My Company s Credit Card Debt Was Overwhelming

|

|

|

- Alban Palmer

- 8 years ago

- Views:

Transcription

1 My Company s Credit Card Debt Was Overwhelming just paying minimum payments every month, we would not be able to recover until I decided to seek help page 2 I know I was in big trouble I felt like I was working for the credit card companies and they would own my company in a matter of years. page 3 I knew how slippery a slope it was. I was racking up credit card debt, the credit card companies increased all my interest rates, they reduced my limits across the board page 4 The stress of living with this kind of debt ate into every part of our lives, personally, professionally, even physically. page 6 The debt that I had accrued on personal credit cards to keep the business running and keep my family fed had mounted to nearly $60,000. page 7 I had over $45,000 in credit card debt & I could see that I would NEVER get out from under it not without help! page 8 It was very easy at that time to not ignore the credit card offers that came poring in the mail; zero percent financing for the first year I eventually accumulated over $80,000 in credit card debt....page 9 The card had a $20,000 limit. Imagine my surprise when it was maxed out as well as all my cards to the tune of $150,000...I could not even pay the minimums the interest rate was now 39%. page 10 Many of our clients have authorized us to share their success stories. The attached testimonials represent the experiences of these companies in our program. Every restructuring is unique and under no circumstances should these be construed as a representation of what you can expect in our program. There is no guarantee as to savings or any specific results except if you qualify for Corporate Turnaround s guarantee, your company will pay back less than it owes at the time of settlement, including Corporate Turnaround s fees. To estimate the time it could take your company to complete our program, take your total amount of debt in the restructuring, which may increase over time, and divide it by what you are paying each month. The program may take more or less time to complete depending on your unique situation. Your credit may become further impaired during the debt restructuring process. Corporate Turnaround does not provide credit repair. Until a debt is resolved, debts may increase and creditors may continue with their collection efforts, including phone calls and legal action. Corporate Turnaround is not a law firm and does not provide legal advice. If you are sued or are considering bankruptcy, you should seek advice from a licensed attorney. We reserve the right to decline any creditor into our program.

2 Page 2

3 Reliant Computer Services, LLC 354 Route 46 Budd lake, NJ January 2011 Dear Corporate Turnaround, When I called Chris at Corporate Turnaround in early 2008 I know I was in big trouble I piled on 35,000+ in credit card debt and credit card loans and business was slowing down! I felt like I was working for the credit card companies and they would own my company in matter of years. I was under the impression that a company would usually have 10-20% of their business owed out to credit in order to expand and stay in business. I was too small to get any help from the big banks and I went to the steamy world of high interest credit cards and credit card loans. It was out of control; I was starting to pay credit cards with money I borrowed from credit card loans and ordering parts with credit card money. When I made some business, I could only pay a small part back to the credit cards even though I thought I could pay more. When I first talked to Chris at CT I was scared and ashamed of what I had done with my little company. Chris and the people I spoke with were remarkably compassionate and reassuring; they told me it would be alright and they would guide me through some of the rough waters. They told me they would take the brunt of the phone calls, threatening letters and possible law suits to come. They would be my power of attorney to the creditors I owed money to and it was like having a personal team of lawyers. I had the unfortunate experience of going bankrupt personally in 1999, losing my home, all of my possessions and save stocks and cash. I was a victim of the dot com bust in the 90 s losing my career and I job I loved for nearly 15 years. Bankruptcy is a difficulty and horrible experience and I was really worried I was going to experience it again less than a decade later; the constant harassing phone calls, the threatening letters and the shame. Chris assigned me and my advocate, Anthony Passanante, who I knew after our first conversation was going to be a real fighter in helping me to pay down my debt and keeping me positive. Anthony waged war on my behalf and got the creditors off my back and reduced the debt I owed them by sizable amounts. I was able to get back to running my business and I make money again! My creditors couldn t harass me or send me threats anymore, I would just turn my troubles over to Anthony and he did the rest! I never meet Anthony personally, but he has a great sense of humor, is compassionate and a tough negotiator with my creditors. I have often tried to image what Anthony says to creditors while representing me, and then I just smile knowing he is on my side. I can t believe the journey with CT is at an end already and I really don t owe any creditors outside of my car and my home. I didn t picture myself as one of the people who would be writing a letter of recommendation like the other letter I have received from CT. It feels Great!!! I was able to own my home again and keep my business because of the people at CT. Anthony, thank you for helping me to keep my business and my respect! I feel like you are my friend, like a big brother, and I will still drop you a line once in awhile if you don t mind. Sincerely, Tom, Owner & Operator Your company s results may vary. Every restructuring has a unique combination of issues and factors, including the length of participation in the program. All of these variables affect individual outcomes. There are no typical results. Until a debt is resolved, creditors may continue with their collection efforts, including phone calls and legal action. CT does not provide any legal services or legal advice. Consult with a licensed attorney regarding the applicability of bankruptcy. Debts may increase until a resolution is reached. Page 3

