Certain exceptions apply to Hospital Inpatient Confinement for childbirth as described below.

|

|

|

- Donald Stone

- 8 years ago

- Views:

Transcription

1 Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced by 30% unless: - For Hospital Inpatient Confinement Charges and charges for services provided in an inpatient confinement facility, a Precertification is requested from the Company by the Insured Person or a designated patient representative as soon as a Hospital Inpatient Confinement or confinement in an inpatient confinement facility is scheduled, but no later than the day of a Hospital Inpatient Confinement or confinement in an inpatient confinement facility, for other than Emergency Services. If a Precertification is not requested in a timely manner as specified above, the 30% reduction in benefits payable will be applied to all non-emergency Hospital Inpatient Confinement Charges and charges in an inpatient confinement facility. For the purpose of these requirements, Precertification means notification to the Company by the Insured Person or his or her designated representative prior to a nonemergency Hospital Inpatient Confinement or confinement in an inpatient confinement facility. Benefits will be payable only for that part of the Hospital Inpatient Confinement Charges or inpatient confinement facility charges that the Company determines to be a Covered Charge. An inpatient confinement facility includes: - Hospital; - Skilled Nursing Facility; - Rehabilitation hospital; - Hospice; - Long term acute care facility; - Psychiatric Hospital or psychiatric unit of a general Hospital for Mental Health or Behavioral Treatment Services; - Inpatient Alcohol or Drug Abuse Treatment Facility or drug or alcohol unit of a general Hospital or any other facility required by state law to be recognized as a treatment facility under the Group Policy for Alcohol and Drug Abuse Treatment Services; Certain exceptions apply to Hospital Inpatient Confinement for childbirth as described below. - For Emergency Services, the Insured Person or a designated patient representative must contact the Company within two business days of a Hospital Inpatient Confinement or of a confinement in an inpatient confinement facility. April 2015

2 The 30% reduction in Benefits Payable is a penalty for failure to comply with the Utilization Management Requirements listed. The reduction: - will not count toward satisfaction of the Out-of-Pocket Expense limits; and - will not exceed $2,500 per individual each Calendar Year. - Precertification - Applicable to medical care received from PPO Providers or Non- Preferred Providers A Precertification by the Company is required for all Hospital Inpatient Confinements or inpatient facility confinements. Precertification requires a review by the Company of a Physician's report of the need for a Hospital Inpatient Confinement or confinement in an inpatient confinement facility, (unless it is for an automatically approved Hospital Inpatient Confinement for childbirth). The report (verbal or Written) must include the: - reason(s) for the Hospital Inpatient Confinement or confinement in an inpatient confinement facility; and - significant symptoms, physical findings, and treatment plan; and - procedures performed or to be performed during the Hospital Inpatient Confinement or confinement in an inpatient confinement facility; and - estimated length of the Hospital Inpatient Confinement or confinement in an inpatient confinement facility. If a Hospital Inpatient Confinement or confinement in an inpatient confinement facility will exceed the approved number of days, the Company will initiate a Continued Stay Review. For the purpose of these requirements, Continued Stay Review means a review by the Company of a Physician's report of the need for continued Hospital Inpatient Confinement or confinement in an inpatient confinement facility. The report (verbal or Written) must include the: - reason(s) for requesting continued Hospital Inpatient Confinement or confinement in an inpatient confinement facility; and - significant symptoms, physical findings, and treatment plan; and - procedures performed or to be performed during the Hospital Inpatient Confinement or confinement in an inpatient confinement facility; and - estimated length of the continued Hospital Inpatient Confinement or confinement in an inpatient confinement facility. Charges incurred for room, board and other usual services, including Physician Visits that are in excess of those approved by the Company for Inpatient Hospital Confinement or confinement in an inpatient confinement facility will not be considered Covered Charges. The following exception applies to Hospital Inpatient Confinement for childbirth.

3 Covered Charge requirements are waived and a Precertification is not required for mother and baby, for: - A 48-hour Hospital Inpatient Confinement following vaginal delivery; or - A 96-hour Hospital Inpatient Confinement following cesarean section. A request for review by the Company of the need for continued Hospital Inpatient Confinement for mother or baby beyond the automatically approved time period stated above must be made by the Insured Person or a designated patient representative before the end of that time period. If the Insured Person or a designated patient representative fails to request a review as specified in this section, benefits will be reduced as described above. Exception: For all Hospital Inpatient Confinement Charges incurred beyond the 48- hour or 96-hour automatically approved Hospital Inpatient Confinement for childbirth, the penalty will be applied beginning the day after the automatically approved time period ends. Except as waived above, no benefits will be payable for any Treatment or Service that is not a Covered Charge. - Definitions Applicable to the Utilization Management Program Concurrent Review Utilization Review conducted during an Insured Person s Hospital stay or course of treatment. Continued Stay Review A review by the Company of a Physician's report of the need for continued Hospital Inpatient Confinement or confinement in an inpatient confinement facility to determine if the continued stay is a Covered Charge. Health Professional An individual who: - has undergone formal training in a health care field; - holds an associate or higher degree in a health care field, or holds a state license or state certificate in a health care field; and - has professional experience in providing direct patient care. Initial Clinical Review(er) Clinical review conducted by appropriate licensed or certified Health Professionals. Initial Clinical Review staff may approve requests for admissions, procedures, and services that meet clinical review criteria, but must refer requests that do not meet clinical review criteria to a Peer Clinical Reviewer for certification or Adverse Determination.

4 Notification of Utilization Review Services Receipt of necessary information to initiate review of a request for Utilization Review services to include the Insured Person s name and the Member s name (if different from the Insured Person s name), attending Physician s name, treatment facility s name, diagnosis, and date of service. Ordering Provider The Physician or other provider who specifically prescribes the health care service being reviewed. Peer Clinical Review(er) Clinical review conducted by a Physician or other Health Professional when a request for an admission, procedure, or service was not approved during the Initial Clinical Review. In the case of an appeal review, the Peer Clinical Reviewer is a Physician or other Health Professional who holds an unrestricted license and is in the same or similar specialty as typically manages the medical condition, procedures, or treatment under review. Generally, as a peer in a similar specialty, the individual must be in the same profession, i.e., the same licensure category as the Ordering Provider. Precertification A review by the Company of a Physician s report of the need for a Hospital Inpatient Confinement or a confinement in an inpatient confinement facility (unless it is for an automatically approved Hospital Inpatient Confinement for childbirth). Prospective Review Utilization Review conducted prior to an Insured Person s stay in a Hospital or other health care facility or course of treatment, including any required preauthorization or Precertification.

