The effective date of the plan is the date approved by the Department of Banking and Insurance.

|

|

|

- Cathleen Ross

- 8 years ago

- Views:

Transcription

1 Decision Point Review/Pre-Certification Plan for: New Jersey Skylands Management, LLC servicing: New Jersey Skylands Insurance Association (NAIC# 11454) New Jersey Skylands Insurance Company (NAIC# 11453) (Collectively referred to as NJSI) Introduction The primary objective of NJSI s Decision Point Review/Pre-Certification Plan is to provide for the timely payment of medically necessary treatment and testing whenever an eligible insured is injured in a covered automobile accident. We encourage open communication with Insureds and medical providers to ensure that the medical review process does not delay the planned course of treatment designed to return a patient to his/her pre-accident status. Another important objective of our DPR plan, which protects all of our Insureds, is to mitigate payments for treatment and testing which is not medically necessary. Medically necessary as defined in our policy means that the medical treatment or diagnostic test is consistent with the clinically supported symptoms, diagnosis or indications of the injured person, and: Effective Date 1. The treatment is the most appropriate level of service that is in accordance with the standards of good practice and standard professional treatment protocols including the Care Paths and other protocols recognized or designated by the Commissioner of Banking and Insurance of New Jersey, as applicable; 2. The treatment of the injury is not primarily for the convenience of the injured person or provider; and 3. Does not include unnecessary testing or treatment. The effective date of the plan is the date approved by the Department of Banking and Insurance. Plan Outline The following Plan Outline provides a detailed description of the NJSI Decision Point Review/Pre- Certification Plan. The outline is designed to correspond with the numbering used in 11:3-4.7(c) with the number of each section of the Outline corresponding to each section of the regulation for easy reference. Supporting documents are included in the Plan Binder and are referenced accordingly in each section of the Outline. 1. Identification of Vendor NJSI s Decision Point Review / Pre-Certification Plan Administrator is: Horizon Casualty Services, Inc. 33 Washington Street, 11 th Floor Page 1 of 9 Pre-Cert Plan Narrative Approved Revision (networks).doc

2 Newark, NJ (866) phone (973) fax Details concerning Horizon s Medical Director Program, Pre-certification/Decision Point Review procedures, and workflows are all provided in the Horizon vendor filing, which has been submitted under separate cover. 2. Identification of Specific Medical Procedures, Treatments, Diagnoses, Diagnostic Tests, Durable Medical Equipment, and Other Services Subject to Decision Point Review / Pre-Certification The following is a comprehensive list of all services and supplies requiring pre-certification under the NJSI Plan. This list is unchanged from our previously approved DPR plan. 1. Non-emergency in-patient and outpatient hospital care. 2. All non-emergency surgical procedures. 3. Durable medical equipment (including orthotics and prosthetics) costing greater than $50, or rental greater than 30 days 4. Extended care rehabilitation facilities 5. Home health services. 6. Infusion therapy 7. Outpatient psychological/psychiatric services and testing. 8. All physical, occupational, speech, cognitive or other restorative therapy, or body part manipulation including Manipulation Under Anesthesia, except that provided for Identified Injuries in accordance with Decision Point Review 9. All pain management services, except that provided for Identified Injuries in accordance with Decision Point Review 10. All non-emergency diagnostic testing services, except those provided for Identified Injuries in accordance with Decision Point Review 11. Non-emergency dental restoration 3. Informational Materials for Policyholders, Eligible Injured Persons (EIP), and Providers NJSI believes that adequate and appropriate communication with our Policyholders, EIPs, and Providers is not only good customer service, but it is essential for the smooth and effective functioning of the Decision Point Review/Pre-Certification and claims investigation process. The more we can do to eliminate ambiguity for claimants and providers by carefully explaining the process to them, the less we will experience disputes and unsatisfied customers. To that end, NJSI utilizes several avenues to distribute important information concerning the Decision Point Review / Pre-Certification process to Policyholders, EIPs, and Providers. The requirement column in the following table is numbered to correspond with the requirements outlined in 11:3-4.7(d) 1-9 of the revised regulations for easy reference. Page 2 of 9

3 Copies of all relevant informational materials are attached in Section II for review. NJSI Notice Materials S13392 Claim Satisfaction Policy Addendum & Policy ID Card Claim Acknowledgement Letter and Personal Injury Protection and Decision Point Review/Pre- Certification brochure Requirements of 11:3-4.7(d) 1-9 Covered by Materials Point of Contact Letter 1, 2, 3, 4, 6, 7, 8, 9 Recipient of Notice 1, 5, 6, 7, 8, 9 Policyholders 1, 5, 6, 7, 8, 9 All Claimants Providers, Claimants Method/Time of Delivery Attached to policy at inception and renewal. Letter sent by NJSI Claim Representative to each Claimant or their designated representative upon receipt of the claim. Letter sent by Horizon to each provider upon receipt of notice of treatment. Copy also sent to claimant. 4. Procedures for Prompt Review of Pre-Certification and Decision Point Review Requests The procedures for review of Pre-Cert and DPR requests under the NJSI DPR Plan are outlined in the Horizon Casualty Services filing, which has been submitted under separate cover. 5. Procedures for Scheduling Independent Medical Examinations (IMEs) The procedures for scheduling IMEs are outlined in the Horizon Casualty Services filing, which has been submitted under separate cover. The purpose of an IME scheduled pursuant to this Plan is to provide a timely review of proposed medical care in order to determine the medical necessity of further treatment or testing and/or to verify the causal relationship of the claimed injuries to the accident. If a physical/mental examination of the Eligible Injured Person (EIP) is requested pursuant to this Plan, we or our Plan Administrator will notify the EIP of the date, time and location of the examination. The appointment for the IME will be scheduled within seven business days of the Plan Administrator s receipt of the request for DPR/Pre-Certification unless the injured person agrees to extend the time period. The IME will be conducted by a practitioner in the same discipline as the treating provider at a location that is reasonably convenient to the EIP. If requested by us or the Plan Administrator, the EIP may be required to provide medical records, test results, diagnostic films, and other pertinent information to the IME physician in order to facilitate a proper review of the EIP s case. This information must be provided Page 3 of 9

4 no later than at the time of the examination. The EIP is also required to present proper photo identification to the IME physician at the time of the examination. When an IME is scheduled, a notice will be sent to all known treating providers advising them of the examination and the consequences of the EIP s unexcused failure to attend more than one scheduled appointment. Treatment may proceed while the IME is being scheduled and until the results are available. A copy of the written IME report, if prepared, will be provided to the EIP or his/her representative upon request. Consequences of Failure to Attend Scheduled IMEs. The EIP is expected to attend each examination as scheduled by us or our Plan Administrator. Failure of an EIP to attend a scheduled examination without a minimum of 3 business days notice to the examining physician or the Plan Administrator shall constitute an unexcused failure to attend. Failure of an EIP to attend a scheduled examination will be considered excused if the EIP notifies the examining physician or Plan Administrator at least 3 business days prior to the examination date and re-schedules the appointment for a date, not to exceed 35 calendar days from the date of the original appointment. If an EIP has an otherwise excused failure to attend a scheduled examination and does not re-schedule the appointment to occur within 35 calendar days of the original appointment date, the failure to attend shall be deemed unexcused. If an EIP re-schedules an examination for a date more than 35 calendar days from the date of the original appointment, any failure to attend the re-scheduled appointment will be unexcused. If an EIP attends a scheduled examination, but fails to supply all requested medical records, test results, diagnostic imaging films and other pertinent materials; and proper photo identification it shall be deemed an unexcused failure to attend the examination and the examination will not take place. If an EIP has more than one unexcused failure to attend a scheduled examination, notification will be sent to the EIP or his/her representative and all known treating providers advising that payment for all treatment, diagnostic testing, prescription drugs, and durable medical equipment provided on or after the date of notification and relating to the diagnosis code(s) and/or corresponding family of codes associated with the DPR/Pre- Certification request that necessitated scheduling of the examination will be denied. Page 4 of 9

