Welcome to American Specialty Health Insurance Company

|

|

|

- Cuthbert Gibbs

- 8 years ago

- Views:

Transcription

1 CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health care services. We bring experience and detailed knowledge of the insurance and complementary health care industries to the partnership we form with our customers. This results in better customer service for our insureds. This handbook and disclosure document will help you get the most out of your health care dollars. It contains basic information to help you maximize the benefits you are entitled to receive. We are available to answer your questions. You can access additional information on our Web site, Or, if you would like to discuss any of the enclosed information, please call our Customer Service Department toll free at Sincerely, George DeVries President and Chief Executive Officer American Specialty Health Insurance Company

2 TABLE OF CONTENTS INTRODUCTION 4 Important Information About Your Coverage 4 Insured Rights and Responsibilities 5 Language Assistance Program 6 Insured Participation in ASH Insurance Public Policy Committee 6 ENROLLMENT AND ELIGIBILITY 6 Underlying Group Health Care Coverage Requirement 6 Dependent Eligibility If Applicable 7 Your ID Card: The Key to Your Care 7 Canceling Your Coverage 7 Why Coverage May End 7 Address Changes 8 UTILIZATION MANAGEMENT PROCESSES 8 Utilization Review Requirements/Financial Responsibility 8 Decision-Making Guidelines 9 Notification of Determinations 10 Provider Reimbursement 10 Continuity of Care 10 Emergency and Urgent Care 11 UNDERSTANDING YOUR BENEFITS 11 Your Benefits 11 Premiums, Copayments, Deductibles, and Coinsurance 12 Maximum Allowable Fees (How Claims Are Processed) 13 Subrogation: What Does It Mean? 13 Appeals and Grievances 14 Privacy and Confidentiality 16 Third-Party Administrator Disclosure 17 Quality Improvement Program 17 2

3 The information contained in this handbook is summarized from your Certificate of Insurance and other policy documents issued to your plan sponsor. Please note that those documents form your actual policy with American Specialty Health Insurance Company. If you have any questions about coverage under your specific policy, always refer to the Certificate of Insurance and other policy documents issued to you by your plan sponsor. If you have any questions about the information presented in this handbook or need any other assistance, you may contact our Customer Service Department by calling toll free, You may also use that number to receive assistance in languages other than English. 3

4 INTRODUCTION Important Information About Your Coverage Your plan sponsor has chosen to provide you with a flexible, PPO-based complementary health care benefit package from American Specialty Health Insurance Company (ASH Insurance). Your ASH Insurance coverage is a limited policy that provides certain complementary health care benefits; it is not a replacement for any basic or major medical health benefit plan available to you. As an enrollee of an ASH Insurance PPO plan, you have the freedom to choose your complementary health care provider. You may choose from a list of providers who participate in our network (in-network providers), or you may elect to see a licensed provider outside of our network (out-of-network providers). The freedom of flexibility You are free to see providers who are either in-network or out-of-network. The network participation status of your provider at the time of service determines your benefit level. Whatever the reason, our PPO plan gives you freedom to see your provider of choice. You are not required to choose a specific provider. However, all covered services must be medically necessary and are subject to review by ASH Insurance. When you choose an out-of-network provider, you will need to file claims for reimbursement. Except when required by law, reimbursement for covered services rendered by out-of-network providers is limited to licensed providers. To take advantage of a higher benefit level, you may choose to see in-network providers, with the security of knowing that you have the option of receiving benefits for covered services if you choose to go outside the network. Your provider directory contains a complete listing of innetwork providers and some helpful information for using them. Because the list of in-network providers is subject to change, you should verify whether a provider is an in-network provider prior to receiving services. If you are not sure about the network status of a specific provider, or if you would like to request up-to-date information about a provider s status, please visit our Web site at or call our Customer Service Department toll free at If an in-network provider is not reasonably accessible to you, we will work with you and available out-of-network providers to arrange for the provision of covered services in connection with your remaining in-network level benefits. In such cases, you will be responsible for coordinating with an out-of-network provider to submit a clinical treatment plan to ASH Insurance for prospective medical necessity review of your proposed treatment to determine eligibility for benefits at the in-network level. You may generally access any appropriately licensed provider of complementary health care covered by your ASH Insurance plan without a physician referral. In some states, however, the scope of practice for certain types of providers may require that either a diagnosis, referral, or a specific prescriptive order be obtained from specified providers prior to the provider with the restricted scope of practice providing treatment to persons in that state. To determine whether this limitation may apply to a particular provider from whom you wish to receive treatment or services, we encourage you to consult the provider. You may also consult your Summary of Benefits or your Certificate of Insurance to determine whether such scope of practice issues 4

5 apply to the different types of in-network providers listed in your directory. For more information about scope of practice limitations applicable to different provider types throughout the country, you may also contact our Customer Service Department toll free at The freedom to save When you receive covered services from an in-network provider, you ll generally enjoy lower out-of-pocket costs than you would when seeing an out-of-network provider. When you receive covered services from an in-network provider you are only responsible for the copayment specified in your Certificate of Insurance. This is a fixed dollar amount that you can determine prior to receiving services. In-network providers have contracted with us to accept an agreed upon fee payment from ASH Insurance for the remaining costs and may not bill you for any remaining balance. When you see an out-of-network provider, on the other hand, your costs are not fixed. You must first meet any applicable deductible before receiving benefits for covered services. If your plan is not subject to a deductible, or you have met your deductible requirements, ASH Insurance will pay a benefit amount toward the billed charges up to the maximum amount specified in your Certificate of Insurance. You are responsible for paying any remaining costs this responsibility reflects your coinsurance obligation as well as any amount that may be balanced billed by the out-of-network provider. Insured Rights and Responsibilities Our insureds deserve the best service and health care possible. This is why it is important to us that your rights as an insured of ASH Insurance are respected. It is equally important that your responsibilities as an enrollee are explained. As an insured, you have the right to: Considerate and respectful care. Receive information about your illness in understandable terms so that you may give informed consent (except in emergencies, this information should include the proposed course of treatment, alternatives, possibilities of non-treatment, prospects for recovery, and clinical risks involved). Use the information you have received to participate to the extent permitted by law in decisions regarding care, including the right to refuse treatment or services. Full consideration of privacy, including case discussion, consultation, examination, and treatment, all of which are confidential and should be conducted discreetly, with your consent to the presence of any third parties. Reasonable continuity of care and sufficient notification of the appointment time and location as well as the identity of the person(s) providing care. Be advised of and refuse treatment or services if your health care provider engages in experimental studies/procedures affecting your care or treatment. Be informed of continuing health care requirements following discharge from treatment. Receive medically necessary and appropriate care and services, as defined in your benefit plan. File complaints and grievances when dissatisfied with the treatment or service you have received. Request and receive any available information about health education, promotion, and prevention services; community services that may help to assist with your health problems; 5