5 Retrospective Review Utilization Review conducted after the Insured Person is discharged from a Hospital or other health care facility or has completed a course of treatment. Urgent Review Utilization Review that must be completed sooner than a Prospective Review in order to prevent serious jeopardy to an Insured Person s life or health or the ability to regain maximum function, or in the opinion of a Physician with knowledge of the Insured Person s medical condition, would subject the Insured Person to severe pain that cannot be adequately managed without treatment. Whether or not there is a need for an Urgent Review is based upon the Company s determination using the judgment of a prudent layperson who possesses an average knowledge of health and medicine. An Insured Person s provider should not request an Urgent Review for a situation in which the provider or Insured Person has had adequate time to request standard Precertification. Utilization Management The administration of Utilization Review procedures, such as Precertification of hospital admissions and inpatient confinements, monitoring services during a course of treatment, discharge planning, peer reviews, case management and appeals. Utilization Review The evaluation of the clinical necessity, appropriateness, efficacy or efficiency of health care services, procedures, providers, or facilities according to a set of formal techniques and guidelines. - Utilization Review Program - Prospective Review For an initial Prospective Review, a decision and notification of the decision will be made within 15 calendar days of the date the Company receives Notification of Utilization Review Services. If a decision cannot be made due to insufficient information, the Company will either issue an Adverse Determination or send an explanation of the information needed to complete the review prior to expiration of the 15 calendar days. If the Company does not issue an Adverse Determination and requests additional information to complete the review, the Insured Person, the attending Physician or other Ordering Provider, or the facility rendering the service is permitted up to 45 calendar days to provide the necessary information. The Company will render a decision within 15 calendar days of either receiving the

6 necessary information or the expiration of 45 calendar days, if no additional information is received. For certifications, the Company will provide notification to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. Upon request, the Company will provide Written notification of the certification. Adverse Determinations will be made in Writing to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. - Urgent Prospective Review For Urgent Review of a Prospective Review, a decision and notification of the decision will be made within 72 hours of the date the Company receives Notification of Utilization Review Services. If a decision cannot be made due to insufficient information, the Company will either issue an Adverse Determination or send an explanation of the information needed to complete the review within 24 hours of receipt of Notification of Utilization Review Services. If the Company does not issue an Adverse Determination and requests additional information to complete the review, the Insured Person, the attending Physician or other Ordering Provider, or the facility rendering the service is permitted up to 48 hours to provide the necessary information. The Company will render a decision within 48 hours of either receiving the necessary information or if no additional information is received, the expiration of the 48 hours to provide the specified additional information. For certifications, the Company will provide notification to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. Upon request, the Company will provide Written notification of the certification. For Adverse Determinations will be made in Writing to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. - Concurrent Review For a Concurrent Review that does not involve an Urgent Review, a request to extend a course of treatment beyond the period of time or number of treatments previously approved by the Company will be decided within the timeframes and according to the requirements for Prospective Review. - Urgent Concurrent Review For an Urgent Review of a Concurrent Review, a request to extend a course of treatment beyond the period of time or number of treatments previously approved by the Company will be decided and notification of the decision will be made within 24 hours of receipt of the Notification of Utilization Review Services if the request is made at least 24 hours prior to the expiration of the previously approved period or number of treatments. If a request is made less than 24 hours prior to the expiration

7 of the previously approved period or number of treatments, a decision and notification of the decision will be made within 72 hours of receipt of the Notification of Utilization Review Services. - Retrospective Review For a Retrospective Review, a decision and notification of the decision will be made within 30 calendar days after the Company receives Notification of Utilization Review Services. If a decision cannot be made due to insufficient information, the Company will either issue an Adverse Determination or send an explanation of the information needed to complete the review prior to the expiration of the 30 calendar days. If the Company does not issue an Adverse Determination and requests additional information to complete the review, the Insured Person, the attending Physician or other Ordering Provider, or the facility rendering the service is permitted up to 45 calendar days to provide the necessary information. The Company will render a decision within 15 calendar days of either receiving the necessary information or the expiration of 45 calendar days, if no additional information is received. For certifications, the Company will provide notification to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. Upon request, the Company will provide Written notification of the certification. Adverse Determinations will be made in Writing to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. - Request for Reconsideration When an initial decision is made not to certify an admission or other service and no peer-to-peer conversation has occurred, the Peer Clinical Reviewer that made the initial decision will be made available within one (1) business day to discuss the Adverse Determination decision with the attending Physician or other Ordering Provider upon their request. If the original Peer Clinical Reviewer is not available, another Peer Clinical Reviewer will be made available to discuss the review. At the time of the conversation, if the reconsideration process is unable to resolve the difference of opinion regarding a decision not to certify, the attending Physician or other Ordering Provider will be informed of the right to initiate an appeal and the procedure to do so. For certifications, the Company will provide notification to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person. Upon request, the Company will provide Written notification of the certification. For Adverse Determinations notification will be made in Writing to the attending Physician or other Ordering Provider, the facility rendering service and the Insured Person.

8 - Appeal of Adverse Determinations The Insured Person, a designated patient representative, Physician, or other health care provider has the right to request an appeal review of any Utilization Management decision by telephone, fax, or in Writing. The Company will make a full and fair review of the Adverse Determination. - Expedited Appeal Review and Voluntary Appeal Review An expedited appeal review is a request, usually by telephone but can be Written, for a review of a decision not to certify an Urgent Review. An expedited appeal review must be requested within 180 calendar days of the receipt of an Adverse Determination. A decision and notification of the decision on the expedited appeal of an Urgent Review decision will be made within 72 hours from request of an expedited appeal review. Written or electronic notification of the appeal review outcome will be made to the attending Physician or other Ordering Provider and the Insured Person. If the Adverse Determination is affirmed on the appeal review, the Insured Person, attending Physician, or other Ordering Provider can request an external review or a voluntary appeal review. The voluntary appeal review may be requested by telephone, fax or in Writing within 60 calendar days of the receipt of the first appeal review Adverse Determination. The Insured Person, attending Physician or other Ordering Provider may submit Written comments, documents, records and other information relating to the request for the voluntary appeal review. The Company will make a decision within 48 hours of request for a voluntary appeal review. Election of a second appeal is voluntary and does not negate the Insured Person s right to an external review, nor does it have any effect on the Member or the Insured Person s rights to any other benefit under the Group Policy. The Company offers the voluntary appeal review process in an effort that the claim may be resolved in good faith without legal intervention. At any time during the second appeal process, the Insured Person may request an external review. Note: The expedited appeal process does not apply to Retrospective Reviews.