5 In such cases, no future treatment, diagnostic testing, prescription drugs, or durable medical equipment associated with the relevant diagnosis code(s) will be reimbursable under our policy. 6. Reconsideration Procedure 1 st Level Appeal. The procedure for internal appeal of a decision by the vendor to modify or deny reimbursement for treatment or testing is outlined in the Horizon Casualty Services filing, which has been submitted under separate cover. A complete description of our entire Internal Appeals process is provided under Section Restrictions on Assignment of Benefits and Dispute Resolution NJSI has included restrictions on the Assignment of Benefits under our policy. A copy of the revised endorsement is included in Section IV of the plan binder for easy reference. The revised policy allows any EIP to assign his or her benefits to any health care provider that is providing the EIP with covered services or supplies in conjunction with their Personal Injury Protection claim. In order for any assignment to be valid, the health care provider must agree, in writing as part of the assignment, to fully comply with our Decision Point Review/Pre-Certification plan and all of the terms and conditions of our policy including pre-certification, decision point reviews, deductibles, co-payments, exclusions, duties of cooperation, and conditions for dispute resolution. The provider must also agree, in writing as part of their assignment, to hold harmless the Insured, the Company, and the Company s Vendor(s) for any reduction in benefits caused by the provider s failure to comply with the terms of the Decision Point Review / Pre- Certification plan or our Policy. An assignment that does not specifically agree to these conditions will not be considered valid. In addition, any and all assignments become void and unenforceable under certain conditions including: Coverage is not afforded under the policy. An Insured or Provider does not submit to Examination Under Oath. A provider does not comply with the Dispute Resolution provisions of the policy including utilization of the Internal Appeals Process. A provider does not comply with requests for medical records, test results, or other relevant medical documentation. An insured or provider does not comply with all requirements, duties, and conditions of the policy and the Decision Point Review / Pre- Certification plan. While we make every effort to provide fair and timely payment of benefits on all valid claims, there are situations where a dispute will arise between us and an assignee over payment of PIP benefits. Often, such disputes are simple matters that, when brought to our Page 5 of 9

6 attention, can be resolved quickly and amicably without the need for costly and time consuming litigation. In an effort to avoid such unnecessary litigation, which is ultimately very costly to our policyholders, we have included a requirement in our policy that any assignee who has a dispute must utilize our Internal Appeals process prior to filing any form of litigation. When a dispute arises, it will either involve Medical/Billing issues or Coverage Issues. For Medical/Billing issues such as denial of a Decision Point Review or Pre-Certification request; a fee schedule or Usual & Customary dispute; or alleged failure to make timely payment of medical bills, there are two levels of appeal. At the first level of appeal, the matter is submitted to Horizon Casualty Services via their internal appeals process, which is outlined in their plan filing. This process results in a decision being rendered within 72 hours of Horizon s receipt of the request and all supporting documentation. If the matter is not satisfactorily resolved through the Horizon Appeal process, it is then escalated to the second level of appeal. At the second level, the appeal is submitted to NJSI for review under the Internal Appeals Process outlined in our policy. In addition to second level Medical and Billing issues, all coverage issues are submitted directly to NJSI since they are outside of Horizon s purview as the Plan Administrator. NJSI will investigate the matter under appeal and render a decision within 30 days of our receipt of the appeal. The Appeals Process is illustrated as follows: Medical / Billing Dispute (Denial of DPR/Pre-Cert Request, Fee Schedule/U&C, Unpaid bills, Etc.) Coverage Dispute (SIU, Eligibility, Disclaimer, Etc.) 1 st Level Appeal Horizon Casualty Services Internal Appeal Process Expedited Appeal with decision rendered in 72 hrs. 2 nd Level Appeal NJSI Internal Appeal Process All Issues not satisfactorily resolved through 1 st level of appeal. Decision within 30 days. NJSI Internal Appeal Process Decision within 30 days. Page 6 of 9

7 To utilize the NJSI Appeal Process for second level appeals or coverage appeals, the assignee simply needs to send notification of their dispute, in writing, including any supporting documents such as copies of unpaid bills or medical records to us at: New Jersey Skylands Insurance P.O. Box 623 Basking Ridge, NJ Attn: PIP Appeals Coordinator To ensure proper receipt of the dispute by us, it should be submitted via certified mail/return receipt requested through the US Postal Service or via another courier that provides proof of delivery such as Federal Express. Proof of receipt by us must be provided at our request. Should the assignee choose to retain an attorney to handle the Appeal Process, they do so strictly at their own expense. If we are unable to resolve the matter within 30 days after having received proper notice, the assignee is free to litigate the matter through the approved Dispute Resolution Organization or the courts. 8. Network Information NJSI offers Voluntary Utilization Networks for Diagnostic Imaging and Electro-diagnostic testing, Durable Medical Equipment, and Prescription Drugs. Each of these Networks is offered through our Plan Administrator as outlined below. A. Prescription Drugs Horizon Casualty Services through their Advanced PCS Network. B. Diagnostic Imaging/Electrodiagnostic Testing Horizon Casualty Services C. Durable Medical Equipment Horizon Casualty Services. Benefits may be obtained through each of these networks via a single point of contact Horizon Casualty Services. Horizon provides an explanation of the Voluntary Utilization process to each treating doctor in their Provider Letter and they include a list of Diagnostic & DME Network providers as an attachment to each letter. (A copy of Horizon s Provider Letter specific to NJSI s account is included in Section II of the binder for reference.) In addition, they provide a toll free number and a web address for access to the Advanced PCS pharmacy network for prescription drugs. Information on all Voluntary Utilization Networks is also available to any party to the claim through Horizon s toll free number. Each of the listed networks meets the requirements outlined in 11:3-4.8 (a) as follows: Horizon Casualty Services is an approved Workers Compensation Managed Care Organization. Page 7 of 9

8 Copies of the vendor contracts are located in Section III. Notice Requirements The terms and conditions of both our existing PIP Endorsement and our revised PIP Endorsement require any insured to promptly notify us of any claim and provide us with information including: How, when and where the accident happened. A detailed description of the injuries sustained in the accident. A detailed description of all pre-existing injuries and/or conditions the insured may have. The names of any physicians and/or medical facilities consulted by the insured with respect to the injuries along with their contact information. Pursuant to 11:3-4.4(e) 1-3, NJSI requires any insured to adhere to the reporting requirements outlined above. Failure to supply the required information shall result in a reduction in the amount of reimbursement of the eligible charge for medically necessary expenses that are incurred by the insured after he/she should have notified us of the loss according to the following schedule: Notice received days after the date of the accident 25% Notice received 60 or more days after the date of the accident 50% These penalties apply in addition to any other deductibles, co-payments, and penalties that may otherwise apply to the claim. This provision does not relieve any treating medical provider from their obligation to promptly provide notification of treatment under NJAC 11:3-25 also known as the 21 Day Rule. Transition Plan The existing NJSI PIP Endorsement and Decision Point Review plan already provide for a 30% out of network co-payment penalty. Therefore, there will be no change to existing claimants with respect to out of network penalties. Similarly, NJSI does not have a provision in its existing plan for applying a 50% penalty for missed IMEs. We view attendance at an IME by an insured as a condition of coverage under the terms and conditions of our policy and it is our practice to address missed appointments in that context. Since we already do not apply the 50% penalty there will be no change for existing claimants. Other changes that have been made to our PIP Endorsement including changes to our Assignment of Benefits and Dispute Resolution provisions will take effect upon approval of our policy filing. Page 8 of 9

9 These changes will be phased in for policyholders at their 6 month renewal or at policy inception for new business. There will be no impact to existing claims being handled under our current policy. NJSI policyholders, eligible injured persons, and providers will be notified of the changes with respect to decision point review and pre-certification penalties via our revised point of contact letter and point of contact cover letter that will be sent to each party in the event of a claim. Copies of the letters and attachments are found in section II of the plan. Page 9 of 9

Personal Injury Protection Benefits And Pre-Certification

Personal Injury Protection Benefits And Pre-Certification When you are injured in an auto accident you need to concentrate on getting better, not getting your medical bills paid. At New Jersey Skylands,

Personal Injury Protection Benefits And Pre-Certification When you are injured in an auto accident you need to concentrate on getting better, not getting your medical bills paid. At New Jersey Skylands,