4 Page 4

5 Page 5

6 H C Roberts Automotive Repair, Inc. Boonville, NY /29/09 Dear Corporate Turnaround, I would like to thank your company and staff, especially Adam Lang, for the tireless effort you have put into helping us resolve our debt during the last four years. When we first came to your company, we had two very small children at home, two mortgages, a mountain of personal debt, and a business that resembled a black hole; sucking up our every bit of time, energy and money. We had started our business with very little capital, so while we were never short of work, paying the bills and overhead was always a stretch. When the local furniture factory went out of business and left at least half of our customers unemployed, our accounts receivable soared, our cash flow stopped, and that stretch became a definite pinch. Luckily, or so we thought, we had good credit so financing was always available. In reality, it was too readily available. By the time we were ready to face the facts of our financial situation, we had roughly $57,000 in credit card debt alone. This didn t even account for our lines of credit, vendor accounts, overhead and back employment taxes. The stress of living with this kind of debt ate into every single part of our lives, personally, professionally, even physically. This was the point we were at when my husband called Corporate Turnaround and first spoke to Adam. He was knowledgeable, giving us facts while collection agents and lawyers only provided nebulous, sweeping threats. He was up front about how hard it would be, and about how good it would be when it was over. And now that it finally is over, I can tell you with confidence that he was right. As we move closer and closer to paying off the last bits of credit card debt and organizing our general finances, I m rediscovering many things I had thought were lost forever. Things like spending money, ample groceries and taking the kids for an occasional treat or a trip to the zoo. But more than that I ve discovered that I can breathe, laugh and sleep again. These things are priceless, so again I say thank you to Corporate Turnaround as a company, and to Adam Lang as a professional -- and a person. Sincerely, Catherine A. Roberts VP, HC Roberts Automotive Repair, Inc. Page 6

7 Page 7

8 Page 8

9 Page 9

10 Page 10

I Didn t Want To File For Bankruptcy

I Didn t Want To File For Bankruptcy I contemplated filing bankruptcy as my only option. Without your help I stood a real chance of losing my business, my home and the ability to provide for my family.

I Didn t Want To File For Bankruptcy I contemplated filing bankruptcy as my only option. Without your help I stood a real chance of losing my business, my home and the ability to provide for my family.

How Long Will it Take to Get Out of Debt?

How Long Will It Take To Get Out Of Debt? I can t believe, in a little over two short years, my business is where it is: DEBT FREE! I feel like a GIANT weight has been lifted and I can t thank the Team

How Long Will It Take To Get Out Of Debt? I can t believe, in a little over two short years, my business is where it is: DEBT FREE! I feel like a GIANT weight has been lifted and I can t thank the Team

ISI Debtor Testimonials. April 2015 ISI. Tackling problem debt together

ISI Debtor Testimonials April 2015 ISI Tackling problem debt together The following are the words of debtors who have availed of the ISI s debt solutions and are real cases. They have reviewed and agreed

ISI Debtor Testimonials April 2015 ISI Tackling problem debt together The following are the words of debtors who have availed of the ISI s debt solutions and are real cases. They have reviewed and agreed

If Your In Debt And In Financial Distress Don t Do Anything Until You Read This Special Report That Reveals

If Your In Debt And In Financial Distress Don t Do Anything Until You Read This Special Report That Reveals Inside Secrets Credit Card Companies And Creditors Don t Want You To Know About Credit Relief