6 and the appropriate use of treatments, regardless of their relationship to your health care benefits. Examine and receive an explanation regarding any charges billed to you. Have these rights apply to the person who has legal responsibility for making decisions regarding your medical care. Exercise these rights without regard to gender; ethnic, cultural, economic, educational, or religious background; or the source of payment for care. Receive information about ASH Insurance, its services, its practitioners and providers, and insureds rights and responsibilities. Make recommendations regarding ASH Insurance s rights and responsibilities policies for insureds. As an insured, you have the responsibility to: Give your health care provider and/or health plan the information necessary to provide you with the best possible care. Follow the agreed upon treatment plan and instructions for your care. Promptly pay copayments or co-insurance and deductibles, if any. Language Assistance Program Good communication with ASH Insurance and with your providers is important. If English is not your first language, ASH Insurance provides free interpretation services of certain written materials and free interpretation services during visits to your provider. To ask for language services call ASH Insurance toll free at If you have a preferred language other than English, please notify us of your personal language needs by calling the ASH Insurance phone number listed above. Insured Participation in ASH Insurance Public Policy Committee ASH Insurance has established a Public Policy Committee to make recommendations regarding ASH Insurance s policies. To request additional information regarding the development of ASH Insurance policies or about participating in this committee, please call ASH Insurance toll free at ENROLLMENT AND ELIGIBILITY Underlying Group Health Care Coverage Requirement Your ASH Insurance plan is a limited policy that provides certain complementary health care benefits; it is not a replacement for any basic or major medical health benefit plan available to you. For this reason, eligibility under the plan requires that you and any dependents, if applicable, also be enrolled in your plan sponsor s underlying group health care plan. Coverage under your ASH Insurance plan will end the same date that coverage ends under your plan sponsor s underlying group health care plan. 6

7 Dependent Eligibility If Applicable Specifications for eligible dependent coverage, if applicable to your plan, are contained in your Certificate of Insurance. Please refer to your Certificate of Insurance or call ASH Insurance Customer Service Department toll free at for questions about dependent coverage. Your ID Card: The Key to Your Care As an insured of ASH Insurance you will receive an ID card upon enrollment. That card serves many important roles for your health care. Your card identifies you as an ASH Insurance plan enrollee. It is important to present your ID card every time you visit your complementary health care professional. Your card not only identifies you, it also lists important information relating to your covered benefits. Information on your card includes your ID number, group number, plan code and innetwork copayment amount and annual maximum in-network visit limit. It also includes your outof-network deductible (if any), coinsurance amount and annual maximum out-of-network visit limit. Your ID card will not expire unless your coverage terminates. New cards will be issued to you only when significant changes in your coverage occur. When you receive your card, it is important to review the information carefully to ensure that everything is correct. Please keep in mind that your card is not a guarantee of coverage. Insureds are covered only for services listed in their Certificates of Insurance. If, for any reason, you need a new card or additional cards, you may request them through our Customer Service Department. Canceling Your Coverage At some point due to one of many reasons, such as divorce, termination of employment or participation or a dependent reaching their limiting age, you may need to cancel coverage under your ASH Insurance policy for yourself or a dependent. To cancel coverage, contact your plan sponsor s personnel or payroll office. They will assist you with any necessary procedures. Be sure to check with your plan sponsor to determine if you or your dependents would quality for state or federal continuation of benefits. Please reference your Certificate of Insurance or check with your plan sponsor for the applicable cancellation date. In some circumstances, coverage may terminate at the end of the month rather than on the date of an event. Why Coverage May End Coverage under your ASH Insurance plan may end if: premium contributions are not made, your employment or participation ends, you cease to be eligible for insurance, 7

8 your group policy terminates, your coverage under your plan sponsor s underlying group health care plan terminates, or you knowingly furnish false, incorrect or incomplete information to us which is material to the acceptance of your application. Under applicable state and federal laws, enrollees may have the right to elect to remain covered under their plan, provided such election is timely and an appropriate provision is made for the applicable premium payment. For detailed information regarding your continuation of coverage rights, please consult your Certificate of Insurance. Address Changes On the move? Please do not forget to let us know if your address changes. If you have moved, please take a moment to contact our Customer Service Department and advise us of your new address. If it is more convenient, you may drop us a note. Please be sure to include the following information: your name, subscriber number, new address, phone number (if changed) and moving date. If applicable, please specify whether the new information also applies to any covered dependents. You may reach our Customer Service Department toll free at , Monday through Friday from 5 a.m. to 6 p.m. (PST). Please remember to also change your address at your health care providers offices. Keeping you informed is very important to us! Help us stay in touch with you. UTILIZATION MANAGEMENT PROCESSES Utilization Review Requirements/Financial Responsibility In-Network All covered services provided to you by an in-network provider are subject to utilization review to verify medical necessity of services provided. Utilization review of services provided by an innetwork provider will include pre- or post-service review of clinical treatment forms or medical records. In-network providers are contractually responsible to submit all medical records and clinical treatment forms to us and also to communicate with us as necessary regarding the medical records and clinical treatment forms on behalf of the insured. Insureds are encouraged to communicate with their in-network providers and/or us regarding any utilization review requirements. In-network providers are contractually and financially responsible to comply with our utilization review program. You are not financially responsible for any services that are not covered as a result of an in-network provider s failure to comply with our utilization review program. In-network providers are responsible to provide all medically necessary services that they believe are appropriate for you. Out-of-Network All covered services provided to you by an out-of-network provider are subject to utilization review to verify medical necessity of services provided and/or to determine whether services are related to covered services. Utilization review of services provided by an out-of-network provider 8

9 may include post-service review of medical records. If necessary, we will send a request for medical records to you or your designated representative, which may include your out-ofnetwork provider. You are responsible to submit the appropriate medical records requested by us in connection with treatment or services received from an out-of-network provider and to communicate with us as necessary regarding such request. You are encouraged to communicate with your out-of-network providers and/or us regarding any utilization review requirements and to have your out-of-network providers contact us as necessary. You are financially responsible for any non-covered services, which include any treatments or services that are determined by us as not being medically necessary and therefore not covered services. You are also financially responsible for any services that are determined by us to not be related to the covered services under your ASH Insurance plan. Decision-Making Guidelines ASH Insurance approves and provides reimbursement for covered, medically necessary treatment or services that falls within the primary focus and scope of a provider s specialty training. ASH Insurance will consider a variety of factors including, but not limited to, severity and chronicity of the condition and the health and demographic status of the patient (e.g. age, sex, prior illness, etc.) when making decisions to approve or deny reimbursement for health care services. ASH Insurance will consider whether the treatment or services are likely to return the patient to his or her normal health and function, or as close to his or her normal health and function as reasonably possible, as they existed before the onset of the illness, injury or condition involved. We do not specifically reward participating providers or other individuals for issuing denials of coverage or services. Utilization management decision making is based only on appropriateness of care and service and existence of coverage. During the review process, the ASH Insurance contracted provider will render medically indicated treatment or services. Verification of medical necessity is part of the process that defines reimbursement to the provider for services, but should not affect the timeliness of the patient s treatment. If the provider disagrees with the ASH Insurance decision, a reconsideration process is available so the treating provider can discuss the decision directly with the clinical services manager who made the decision. If the provider continues to disagree with the initial decision, appeal options are available through ASH Insurance. Decision-Making Timelines Decisions to approve or deny reimbursement for health care services will be made in a timely fashion appropriate for the nature of the patient s condition. If the provider chooses to submit a pre-service verification of medical necessity, the ASH Insurance decision will be made in a timely fashion appropriate for the nature of the patient s condition not to exceed two business days from ASH Insurance s receipt of the information reasonably necessary and requested by ASH Insurance to make the determination. When the insured s condition is such that the insured faces an imminent and serious threat to his or her health, including, but not limited to, the potential loss of life, limb, or other major bodily function, or the normal timeframe for decision-making process would be detrimental to the insured s life or health or could jeopardize the insured s ability to regain maximum function, 9