MetLife Auto & Home. Decision Point Review and Pre-certification Plan Q & A

MetLife Auto & Home INTRODUCTION Decision Point Review and Pre-certification Plan Q & A At MetLife Auto & Home, we understand that when you purchase an automobile insurance policy, you are buying protection

MetLife Auto & Home INTRODUCTION Decision Point Review and Pre-certification Plan Q & A At MetLife Auto & Home, we understand that when you purchase an automobile insurance policy, you are buying protection

ENCOMPASS INSURANCE COMPANY OF NEW JERSEY DECISION POINT & PRECERTIFICATION PLAN

ENCOMPASS INSURANCE COMPANY OF NEW JERSEY DECISION POINT & PRECERTIFICATION PLAN DECISION POINT REVIEW: Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance has published standard

ENCOMPASS INSURANCE COMPANY OF NEW JERSEY DECISION POINT & PRECERTIFICATION PLAN DECISION POINT REVIEW: Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance has published standard

Overview of the Provisions of the NJ Automobile Insurance Cost Reduction Act

Overview of the Provisions of the NJ Automobile Insurance Cost Reduction Act has requested that CorVel Corporation work with you and your physician to assure that you receive all medically

Overview of the Provisions of the NJ Automobile Insurance Cost Reduction Act has requested that CorVel Corporation work with you and your physician to assure that you receive all medically

IMPORTANT NOTICE. Decision Point Review & Pre-Certification Requirements INTRODUCTION

IMPORTANT NOTICE Decision Point Review & Pre-Certification Requirements INTRODUCTION At GEICO, we understand that when you purchase an automobile insurance policy, you are buying protection and peace of

IMPORTANT NOTICE Decision Point Review & Pre-Certification Requirements INTRODUCTION At GEICO, we understand that when you purchase an automobile insurance policy, you are buying protection and peace of

FREQUENTLY ASKED DECISION POINT REVIEW/PRE-CERTIFICATION QUESTIONS

FREQUENTLY ASKED DECISION POINT REVIEW/PRE-CERTIFICATION QUESTIONS INTRODUCTION At 21st Century Centennial Insurance Company, we understand that when you purchase an automobile insurance policy, you are

FREQUENTLY ASKED DECISION POINT REVIEW/PRE-CERTIFICATION QUESTIONS INTRODUCTION At 21st Century Centennial Insurance Company, we understand that when you purchase an automobile insurance policy, you are

CARE PATHS/DECISION POINT REVIEW

Personal Service Insurance Company PO Box 3001 Plymouth Meeting, PA 19462 Ph: 610.832.4940 Fax: 610.832.2138 Toll Free: 800.954.2442 Date (##/##/####) Physician Name Street Address City, State, Zip Claimant:

Personal Service Insurance Company PO Box 3001 Plymouth Meeting, PA 19462 Ph: 610.832.4940 Fax: 610.832.2138 Toll Free: 800.954.2442 Date (##/##/####) Physician Name Street Address City, State, Zip Claimant:

Our Customer: Claim Number: Date of Loss: Dear

MetLife Auto & Home Our Customer: Claim Number: Date of Loss: Dear Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical expenses. These medical expenses

MetLife Auto & Home Our Customer: Claim Number: Date of Loss: Dear Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical expenses. These medical expenses

00/00/00 CARE PATHS/DECISION POINT REVIEW

00/00/00 FIRST-NAME MI LAST-NAME BUSINESS-NAME ST-NO STREET UNIT-NO CITY, STATE ZIP Insured: INSD-FIRST-NAME INSD-MI INSD-LAST-NAME Claim No: CLAIM-NO DIV-EX Date of Loss: MO-LOSS/DAY-LOSS/YR Dear DEAR-NAME:

00/00/00 FIRST-NAME MI LAST-NAME BUSINESS-NAME ST-NO STREET UNIT-NO CITY, STATE ZIP Insured: INSD-FIRST-NAME INSD-MI INSD-LAST-NAME Claim No: CLAIM-NO DIV-EX Date of Loss: MO-LOSS/DAY-LOSS/YR Dear DEAR-NAME:

New Jersey Regional Claims PO Box 5483 Mount Laurel, NJ 08054 Phone : 1-800-451-5982 Fax : 856-235-6232. Date (##/##/####)

New Jersey Regional Claims PO Box 5483 Mount Laurel, NJ 08054 Phone : 1-800-451-5982 Fax : 856-235-6232 Date (##/##/####) Physician Name Street Address City, State, Zip Claimant: Claim Number: Medlogix

New Jersey Regional Claims PO Box 5483 Mount Laurel, NJ 08054 Phone : 1-800-451-5982 Fax : 856-235-6232 Date (##/##/####) Physician Name Street Address City, State, Zip Claimant: Claim Number: Medlogix

Company Name: Claim Number: Loss Date: Policy Holder: Premier Prizm Acct No.: Injured Party:

PO Box 9515 Fredericksburg, VA 22403-9515 Mail Date: Date Loss Reported to GEICO:!!!### Company Name: Claim Number: Loss Date: Policy Holder: Premier Prizm Acct No.: Injured Party: Personal Injury Protection

PO Box 9515 Fredericksburg, VA 22403-9515 Mail Date: Date Loss Reported to GEICO:!!!### Company Name: Claim Number: Loss Date: Policy Holder: Premier Prizm Acct No.: Injured Party: Personal Injury Protection

10 Woodbridge Center Drive * PO Box 5038* Woodbridge, NJ 07095

10 Woodbridge Center Drive * PO Box 5038* Woodbridge, NJ 07095 Date Name Address RE: CLAIMANT: CLAIM#: INSURANCE CO: CAMDEN FIRE INSURANCE ASSOCIATION CISI#: DOL: Dear : Please read this letter carefully

10 Woodbridge Center Drive * PO Box 5038* Woodbridge, NJ 07095 Date Name Address RE: CLAIMANT: CLAIM#: INSURANCE CO: CAMDEN FIRE INSURANCE ASSOCIATION CISI#: DOL: Dear : Please read this letter carefully

American Commerce Insurance Company

American Commerce Insurance Company INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Dear Insured and/or /Eligible Injured Person/Medical Provider: Please read this letter carefully because it

American Commerce Insurance Company INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Dear Insured and/or /Eligible Injured Person/Medical Provider: Please read this letter carefully because it

INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Sent on Concentra Integrated Services Letter Head

INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Sent on Concentra Integrated Services Letter Head Dear Insured and/or Eligible Injured Person/Medical Provider: Please read this letter carefully

INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDERS Sent on Concentra Integrated Services Letter Head Dear Insured and/or Eligible Injured Person/Medical Provider: Please read this letter carefully

PIP Claim Information Basic Policy

PIP Claim Information Basic Policy We understand this may be a difficult and confusing experience and we wish to assist you in any way we can. We hope the following information will help explain the claims

PIP Claim Information Basic Policy We understand this may be a difficult and confusing experience and we wish to assist you in any way we can. We hope the following information will help explain the claims

CHUBB GROUP OF INSURANCE COMPANIES

CHUBB GROUP OF INSURANCE COMPANIES Dear Insured, Attached please find an informational letter which is being sent to your treating provider outlining the processes and procedures for Precertification and

CHUBB GROUP OF INSURANCE COMPANIES Dear Insured, Attached please find an informational letter which is being sent to your treating provider outlining the processes and procedures for Precertification and

IMPORTANT INFORMATION ABOUT YOUR PERSONAL INJURY PROTECTION COVERAGE (ALSO KNOWN AS NO-FAULT MEDICAL COVERAGE)

IMPORTANT INFORMATION ABOUT YOUR PERSONAL INJURY PROTECTION COVERAGE (ALSO KNOWN AS NO-FAULT MEDICAL COVERAGE) The New Jersey Automobile Insurance Cost Reduction Act (AICRA) introduced changes to how auto

IMPORTANT INFORMATION ABOUT YOUR PERSONAL INJURY PROTECTION COVERAGE (ALSO KNOWN AS NO-FAULT MEDICAL COVERAGE) The New Jersey Automobile Insurance Cost Reduction Act (AICRA) introduced changes to how auto