If Your In Debt And In Financial Distress Don t Do Anything Until You Read This Special Report That Reveals Inside Secrets Credit Card Companies And Creditors Don t Want You To Know About Credit Relief

Imagine How It Would Feel Not To Worry About Debt. Primerica. Debt Resolution. Customized Debt Solutions

Imagine How It Would Feel Not To Worry About Debt Primerica Debt Resolution Customized Debt Solutions Are you struggling and feel overwhelmed by your personal debt situation? Do you want to get out of

Imagine How It Would Feel Not To Worry About Debt Primerica Debt Resolution Customized Debt Solutions Are you struggling and feel overwhelmed by your personal debt situation? Do you want to get out of

How to Stop and Avoid Foreclosure in Today's Market

Solutions Home Buyers, Inc. 800-478-9213 ext. 700 SolutionsHomeBuyersFL.com How to Stop and Avoid Foreclosure in Today's Market This Guide Aims To Help You Navigate the foreclosure process [Type the company

Solutions Home Buyers, Inc. 800-478-9213 ext. 700 SolutionsHomeBuyersFL.com How to Stop and Avoid Foreclosure in Today's Market This Guide Aims To Help You Navigate the foreclosure process [Type the company

Credit Repair Made Easy

Credit Repair Made Easy A simple self help guide to credit repair By Don Troiano Introduction My name is Don Troiano and I spent over 15 years in the mortgage industry. Knowing how to guide customers in

Credit Repair Made Easy A simple self help guide to credit repair By Don Troiano Introduction My name is Don Troiano and I spent over 15 years in the mortgage industry. Knowing how to guide customers in

Straight Bankruptcy Vs Foreclosure - What's the Difference?

SPECIAL REPORT 2014 Welcome and thank you for taking the time to request this information package. I want you to read this first, before you read the remainder of my materials for a personal reason. I

SPECIAL REPORT 2014 Welcome and thank you for taking the time to request this information package. I want you to read this first, before you read the remainder of my materials for a personal reason. I

Sell Your House in DAYS Instead of Months

Sell Your House in DAYS Instead of Months No Agents No Fees No Commissions No Hassle Learn the secret of selling your house in days instead of months If you re trying to sell your house, you may not have

Sell Your House in DAYS Instead of Months No Agents No Fees No Commissions No Hassle Learn the secret of selling your house in days instead of months If you re trying to sell your house, you may not have

How to Stop and Avoid Foreclosure in Today's Market

How to Stop and Avoid Foreclosure in Today's Market This Guide Aims To Help You Navigate the foreclosure process [Type the company name] Discover all of your options [Pick the date] Find the solution or

How to Stop and Avoid Foreclosure in Today's Market This Guide Aims To Help You Navigate the foreclosure process [Type the company name] Discover all of your options [Pick the date] Find the solution or

How To Know If You Can Get A Court Order To Stop Being Sued And Garnished

Five minute guide to being sued & wage garnishment First, it is important to distinguish between actually being sued and having creditors threaten to sue you. The difference is important. We have seen

Five minute guide to being sued & wage garnishment First, it is important to distinguish between actually being sued and having creditors threaten to sue you. The difference is important. We have seen

Being a Guarantor. Financial Series. in Alberta. What is a Guarantor? June 2011. Has someone you know asked you to be a Guarantor?

Financial Series June 2011 Being a Guarantor in Alberta Has someone you know asked you to be a Guarantor? Are you already a Guarantor and worried about what comes next, or what is already occurring? This

Financial Series June 2011 Being a Guarantor in Alberta Has someone you know asked you to be a Guarantor? Are you already a Guarantor and worried about what comes next, or what is already occurring? This

WHY FILE FOR BANKRUPTCY IN NEW JERSEY?

WHY FILE FOR BANKRUPTCY IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY Deciding to file for bankruptcy is not an easy decision. Most people struggle with the decision to file for

WHY FILE FOR BANKRUPTCY IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY Deciding to file for bankruptcy is not an easy decision. Most people struggle with the decision to file for

Is life better after bankruptcy?