10 decisions to approve or deny requests will be made in a timely fashion, appropriate for the nature of the insured s condition, not to exceed 72 hours after ASH Insurance s receipt of information reasonably necessary and requested by ASH Insurance to make the determination. If ASH Insurance cannot make a decision to verify medical necessity within the timeframes specified above because ASH Insurance is not in receipt of all of the information reasonably necessary and requested, or because ASH Insurance has asked that an additional examination or test that is reasonable and consistent with professionally recognized standards of care be performed, ASH Insurance will immediately, upon the expiration of the timeframe described above or as soon as it becomes aware that it will not meet the timeframe (whichever occurs first), provide written notice to the provider and the insured. The notice will state that ASH Insurance cannot make a decision to verify the medical/clinical necessity of the request within the required timeframe. It will also specify, as applicable, the information requested but not received, the expert reviewer to be consulted, or the additional examinations or tests required. The notice will also state the anticipated date on which a decision may be rendered. Upon receipt of all information reasonably necessary and requested, ASH Insurance will verify the medical necessity of the requested treatment or service within the timeframes specified above, as applicable. Notification of Determinations You are notified of approved or modified treatment or service requests via the Insured Response Form (IRF). Service denial letters are sent to insureds and providers in the event that the requests for services are denied. The criteria used to deny services for a case under evaluation is disclosed to you and your provider in that notification letter. You may request a copy of the clinical guidelines used in the evaluation of medical necessity by contacting our Customer Service Department. If you are not satisfied with the decision, you may submit an appeal request to ASH Insurance as indicated on the IRF or service denial letter. Provider Reimbursement The providers participating in ASH Insurance s PPO plan as in-network providers receive payment for providing covered services on a fee-for-service basis according to an agreed upon fee schedule. Those providers have agreed to accept your copayment (plus any applicable deductible) and our fee-schedule payment as payment in full for covered services provided to ASH Insurance enrollees. Out-of-network providers are paid for covered services up to the benefit maximum; they may balance bill enrollees for non-covered services and for amounts, if any, remaining after the benefit maximum, and any enrollee deductibles and coinsurance, have been paid. Continuity of Care When you are in the course of treatment with an in-network provider, should that provider cease to participate in our plan, your ASH Insurance plan allows you to continue seeing that provider with benefits at the in-network level for a period of time until your documented treatment plan is concluded or you may be safely transferred to another participating provider. The continuation 10

11 of in-network level coverage is available only when the provider who has left our network agrees to continue abiding by our plan requirements and fee schedule. Emergency and Urgent Care In-network providers must make provisions to allow access 24 hours a day, seven days a week in the case emergency or urgent care is needed by an insured. Where applicable to the types of complementary health care made available under your ASH Insurance plan, such services are generally those provided for the sudden and unexpected onset of an injury or condition which manifests itself by acute symptoms of sufficient severity, including severe pain, such that a prudent layperson, who possesses an average knowledge of health and medicine, could reasonably expect that a delay of immediate attention could result in (1) placing the health of the individual (or with respect to a pregnant woman, the health of the woman or her unborn child) in serious jeopardy; (2) serious impairment to bodily functions; (3) serious dysfunction of any bodily organ or part; or (4) decreasing the likelihood of maximum recovery. In emergent or urgent situations, should an in-network provider not be reasonably accessible to you, you may be able to receive covered services from an out-of-network provider for your in-network copayment only. Such situations, however, are subject to our post-service review of the emergency or urgent status of your case. Should you encounter the need for emergency care, dial and seek assistance immediately. UNDERSTANDING YOUR BENEFITS Your Benefits Your Policy As an ASH Insurance enrollee, you will receive, upon enrollment, a Certificate of Insurance. That document specifically outlines the benefits and service exclusions and limitations under your ASH Insurance policy. You should consult the Schedule of Insurance and applicable benefit description sections in your Certificate of Insurance to determine whether and to what extent a service is covered under your specific plan. It is important to always look at both the Schedule of Insurance and the particular benefit description sections in your Certificate of Insurance to determine the benefits covered under your plan. Prior to enrollment you may also receive a Summary of Benefits document that summarizes the coverage available under your Certificate of Insurance. Your Certificate of Insurance, however, contains the most detailed information and would control in the case of any discrepancies between those documents. Policy Changes Each year as your policy renews, you will receive information on any policy changes or clarifications. Please be sure to read all information carefully so that you may fully utilize your coverage and be familiar with your benefits. When you understand the extent of your health care coverage, you can make the most of your health care benefits. Filing Claims Time is a valuable commodity for all of us; that is why ASH Insurance minimizes the amount of paperwork required for our enrollees. In most cases, claims are submitted directly by in-network 11

12 health care providers. On occasion, it may be necessary for you to submit a claim for reimbursement (such as when you use out-of-network providers). When submitting a claim, be sure to follow these guidelines: Send an itemized bill from the provider of service with an ASH Insurance Company Claim Form. Send the bill and claim form as soon as possible after the services are received, but no later than the time specified in your Certificate of Insurance, to ASH Insurance, P.O. Box , San Diego, CA Explanation of Benefits (EOB) Occasionally, you may be responsible for paying a portion of a claim. The most common financial responsibilities of our insureds involve deductible, coinsurance, or copayment amounts and non-covered charges from out-of-network providers. You will be notified of financial responsibilities other than copayments with a form called an Explanation of Benefits (EOB). The EOB contains important information including the total amount charged, allowed amount, the amount paid by ASH Insurance and the amount that is your responsibility. An EOB is not a bill. The dollar amount indicated as your responsibility on your EOB should always be paid to the provider of service upon receipt of a bill; it will not be paid by ASH Insurance. Premiums, Copayments, Deductibles, and Coinsurance Your plan sponsor may pay all or a part of your premiums. To determine what premium amount, if any, you may be responsible for under your group plan, please consult your plan sponsor. In addition to premiums, ASH Insurance plan policies may contain a copayment, deductible, and/or coinsurance for covered services. As an enrollee, you are responsible for these amounts, so it is important to understand the differences of each and how they affect your policy. A copayment is a specified dollar amount that you must pay each time covered services are provided. An example of a service that may require a copayment is an office visit. As an enrollee, you should be prepared to pay your copayment at the time the services are provided. Please refer to the Schedule of Insurance in your Certificate of Insurance for your plan s specific copayment information. Under your ASH Insurance plan, copayments apply to covered services received from in-network providers. For such services, ASH Insurance reimburses the innetwork providers for the remainder of the covered services based on a fee schedule. A deductible is a specified dollar amount that an insured or family is required to pay each contract year before ASH Insurance will pay for covered services. If applicable, the amount of your deductible is indicated in the Schedule of Insurance in your Certificate of Insurance and is calculated on a calendar-year basis. Deductibles under your ASH Insurance plan are limited, if applicable, to covered services rendered by out-of-network providers. When an insured or a family satisfies such a deductible, or for plans that do not contain a deductible requirement for covered services received out-of-network, ASH Insurance will 12