Countryway Insurance Company P.O. Box 4851, Syracuse, New York 13221-4851

Countryway Insurance Company P.O. Box 4851, Syracuse, New York 13221-4851 Dear Insured: Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical expenses. These

Countryway Insurance Company P.O. Box 4851, Syracuse, New York 13221-4851 Dear Insured: Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical expenses. These

GEICO General Insurance Company

GEICO General Insurance Company Buffalo/New Jersey Claims, PO BOX 9515 Fredericksburg, VA 22403-9515 Date Date Loss Reported to GEICO: Company Name: Claim Number: Loss Date: Policyholder: Policy Number:

GEICO General Insurance Company Buffalo/New Jersey Claims, PO BOX 9515 Fredericksburg, VA 22403-9515 Date Date Loss Reported to GEICO: Company Name: Claim Number: Loss Date: Policyholder: Policy Number:

Countryway Insurance Company P.O. Box 4851, Syracuse, New York 13221-4851

Dear Insured: Please read this letter carefully because it provides specific information concerning how a medical claim under personal injury protection coverage will be handled, including specific requirements

Dear Insured: Please read this letter carefully because it provides specific information concerning how a medical claim under personal injury protection coverage will be handled, including specific requirements

DECISION POINT REVIEW

ALLSTATE NEW JERSEY INSURANCE COMPANY/ALLSTATE NEW JERSEY PROPERTY AND CASUALTY INSURANCE COMPANY DECISION POINT REVIEW PLAN INCLUSIVE OF PRE-CERTIFICATION REQUIREMENT DECISION POINT REVIEW Pursuant to

ALLSTATE NEW JERSEY INSURANCE COMPANY/ALLSTATE NEW JERSEY PROPERTY AND CASUALTY INSURANCE COMPANY DECISION POINT REVIEW PLAN INCLUSIVE OF PRE-CERTIFICATION REQUIREMENT DECISION POINT REVIEW Pursuant to

How To Get Reimbursed For A Car Accident

PRAETORIAN INSURANCE COMPANY PERSONAL INJURY PROTECTION IMPORTANT NOTICE TO POLICYHOLDERS MEDICAL PROTOCOLS DECISION POINT REVIEW: Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and

PRAETORIAN INSURANCE COMPANY PERSONAL INJURY PROTECTION IMPORTANT NOTICE TO POLICYHOLDERS MEDICAL PROTOCOLS DECISION POINT REVIEW: Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and

How To Write A Plan For A Car Accident In New Jersey

Date Name Name Address City, State Zip ATTN: PATIENT NAME: CLAIM NUMBER: DATE OF LOSS: Dear Doctor: Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical

Date Name Name Address City, State Zip ATTN: PATIENT NAME: CLAIM NUMBER: DATE OF LOSS: Dear Doctor: Personal Injury Protection (PIP) is the portion of the auto policy that provides coverage for medical

American Commerce Insurance Company

American Commerce Insurance Company Decision Point Review Plan And Pre-certification Requirements DECISION POINT REVIEW Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance has

American Commerce Insurance Company Decision Point Review Plan And Pre-certification Requirements DECISION POINT REVIEW Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance has

PRE-CERTIFICATION AND DECISION POINT REVIEW PLAN

PRE-CERTIFICATION AND DECISION POINT REVIEW PLAN The New Jersey Department of Banking and Insurance has published standard courses of treatment, identified as Care Paths, for soft tissue injuries of the

PRE-CERTIFICATION AND DECISION POINT REVIEW PLAN The New Jersey Department of Banking and Insurance has published standard courses of treatment, identified as Care Paths, for soft tissue injuries of the

UNIVERSAL UNDERWRITERS INSURANCE COMPANY

UNIVERSAL UNDERWRITERS INSURANCE COMPANY Decision Point Review Plan And Pre-certification Requirements DECISION POINT REVIEW Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance

UNIVERSAL UNDERWRITERS INSURANCE COMPANY Decision Point Review Plan And Pre-certification Requirements DECISION POINT REVIEW Pursuant to N.J.A.C. 11:3-4, the New Jersey Department of Banking and Insurance

INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDER/ATTORNEY

685 Highway 202/206, Suite 301 P.O. Box 5919 Bridgewater, NJ 08807 (908) 243-1800 Toll free 1-800-987-2032 Fax 1-877-397-5868 INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDER/ATTORNEY «Date «PersonName_To»

685 Highway 202/206, Suite 301 P.O. Box 5919 Bridgewater, NJ 08807 (908) 243-1800 Toll free 1-800-987-2032 Fax 1-877-397-5868 INITIAL INFORMATION LETTER TO INSURED/CLAIMANT/PROVIDER/ATTORNEY «Date «PersonName_To»

Hortica Insurance #1 Horticultural Lane PO Box 428 Edwardsville IL 62025 1-800-851-7740 Fax 1-800-632-4445

Hortica Insurance #1 Horticultural Lane PO Box 428 Edwardsville IL 62025 1-800-851-7740 Fax 1-800-632-4445 Claimant: Claim Number: Medlogix ID #: Date of Accident: Insured: Dear Provider: This letter is

Hortica Insurance #1 Horticultural Lane PO Box 428 Edwardsville IL 62025 1-800-851-7740 Fax 1-800-632-4445 Claimant: Claim Number: Medlogix ID #: Date of Accident: Insured: Dear Provider: This letter is

State Farm Indemnity Company State Farm Guaranty Insurance Company Personal Injury Protection Benefits New Jersey Decision Point Review Plan

State Farm Indemnity Company State Farm Guaranty Insurance Company Personal Injury Protection Benefits New Jersey Decision Point Review Plan Pursuant to N.J.A.C. 11:3-4.7, State Farm submits the following

State Farm Indemnity Company State Farm Guaranty Insurance Company Personal Injury Protection Benefits New Jersey Decision Point Review Plan Pursuant to N.J.A.C. 11:3-4.7, State Farm submits the following

INITIAL AND PERIODIC NOTIFICATION REQUIREMENT

Geico General Insurance Company Buffalo/New Jersey Claims, PO BOX 9515 Fredericksburg, VA 22403-9515 Date Loss Reported to GEICO: Company Name: Claim Number: Loss Date: Policyholder: Policy Number: Driver:

Geico General Insurance Company Buffalo/New Jersey Claims, PO BOX 9515 Fredericksburg, VA 22403-9515 Date Loss Reported to GEICO: Company Name: Claim Number: Loss Date: Policyholder: Policy Number: Driver:

CURE DECISION POINT REVIEW PLAN (DPRP) DISCLOSURE NOTICE Page 1 of 5

CURE DECISION POINT REVIEW PLAN (DPRP) DISCLOSURE NOTICE Page 1 of 5 How To Comply with the DPRP Requirements Of Your CURE Policy The 'Automobile Insurance Cost Reduction Act' was signed into law on May

CURE DECISION POINT REVIEW PLAN (DPRP) DISCLOSURE NOTICE Page 1 of 5 How To Comply with the DPRP Requirements Of Your CURE Policy The 'Automobile Insurance Cost Reduction Act' was signed into law on May

Decision Point Review/PreCertification Plan for: Esurance Insurance Company of New Jersey (NAIC# 21714) (Referred to as EICNJ)

Decision Point Review/PreCertification Plan for: Esurance Insurance Company of New Jersey (NAIC# 21714) (Referred to as EICNJ) The New Jersey Automobile Insurance Cost Reduction Act (NJ AICRA) became law

Decision Point Review/PreCertification Plan for: Esurance Insurance Company of New Jersey (NAIC# 21714) (Referred to as EICNJ) The New Jersey Automobile Insurance Cost Reduction Act (NJ AICRA) became law

NEW JERSEY PERSONAL INJURY PROTECTION DECISION POINT REVIEW AND PRE-CERTIFICATION

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. NEW JERSEY PERSONAL INJURY PROTECTION DECISION POINT REVIEW AND PRE-CERTIFICATION This endorsement modifies insurance provided under the following:

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. NEW JERSEY PERSONAL INJURY PROTECTION DECISION POINT REVIEW AND PRE-CERTIFICATION This endorsement modifies insurance provided under the following:

GEICO Decision Point Review Plan and Precertification Requirements

INITIAL AND PERIODIC NOTIFICATION REQUIREMENT GEICO Decision Point Review Plan and Precertification Requirements GEICO requires that the Insured/Eligible Injured Person advise and inform them about the

INITIAL AND PERIODIC NOTIFICATION REQUIREMENT GEICO Decision Point Review Plan and Precertification Requirements GEICO requires that the Insured/Eligible Injured Person advise and inform them about the

DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER YOUR AUTO POLICY

PO Box 920 Lincroft, NJ 07738 Underwritten by Teachers Auto Insurance Company of New Jersey TIP 3606 (Ed. 3/12) Decision Point Review Plan DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER

PO Box 920 Lincroft, NJ 07738 Underwritten by Teachers Auto Insurance Company of New Jersey TIP 3606 (Ed. 3/12) Decision Point Review Plan DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER

DECISION POINT REVIEW PLAN REQUIREMENTS

NJM Insurance 301 Sullivan Way, West Trenton, NJ 08628 Group 609-883-1300 / www.njm.com DECISION POINT REVIEW PLAN REQUIREMENTS IMPORTANT INFORMATION ABOUT YOUR NO-FAULT MEDICAL COVERAGE For NJM Insurance

NJM Insurance 301 Sullivan Way, West Trenton, NJ 08628 Group 609-883-1300 / www.njm.com DECISION POINT REVIEW PLAN REQUIREMENTS IMPORTANT INFORMATION ABOUT YOUR NO-FAULT MEDICAL COVERAGE For NJM Insurance

requirements which you and your medical provider must follow in order to receive the maximum benefits provided by your

Decision Point Review & Pre-Certification Requirements IMPORTANT NOTICE INTRODUCTION At GEICO, we understand that when you purchase an automobile insurance policy, you are buying protection and peace of

Decision Point Review & Pre-Certification Requirements IMPORTANT NOTICE INTRODUCTION At GEICO, we understand that when you purchase an automobile insurance policy, you are buying protection and peace of

DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER YOUR AUTO POLICY

PAC 3606 TL (Ed. 1/06) Twin Lights Decision Point Review Plan DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER YOUR AUTO POLICY The following provisions apply in the event that you (or anyone

PAC 3606 TL (Ed. 1/06) Twin Lights Decision Point Review Plan DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER YOUR AUTO POLICY The following provisions apply in the event that you (or anyone

DECISION POINT REVIEW AND PRE-CERTIFICATION REQUIREMENTS UNDER YOUR AUTO POLICY

PALISADES SAFETY AND INSURANCE ASSOCIATION PALISADES INSURANCE COMPANY PALISADES SAFETY AND INSURANCE MANAGEMENT CORPORATION, ATTORNEY-IN-FACT PO Box 617 Two Connell Drive Berkeley Heights, NJ 07922 Tel

PALISADES SAFETY AND INSURANCE ASSOCIATION PALISADES INSURANCE COMPANY PALISADES SAFETY AND INSURANCE MANAGEMENT CORPORATION, ATTORNEY-IN-FACT PO Box 617 Two Connell Drive Berkeley Heights, NJ 07922 Tel

DECISION POINT REVIEW PLAN REQUIREMENTS IMPORTANT INFORMATION

NJM Insurance 301 Sullivan Way, West Trenton, NJ 08628 Group 609-883-1300 / www.njm.com DECISION POINT REVIEW PLAN REQUIREMENTS IMPORTANT INFORMATION For Licensed Health Care Providers About No-Fault Medical

NJM Insurance 301 Sullivan Way, West Trenton, NJ 08628 Group 609-883-1300 / www.njm.com DECISION POINT REVIEW PLAN REQUIREMENTS IMPORTANT INFORMATION For Licensed Health Care Providers About No-Fault Medical

IMPORTANT NOTICE. Decision Point Review & Precertification Requirements

IDS Property Casualty Insurance Company 3500 Packerland Drive De Pere, WI 54115-9070 IMPORTANT NOTICE Decision Point Review & Precertification Requirements Personal Injury Protection (PIP) coverage shall

IDS Property Casualty Insurance Company 3500 Packerland Drive De Pere, WI 54115-9070 IMPORTANT NOTICE Decision Point Review & Precertification Requirements Personal Injury Protection (PIP) coverage shall

ALLSTATE NEW JERSEY INSURANCE COMPANY / ALLSTATE NEW JERSEY PROPERTY AND CASUALTY INSURANCE COMPANY

ALLSTATE NEW JERSEY INSURANCE COMPANY / ALLSTATE NEW JERSEY PROPERTY AND CASUALTY INSURANCE COMPANY DECISION POINT REVIEW PLAN INCLUSIVE OF PRECERTIFICATION REQUIREMENT DECISION POINT REVIEW: Pursuant

ALLSTATE NEW JERSEY INSURANCE COMPANY / ALLSTATE NEW JERSEY PROPERTY AND CASUALTY INSURANCE COMPANY DECISION POINT REVIEW PLAN INCLUSIVE OF PRECERTIFICATION REQUIREMENT DECISION POINT REVIEW: Pursuant

GEICO Precertification/ Decision Point Review Plan. Inclusive of Precertification Requirement. (For Losses Occurring On or After 10/1/2012)

GEICO Precertification/ Decision Point Review Plan Inclusive of Precertification Requirement (For Losses Occurring On or After 10/1/2012) *00001000001* M595A (08-13) Page 1 of 27 GEICO Decision Point Review

GEICO Precertification/ Decision Point Review Plan Inclusive of Precertification Requirement (For Losses Occurring On or After 10/1/2012) *00001000001* M595A (08-13) Page 1 of 27 GEICO Decision Point Review

PERSONAL INJURY PROTECTION DISPUTE RESOLUTION. The purpose of this subchapter is to establish procedures for the resolution of disputes

SUBCHAPTER 5. PERSONAL INJURY PROTECTION DISPUTE RESOLUTION 11:3-5.1 Purpose and scope (a) The purpose of this subchapter is to establish procedures for the resolution of disputes concerning the payment

SUBCHAPTER 5. PERSONAL INJURY PROTECTION DISPUTE RESOLUTION 11:3-5.1 Purpose and scope (a) The purpose of this subchapter is to establish procedures for the resolution of disputes concerning the payment

Florida Managed Care Arrangement. Employer s Handbook

Florida Managed Care Arrangement Employer s Handbook Contents Introduction... 1 Employer Guidelines... 2 Identification Form... 5 Employee Information... 6 Coventry s & HDi s Responsibilities... 8 Frequently

Florida Managed Care Arrangement Employer s Handbook Contents Introduction... 1 Employer Guidelines... 2 Identification Form... 5 Employee Information... 6 Coventry s & HDi s Responsibilities... 8 Frequently

Frequently Asked Questions About Your Hospital Bills

Frequently Asked Questions About Your Hospital Bills The Registration Process Why do I have to verify my address each time? Though address and telephone numbers remain constant for approximately 70% of

Frequently Asked Questions About Your Hospital Bills The Registration Process Why do I have to verify my address each time? Though address and telephone numbers remain constant for approximately 70% of

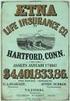

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

NC WORKERS COMPENSATION: BASIC INFORMATION FOR MEDICAL PROVIDERS

NC WORKERS COMPENSATION: BASIC INFORMATION FOR MEDICAL PROVIDERS CURRENT AS OF APRIL 1, 2010 I. INFORMATION SOURCES Where is information available for medical providers treating patients with injuries/conditions

NC WORKERS COMPENSATION: BASIC INFORMATION FOR MEDICAL PROVIDERS CURRENT AS OF APRIL 1, 2010 I. INFORMATION SOURCES Where is information available for medical providers treating patients with injuries/conditions

Certain exceptions apply to Hospital Inpatient Confinement for childbirth as described below.

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

A M E R I C A N A R B I T R A T I O N A S S O C I A T I O N NO-FAULT/ACCIDENT CLAIMS AWARD OF DISPUTE RESOLUTION PROFESSIONAL

CASE NO. 18 Z 600 19775 03 2 A M E R I C A N A R B I T R A T I O N A S S O C I A T I O N NO-FAULT/ACCIDENT CLAIMS In the Matter of the Arbitration between (Claimant) AAA CASE NO.: 18 Z 600 19775 03 v.