9 - Standard Appeal Review and Voluntary Appeal Review A standard appeal may be requested in Writing. It must be requested within 180 calendar days of the receipt of an Adverse Determination. A Final Adverse Determination will be made in Writing to the Insured Person or the attending Physician within 30 calendar days of receiving the request for an appeal for postservice claims and 15 calendar days for pre-service claims. If the Adverse Determination is affirmed on the appeal review, the Insured Person, attending Physician, or other Ordering Provider can request an external review or a voluntary appeal review. The voluntary appeal review may be requested by fax or in Writing within 60 calendar days of the receipt of the first appeal review Adverse Determination. The Insured Person or authorized representative acting on behalf of the Insured Person has the right to appear before the voluntary second level review meeting panel. The Company will provide 15 business days advance notice of the date of the voluntary second level review meeting to the Insured Person or authorized representative acting on behalf of the Insured Person. The Insured or the attending Physician may submit Written comments, documents, records and other information relating to the request for the voluntary second appeal review. The review panel will make a Final Adverse Determination decision within 60 business days of the date of the request for a voluntary second appeal review and will issue a Written or electronic decision to the Insured Person or authorized representative acting on behalf of the Insured Person within 5 business days of completing the voluntary second level review meeting. Election of a second appeal is voluntary and does not negate the Insured Person s right to an external review, nor does it have any effect on the Member or the Insured Person s rights to any other benefit under the Group Policy. The Company offers the voluntary appeal review process in an effort that the claim may be resolved in good faith without legal intervention. At any time during the second appeal process, the Insured Person may request an external review. Notice of Utilization Review For purposes of satisfying the claims processing requirements, receipt of claim will be considered to be met when the Company receives Notification of Utilization Review Services. If an Insured Person or designated patient representative fails to follow the Company s procedures for filing a claim for a Precertification, a Prospective Review, or an Urgent Review, the Company will notify the Insured Person or designated patient representative of the failure and the proper procedures to be followed.

10 GRIEVANCE PROCEDURES The Insured Person or authorized representative acting on the Insured Person s behalf may file a Grievance if the Insured Person is dissatisfied with any action the Company may have taken. An informal review may also be requested if the Insured Person or authorized representative acting on the Insured Person s behalf is dissatisfied with any action taken by the Company. A Written letter can be sent to the local service center (the address is shown on the Insured Person s ID card). If the Grievance involves an Urgent Care Request, an oral Grievance may be submitted to the local service center (the phone number is on the Insured Person s ID card). Definitions Grievance means a Written appeal of an Adverse Determination or Final Adverse Determination submitted by or on behalf of the Insured Person regarding: - availability, delivery, or quality of health care services regarding an Adverse Determination; - claims payment, handling or reimbursement for health care services; - matters pertaining to the contractual relationship between the Insured Person and the Company; or - matters pertaining to the contractual relationship between a health care provider and the Company. [EM1][EM2]Urgent Care Request means a request for a health care service or course of treatment with respect to which the time periods for making a non-urgent Care Request determination: - Could seriously jeopardize the Insured Person s life or health or the ability for the Insured Person to regain maximum function; or - In the opinion of a Physician with knowledge of the Insured Person s medical condition, would subject the Insured Person to severe pain that cannot be adequately managed without the health care Treatment or Service that is the subject of the request. Grievance Review First Level Review Within 180 calendar days after the date of receipt of a notice of an Adverse Determination, the Insured Person or an authorized representative acting on the Insured Person s behalf, may file a Grievance with the Company requesting a first level review of an Adverse Determination. The Insured Person or authorized representative acting on the Insured Person s behalf is

11 entitled to: - submit Written comments, documents, records and other material relating to the request for benefits for the reviewer or reviewers to consider when conducting the review; and - receive from the Company, upon request and free of charge, reasonable access to and copies of all documents, records and other information relevant to the Insured Person s request for benefits. The Company will make a decision and notify the Insured Person or authorized representative acting on the Insured Person s behalf in Writing or electronically within the following timeframes: - for a Prospective Review, within a reasonable period of time that is appropriate given the Insured Person s medical condition, but no later than 15 calendar days after receipt of the Grievance requesting the first level review. - for a Retrospective Review, within a reasonable period of time, but no later than 30 calendar days after receipt of the Grievance requesting the first level review. Voluntary Second Level Review Within 60 calendar days after the date of receipt of a first level review decision involving an Adverse Determination, the Insured Person or an authorized representative acting on the Insured Person s behalf, may file a voluntary second level review. Within five business days after receipt of a request for a second level review, the Company will send notice to the Insured Person or authorized representative acting on behalf of the Insured Person of their right to: - Request, within ten business days after receipt of the notice, the opportunity to appear in person before a panel of Company designated representatives; - Receive from the Company, upon request, copies of all documents, records and other information that is not confidential or privileged relevant to the Insured Person s request for benefits; - Present the Insured Person s case to the review panel; - Submit Written comments, documents, records and other material relating to the request for benefits to the review panel for consideration when conducting the second level review; - If applicable, ask questions of any of the Company representatives on the review panel; provided, the questions are governed and relevant to the subject matter of the second level review; and - Be assisted or represented by an individual of the Insured Person s choice, at the

12 Insured Person s expense. Procedures for conducting the second level review: - The review panel will schedule and hold the second level review within sixty (60) business days after the date of receipt of the request for a second level review. The Insured Person or authorized representative acting on behalf of the Insured Person will be notified in writing fifteen (15) business days in advance of the date of the second level review. The Company will not unreasonably deny a request for postponement of the second level review made by the Insured Person or authorized representative acting on behalf of the Insured Person. - The second level review will be held during regular business hours at a location that meets the guidelines established by the Americans with Disabilities Act. - In cases where an in-person second level review is not practical for geographical reasons, or any other reason, the Company will give the Insured Person or authorized representative acting on behalf of the Insured Person, the opportunity to communicate with the review panel, at the Company s expense, by conference call or other appropriate technology as determined by the Company. - The review panel will provide the Insured Person or authorized representative acting on behalf of the Insured Person notice of the right to have an attorney present at the second level review. - The review panel will issue a Written or electronic decision to the Insured Person or authorized representative acting on behalf of the Insured Person within five (5) business days of completing the second level review meeting. The decision issued will include the: - Titles and qualifying credentials of the reviewers on the panel; - Statement of the review panel s understanding of the nature of the Grievance and all pertinent facts; - Rationale for the review panel s decision; - Reference to evidence or documentation considered by the review panel in rendering its decision; and - In cases concerning a Grievance involving an Adverse Determination: - Instructions for requesting a Written statement of the clinical rationale, including the clinical review criteria used to make the determination; and - If applicable, a statement describing the procedures for obtaining an external review of the Adverse Determination. Expedited Review of Urgent Care Requests An expedited review will be made available in a situation where the timeframe of the first and second level review would seriously jeopardize the life or health of the Insured Person, or the ability of the Insured Person to regain maximum function. The Insured Person or