Is life better after bankruptcy? One hundred eighty four people speak out. For most people, bankruptcy works. That s the headline news from a survey of 184 people who filed bankruptcy with the Law Office

Is life better after bankruptcy? One hundred eighty four people speak out. For most people, bankruptcy works. That s the headline news from a survey of 184 people who filed bankruptcy with the Law Office

CHAPTER 13 CASES IN NEW JERSEY

CHAPTER 13 CASES IN NEW JERSEY STUDENT LOAN AFTER BANKRUPTCY TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY Are you struggling to pay student loans? If so, you are not alone. According to an article

CHAPTER 13 CASES IN NEW JERSEY STUDENT LOAN AFTER BANKRUPTCY TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY Are you struggling to pay student loans? If so, you are not alone. According to an article

CLIENT SERVICES: Tax Problem Resolution Services

CLIENT SERVICES: Tax Problem Resolution Services Dear Client: Are you having problems with the IRS? We re here to help you resolve your tax problems and put an end to the misery that the IRS can put you

CLIENT SERVICES: Tax Problem Resolution Services Dear Client: Are you having problems with the IRS? We re here to help you resolve your tax problems and put an end to the misery that the IRS can put you

WHAT IS THE DIFFERENCE BETWEEN CHAPTER 7 AND CHAPTER 13?

NEW JERSEY BANKRUPTCY WHAT IS THE DIFFERENCE BETWEEN CHAPTER 7 AND CHAPTER 13? Because the Difference Between Chapter 7 and Chapter 13 Can Have Serious Consequences for a Client Who Files the Wrong Case,

NEW JERSEY BANKRUPTCY WHAT IS THE DIFFERENCE BETWEEN CHAPTER 7 AND CHAPTER 13? Because the Difference Between Chapter 7 and Chapter 13 Can Have Serious Consequences for a Client Who Files the Wrong Case,

Deciding Which Bills to Pay First Lunch & Learn - Lesson 5 Presented by Nancy Porter

Deciding Which Bills to Pay First Lunch & Learn - Lesson 5 Presented by Nancy Porter Welcome again. This week we are going to talk about deciding which bills to pay first. I m glad Deborah gave you a little

Deciding Which Bills to Pay First Lunch & Learn - Lesson 5 Presented by Nancy Porter Welcome again. This week we are going to talk about deciding which bills to pay first. I m glad Deborah gave you a little

Managing High Levels of Debt

STUDENT MODULE 13.1 BANKRUPTCY PAGE 1 Standard 13: The student will evaluate the consequences of bankruptcy. Managing High Levels of Debt Montana and Carolina could not wait to graduate from high school

STUDENT MODULE 13.1 BANKRUPTCY PAGE 1 Standard 13: The student will evaluate the consequences of bankruptcy. Managing High Levels of Debt Montana and Carolina could not wait to graduate from high school

BANKRUPTCY The Bankruptcy and Insolvency Act

1 BANKRUPTCY Bankruptcy, not a nice word. It conjures up all sorts of bad impressions. However, on the other hand, it may be the start of a new life. How can that be? Read on. It might be just what you

1 BANKRUPTCY Bankruptcy, not a nice word. It conjures up all sorts of bad impressions. However, on the other hand, it may be the start of a new life. How can that be? Read on. It might be just what you

SignatureWOMEN. A SignatureFD Case Study on moving forward after a divorce BREAKING UP IS HARD TO DO

SignatureWOMEN A SignatureFD Case Study on moving forward after a divorce BREAKING UP IS HARD TO DO BREAKING UP IS HARD TO DO Ending a marriage is difficult. Rushing through the process may lead to mistakes

SignatureWOMEN A SignatureFD Case Study on moving forward after a divorce BREAKING UP IS HARD TO DO BREAKING UP IS HARD TO DO Ending a marriage is difficult. Rushing through the process may lead to mistakes

The good news for you is that I ve captured the 27 biggest mistakes business owners make when negotiating business debts.