CASE NO. 18 Z 600 19775 03 2 A M E R I C A N A R B I T R A T I O N A S S O C I A T I O N NO-FAULT/ACCIDENT CLAIMS In the Matter of the Arbitration between (Claimant) AAA CASE NO.: 18 Z 600 19775 03 v.

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. PERSONAL INJURY PROTECTION COVERAGE (STANDARD PERSONAL AUTO POLICY) - NEW JERSEY

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. PERSONAL INJURY PROTECTION COVERAGE (STANDARD PERSONAL AUTO POLICY) - NEW JERSEY PERSONAL AUTO With respect to coverage provided by this endorsement,

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. PERSONAL INJURY PROTECTION COVERAGE (STANDARD PERSONAL AUTO POLICY) - NEW JERSEY PERSONAL AUTO With respect to coverage provided by this endorsement,

Your Health Care Benefit Program. BlueChoice PPO Basic Option Certificate of Benefits

Your Health Care Benefit Program BlueChoice PPO Basic Option Certificate of Benefits 1215 South Boulder P.O. Box 3283 Tulsa, Oklahoma 74102 3283 70260.0208 Effective May 1, 2010 Table of Contents Certificate............................................................................

Your Health Care Benefit Program BlueChoice PPO Basic Option Certificate of Benefits 1215 South Boulder P.O. Box 3283 Tulsa, Oklahoma 74102 3283 70260.0208 Effective May 1, 2010 Table of Contents Certificate............................................................................

WORKERS COMPENSATION INFORMATION. Soc. Sec.# Address Marital Status: Single Married Divorced Widowed Email: Home Phone: Cell Phone: Work Phone:

WORKERS COMPENSATION INFORMATION PATIENT INFORMATION Name: Birthdate: Soc. Sec.# Address Marital Status: Single Married Divorced Widowed Email: Home Phone: Cell Phone: Work Phone: Preferred Pharmacy: Tel

WORKERS COMPENSATION INFORMATION PATIENT INFORMATION Name: Birthdate: Soc. Sec.# Address Marital Status: Single Married Divorced Widowed Email: Home Phone: Cell Phone: Work Phone: Preferred Pharmacy: Tel

211 CMR 51.00: PREFERRED PROVIDER HEALTH PLANS AND WORKERS COMPENSATION PREFERRED PROVIDER ARRANGEMENTS

211 CMR 51.00: PREFERRED PROVIDER HEALTH PLANS AND WORKERS COMPENSATION PREFERRED PROVIDER ARRANGEMENTS Section 51.01: Authority 51.02: Definitions 51.03: Applicability 51.04: Approval of Preferred Provider

211 CMR 51.00: PREFERRED PROVIDER HEALTH PLANS AND WORKERS COMPENSATION PREFERRED PROVIDER ARRANGEMENTS Section 51.01: Authority 51.02: Definitions 51.03: Applicability 51.04: Approval of Preferred Provider

A M E R I C A N A R B I T R A T I O N A S S O C I A T I O N NO-FAULT/ACCIDENT CLAIMS AWARD OF DISPUTE RESOLUTION PROFESSIONAL

CASE NO. 18 Z 600 10126 02 2 A M E R I C A N A R B I T R A T I O N A S S O C I A T I O N NO-FAULT/ACCIDENT CLAIMS In the Matter of the Arbitration between (Claimant) AAA CASE NO.: 18 Z 600 10126 02 v.

CASE NO. 18 Z 600 10126 02 2 A M E R I C A N A R B I T R A T I O N A S S O C I A T I O N NO-FAULT/ACCIDENT CLAIMS In the Matter of the Arbitration between (Claimant) AAA CASE NO.: 18 Z 600 10126 02 v.

Zurich Handbook. Managed Care Arrangement program summary

Zurich Handbook Managed Care Arrangement program summary A Managed Care Arrangement (MCA) is being used to ensure that employees receive timely and proper medical treatment with respect to work-related

Zurich Handbook Managed Care Arrangement program summary A Managed Care Arrangement (MCA) is being used to ensure that employees receive timely and proper medical treatment with respect to work-related

Updated as of 05/15/13-1 -

Updated as of 05/15/13-1 - GENERAL OFFICE POLICIES Thank you for choosing the Quiroz Adult Medicine Clinic, PA (QAMC) as your health care provider. The following general office policies are provided to

Updated as of 05/15/13-1 - GENERAL OFFICE POLICIES Thank you for choosing the Quiroz Adult Medicine Clinic, PA (QAMC) as your health care provider. The following general office policies are provided to

Award of Dispute Resolution Professional. Hearing Information

In the Matter of the Arbitration between Allied PT & Acupuncture a/s/o V.B. CLAIMANT(s), Forthright File No: NJ1012001364788 Insurance Claim File No: NJP66574 Claimant Counsel: Pacifico & Lawrence v. Claimant

In the Matter of the Arbitration between Allied PT & Acupuncture a/s/o V.B. CLAIMANT(s), Forthright File No: NJ1012001364788 Insurance Claim File No: NJP66574 Claimant Counsel: Pacifico & Lawrence v. Claimant

Hanford s Guide to Industrial Insurance Benefits for Employees of Self-insured Businesses Supplemental Guide December 2008 DEPARTMENT OF ENERGY UNITED STATES OF Introduction All injured workers receive

Hanford s Guide to Industrial Insurance Benefits for Employees of Self-insured Businesses Supplemental Guide December 2008 DEPARTMENT OF ENERGY UNITED STATES OF Introduction All injured workers receive

Administrative Code. Title 23: Medicaid Part 306 Third Party Recovery

Administrative Code Title 23: Medicaid Part 306 Third Party Recovery Table of Contents Title 23: Division of Medicaid... 1 Part 306: Third Party Recovery... 1 Part 306 Chapter 1: Third Party Recovery...

Administrative Code Title 23: Medicaid Part 306 Third Party Recovery Table of Contents Title 23: Division of Medicaid... 1 Part 306: Third Party Recovery... 1 Part 306 Chapter 1: Third Party Recovery...

California Workers Compensation Medical Provider Network Employee Notification & Guide

California Workers Compensation Medical Provider Network Employee Notification & Guide In partnership with We are pleased to introduce the California workers compensation medical provider network (MPN)

California Workers Compensation Medical Provider Network Employee Notification & Guide In partnership with We are pleased to introduce the California workers compensation medical provider network (MPN)

TITLE 11. INSURANCE CHAPTER 3. AUTOMOBILE INSURANCE SUBCHAPTER 4. PERSONAL INJURY PROTECTION BENEFITS; MEDICAL PROTOCOLS; DIAGNOSTIC TESTS

TITLE 11. INSURANCE CHAPTER 3. AUTOMOBILE INSURANCE SUBCHAPTER 4. PERSONAL INJURY PROTECTION BENEFITS; MEDICAL PROTOCOLS; DIAGNOSTIC TESTS 11:3-4.1 Scope and purpose (a) This subchapter implements the

TITLE 11. INSURANCE CHAPTER 3. AUTOMOBILE INSURANCE SUBCHAPTER 4. PERSONAL INJURY PROTECTION BENEFITS; MEDICAL PROTOCOLS; DIAGNOSTIC TESTS 11:3-4.1 Scope and purpose (a) This subchapter implements the

PATIENT INFORMATION EMERGENCY CONTACT LAST FIRST RELATIONSHIP REFERRAL SOURCE DOCTOR / REFERRING CLINICIAN: FAMILY MEMBER/FRIEND: INSURANCE:

PATIENT INFORMATION LAST FIRST MI GENDER M F BIRTHDATE MO./ DAY/ YEAR SS# - - ADDRESS CITY ST ZIP PHONE (CELL) PHONE (HOME) EMAIL MARITAL STATUS EMPLOYER ADDRESS OCCUPATION WORK PHONE EXT WHO IS YOUR PRIMARY

PATIENT INFORMATION LAST FIRST MI GENDER M F BIRTHDATE MO./ DAY/ YEAR SS# - - ADDRESS CITY ST ZIP PHONE (CELL) PHONE (HOME) EMAIL MARITAL STATUS EMPLOYER ADDRESS OCCUPATION WORK PHONE EXT WHO IS YOUR PRIMARY