13 authorized representative acting on behalf of the Insured Person may submit a request for an expedited review orally or in Writing. The Company will notify the Insured Person or authorized representative acting on behalf of the Insured Person of the decision orally within 72 hours after receiving the request. Written confirmation of the decision will be sent within three (3) calendar days after providing notification of the decision if the notification was not in Writing. EXTERNAL REVIEW Right to Request an External Review of Adverse Determinations Within six (6) months after receiving notice of an Adverse Determination or Final Adverse Determination the Insured Person or an authorized representative acting on behalf of the Insured Person, has the right to request an external review in Writing from the Company, if the Insured Person has exhausted the Company s internal review process. Within ten business days after receipt of the request, the Company will complete a preliminary review to determine if the request is eligible for an external review. Within three business days after completion of the preliminary review, the Company will notify the Insured Person or authorized representative in Writing if the request is complete and eligible for external review. If the request is not complete, the Company will notify the Insured Person or authorized representative in Writing and include the reasons for ineligibility. The Insured Person or authorized representative may appeal an ineligible decision with the Tennessee Department of Commerce and Insurance at the following address: Department of Commerce and Insurance Division of Insurance/Consumer Insurance Service Davy Crockett Tower, 4 th Floor 500 James Robertson Pkwy Nashville, TN Phone: (615) or Insurance.Info@TN.Gov Within three business days after the determination that an external review is determined eligible, the Company will notify the Insured Person or authorized representative in Writing of the eligibility and acceptance for external review and that additional information may be submitted in Writing to the external review organization within six business days following the date of receipt of the notice. Within three calendar days after receiving the decision from the external review organization, the

14 Company will notify the Insured Person or authorized representative of the external review organization s decision. Upon receipt of a notice to reverse the Adverse Determination or Final Adverse Determination, the Company will immediately approve the coverage that was the subject of the external review and if the decision involves healthcare provider compensation, the Company will make appropriate payment to the healthcare provider within ten business days. If the Insured Person has a medical condition where the time-frame for completion of a standard external review would seriously jeopardize the Insured Person s life or health or ability to regain maximum function, an expedited review will be completed by the external review organization and the Company will notify the Insured Person or authorized representative of the external review organization s decision within 72 hours after the date of receipt of the request that meets the reviewability requirements. If the expedited review request is for Treatment or Service that is Experimental or Investigational, the Insured Person s treating Physician must certify in Writing that the recommended or requested Treatment or Service would be significantly less effective if not promptly initiated. An expedited external review will not be provided for retrospective Adverse Determinations or Final Adverse Determinations. The Company will pay the cost of the external review. An external review decision is binding on the Company, the Insured Person, and the health care provider unless there are other remedies available under applicable federal or Tennessee law.

Utilization Review Determinations Timeframe

Utilization Review s Timeframe The purpose of this chart is to reference utilization review determination timeframes. It is not meant to completely outline the UR process. See Policy: Prospective, Concurrent,

Utilization Review s Timeframe The purpose of this chart is to reference utilization review determination timeframes. It is not meant to completely outline the UR process. See Policy: Prospective, Concurrent,

TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

9. Claims and Appeals Procedure

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

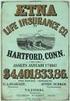

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Medical and Rx Claims Procedures

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

What Happens When Your Health Insurance Carrier Says NO

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 2009 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO.

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

How To Appeal An Adverse Benefit Determination In Aetna

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR

HOUSE BILL NO. INTRODUCED BY G. MACLAREN BY REQUEST OF THE STATE AUDITOR 0 A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR UTILIZATION REVIEW, GRIEVANCE, AND EXTERNAL

HOUSE BILL NO. INTRODUCED BY G. MACLAREN BY REQUEST OF THE STATE AUDITOR 0 A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR UTILIZATION REVIEW, GRIEVANCE, AND EXTERNAL

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT

Model Regulation Service April 2010 UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT Table of Contents Section 1. Title Section 2. Purpose and Intent Section 3. Definitions Section 4. Applicability and

Model Regulation Service April 2010 UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT Table of Contents Section 1. Title Section 2. Purpose and Intent Section 3. Definitions Section 4. Applicability and

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures.

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

RULES AND REGULATIONS FOR THE UTILIZATION REVIEW OF HEALTH CARE SERVICES (R23-17.12-UR)

RULES AND REGULATIONS FOR THE UTILIZATION REVIEW OF HEALTH CARE SERVICES (R23-17.12-UR) STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS Department of Health August 1993 (E) As amended: August 1993 December

RULES AND REGULATIONS FOR THE UTILIZATION REVIEW OF HEALTH CARE SERVICES (R23-17.12-UR) STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS Department of Health August 1993 (E) As amended: August 1993 December

Exhibit 2.9 Utilization Management Program

Exhibit 2.9 Utilization Management Program Access HealthSource, Inc. Utilization Management Company is licensed as a Utilization Review Agent with the Texas Department of Insurance. The Access HealthSource,

Exhibit 2.9 Utilization Management Program Access HealthSource, Inc. Utilization Management Company is licensed as a Utilization Review Agent with the Texas Department of Insurance. The Access HealthSource,

EXTERNAL REVIEW CONSUMER GUIDE

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS

April 2015 UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS ELIGIBILITY CLAIMS PROCEDURES Any participant (employee) or beneficiary (dependent), or an authorized representative

April 2015 UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS ELIGIBILITY CLAIMS PROCEDURES Any participant (employee) or beneficiary (dependent), or an authorized representative

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

Utilization Management

Utilization Management Utilization Management (UM) is an organization-wide, interdisciplinary approach to balancing quality, risk, and cost concerns in the provision of patient care. It is the process

Utilization Management Utilization Management (UM) is an organization-wide, interdisciplinary approach to balancing quality, risk, and cost concerns in the provision of patient care. It is the process

Your Health Care Benefit Program. BlueChoice PPO Basic Option Certificate of Benefits

Your Health Care Benefit Program BlueChoice PPO Basic Option Certificate of Benefits 1215 South Boulder P.O. Box 3283 Tulsa, Oklahoma 74102 3283 70260.0208 Effective May 1, 2010 Table of Contents Certificate............................................................................

Your Health Care Benefit Program BlueChoice PPO Basic Option Certificate of Benefits 1215 South Boulder P.O. Box 3283 Tulsa, Oklahoma 74102 3283 70260.0208 Effective May 1, 2010 Table of Contents Certificate............................................................................

Appeals and Provider Dispute Resolution

Appeals and Provider Dispute Resolution There are two distinct processes related to Non-Coverage (Adverse) Determinations (NCD) regarding requests for services or payment: (1) Appeals and (2) Provider

Appeals and Provider Dispute Resolution There are two distinct processes related to Non-Coverage (Adverse) Determinations (NCD) regarding requests for services or payment: (1) Appeals and (2) Provider

Behavioral Health (MAPSI) Utilization Management Program Components

Behavioral Health (MAPSI) Utilization Management Program Components Payer Name: Printed Name of Payer Representative: Phone: Is this document applicable to all groups? Yes No If no, please indicate specific

Behavioral Health (MAPSI) Utilization Management Program Components Payer Name: Printed Name of Payer Representative: Phone: Is this document applicable to all groups? Yes No If no, please indicate specific

Welcome to American Specialty Health Insurance Company

CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health

CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health

MEDICAL MANAGEMENT OVERVIEW MEDICAL NECESSITY CRITERIA RESPONSIBILITY FOR UTILIZATION REVIEWS MEDICAL DIRECTOR AVAILABILITY

