coverage

Member Handbook A brief guide to your health care coverage Preferred Provider Organization Plan Using the Private Healthcare Systems Network PREFERRED PROVIDER ORGANIZATION (PPO) PLAN USING THE PRIVATE

Member Handbook A brief guide to your health care coverage Preferred Provider Organization Plan Using the Private Healthcare Systems Network PREFERRED PROVIDER ORGANIZATION (PPO) PLAN USING THE PRIVATE

For Members of Large Group HMO_POS Plans. Florida Hospital Care Advantage

For Members of Large Group HMO_POS Plans Florida Hospital Care Advantage Member Guidebook 6450 US Highway 1, Rockledge, FL 32955 Toll-free 1.844.522.5279 TDD/TTY relay 1.800.955.8771 Monday-Friday, 8 am

For Members of Large Group HMO_POS Plans Florida Hospital Care Advantage Member Guidebook 6450 US Highway 1, Rockledge, FL 32955 Toll-free 1.844.522.5279 TDD/TTY relay 1.800.955.8771 Monday-Friday, 8 am

Hello. Medicare Advantage plans. Overview 2. Plans 3. Timing 6. Tools 7

Hello Advantage At UnitedHealthcare, we want you to get the most from your Medicare coverage. Our simple, all-in-one Medicare Advantage plans are designed to offer you benefits, services and tools to help

Hello Advantage At UnitedHealthcare, we want you to get the most from your Medicare coverage. Our simple, all-in-one Medicare Advantage plans are designed to offer you benefits, services and tools to help

APWU Health Plan s Blueprint to. Understanding your health insurance coverage

APWU Health Plan s Blueprint to Understanding your health insurance coverage This guide is designed to help you understand how APWU Health Plan works with Medicare. Dealing with one health insurance company

APWU Health Plan s Blueprint to Understanding your health insurance coverage This guide is designed to help you understand how APWU Health Plan works with Medicare. Dealing with one health insurance company

NATIONAL ROOFERS UNION AND EMPLOYERS JOINT HEALTH AND WELFARE FUND

NATIONAL ROOFERS UNION AND EMPLOYERS JOINT HEALTH AND WELFARE FUND Summary Plan Description and Plan Rules describing the Medical, Dental, Vision, Disability Income, Life and Accidental Death and Dismemberment

NATIONAL ROOFERS UNION AND EMPLOYERS JOINT HEALTH AND WELFARE FUND Summary Plan Description and Plan Rules describing the Medical, Dental, Vision, Disability Income, Life and Accidental Death and Dismemberment

Medicare & Senior Advantage Guide for Retiring Physicians

Medicare & Senior Advantage Guide for Retiring Physicians Medicare Basics Medicare is a federal health insurance program that pays for hospital and medical care for: Individuals who are age 65 or older

Medicare & Senior Advantage Guide for Retiring Physicians Medicare Basics Medicare is a federal health insurance program that pays for hospital and medical care for: Individuals who are age 65 or older

Your Health Care Benefit Program. BlueAdvantage Entrepreneur Participating Provider Option

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

9.0 Government Safety Net Programs

9.0 Government Safety Net Programs 9.1 Medicaid Managed Care, Child Health Plus and Family Health Plus Note: This section does not apply to Healthy New York, another government safety net program with

9.0 Government Safety Net Programs 9.1 Medicaid Managed Care, Child Health Plus and Family Health Plus Note: This section does not apply to Healthy New York, another government safety net program with

MEDICARE FACTS 2014 MEDICARE AND YOUR ALCATEL-LUCENT COVERAGE

MEDICARE FACTS 2014 MEDICARE AND YOUR ALCATEL-LUCENT COVERAGE Use this guide to learn more about Medicare and how it works with your Alcatel-Lucent medical and prescription drug coverage. For Formerly

MEDICARE FACTS 2014 MEDICARE AND YOUR ALCATEL-LUCENT COVERAGE Use this guide to learn more about Medicare and how it works with your Alcatel-Lucent medical and prescription drug coverage. For Formerly

Direct FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DESIGN GUIDE. For Office Use Only SelectAccount Group Number Enrollment Specialist Market Segment

I. EMPLOYER INFORMATION Direct FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DESIGN GUIDE Employer s Name Employer s Street Address City State Zip Code Employer s Tax I.D. Number (required) Type of Corporation