SUBCHAPTER 37. ORDER OF BENEFIT DETERMINATION BETWEEN AUTOMOBILE PERSONAL INJURY PROTECTION AND HEALTH INSURANCE

SUBCHAPTER 37. ORDER OF BENEFIT DETERMINATION BETWEEN AUTOMOBILE PERSONAL INJURY PROTECTION AND HEALTH INSURANCE 11:3-37.1 Purpose and scope The purpose of this subchapter is to establish guidelines for

SUBCHAPTER 37. ORDER OF BENEFIT DETERMINATION BETWEEN AUTOMOBILE PERSONAL INJURY PROTECTION AND HEALTH INSURANCE 11:3-37.1 Purpose and scope The purpose of this subchapter is to establish guidelines for

Early Intervention Central Billing Office. Provider Insurance Billing Procedures

Early Intervention Central Billing Office Provider Insurance Billing Procedures May 2013 Provider Insurance Billing Procedures Provider Registration Each provider choosing to opt out of billing for one,

Early Intervention Central Billing Office Provider Insurance Billing Procedures May 2013 Provider Insurance Billing Procedures Provider Registration Each provider choosing to opt out of billing for one,

TITLE 18 INSURANCE DELAWARE ADMINISTRATIVE CODE 1. 600 Automobile Insurance. 603 Delaware Motorists Protection Act [Formerly Regulation 9]

![TITLE 18 INSURANCE DELAWARE ADMINISTRATIVE CODE 1. 600 Automobile Insurance. 603 Delaware Motorists Protection Act [Formerly Regulation 9] TITLE 18 INSURANCE DELAWARE ADMINISTRATIVE CODE 1. 600 Automobile Insurance. 603 Delaware Motorists Protection Act [Formerly Regulation 9]](/thumbs/24/4391353.jpg) DELAWARE ADMINISTRATIVE CODE 1 600 Automobile Insurance 603 Delaware Motorists Protection Act [Formerly Regulation 9] 1.0 Scope and Authority 1.1 This Regulation is adopted by the Commissioner pursuant

DELAWARE ADMINISTRATIVE CODE 1 600 Automobile Insurance 603 Delaware Motorists Protection Act [Formerly Regulation 9] 1.0 Scope and Authority 1.1 This Regulation is adopted by the Commissioner pursuant

Medical and Rx Claims Procedures

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

Award of Dispute Resolution Professional

In the Matter of the Arbitration between Objective Diagnostic & Rehab Services a/s/o V.K. CLAIMANT(s), Forthright File No: NJ1003001314411 Insurance Claim File No: 58993 Claimant Counsel: Law Offices of

In the Matter of the Arbitration between Objective Diagnostic & Rehab Services a/s/o V.K. CLAIMANT(s), Forthright File No: NJ1003001314411 Insurance Claim File No: 58993 Claimant Counsel: Law Offices of

9. Claims and Appeals Procedure

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

EXTERNAL REVIEW CONSUMER GUIDE

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

Quiroz Adult Medicine Clinic, P.A. General Office Policies

General Office Policies Thank you for choosing Quiroz Adult Medicine Clinic P.A. (QAMC) as your health care provider. The following general office policies are provided to understand our office protocols

General Office Policies Thank you for choosing Quiroz Adult Medicine Clinic P.A. (QAMC) as your health care provider. The following general office policies are provided to understand our office protocols

Please read this information carefully and share it with your health care providers.

NEW JERSEY PROPERTY-LIABILITY INSURANCE GUARANTY ASSOCIATION DECISION POINT REVIEW PLAN INCLUSIVE OF PRECERTIFICATION REQUIREMENTS Please read this information carefully and share it with your health care

NEW JERSEY PROPERTY-LIABILITY INSURANCE GUARANTY ASSOCIATION DECISION POINT REVIEW PLAN INCLUSIVE OF PRECERTIFICATION REQUIREMENTS Please read this information carefully and share it with your health care

INDIANA: Frequently Asked Questions About the Autism Insurance Reform Law. What does Indiana s Autism Spectrum Disorder Insurance Mandate do?

INDIANA: Frequently Asked Questions About the Autism Insurance Reform Law What does Indiana s Autism Spectrum Disorder Insurance Mandate do? Broadly speaking, the insurance mandate requires insurance providers

INDIANA: Frequently Asked Questions About the Autism Insurance Reform Law What does Indiana s Autism Spectrum Disorder Insurance Mandate do? Broadly speaking, the insurance mandate requires insurance providers

Network Provider. Physician Assistant. Contract

Network Provider Physician Assistant Contract Updated 10/1/02 HCPACv1.0 TABLE OF CONTENTS I. RECITALS...1 II. DEFINITIONS...1 III. RELATIONSHIP BETWEEN THE INSURANCE BOARD AND THE PHYSICIAN ASSISTANT...3

Network Provider Physician Assistant Contract Updated 10/1/02 HCPACv1.0 TABLE OF CONTENTS I. RECITALS...1 II. DEFINITIONS...1 III. RELATIONSHIP BETWEEN THE INSURANCE BOARD AND THE PHYSICIAN ASSISTANT...3

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures.

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

To file a claim: If you have any questions or need additional assistance, please contact our Claim office at 1-800-811-2696.

The Accident Expense Plus policy is a financial tool that helps cover high deductibles, co-pays and other expenses not covered by your primary major medical plan. This supplemental plan reimburses you

The Accident Expense Plus policy is a financial tool that helps cover high deductibles, co-pays and other expenses not covered by your primary major medical plan. This supplemental plan reimburses you

FLORIDA WORKERS' COMPENSATION REIMBURSEMENT MANUAL FOR HOSPITALS 2004 EDITION. Rule 69L-7.501, Florida Administrative Code

FLORIDA WORKERS' COMPENSATION REIMBURSEMENT MANUAL FOR HOSPITALS 2004 EDITION Rule 69L-7.501, Florida Administrative Code Effective January 1, 2004 1 TABLE OF CONTENTS Title Page Section 1: Managed Care

FLORIDA WORKERS' COMPENSATION REIMBURSEMENT MANUAL FOR HOSPITALS 2004 EDITION Rule 69L-7.501, Florida Administrative Code Effective January 1, 2004 1 TABLE OF CONTENTS Title Page Section 1: Managed Care

SUBCHAPTER 4. PERSONAL INJURY PROTECTION BENEFITS; MEDICAL

SUBCHAPTER 4. PERSONAL INJURY PROTECTION BENEFITS; MEDICAL PROTOCOLS; DIAGNOSTIC TESTS 11:3-4.1 Scope and purpose (a) This subchapter implements the provisions of N.J.S.A. 39:6A-3.1, 39:6A-4 and 39:6A-4.3

SUBCHAPTER 4. PERSONAL INJURY PROTECTION BENEFITS; MEDICAL PROTOCOLS; DIAGNOSTIC TESTS 11:3-4.1 Scope and purpose (a) This subchapter implements the provisions of N.J.S.A. 39:6A-3.1, 39:6A-4 and 39:6A-4.3

OFFICE OF INSURANCE REGULATION Property and Casualty Product Review

OFFICE OF INSURANCE REGULATION Property and Casualty Product Review NOTIFICATION OF PERSONAL INJURY PROTECTION BENEFITS YOUR PERSONAL INJURY PROTECTION RIGHTS AND BENEFITS UNDER THE FLORIDA MOTOR VEHICLE

OFFICE OF INSURANCE REGULATION Property and Casualty Product Review NOTIFICATION OF PERSONAL INJURY PROTECTION BENEFITS YOUR PERSONAL INJURY PROTECTION RIGHTS AND BENEFITS UNDER THE FLORIDA MOTOR VEHICLE

Occupational Health Services

Occupational Health Services Workers Compensation MCO Occupational Health Services Workers Compensation MCO This section of the Provider Manual was created to provide you and your staff with basic organizational

Occupational Health Services Workers Compensation MCO Occupational Health Services Workers Compensation MCO This section of the Provider Manual was created to provide you and your staff with basic organizational