4 MEDICAL MANAGEMENT OVERVIEW Our medical management philosophy and approach focus on providing both high quality and cost-effective healthcare services to our members. Our Medical Management Department

4 MEDICAL MANAGEMENT OVERVIEW Our medical management philosophy and approach focus on providing both high quality and cost-effective healthcare services to our members. Our Medical Management Department

CHAPTER 7: UTILIZATION MANAGEMENT

OVERVIEW The Plan s Utilization Management (UM) program is collaboration with providers to promote and document the appropriate use of health care resources. The program reflects the most current utilization

OVERVIEW The Plan s Utilization Management (UM) program is collaboration with providers to promote and document the appropriate use of health care resources. The program reflects the most current utilization

UTILIZATION MANGEMENT

UTILIZATION MANGEMENT The Anthem Health Care Management Division has a singular dynamic focus - to continually improve the system of health care delivery that influences utilization and cost of services

UTILIZATION MANGEMENT The Anthem Health Care Management Division has a singular dynamic focus - to continually improve the system of health care delivery that influences utilization and cost of services

Functions: The UM Program consists of the following components:

1.0 Introduction Alameda County Behavioral Health Care Services (ACBHCS) includes a Utilization Management (UM) Program and Behavioral Health Managed Care Plan (MCP). They are dedicated to delivering cost

1.0 Introduction Alameda County Behavioral Health Care Services (ACBHCS) includes a Utilization Management (UM) Program and Behavioral Health Managed Care Plan (MCP). They are dedicated to delivering cost

HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

Your Health Care Benefit Program. BlueAdvantage Entrepreneur Participating Provider Option

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

AGENCY FOR HEALTH CARE ADMINISTRATION HEALTH QUALITY ASSURANCE BUREAU OF MANAGED HEALTH CARE 2727 Mahan Drive Tallahassee Florida 32308

AGENCY FOR HEALTH CARE ADMINISTRATION HEALTH QUALITY ASSURANCE BUREAU OF MANAGED HEALTH CARE 2727 Mahan Drive Tallahassee Florida 32308 WORKERS COMPENSATION MANAGED CARE ARRANGEMENT SURVEY REPORT NAME

AGENCY FOR HEALTH CARE ADMINISTRATION HEALTH QUALITY ASSURANCE BUREAU OF MANAGED HEALTH CARE 2727 Mahan Drive Tallahassee Florida 32308 WORKERS COMPENSATION MANAGED CARE ARRANGEMENT SURVEY REPORT NAME

RULES AND REGULATIONS FOR THE CERTIFICATION OF HEALTH PLANS (R23-17.13-CHP)

RULES AND REGULATIONS FOR THE CERTIFICATION OF HEALTH PLANS (R23-17.13-CHP) STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS Department of Health September 1997 As amended: December 1999 March 2001 November

RULES AND REGULATIONS FOR THE CERTIFICATION OF HEALTH PLANS (R23-17.13-CHP) STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS Department of Health September 1997 As amended: December 1999 March 2001 November

Health Care Management Policy and Procedure

Utilization Management... 2 Pharmaceutical Management... 3 Member Clinical Appeal and Independent External Review ASO Groups Not Voluntarily Complying with the Illinois External Review Act (Federal)...

Utilization Management... 2 Pharmaceutical Management... 3 Member Clinical Appeal and Independent External Review ASO Groups Not Voluntarily Complying with the Illinois External Review Act (Federal)...

Member Handbook A brief guide to your health care coverage

Member Handbook A brief guide to your health care coverage Preferred Provider Organization Plan Using the Private Healthcare Systems Network PREFERRED PROVIDER ORGANIZATION (PPO) PLAN USING THE PRIVATE

Member Handbook A brief guide to your health care coverage Preferred Provider Organization Plan Using the Private Healthcare Systems Network PREFERRED PROVIDER ORGANIZATION (PPO) PLAN USING THE PRIVATE

Compliance Assistance Group Health and Disability Plans

Compliance Assistance Group Health and Disability Plans Benefit Claims Procedure Regulation (29 CFR 2560.503-1) The claims procedure regulation (29 CFR 2560.503-1) provides minimum procedural requirements

Compliance Assistance Group Health and Disability Plans Benefit Claims Procedure Regulation (29 CFR 2560.503-1) The claims procedure regulation (29 CFR 2560.503-1) provides minimum procedural requirements

005. Independent Review Organization External Review Annual Report Form

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

Appeals Provider Manual 15

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

United HealthCare Insurance Company. Definity SM. Health Reimbursement Account. For. Rockingham County

United HealthCare Insurance Company Definity SM Health Reimbursement Account For Rockingham County Group Number: 717360 Effective Date: October 1, 2009 HRA SPD Notice to Employees Definity SM Health Reimbursement

United HealthCare Insurance Company Definity SM Health Reimbursement Account For Rockingham County Group Number: 717360 Effective Date: October 1, 2009 HRA SPD Notice to Employees Definity SM Health Reimbursement

QUALCARE AMENDMENT TO PROVIDER NETWORK PARTICIPATION AGREEMENT

QUALCARE AMENDMENT TO PROVIDER NETWORK PARTICIPATION AGREEMENT This AMENDMENT (the Amendment ) amends that certain Provider Network Participation Agreement (the Agreement ) by and between QualCare and

QUALCARE AMENDMENT TO PROVIDER NETWORK PARTICIPATION AGREEMENT This AMENDMENT (the Amendment ) amends that certain Provider Network Participation Agreement (the Agreement ) by and between QualCare and

OUTLINE OF MEDICARE SUPPLEMENT COVERAGE BENEFIT CHART OF MEDICARE SUPPLEMENT PLANS SOLD FOR EFFECTIVE DATES ON OR AFTER JUNE 1, 2010

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

Private Review Agent Application for Certification

2/3/16 Private Review Agent Application for Certification The items listed below may paraphrase the law or regulation. The checklist is not required to be included with the application. It should be used

2/3/16 Private Review Agent Application for Certification The items listed below may paraphrase the law or regulation. The checklist is not required to be included with the application. It should be used

Unit 1 Core Care Management Activities

Unit 1 Core Care Management Activities Healthcare Management Services Healthcare Management Services (HMS) is responsible for all the medical management services provided to Highmark Blue Shield members,

Unit 1 Core Care Management Activities Healthcare Management Services Healthcare Management Services (HMS) is responsible for all the medical management services provided to Highmark Blue Shield members,

How To Manage Health Care Needs

HEALTH MANAGEMENT CUP recognizes the importance of promoting effective health management and preventive care for conditions that are relevant to our populations, thereby improving health care outcomes.

HEALTH MANAGEMENT CUP recognizes the importance of promoting effective health management and preventive care for conditions that are relevant to our populations, thereby improving health care outcomes.