13 reimburse billed charges for covered services at the percentage indicated in your Certificate of Insurance s Schedule of Insurance. This payment, also known as the benefit amount, is subject to a maximum limit as specified in the Schedule of Insurance. Unless otherwise indicated, the deductible must be met before a benefit amount is payable under the policy. Coinsurance is the amount, usually expressed as a percentage, you must pay after ASH Insurance has applied the eligible benefit amount to billed charges for covered services from an out-of-network provider. If you, as an enrollee, are responsible for any portion (other than fixed dollar amount copayments) of the cost for covered services that you receive, ASH Insurance will send you an Explanation of Benefits. Maximum Allowable Fees (How Claims Are Processed) When you receive covered services from any in-network provider, the charges are covered based on the contract agreements ASH Insurance has with its participating providers. If there is a difference between the billed amount and what ASH Insurance allows, you will not be held liable for that amount. You will only be liable for any copayments specified in your Certificate of Insurance or any non-covered services. When you receive covered services from out-of-network providers, the situation is different. Because we do not have any contract agreements with non-participating providers, the charges that are covered are based on billed charges and are limited to the percentage and maximum amount specified in your Certificate of Insurance s Schedule of Insurance. If there is a difference between what was billed and our maximum allowable benefit amount, you will be responsible for that difference. For example, if your plan provides a benefit amount of 50 percent of billed charges, up to a maximum of $30, and the billed charges for covered services provided during an office visit were $50 (and your deductible, if any, was already met), then we would pay $25 and you would be responsible for the remaining $25. If the billed charges for covered services provided during an office visit were $80 and your deductible, if any, was already met, then we would pay the maximum of $30, and you would be responsible for the remaining $50 in billed charges from the out-of-network provider. Maximum benefit amounts apply to all covered services received from out-of-network providers. Please keep in mind that benefit amounts will only be applied to billed charges from out-ofnetwork providers after any deductible requirements have been met. Subrogation: What Does It Mean? At some time during your life, you may be involved in an accident. For example, you could fall on a slippery floor or be involved in an automobile collision. Occasionally, there is another party involved in the accident that may be responsible for the resulting expenses. If you were injured in the accident and needed complementary health care, your covered expenses would be paid by ASH Insurance as provided under your policy. In turn, ASH Insurance may try to recover the money spent on your injuries from a party liable for them or from any settlement you may receive from the liable party. This attempt to recover money from 13

14 the liable party or from settlements you may receive from the liable party is known as subrogation. If you or a family member is injured in an accident and there is a right to recover damages from a third party, it is important that you promptly notify your provider and ASH Insurance. If you are dealing with an insurance company and/or an attorney, please let us know their names, addresses, and telephone numbers. You must execute any assignments, liens or other documents and provide information that ASH Insurance requests. Benefits may be withheld until documents or information are received. When ASH Insurance pursues subrogation we are doing our part to keep the costs of your health care down. Our share of the recovery will be equitable considering the adequacy of your compensation in order to be made whole. In order for services to be covered according to your policy, you must follow ASH Insurance requirements for coverage. For a more complete description of ASH Insurance s subrogation rights, please refer to your Certificate of Insurance. Appeals and Grievances We recognize that at times questions and concerns about benefits, claims or services you have received may arise. Whenever you have a question or concern, please call our Customer Service Department toll free at A representative will make every effort to resolve your concern promptly and completely. Sharing your concerns will help us to identify our strengths and weaknesses. Your input matters, and we encourage you to call with any concerns you may have regarding your plan. If you continue to feel a decision has adversely affected your coverage, benefits or relationship with ASH Insurance, you may file an appeal or grievance. An appeal is a request by you, the Insured, that we reconsider an adverse benefit determination. A grievance is a formal oral or written expression of dissatisfaction by you not involving an adverse benefit determination. You may also be eligible for an independent (external) review. Independent review is a process whereby an independent third party, outside of ASH Insurance, evaluates the merits of a clinical appeal. The appeal and grievance processes are outlined below. Formal Appeals Process If you believe that your claim was not paid properly, or that you were incorrectly denied coverage, you and/or your authorized representative may file a formal appeal. Written appeals should be addressed to American Specialty Health, Appeals & Grievances Department, P.O. Box , San Diego, CA Verbal appeals should be directed to the Customer Service Department toll free at All appeals must be made in a timely manner. Formal appeals must be filed within 180 days of notification of a partial approval or non-approval of requested benefits (otherwise known as an adverse determination), unless applicable state law provides for a longer period of time. Please clearly describe the adverse determination you are appealing, the reason for your appeal, and provide any additional information to support your appeal. ASH Insurance s appeal process, which separates administrative concerns from clinical issues, is described below. Administrative Appeals 14

15 Administrative appeals typically involve adverse determinations based on eligibility and nonclinical, contractual limitations. Depending on state law, administrative appeals can include more than one level of review. Managers from ASH Insurance s operational departments review first level administrative appeals. Upon receipt of the appeal, ASH Insurance will respond to you within 15 days for pre-service claims or 30 days for post-service claims. If you disagree with the outcome of the first level appeal, you may appeal the decision within 45 days of receiving it. The Administrative Review Committee (ARC) reviews second level administrative appeals. The ARC is made up of ASH Insurance managers, directors, and officers. In addition, one contracted provider from our provider network participates on the ARC. This provider is not an employee of ASH Insurance, but will be a health care professional in the same or similar profession as the treating provider or one who typically provides treatment or services using the same procedures to deliver the services under review. Upon receipt of the second level appeal, ASH Insurance will respond within 15 days for pre-service claims or 30 days for post-service claims. Clinical Appeals Appeals resulting from a partial approval or non-approval of services relative to medical necessity or a partial approval or non-approval resulting from treatment that is determined to be experimental or investigational are considered clinical appeals. Depending on state law, clinical appeals can also include more than one level of review. A senior clinical services manager, who is licensed in the same specialty as the treating provider and who was not involved in the original decision, reviews first level clinical appeals. Upon receipt of your appeal, ASH Insurance will respond within either 15 days for pre-service claims or 30 days for post-service claims. If you disagree with the outcome of the first level appeal, you may appeal the decision within 45 days of receipt of the appeal determination. A clinical director reviews second level clinical appeals. In the event the decision is upheld, the appeal will also be reviewed by a contracted provider from our network. The contracted provider will be a health care professional in the same or similar profession as the treating provider or one who typically provides treatment or services using the same procedures to deliver the services under review. Upon receipt of your second level appeal, ASH Insurance will respond within either 15 days for pre-service claims or 30 days for post-service claims. Urgent Care Reviews If your claim involves coverage of a service or treatment that if delayed, might seriously jeopardize your life, health, or ability to regain maximum function, or if you are experiencing severe pain that cannot be adequately managed without the requested care, you may request an expedited review by either calling ASH Insurance s Customer Service Department or writing to ASH Insurance s Appeals and Grievance Department. If your condition meets the criteria for an expedited review, you will be notified of the decision no later than 72 hours from the receipt of your request. Full and Fair Review To provide you with a full and fair review, representatives of ASH Insurance committees, who were not involved in any previous review determination and who are not subordinates of such persons, participate in appeal review determinations. Voluntary Appeals Process If after all required appeal review levels have been completed, you are still not satisfied with the final determination, you have the option to pursue the following levels of voluntary appeals: 15