TITLE 11. INSURANCE CHAPTER 3. AUTOMOBILE INSURANCE SUBCHAPTER 5. PERSONAL INJURY PROTECTION DISPUTE RESOLUTION

TITLE 11. INSURANCE CHAPTER 3. AUTOMOBILE INSURANCE SUBCHAPTER 5. PERSONAL INJURY PROTECTION DISPUTE RESOLUTION 11:3-5.1 Purpose and scope (a) The purpose of this subchapter is to establish procedures

TITLE 11. INSURANCE CHAPTER 3. AUTOMOBILE INSURANCE SUBCHAPTER 5. PERSONAL INJURY PROTECTION DISPUTE RESOLUTION 11:3-5.1 Purpose and scope (a) The purpose of this subchapter is to establish procedures

Steven M. Goldman, Commissioner, Department of Banking and

INSURANCE DEPARTMENT OF BANKING AND INSURANCE DIVISION OF INSURANCE Personal Injury Protection Benefits; Medical Protocols; Diagnostic Tests Deductibles and Co pays Proposed Amendment: N.J.A.C. 11:3 4.4

INSURANCE DEPARTMENT OF BANKING AND INSURANCE DIVISION OF INSURANCE Personal Injury Protection Benefits; Medical Protocols; Diagnostic Tests Deductibles and Co pays Proposed Amendment: N.J.A.C. 11:3 4.4

Monumental Life Insurance Company

Insurance Claim Filing Instructions PROOF OF LOSS CONSISTS OF THE FOLLOWING: 1. A completed and signed Claim form and Attending Physician s Statement. 2. For Hospital/Intensive Care/Hospital Services Coverage

Insurance Claim Filing Instructions PROOF OF LOSS CONSISTS OF THE FOLLOWING: 1. A completed and signed Claim form and Attending Physician s Statement. 2. For Hospital/Intensive Care/Hospital Services Coverage

X Guarantor/Parent/Guardian Signature

Patient Name: Last First Address City State Zip Phone# (C) (H) (W) Date of Birth Social Security# (REQUIRED FOR BILLING) If Patient is a Minor, a Parent s Name & Social Security# are Required Emergency

Patient Name: Last First Address City State Zip Phone# (C) (H) (W) Date of Birth Social Security# (REQUIRED FOR BILLING) If Patient is a Minor, a Parent s Name & Social Security# are Required Emergency

How To Change A Doctor In Arkansas

RULE 099.33 MANAGED CARE #099.33 TABLE OF CONTENTS I. DEFINITIONS II. INITIAL CHOICE OF PHYSICIAN III. REFERRALS IV. CHANGE OF PHYSICIAN V. MULTIPLE MCOs VI. RULES, TERMS, AND CONDITIONS OF MCO/IMCS VII.

RULE 099.33 MANAGED CARE #099.33 TABLE OF CONTENTS I. DEFINITIONS II. INITIAL CHOICE OF PHYSICIAN III. REFERRALS IV. CHANGE OF PHYSICIAN V. MULTIPLE MCOs VI. RULES, TERMS, AND CONDITIONS OF MCO/IMCS VII.

Compensation and Claims Processing

Compensation and Claims Processing Compensation The network rate for eligible outpatient visits is reimbursed to you at the lesser of (1) your customary charge, less any applicable co-payments, coinsurance

Compensation and Claims Processing Compensation The network rate for eligible outpatient visits is reimbursed to you at the lesser of (1) your customary charge, less any applicable co-payments, coinsurance

52ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, 2015

SENATE JUDICIARY COMMITTEE SUBSTITUTE FOR SENATE BILL ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, AN ACT RELATING TO MANAGED HEALTH CARE; AMENDING AND ENACTING SECTIONS OF THE NEW MEXICO INSURANCE

SENATE JUDICIARY COMMITTEE SUBSTITUTE FOR SENATE BILL ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, AN ACT RELATING TO MANAGED HEALTH CARE; AMENDING AND ENACTING SECTIONS OF THE NEW MEXICO INSURANCE

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 2009 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO.

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

APPENDIX B NEW JERSEY ADMINISTRATIVE CODE

APPENDIX B NEW JERSEY ADMINISTRATIVE CODE Current Through N.J. Register Volume 47, Number 16 (47 N.J.R. 2196) Includes Adopted Rules Filed Through July 24, 2015 SUBCHAPTER 3. BASIC AUTOMOBILE INSURANCE

APPENDIX B NEW JERSEY ADMINISTRATIVE CODE Current Through N.J. Register Volume 47, Number 16 (47 N.J.R. 2196) Includes Adopted Rules Filed Through July 24, 2015 SUBCHAPTER 3. BASIC AUTOMOBILE INSURANCE

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

Understanding the Claims Handling Process

Understanding the Claims Handling Process About This Brochure This brochure was designed to answer frequently asked questions about the claim handling process. If you have other questions or would like

Understanding the Claims Handling Process About This Brochure This brochure was designed to answer frequently asked questions about the claim handling process. If you have other questions or would like

FLORIDA PERSONAL INJURY PROTECTION

POLICY NUMBER: COMMERCIAL AUTO CA 22 10 01 08 THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. FLORIDA PERSONAL INJURY PROTECTION For a covered "auto" licensed or principally garaged in,

POLICY NUMBER: COMMERCIAL AUTO CA 22 10 01 08 THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. FLORIDA PERSONAL INJURY PROTECTION For a covered "auto" licensed or principally garaged in,

New Jersey No-Fault PIP Arbitration Rules (2013)

New Jersey No-Fault PIP Arbitration Rules (2013) Amended March 1, 2013 ADMINISTERED BY FORTHRIGHT New Jersey No-Fault PIP Arbitration Rules 2 PART I RULES OF GENERAL APPLICATION...5 1. Scope of Rules...5

New Jersey No-Fault PIP Arbitration Rules (2013) Amended March 1, 2013 ADMINISTERED BY FORTHRIGHT New Jersey No-Fault PIP Arbitration Rules 2 PART I RULES OF GENERAL APPLICATION...5 1. Scope of Rules...5

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

What Your Plan Covers and How Benefits are Paid BENEFIT PLAN. Prepared Exclusively for Vanderbilt University. Aetna Choice POS II Health Fund Plan

BENEFIT PLAN Prepared Exclusively for Vanderbilt University What Your Plan Covers and How Benefits are Paid Aetna Choice POS II Health Fund Plan Table of Contents Schedule of Benefits... Issued with Your

BENEFIT PLAN Prepared Exclusively for Vanderbilt University What Your Plan Covers and How Benefits are Paid Aetna Choice POS II Health Fund Plan Table of Contents Schedule of Benefits... Issued with Your

GLOSSARY OF MEDICAL AND INSURANCE TERMS

GLOSSARY OF MEDICAL AND INSURANCE TERMS At Westfield Family Physicians we are aware that there are lots of words and phrases we used every day that may not be familiar to you, our patients. We are providing

GLOSSARY OF MEDICAL AND INSURANCE TERMS At Westfield Family Physicians we are aware that there are lots of words and phrases we used every day that may not be familiar to you, our patients. We are providing

Managed Care Program

Summit Workers Compensation Managed Care Program KENTUCKY How to obtain medical care for a work-related injury or illness. Welcome Summit s workers compensation managed-care organization (Summit MCO) is

Summit Workers Compensation Managed Care Program KENTUCKY How to obtain medical care for a work-related injury or illness. Welcome Summit s workers compensation managed-care organization (Summit MCO) is

Texas Workers Compensation

Texas Workers Compensation Tips for Successful Medical Billing and Reimbursement Practices Presented by: Regina Schwartz Health Care Specialist Texas Dept of Insurance - Division of Workers Compensation

Texas Workers Compensation Tips for Successful Medical Billing and Reimbursement Practices Presented by: Regina Schwartz Health Care Specialist Texas Dept of Insurance - Division of Workers Compensation

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS Title 15: Mississippi State Department of Health Part 3: Office of Health Protection Subpart 1: Health Facilities Licensure and Certification Post Office

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS Title 15: Mississippi State Department of Health Part 3: Office of Health Protection Subpart 1: Health Facilities Licensure and Certification Post Office