I. EMPLOYER INFORMATION Direct FLEXIBLE SPENDING ACCOUNT (FSA) PLAN DESIGN GUIDE Employer s Name Employer s Street Address City State Zip Code Employer s Tax I.D. Number (required) Type of Corporation

005. Independent Review Organization External Review Annual Report Form

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

UnitedHealthcare Choice Plus. United HealthCare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus United HealthCare Insurance Company Certificate of Coverage For Westminster College Enrolling Group Number: 715916 Effective Date: January 1, 2009 Offered and Underwritten

UnitedHealthcare Choice Plus United HealthCare Insurance Company Certificate of Coverage For Westminster College Enrolling Group Number: 715916 Effective Date: January 1, 2009 Offered and Underwritten

A Guide to Your 2013 UnitedHealthcare Plan Benefits

Health Plan Guide A Guide to Your 2013 UnitedHealthcare Plan Benefits Look inside to learn about: Your health plan options Your preventive care coverage Your prescription coverage http://welcometouhc.com/tascinc

Health Plan Guide A Guide to Your 2013 UnitedHealthcare Plan Benefits Look inside to learn about: Your health plan options Your preventive care coverage Your prescription coverage http://welcometouhc.com/tascinc

Your Disability Plan Handbook...

due benefits. End of Definition of Disability Tax Information Insurance Premiums Thrift Plan Flexible Spending Reductions Rehabilitation & Vocational Training Return-to-work Incentives Appeal Process Notification

due benefits. End of Definition of Disability Tax Information Insurance Premiums Thrift Plan Flexible Spending Reductions Rehabilitation & Vocational Training Return-to-work Incentives Appeal Process Notification

Services Available to Members Complaints & Appeals

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Summary Plan Description Parkway School District Flexible Spending Account Plan

Summary Plan Description Parkway School District Flexible Spending Account Plan Effective: January 1, 2015 Group Number: Medical 716393; FSA 812070 FLEXIBLE SPENDING ACCOUNT PLAN Notice To Employees

Summary Plan Description Parkway School District Flexible Spending Account Plan Effective: January 1, 2015 Group Number: Medical 716393; FSA 812070 FLEXIBLE SPENDING ACCOUNT PLAN Notice To Employees

Reporting and Plan Documents under ERISA and Cafeteria Plan Rules

Reporting and Plan Documents under ERISA and Cafeteria Plan Rules The Employee Retirement Income Security Act (ERISA) was signed in 1974. The U.S. Department of Labor (DOL) is the agency responsible for

Reporting and Plan Documents under ERISA and Cafeteria Plan Rules The Employee Retirement Income Security Act (ERISA) was signed in 1974. The U.S. Department of Labor (DOL) is the agency responsible for

Health Reimbursement Account

Health Reimbursement Account [formerly Flexible Reimbursement Account (FRA)] Summary Plan Description Prior to January 2009, this Vanderbilt benefit was referred to as Flexible Reimbursement Account (FRA).

Health Reimbursement Account [formerly Flexible Reimbursement Account (FRA)] Summary Plan Description Prior to January 2009, this Vanderbilt benefit was referred to as Flexible Reimbursement Account (FRA).

SUMMARY PLAN DESCRIPTION AND PLAN DOCUMENT HRA FOR MEDICARE ELIGIBLE RETIREES

Automobile Mechanics Local No. 701 Union and Industry Welfare Fund SUMMARY PLAN DESCRIPTION AND PLAN DOCUMENT HRA FOR MEDICARE ELIGIBLE RETIREES Dear Participant: We are pleased to provide you with this

Automobile Mechanics Local No. 701 Union and Industry Welfare Fund SUMMARY PLAN DESCRIPTION AND PLAN DOCUMENT HRA FOR MEDICARE ELIGIBLE RETIREES Dear Participant: We are pleased to provide you with this

Health Reimbursement Arrangement (HRA) Accounts

Health Reimbursement Arrangement (HRA) Accounts Questions & Answers for Plan Year 2013 1. Q: How much will be contributed to my HRA account for 2013? A: $600 will be contributed for eligible Administrators

Health Reimbursement Arrangement (HRA) Accounts Questions & Answers for Plan Year 2013 1. Q: How much will be contributed to my HRA account for 2013? A: $600 will be contributed for eligible Administrators