16 After you have submitted an appeal or grievance with ASH Insurance and the decision is upheld or remains unsolved for more than 30 days, or three days for cases requiring expedited review, you may request an Independent Medical Review (IMR) through the California Department of Insurance for cases involving decisions based in whole or in part on medical necessity. If the case does not qualify for review, by an IMR, the Department of Insurance may review the matter as a coverage dispute. You will receive instructions on how to pursue this option as part of the written decision from ASH Insurance. Contact Information To present inquiries or obtain information about coverage and to receive assistance in resolving complaints, you may contact ASH Insurance toll free at After first attempting to resolve an appeal or grievance with ASH Insurance, you may contact the Department of Insurance for assistance with the appeal or grievance by calling HELP (4357) or by writing to California Department of Insurance, Consumer Communication Bureau, 300 South Spring Street, South Tower, Los Angeles, California Civil Action If both levels of internal review for an appeal have been exhausted and the appeal has not been approved, or at any time during the voluntary appeal process (if applicable) then you may have the right to bring a civil action under Section 502(a) of the Employee Retirement Income Security Act or applicable state law. Grievances Grievances are formal oral or written expressions of dissatisfactions by an Insured not involving an adverse benefit determination. Our procedures allow for one level of internal review for all grievances. All grievances will be resolved within 30 days, or according to state-required time frames if shorter. Privacy and Confidentiality ASH Insurance protects the privacy of all protected health information and non-public personal financial information of each insured. A detailed description of our current privacy practices, including an explanation of how we may use and disclose your information is provided in our complete Notice of Privacy Practices. The following brief summary highlights the important parts of our privacy program. As explained in ASH Insurance s complete privacy notice, we may use and share health information about you for the following reasons: For treatment, payment and business and administrative activities; To inform you about our health-related products and services; To recommend other treatment and health care providers; and For medical research and public health activities. For other proposed uses and disclosures, except as required by law, we will explain the use and disclosure and seek your permission. 16

17 You have the following rights and choices regarding your protected health information: You may review, copy and ask us to amend certain health information we have about you; You may ask us for a list of certain disclosures we have made of that information; You may ask us to deliver health information about you to an alternative address or via alternative means; You may ask us not to share your health information with certain parties. Where you have given us permission to use or share your health information, you may change you mind at anytime. To exercise any of your rights and choices, contact us using the information provided in our complete Notice of Privacy Practices. Additionally, you should note that: Subscribers sign a routine consent at the time of enrollment for release of protected health information and records for themselves and their enrolled dependents. This allows ASH Insurance to use insured personal information and records, without specific consent, for the purposes described in this policy. ASH Insurance may be required by state law to periodically update this general release form. If you receive a request to update your general release, please complete it and return it to us. Doing so will help us process your service requests and claims promptly and correctly. Aggregated health information and data, which is not individually identifiable, is not subject to privacy restrictions and may be used and disclosed by ASH Insurance without restrictions. In the event that the information in this handbook conflicts with the information in the complete Notice of Privacy Practices, the information in the complete Notice will prevail. Third-Party Administrator Disclosure Your plan is offered and underwritten by ASH Insurance. ASH Insurance is an affiliate of American Specialty Health Networks, Inc. (ASH Networks). ASH Insurance has entered into an agreement with ASH Networks to provide certain administrative services, including but not limited to customer service, claims processing, utilization management and network management, for ASH Insurance. Quality Improvement Program ASH Insurance has an active quality improvement (QI) program that is designed to improve the quality of clinical care and service provided to enrollees. The program is directed by the quality improvement committee. The committee evaluates the QI program annually. 17

18

Certain exceptions apply to Hospital Inpatient Confinement for childbirth as described below.

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

Medical and Rx Claims Procedures

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

How To Appeal An Adverse Benefit Determination In Aetna

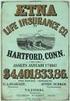

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Member Handbook A brief guide to your health care coverage

Member Handbook A brief guide to your health care coverage Preferred Provider Organization Plan Using the Private Healthcare Systems Network PREFERRED PROVIDER ORGANIZATION (PPO) PLAN USING THE PRIVATE

Member Handbook A brief guide to your health care coverage Preferred Provider Organization Plan Using the Private Healthcare Systems Network PREFERRED PROVIDER ORGANIZATION (PPO) PLAN USING THE PRIVATE

A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR

HOUSE BILL NO. INTRODUCED BY G. MACLAREN BY REQUEST OF THE STATE AUDITOR 0 A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR UTILIZATION REVIEW, GRIEVANCE, AND EXTERNAL

HOUSE BILL NO. INTRODUCED BY G. MACLAREN BY REQUEST OF THE STATE AUDITOR 0 A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR UTILIZATION REVIEW, GRIEVANCE, AND EXTERNAL

9. Claims and Appeals Procedure

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

(d) Concurrent review means utilization review conducted during an inpatient stay.

9792.6. Utilization Review Standards Definitions For Utilization Review Decisions Issued Prior to July 1, 2013 for Injuries Occurring Prior to January 1, 2013. As used in this Article: The following definitions

9792.6. Utilization Review Standards Definitions For Utilization Review Decisions Issued Prior to July 1, 2013 for Injuries Occurring Prior to January 1, 2013. As used in this Article: The following definitions

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C MEDICARE SUPPLEMENT SUBSCRIBER AGREEMENT This agreement describes your benefits from Blue Cross & Blue Shield of Rhode Island. This is a Medicare

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C MEDICARE SUPPLEMENT SUBSCRIBER AGREEMENT This agreement describes your benefits from Blue Cross & Blue Shield of Rhode Island. This is a Medicare

Member Rights, Complaints and Appeals/Grievances 5.0

Member Rights, Complaints and Appeals/Grievances 5.0 5.1 Referring Members for Assistance The Member Services Department has representatives to assist with calls for: General verification of member eligibility

Member Rights, Complaints and Appeals/Grievances 5.0 5.1 Referring Members for Assistance The Member Services Department has representatives to assist with calls for: General verification of member eligibility

CALIFORNIA: A CONSUMER S STEP-BY-STEP GUIDE TO NAVIGATING THE INSURANCE APPEALS PROCESS

Loyola Law School Public Interest Law Center 800 S. Figueroa Street, Suite 1120 Los Angeles, CA 90017 Direct Line: 866-THE-CLRC (866-843-2572) Fax: 213-736-1428 TDD: 213-736-8310 E-mail: CLRC@LLS.edu www.cancerlegalresourcecenter.org

Loyola Law School Public Interest Law Center 800 S. Figueroa Street, Suite 1120 Los Angeles, CA 90017 Direct Line: 866-THE-CLRC (866-843-2572) Fax: 213-736-1428 TDD: 213-736-8310 E-mail: CLRC@LLS.edu www.cancerlegalresourcecenter.org

Business Blue SM. Employee Booklet. Group and Individual Division. Bus.Blue book SMGRP-NGF (Rev. 1/12) High Deductible Ord.