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C MEDICARE SUPPLEMENT SUBSCRIBER AGREEMENT This agreement describes your benefits from Blue Cross & Blue Shield of Rhode Island. This is a Medicare

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C MEDICARE SUPPLEMENT SUBSCRIBER AGREEMENT This agreement describes your benefits from Blue Cross & Blue Shield of Rhode Island. This is a Medicare

POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS

POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS Prepared by The Kansas Insurance Department August 23, 2007 POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS

POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS Prepared by The Kansas Insurance Department August 23, 2007 POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS

RULES AND REGULATIONS FOR UTILIZATION REVIEW IN ARKANSAS ARKANSAS DEPARTMENT OF HEALTH

RULES AND REGULATIONS FOR UTILIZATION REVIEW IN ARKANSAS 2003 ARKANSAS DEPARTMENT OF HEALTH TABLE OF CONTENTS SECTION 1 Authority and Purpose.. 1 SECTION 2 Definitions...2 SECTION 3 Private Review Agents

RULES AND REGULATIONS FOR UTILIZATION REVIEW IN ARKANSAS 2003 ARKANSAS DEPARTMENT OF HEALTH TABLE OF CONTENTS SECTION 1 Authority and Purpose.. 1 SECTION 2 Definitions...2 SECTION 3 Private Review Agents

HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

The Pennsylvania Insurance Department s. Your Guide to filing HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Covered Person/Applicant Authorized Representative (please complete the Appointment of Authorized Representative section)

REQUEST FOR EXTERNAL REVIEW Instructions 1. If you are eligible and have completed the appeal process, you may request an external review of the denial by an External Review Organization (ERO). ERO reviews

REQUEST FOR EXTERNAL REVIEW Instructions 1. If you are eligible and have completed the appeal process, you may request an external review of the denial by an External Review Organization (ERO). ERO reviews

A Bill Regular Session, 2015 SENATE BILL 318

Stricken language would be deleted from and underlined language would be added to present law. Act 0 of the Regular Session 0 State of Arkansas 0th General Assembly As Engrossed: S// A Bill Regular Session,

Stricken language would be deleted from and underlined language would be added to present law. Act 0 of the Regular Session 0 State of Arkansas 0th General Assembly As Engrossed: S// A Bill Regular Session,

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS Title 15: Mississippi State Department of Health Part 3: Office of Health Protection Subpart 1: Health Facilities Licensure and Certification Post Office

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS Title 15: Mississippi State Department of Health Part 3: Office of Health Protection Subpart 1: Health Facilities Licensure and Certification Post Office

VI. Appeals, Complaints & Grievances

A. Definition of Terms In compliance with State requirements, ValueOptions defines the following terms related to Enrollee or Provider concerns with the NorthSTAR program: Administrative Denial: A denial

A. Definition of Terms In compliance with State requirements, ValueOptions defines the following terms related to Enrollee or Provider concerns with the NorthSTAR program: Administrative Denial: A denial

UnitedHealthcare Choice Plus. United HealthCare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus United HealthCare Insurance Company Certificate of Coverage For Westminster College Enrolling Group Number: 715916 Effective Date: January 1, 2009 Offered and Underwritten

UnitedHealthcare Choice Plus United HealthCare Insurance Company Certificate of Coverage For Westminster College Enrolling Group Number: 715916 Effective Date: January 1, 2009 Offered and Underwritten

FEHB Program Carrier Letter All Carriers

FEHB Program Carrier Letter All Carriers U.S. Office of Personnel Management Insurance Operations Letter No. 2010-20 Date: October 19, 2010 Fee-for-Service [16] Experience-rated HMO [16] Community-rated

FEHB Program Carrier Letter All Carriers U.S. Office of Personnel Management Insurance Operations Letter No. 2010-20 Date: October 19, 2010 Fee-for-Service [16] Experience-rated HMO [16] Community-rated

Population Health Management

Population Health Management 1 Population Health Management At a Glance The MedStar Medical Management Department is responsible for managing health care resources for MedStar Select Health Plan. Our goal

Population Health Management 1 Population Health Management At a Glance The MedStar Medical Management Department is responsible for managing health care resources for MedStar Select Health Plan. Our goal

Having health insurance is a

Fully-Insured and Issued in New Jersey Having health insurance is a good thing, and health insurers usually do what they re supposed to do. They authorize coverage for services that are medically necessary

Fully-Insured and Issued in New Jersey Having health insurance is a good thing, and health insurers usually do what they re supposed to do. They authorize coverage for services that are medically necessary

Your Health Care Benefit Program. The City of Oklahoma City

Your Health Care Benefit Program For Employees of The City of Oklahoma City Effective January 1, 2010 Administered by: Table of Contents Plan Summary.........................................................................

Your Health Care Benefit Program For Employees of The City of Oklahoma City Effective January 1, 2010 Administered by: Table of Contents Plan Summary.........................................................................

Riverside Physician Network Utilization Management

Subject: Program Riverside Physician Network Author: Candis Kliewer, RN Department: Product: Commercial, Senior Revised by: Linda McKevitt, RN Approved by: Effective Date January 1997 Revision Date 1/21/15

Subject: Program Riverside Physician Network Author: Candis Kliewer, RN Department: Product: Commercial, Senior Revised by: Linda McKevitt, RN Approved by: Effective Date January 1997 Revision Date 1/21/15

IMPORTANT: This new Member Handbook replaces similar language in the enclosed Certificate of Coverage & Member Handbook (or individual contract).

IMPORTANT: This new Member Handbook replaces similar language in the enclosed Certificate of Coverage & Member Handbook (or individual contract). IMPORTANT: All references to referrals contained within

IMPORTANT: This new Member Handbook replaces similar language in the enclosed Certificate of Coverage & Member Handbook (or individual contract). IMPORTANT: All references to referrals contained within

Health Insurance SMART NC

Health Insurance SMART NC ANNUAL REPORT ON EXTERNAL REVIEW ACTIVITY 202 North Carolina Department of Insurance Wayne Goodwin, Commissioner A REPORT ON EXTERNAL REVIEW REQUESTS IN NORTH CAROLINA Health

Health Insurance SMART NC ANNUAL REPORT ON EXTERNAL REVIEW ACTIVITY 202 North Carolina Department of Insurance Wayne Goodwin, Commissioner A REPORT ON EXTERNAL REVIEW REQUESTS IN NORTH CAROLINA Health

A PATIENT S GUIDE TO. Navigating the Insurance Appeals Process

A PATIENT S GUIDE TO Navigating the Insurance Appeals Process Dealing with an injury or illness is a stressful time for any patient as well as for their family members. This publication has been created

A PATIENT S GUIDE TO Navigating the Insurance Appeals Process Dealing with an injury or illness is a stressful time for any patient as well as for their family members. This publication has been created

Provider Manual. Utilization Management

Provider Manual Utilization Management Utilization Management This section of the Manual was created to help guide you and your staff in working with Kaiser Permanente s Utilization Management (UM) policies

Provider Manual Utilization Management Utilization Management This section of the Manual was created to help guide you and your staff in working with Kaiser Permanente s Utilization Management (UM) policies

Zenith Insurance Company ZNAT Insurance Company 21255 Califa Street Woodland Hills, CA 91367. California Utilization Review Plan.