Business Blue SM Employee Booklet Group and Individual Division Bus.Blue book SMGRP-NGF (Rev. 1/12) www.southcarolinablues.com Dear Member: I would like to take this opportunity to welcome you to Blue

Business Blue SM Employee Booklet Group and Individual Division Bus.Blue book SMGRP-NGF (Rev. 1/12) www.southcarolinablues.com Dear Member: I would like to take this opportunity to welcome you to Blue

Individual Dental Policy Underwritten by Premier Access Insurance Company

Individual Dental Policy Underwritten by Premier Access Insurance Company Premier Access Insurance Company ( Premier Access ) certifies that you are being issued this Policy and Certificate (collectively

Individual Dental Policy Underwritten by Premier Access Insurance Company Premier Access Insurance Company ( Premier Access ) certifies that you are being issued this Policy and Certificate (collectively

2016 Provider Directory. Commercial Unity Prime Network

2016 Provider Directory Commercial Unity Prime Network TM IMPORTANT CONTACT INFORMATION Read the instructions for using this network and then complete this page after you have selected Primary Care Physicians

2016 Provider Directory Commercial Unity Prime Network TM IMPORTANT CONTACT INFORMATION Read the instructions for using this network and then complete this page after you have selected Primary Care Physicians

Title 19, Part 3, Chapter 14: Managed Care Plan Network Adequacy. Requirements for Health Carriers and Participating Providers

Title 19, Part 3, Chapter 14: Managed Care Plan Network Adequacy Table of Contents Rule 14.01. Rule 14.02. Rule 14.03. Rule 14.04. Rule 14.05. Rule 14.06. Rule 14.07. Rule 14.08. Rule 14.09. Rule 14.10.

Title 19, Part 3, Chapter 14: Managed Care Plan Network Adequacy Table of Contents Rule 14.01. Rule 14.02. Rule 14.03. Rule 14.04. Rule 14.05. Rule 14.06. Rule 14.07. Rule 14.08. Rule 14.09. Rule 14.10.

407-767-8554 Fax 407-767-9121

Florida Consumers Notice of Rights Health Insurance, F.S.C.A.I, F.S.C.A.I., FL 32832, FL 32703 Introduction The Office of the Insurance Consumer Advocate has created this guide to inform consumers of some

Florida Consumers Notice of Rights Health Insurance, F.S.C.A.I, F.S.C.A.I., FL 32832, FL 32703 Introduction The Office of the Insurance Consumer Advocate has created this guide to inform consumers of some

TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

Appeals and Provider Dispute Resolution

Appeals and Provider Dispute Resolution There are two distinct processes related to Non-Coverage (Adverse) Determinations (NCD) regarding requests for services or payment: (1) Appeals and (2) Provider

Appeals and Provider Dispute Resolution There are two distinct processes related to Non-Coverage (Adverse) Determinations (NCD) regarding requests for services or payment: (1) Appeals and (2) Provider

Your Health Care Benefit Program. BlueAdvantage Entrepreneur Participating Provider Option

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

Compliance Assistance Group Health and Disability Plans

Compliance Assistance Group Health and Disability Plans Benefit Claims Procedure Regulation (29 CFR 2560.503-1) The claims procedure regulation (29 CFR 2560.503-1) provides minimum procedural requirements

Compliance Assistance Group Health and Disability Plans Benefit Claims Procedure Regulation (29 CFR 2560.503-1) The claims procedure regulation (29 CFR 2560.503-1) provides minimum procedural requirements

Welcome Information. Registration: All patients must complete a patient information form before seeing their provider.

Welcome Information Thank you for choosing our practice to take care of your health care needs! We know that you have a choice in selecting your medical care and we strive to provide you with the best

Welcome Information Thank you for choosing our practice to take care of your health care needs! We know that you have a choice in selecting your medical care and we strive to provide you with the best

Services Available to Members Complaints & Appeals

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

The Pennsylvania Insurance Department s. Your Guide to filing HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

211 CMR 51.00: PREFERRED PROVIDER HEALTH PLANS AND WORKERS COMPENSATION PREFERRED PROVIDER ARRANGEMENTS

211 CMR 51.00: PREFERRED PROVIDER HEALTH PLANS AND WORKERS COMPENSATION PREFERRED PROVIDER ARRANGEMENTS Section 51.01: Authority 51.02: Definitions 51.03: Applicability 51.04: Approval of Preferred Provider

211 CMR 51.00: PREFERRED PROVIDER HEALTH PLANS AND WORKERS COMPENSATION PREFERRED PROVIDER ARRANGEMENTS Section 51.01: Authority 51.02: Definitions 51.03: Applicability 51.04: Approval of Preferred Provider

Patient Resource Guide for Billing and Insurance Information

Patient Resource Guide for Billing and Insurance Information 17 Patient Account Payment Policies July 2012 Update Lexington Clinic Central Business Office Payment Policies Customer service...2 Check-in...2

Patient Resource Guide for Billing and Insurance Information 17 Patient Account Payment Policies July 2012 Update Lexington Clinic Central Business Office Payment Policies Customer service...2 Check-in...2

COMPLAINT AND GRIEVANCE PROCESS

COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check

COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check

SUMMARY PLAN DESCRIPTION. for. the Retiree Medical and Dental Benefits of the. Bentley University. Employee Health and Welfare Benefit Plan

SUMMARY PLAN DESCRIPTION for the Retiree Medical and Dental Benefits of the Bentley University Employee Health and Welfare Benefit Plan Effective January 1, 2015 Table of Contents page Introduction...

SUMMARY PLAN DESCRIPTION for the Retiree Medical and Dental Benefits of the Bentley University Employee Health and Welfare Benefit Plan Effective January 1, 2015 Table of Contents page Introduction...

Premera Blue Cross Medicare Advantage Provider Reference Manual

Premera Blue Cross Medicare Advantage Provider Reference Manual Introduction to Premera Blue Cross Medicare Advantage Plans Premera Blue Cross offers Medicare Advantage (MA) plans in King, Pierce, Snohomish,

Premera Blue Cross Medicare Advantage Provider Reference Manual Introduction to Premera Blue Cross Medicare Advantage Plans Premera Blue Cross offers Medicare Advantage (MA) plans in King, Pierce, Snohomish,

CHAPTER 7: RIGHTS AND RESPONSIBILITIES

We want to make sure you are aware of your rights and responsibilities, as well as those of your Tufts Health Together (MassHealth), Tufts Health Forward (Commonwealth Care), Tufts Health Extend, Network

We want to make sure you are aware of your rights and responsibilities, as well as those of your Tufts Health Together (MassHealth), Tufts Health Forward (Commonwealth Care), Tufts Health Extend, Network

Your Health Care Benefit Program. BlueChoice PPO Basic Option Certificate of Benefits

Your Health Care Benefit Program BlueChoice PPO Basic Option Certificate of Benefits 1215 South Boulder P.O. Box 3283 Tulsa, Oklahoma 74102 3283 70260.0208 Effective May 1, 2010 Table of Contents Certificate............................................................................

Your Health Care Benefit Program BlueChoice PPO Basic Option Certificate of Benefits 1215 South Boulder P.O. Box 3283 Tulsa, Oklahoma 74102 3283 70260.0208 Effective May 1, 2010 Table of Contents Certificate............................................................................

FIDUCIARY UNDERSTANDING YOUR RESPONSIBILITIES UNDER A GROUP HEALTH PLAN. Health Insurance Cooperative Agency www.hicinsur.com 913.649.

UNDERSTANDING YOUR FIDUCIARY RESPONSIBILITIES UNDER A GROUP HEALTH PLAN Health Insurance Cooperative Agency www.hicinsur.com 913.649.5500 1 Content Introduction The essential elements of a group health

UNDERSTANDING YOUR FIDUCIARY RESPONSIBILITIES UNDER A GROUP HEALTH PLAN Health Insurance Cooperative Agency www.hicinsur.com 913.649.5500 1 Content Introduction The essential elements of a group health

Appeals Provider Manual 15

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

Provider Handbook Supplement for Blue Shield of California (BSC)

Magellan Healthcare, Inc. * Provider Handbook Supplement for Blue Shield of California (BSC) *In California, Magellan does business as Human Affairs International of California, Inc. and/or Magellan Health

Magellan Healthcare, Inc. * Provider Handbook Supplement for Blue Shield of California (BSC) *In California, Magellan does business as Human Affairs International of California, Inc. and/or Magellan Health

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN. Amended and Restated

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN Amended and Restated Effective June 1, 2006 SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE

SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE BENEFIT PLAN Amended and Restated Effective June 1, 2006 SURA/JEFFERSON SCIENCE ASSOCIATES, LLC COMPREHENSIVE HEALTH AND WELFARE

Member Guide. Combined Evidence of Coverage & Disclosure Form 2013. Healthy San Diego. Your Managed Medi-Cal Plan

Member Guide Combined Evidence of Coverage & Disclosure Form 2013 Healthy San Diego Your Managed Medi-Cal Plan Corporate Office 2420 Fenton Street, Suite 100 Chula Vista, CA 91914 1-800-224-7766 Important

Member Guide Combined Evidence of Coverage & Disclosure Form 2013 Healthy San Diego Your Managed Medi-Cal Plan Corporate Office 2420 Fenton Street, Suite 100 Chula Vista, CA 91914 1-800-224-7766 Important

PacifiCare of Oklahoma, Inc.

PacifiCare of Oklahoma, Inc. Welcome to PacifiCare When you chose PacifiCare as your health care plan, you opened the door to many benefits, services and resources designed to keep you healthy. This booklet

PacifiCare of Oklahoma, Inc. Welcome to PacifiCare When you chose PacifiCare as your health care plan, you opened the door to many benefits, services and resources designed to keep you healthy. This booklet

California Workers Compensation Medical Provider Network Employee Notification & Guide

California Workers Compensation Medical Provider Network Employee Notification & Guide In partnership with We are pleased to introduce the California workers compensation medical provider network (MPN)

California Workers Compensation Medical Provider Network Employee Notification & Guide In partnership with We are pleased to introduce the California workers compensation medical provider network (MPN)

Utilization Management

Utilization Management L.A. Care Health Plan Please read carefully. How to contact health plan staff if you have questions about Utilization Management issues When L.A. Care makes a decision to approve

Utilization Management L.A. Care Health Plan Please read carefully. How to contact health plan staff if you have questions about Utilization Management issues When L.A. Care makes a decision to approve

Neighborhood Health Partnership

Neighborhood Health Partnership Answers to Frequently Asked Questions Q. Whom do I call for assistance or if I need information in another language? A. Call Customer Service at the phone number on your

Neighborhood Health Partnership Answers to Frequently Asked Questions Q. Whom do I call for assistance or if I need information in another language? A. Call Customer Service at the phone number on your

Laborers Health & Welfare Bulletin

What Is An EOB Notice? An Explanation of Benefits notice (EOB) is a summary of your recent medical benefit claim that has been processed for payment. The notice will show the dates and what types of services

What Is An EOB Notice? An Explanation of Benefits notice (EOB) is a summary of your recent medical benefit claim that has been processed for payment. The notice will show the dates and what types of services

United HealthCare Insurance Company. Definity SM. Health Reimbursement Account. For. Rockingham County

United HealthCare Insurance Company Definity SM Health Reimbursement Account For Rockingham County Group Number: 717360 Effective Date: October 1, 2009 HRA SPD Notice to Employees Definity SM Health Reimbursement

United HealthCare Insurance Company Definity SM Health Reimbursement Account For Rockingham County Group Number: 717360 Effective Date: October 1, 2009 HRA SPD Notice to Employees Definity SM Health Reimbursement

FREQUENTLY ASKED QUESTIONS ID CARDS / ELIGIBILITY / ENROLLMENT

FREQUENTLY ASKED QUESTIONS ID CARDS / ELIGIBILITY / ENROLLMENT BENEFIT INFORMATION CLAIMS STATUS/INFORMATION GENERAL INFORMATION PROVIDERS THE SIGNATURE 90 ACCOUNT PLAN THE SIGNATURE 80 PLAN USING YOUR

FREQUENTLY ASKED QUESTIONS ID CARDS / ELIGIBILITY / ENROLLMENT BENEFIT INFORMATION CLAIMS STATUS/INFORMATION GENERAL INFORMATION PROVIDERS THE SIGNATURE 90 ACCOUNT PLAN THE SIGNATURE 80 PLAN USING YOUR

UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT

Model Regulation Service April 2010 UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT Table of Contents Section 1. Title Section 2. Purpose and Intent Section 3. Definitions Section 4. Applicability and

Model Regulation Service April 2010 UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT Table of Contents Section 1. Title Section 2. Purpose and Intent Section 3. Definitions Section 4. Applicability and

The EyeMed Network. EyeMed Vision Care Attn: OON Claims P.O. Box 8504 Mason, Oh 45040-7111

The following is a summary of the vision benefits for Unity Health System. This document is not the Summary Plan Description document Plan Information Unity Health System has selected EyeMed Vision Care

The following is a summary of the vision benefits for Unity Health System. This document is not the Summary Plan Description document Plan Information Unity Health System has selected EyeMed Vision Care

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP)

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP) 2014 Magellan Health Services Table of Contents SECTION 1: INTRODUCTION... 3 Welcome... 3 Covered

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP) 2014 Magellan Health Services Table of Contents SECTION 1: INTRODUCTION... 3 Welcome... 3 Covered

Plan D. Information About Your Medicare Supplement Coverage:

Plan D Information About Your Medicare Supplement Coverage: Please read the Outline of Coverage first. Then read your Certificate of Coverage. If you have questions about your coverage, call our customer

Plan D Information About Your Medicare Supplement Coverage: Please read the Outline of Coverage first. Then read your Certificate of Coverage. If you have questions about your coverage, call our customer

IMPORTANT: This new Member Handbook replaces similar language in the enclosed Certificate of Coverage & Member Handbook (or individual contract).