Zenith Insurance Company ZNAT Insurance Company 21255 Califa Street Woodland Hills, CA 91367 California Utilization Review Plan October 19, 2015 Table of Contents Definitions 3 Utilization Review Plan

Zenith Insurance Company ZNAT Insurance Company 21255 Califa Street Woodland Hills, CA 91367 California Utilization Review Plan October 19, 2015 Table of Contents Definitions 3 Utilization Review Plan

Services Available to Members Complaints & Appeals

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

UnitedHealthcare Choice Plus. UnitedHealthcare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Health Savings Account (HSA) Plan 7PD of Educators Benefit Services, Inc. Enrolling Group Number: 717578

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Health Savings Account (HSA) Plan 7PD of Educators Benefit Services, Inc. Enrolling Group Number: 717578

UnitedHealthcare Choice Plus. UnitedHealthcare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Plan 7EG of Educators Benefit Services, Inc. Enrolling Group Number: 717578 Effective Date: January 1, 2012

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Plan 7EG of Educators Benefit Services, Inc. Enrolling Group Number: 717578 Effective Date: January 1, 2012

Population Health Management

Population Health Management 1 Population Health Management Table of Contents At a Glance..page 2 Procedures Requiring Prior Authorization..page 3 How to Contact or Notify Medical Management..page 4 Utilization

Population Health Management 1 Population Health Management Table of Contents At a Glance..page 2 Procedures Requiring Prior Authorization..page 3 How to Contact or Notify Medical Management..page 4 Utilization

California Provider Reference Manual Introduction and Overview of Medical Provider Networks (CA MPNs)

California Provider Reference Manual Introduction and Overview of Medical Provider Networks (CA MPNs) Coventry/First Health has designed this manual for The Coventry/First Health Network providers participating

California Provider Reference Manual Introduction and Overview of Medical Provider Networks (CA MPNs) Coventry/First Health has designed this manual for The Coventry/First Health Network providers participating

ENCOMPASS INSURANCE COMPANY OF NEW JERSEY DECISION POINT & PRECERTIFICATION PLAN

ENCOMPASS INSURANCE COMPANY OF NEW JERSEY DECISION POINT & PRECERTIFICATION PLAN DECISION POINT REVIEW: Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance has published standard

ENCOMPASS INSURANCE COMPANY OF NEW JERSEY DECISION POINT & PRECERTIFICATION PLAN DECISION POINT REVIEW: Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance has published standard

XXXXX Petitioner File No. 111988-001 v. Issued and entered this 5 th day of January 2011 by Ken Ross Commissioner ORDER I PROCEDURAL BACKGROUND

In the matter of STATE OF MICHIGAN DEPARTMENT OF ENERGY, LABOR & ECONOMIC GROWTH OFFICE OF FINANCIAL AND INSURANCE REGULATION Before the Commissioner of Financial and Insurance Regulation XXXXX Petitioner

In the matter of STATE OF MICHIGAN DEPARTMENT OF ENERGY, LABOR & ECONOMIC GROWTH OFFICE OF FINANCIAL AND INSURANCE REGULATION Before the Commissioner of Financial and Insurance Regulation XXXXX Petitioner

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN. Amended and Restated

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN Amended and Restated Effective June 1, 2006 SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN Amended and Restated Effective June 1, 2006 SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE

Texas June 2005. The following elements are particularly important in shaping our plans to support this new legislation:

Texas June 2005 On June 1, 2005, Texas Governor Rick Perry signed House Bill 7 (HB 7) into law. First Health believes this new legislation is a major step in controlling Workers Compensation expenses.

Texas June 2005 On June 1, 2005, Texas Governor Rick Perry signed House Bill 7 (HB 7) into law. First Health believes this new legislation is a major step in controlling Workers Compensation expenses.

Total Healthcare Management, Utilization Management and Transition of Care

Total Healthcare Management, Utilization Management and Transition of Care 58 Commercial 59 Authorization Submission Options and Requirements Options: Online -- Register via BlueAccess SM at bcbst.com/provider

Total Healthcare Management, Utilization Management and Transition of Care 58 Commercial 59 Authorization Submission Options and Requirements Options: Online -- Register via BlueAccess SM at bcbst.com/provider

Health care insurer appeals process information packet Aetna Life Insurance Company

Quality health plans & benefits Healthier living Financial well-being Intelligent solutions Health care insurer appeals process information packet Aetna Life Insurance Company Please read this notice carefully

Quality health plans & benefits Healthier living Financial well-being Intelligent solutions Health care insurer appeals process information packet Aetna Life Insurance Company Please read this notice carefully

Section 6. Medical Management Program

Section 6. Medical Management Program Introduction Molina Healthcare maintains a medical management program to ensure patient safety as well as detect and prevent fraud, waste and abuse in its programs.

Section 6. Medical Management Program Introduction Molina Healthcare maintains a medical management program to ensure patient safety as well as detect and prevent fraud, waste and abuse in its programs.

(d) Concurrent review means utilization review conducted during an inpatient stay.

9792.6. Utilization Review Standards Definitions For Utilization Review Decisions Issued Prior to July 1, 2013 for Injuries Occurring Prior to January 1, 2013. As used in this Article: The following definitions

9792.6. Utilization Review Standards Definitions For Utilization Review Decisions Issued Prior to July 1, 2013 for Injuries Occurring Prior to January 1, 2013. As used in this Article: The following definitions

BlueAdvantage SM Health Management

BlueAdvantage SM Health Management BlueAdvantage member benefits include access to a comprehensive health management program designed to encompass total health needs and promote access to individualized,

BlueAdvantage SM Health Management BlueAdvantage member benefits include access to a comprehensive health management program designed to encompass total health needs and promote access to individualized,

Zurich Handbook. Managed Care Arrangement program summary

Zurich Handbook Managed Care Arrangement program summary A Managed Care Arrangement (MCA) is being used to ensure that employees receive timely and proper medical treatment with respect to work-related

Zurich Handbook Managed Care Arrangement program summary A Managed Care Arrangement (MCA) is being used to ensure that employees receive timely and proper medical treatment with respect to work-related

Managed Care Program

Summit Workers Compensation Managed Care Program KENTUCKY How to obtain medical care for a work-related injury or illness. Welcome Summit s workers compensation managed-care organization (Summit MCO) is

Summit Workers Compensation Managed Care Program KENTUCKY How to obtain medical care for a work-related injury or illness. Welcome Summit s workers compensation managed-care organization (Summit MCO) is

Premera Blue Cross Medicare Advantage Provider Reference Manual

Premera Blue Cross Medicare Advantage Provider Reference Manual Introduction to Premera Blue Cross Medicare Advantage Plans Premera Blue Cross offers Medicare Advantage (MA) plans in King, Pierce, Snohomish,