IMPORTANT: This new Member Handbook replaces similar language in the enclosed Certificate of Coverage & Member Handbook (or individual contract). IMPORTANT: All references to referrals contained within

IMPORTANT: This new Member Handbook replaces similar language in the enclosed Certificate of Coverage & Member Handbook (or individual contract). IMPORTANT: All references to referrals contained within

The Health Insurance Marketplace: Know Your Rights

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a Marketplace health plan. These rights include: Getting easy-to-understand information about what your plan

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a Marketplace health plan. These rights include: Getting easy-to-understand information about what your plan

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures.

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

THE TENNESSEE PLAN HANDBOOK

THE TENNESSEE PLAN HANDBOOK The State of Tennessee Medicare Supplement Plan for Retirees 2015 Quick Information: The Tennessee Plan ID number printed on your POMCO Group ID card is: The effective (beginning)

THE TENNESSEE PLAN HANDBOOK The State of Tennessee Medicare Supplement Plan for Retirees 2015 Quick Information: The Tennessee Plan ID number printed on your POMCO Group ID card is: The effective (beginning)

1) How does my provider network work with Sanford Health Plan?

NDPERS FAQ Summary Non-Medicare Members Last Updated: 8/5/2015 PROVIDER NETWORK 1) How does my provider network work with Sanford Health Plan? Sanford Health Plan is offering you the same PPO network you

NDPERS FAQ Summary Non-Medicare Members Last Updated: 8/5/2015 PROVIDER NETWORK 1) How does my provider network work with Sanford Health Plan? Sanford Health Plan is offering you the same PPO network you

Managed Care 101. What is Managed Care?

Managed Care 101 What is Managed Care? Managed care is a system to provide health care that controls how health care services are delivered and paid. Managed care has grown quickly because it offers a

Managed Care 101 What is Managed Care? Managed care is a system to provide health care that controls how health care services are delivered and paid. Managed care has grown quickly because it offers a

Health care insurer appeals process information packet Aetna Life Insurance Company

Quality health plans & benefits Healthier living Financial well-being Intelligent solutions Health care insurer appeals process information packet Aetna Life Insurance Company Please read this notice carefully

Quality health plans & benefits Healthier living Financial well-being Intelligent solutions Health care insurer appeals process information packet Aetna Life Insurance Company Please read this notice carefully

Staker Parson. Short Term Disability Income Protection Plan

Staker Parson Short Term Disability Income Protection Plan Effective Date: 01/01/2006 Contact Information Plan Administrator: Address and Telephone #: Claims Administrator: Address and Telephone #: Staker

Staker Parson Short Term Disability Income Protection Plan Effective Date: 01/01/2006 Contact Information Plan Administrator: Address and Telephone #: Claims Administrator: Address and Telephone #: Staker

Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan

ConneCtiCut insurance DePARtMent Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

ConneCtiCut insurance DePARtMent Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

August 2014. SutterSelect Administrative Manual

August 2014 SutterSelect Administrative Manual Introduction This SutterSelect Administrative Manual has been prepared as a resource for providers who are caring for members of SutterSelect health plans.

August 2014 SutterSelect Administrative Manual Introduction This SutterSelect Administrative Manual has been prepared as a resource for providers who are caring for members of SutterSelect health plans.

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 2009 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO.

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

Plan A. Information About Your Medicare Supplement Coverage:

Plan A Information About Your Medicare Supplement Coverage: Please read the Outline of Coverage first. Then read your Certificate of Coverage. If you have questions about your coverage, call our customer

Plan A Information About Your Medicare Supplement Coverage: Please read the Outline of Coverage first. Then read your Certificate of Coverage. If you have questions about your coverage, call our customer

Patient Assistance Resource Center Health Insurance Appeal Guide 03/14

Health Insurance Appeal Guide 03/14 Filing a Health Insurance Appeal Use this reference guide to understand the health insurance appeal process, and the steps to take to have a health plan reconsider its

Health Insurance Appeal Guide 03/14 Filing a Health Insurance Appeal Use this reference guide to understand the health insurance appeal process, and the steps to take to have a health plan reconsider its

Frequently Asked Billing Questions

Frequently Asked Billing Questions How will I be billed? Mayo Clinic Health System will send you a billing statement with your charges. Provider charges for clinic and hospital services will be billed

Frequently Asked Billing Questions How will I be billed? Mayo Clinic Health System will send you a billing statement with your charges. Provider charges for clinic and hospital services will be billed

North and South Florida Regions. Administrative. Manual

North and South Florida Regions Administrative Manual Inside Front Cover Table of Contents Key Contact Information... 2 Online Account Management SM Useful Tools for Plan Administration... 3 Access Online

North and South Florida Regions Administrative Manual Inside Front Cover Table of Contents Key Contact Information... 2 Online Account Management SM Useful Tools for Plan Administration... 3 Access Online

Zimmer Payer Coverage Approval Process Guide

Zimmer Payer Coverage Approval Process Guide Market Access You ve Got Questions. We ve Got Answers. INSURANCE VERIFICATION PROCESS ELIGIBILITY AND BENEFITS VERIFICATION Understanding and verifying a patient

Zimmer Payer Coverage Approval Process Guide Market Access You ve Got Questions. We ve Got Answers. INSURANCE VERIFICATION PROCESS ELIGIBILITY AND BENEFITS VERIFICATION Understanding and verifying a patient

UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS

April 2015 UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS ELIGIBILITY CLAIMS PROCEDURES Any participant (employee) or beneficiary (dependent), or an authorized representative

April 2015 UNIVERSITY OF ROCHESTER CLAIMS AND APPEALS PROCEDURES FOR NON-PENSION BENEFITS ELIGIBILITY CLAIMS PROCEDURES Any participant (employee) or beneficiary (dependent), or an authorized representative

EQR PROTOCOL 1 ASSESSING MCO COMPLIANCE WITH MEDICAID AND CHIP MANAGED CARE REGULATIONS

EQR PROTOCOL 1 ASSESSING MCO COMPLIANCE WITH MEDICAID AND CHIP MANAGED CARE REGULATIONS Attachment D: The purpose of this Attachment to Protocol 1 is to provide the reviewer(s) with sample review questions

EQR PROTOCOL 1 ASSESSING MCO COMPLIANCE WITH MEDICAID AND CHIP MANAGED CARE REGULATIONS Attachment D: The purpose of this Attachment to Protocol 1 is to provide the reviewer(s) with sample review questions