Premera Blue Cross Medicare Advantage Provider Reference Manual Introduction to Premera Blue Cross Medicare Advantage Plans Premera Blue Cross offers Medicare Advantage (MA) plans in King, Pierce, Snohomish,

MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT RESOURCE GUIDE

MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT RESOURCE GUIDE May 2014 THE UNIVERSITY OF MARYLAND CAREY SCHOOL OF LAW DRUG POLICY AND PUBLIC HEALTH STRATEGIES CLINIC 2 PARITY ACT RESOURCE GUIDE TABLE OF

MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT RESOURCE GUIDE May 2014 THE UNIVERSITY OF MARYLAND CAREY SCHOOL OF LAW DRUG POLICY AND PUBLIC HEALTH STRATEGIES CLINIC 2 PARITY ACT RESOURCE GUIDE TABLE OF

Network Provider. Physician Assistant. Contract

Network Provider Physician Assistant Contract Updated 10/1/02 HCPACv1.0 TABLE OF CONTENTS I. RECITALS...1 II. DEFINITIONS...1 III. RELATIONSHIP BETWEEN THE INSURANCE BOARD AND THE PHYSICIAN ASSISTANT...3

Network Provider Physician Assistant Contract Updated 10/1/02 HCPACv1.0 TABLE OF CONTENTS I. RECITALS...1 II. DEFINITIONS...1 III. RELATIONSHIP BETWEEN THE INSURANCE BOARD AND THE PHYSICIAN ASSISTANT...3

Introduction and Overview of HCO Program

Introduction and Overview of HCO Program To meet the requirements of Article 8 9771.70, First Health has designed this manual for The First Health Network providers participating in The First Health/CompAmerica

Introduction and Overview of HCO Program To meet the requirements of Article 8 9771.70, First Health has designed this manual for The First Health Network providers participating in The First Health/CompAmerica

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP)

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP) 2014 Magellan Health Services Table of Contents SECTION 1: INTRODUCTION... 3 Welcome... 3 Covered

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP) 2014 Magellan Health Services Table of Contents SECTION 1: INTRODUCTION... 3 Welcome... 3 Covered

The Appeals Process For Medical Billing

The Appeals Process For Medical Billing Steven M. Verno Professor, Medical Coding and Billing What is an Appeal? An appeal is a legal process where you are asking the insurance company to review it s adverse

The Appeals Process For Medical Billing Steven M. Verno Professor, Medical Coding and Billing What is an Appeal? An appeal is a legal process where you are asking the insurance company to review it s adverse

YOUR GROUP INSURANCE PLAN KALAMAZOO VALLEY COMMUNITY COLLEGE CLASS 0001 DENTAL, ACCIDENT BENEFITS

YOUR GROUP INSURANCE PLAN KALAMAZOO VALLEY COMMUNITY COLLEGE CLASS 0001 DENTAL, ACCIDENT BENEFITS 00520314/00003.0/ /0001/N40076/99999999/0000/PRINT DATE: 3/04/16 This Booklet Includes All Benefits For

YOUR GROUP INSURANCE PLAN KALAMAZOO VALLEY COMMUNITY COLLEGE CLASS 0001 DENTAL, ACCIDENT BENEFITS 00520314/00003.0/ /0001/N40076/99999999/0000/PRINT DATE: 3/04/16 This Booklet Includes All Benefits For

Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan

ConneCtiCut insurance DePARtMent Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

ConneCtiCut insurance DePARtMent Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

American Commerce Insurance Company

American Commerce Insurance Company INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Dear Insured and/or /Eligible Injured Person/Medical Provider: Please read this letter carefully because it

American Commerce Insurance Company INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Dear Insured and/or /Eligible Injured Person/Medical Provider: Please read this letter carefully because it

CHUBB GROUP OF INSURANCE COMPANIES

CHUBB GROUP OF INSURANCE COMPANIES Dear Insured, Attached please find an informational letter which is being sent to your treating provider outlining the processes and procedures for Precertification and

CHUBB GROUP OF INSURANCE COMPANIES Dear Insured, Attached please find an informational letter which is being sent to your treating provider outlining the processes and procedures for Precertification and

Key Provisions of Tennessee Senate Bill 200 Effective July 1, 2014, through July 1, 2016

2014 Construction of Statute Definition of Injury (Causation) Revises Section 50-6-116, Construction of Chapter, to indicate that for dates of injury on or after July 1, 2014, the chapter should no longer

2014 Construction of Statute Definition of Injury (Causation) Revises Section 50-6-116, Construction of Chapter, to indicate that for dates of injury on or after July 1, 2014, the chapter should no longer

Updated as of 05/15/13-1 -

Updated as of 05/15/13-1 - GENERAL OFFICE POLICIES Thank you for choosing the Quiroz Adult Medicine Clinic, PA (QAMC) as your health care provider. The following general office policies are provided to

Updated as of 05/15/13-1 - GENERAL OFFICE POLICIES Thank you for choosing the Quiroz Adult Medicine Clinic, PA (QAMC) as your health care provider. The following general office policies are provided to

How To Choose A Health Care Plan In The United States

Managed Behavioral Health in PPO100 and Keystone Benefit Plan Summary for PPO100 Service IBH Network Non-Network Pre-Certification Inpatient Psychiatric Care 100%! 80% of IBH allowable after $500 Mental

Managed Behavioral Health in PPO100 and Keystone Benefit Plan Summary for PPO100 Service IBH Network Non-Network Pre-Certification Inpatient Psychiatric Care 100%! 80% of IBH allowable after $500 Mental

10 Woodbridge Center Drive * PO Box 5038* Woodbridge, NJ 07095

10 Woodbridge Center Drive * PO Box 5038* Woodbridge, NJ 07095 Date Name Address RE: CLAIMANT: CLAIM#: INSURANCE CO: CAMDEN FIRE INSURANCE ASSOCIATION CISI#: DOL: Dear : Please read this letter carefully

10 Woodbridge Center Drive * PO Box 5038* Woodbridge, NJ 07095 Date Name Address RE: CLAIMANT: CLAIM#: INSURANCE CO: CAMDEN FIRE INSURANCE ASSOCIATION CISI#: DOL: Dear : Please read this letter carefully

Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan

CONNECTICUT INSURANCE DEPARTMENT Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

CONNECTICUT INSURANCE DEPARTMENT Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

OFFICE OF GROUP BENEFITS 2014 OFFICE OF GROUP BENEFITS CDHP PLAN FOR STATE OF LOUISIANA EMPLOYEES AND RETIREES PLAN AMENDMENT

OFFICE OF GROUP BENEFITS 2014 OFFICE OF GROUP BENEFITS CDHP PLAN FOR STATE OF LOUISIANA EMPLOYEES AND RETIREES PLAN AMENDMENT This Amendment is issued by the Plan Administrator for the Plan documents listed