Dear Business Owner: The 27 Biggest Mistakes to Avoid When Negotiating Business Debts Falling behind with your creditors can be one of the most stressful times in your life. Once collection calls start,

Dear Business Owner: The 27 Biggest Mistakes to Avoid When Negotiating Business Debts Falling behind with your creditors can be one of the most stressful times in your life. Once collection calls start,

How case managers can work with clients to address community housing debts

How case managers can work with clients to address community housing debts More and more clients are coming to Elizabeth Hoffman House Aboriginal Women s Services with multiple debts from several social

How case managers can work with clients to address community housing debts More and more clients are coming to Elizabeth Hoffman House Aboriginal Women s Services with multiple debts from several social

In Home Sales Training Manual. Debt Settlement Program

In Home Sales Training Manual Debt Settlement Program Introduction to the industry The debt relief business is booming because of the rise in unemployment rates, the poor economy, and those who have found

In Home Sales Training Manual Debt Settlement Program Introduction to the industry The debt relief business is booming because of the rise in unemployment rates, the poor economy, and those who have found

Everything You Need to Know About Bankruptcy

Everything You Need to Know About Bankruptcy Raymond J. Sallum Bloomfield, Michigan http://bloomfieldlawgroup.com/chapter-7-bankruptcy B l o o m f i e l d L a w G r o u p R a y m o n d J. S a l l u m (

Everything You Need to Know About Bankruptcy Raymond J. Sallum Bloomfield, Michigan http://bloomfieldlawgroup.com/chapter-7-bankruptcy B l o o m f i e l d L a w G r o u p R a y m o n d J. S a l l u m (

High earners can still struggle

Special Reprint Edition As seen in USA TODAY, June 28, 2007 High earners can still struggle Some who earn six figures have major debt load, live paycheck to paycheck By Stephanie Armour The car payment

Special Reprint Edition As seen in USA TODAY, June 28, 2007 High earners can still struggle Some who earn six figures have major debt load, live paycheck to paycheck By Stephanie Armour The car payment

Do You Need To Make. A Financial U-Turn?

Do You Need To Make A Financial U-Turn? Discover the TRUTH about using Bankruptcy to point your finances in the right direction. By Attorney Christian B. Felden Food For Thought In 2013 I helped folks

Do You Need To Make A Financial U-Turn? Discover the TRUTH about using Bankruptcy to point your finances in the right direction. By Attorney Christian B. Felden Food For Thought In 2013 I helped folks

1 Identify your goal. What is it that you want to buy. 2 Gather information. What are the terms of the credit

Be a Savvy Credit User About 40% of credit card holders carry individual balances of less than $1,000, while about 15% individually carry total card balances of more than $10,000. Forty-eight percent of

Be a Savvy Credit User About 40% of credit card holders carry individual balances of less than $1,000, while about 15% individually carry total card balances of more than $10,000. Forty-eight percent of

CAN REFINANCING STOP A FORECLOSURE IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY

CAN REFINANCING STOP A FORECLOSURE IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY Facing a foreclosure is an extremely emotional situation. Worrying about where your family will

CAN REFINANCING STOP A FORECLOSURE IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY Facing a foreclosure is an extremely emotional situation. Worrying about where your family will

How To Pay Off Debt Through Bankruptcy

Bankruptcy 13 Bankruptcy Debts & Debt Collection What happens if I can't pay my bills? Persons to whom you owe money have several methods of recourse if you fail to pay a debt. The method used depends

Bankruptcy 13 Bankruptcy Debts & Debt Collection What happens if I can't pay my bills? Persons to whom you owe money have several methods of recourse if you fail to pay a debt. The method used depends

Participant Guide Building: Knowledge, Security, Confidence FDIC Financial Education Curriculum

Loan to Own Building: Knowledge, Security, Confidence FDIC Financial Education Curriculum Table of Contents Page Lending Terms 1 Consumer Installment Loan Versus Rent-to-Own 2 Federal Trade Commission

Loan to Own Building: Knowledge, Security, Confidence FDIC Financial Education Curriculum Table of Contents Page Lending Terms 1 Consumer Installment Loan Versus Rent-to-Own 2 Federal Trade Commission

When Finances Go Wrong - Debt

When Finances Go Wrong - Debt Very few people now have no debt at all after all a mobile phone contract, or your rent/mortgage are both debts. It becomes an issue for people when they cannot meet the payments

When Finances Go Wrong - Debt Very few people now have no debt at all after all a mobile phone contract, or your rent/mortgage are both debts. It becomes an issue for people when they cannot meet the payments

How to Cut Your Interest Rates

1 How to Cut Your Interest Rates 2 Table of Contents Contents Page Number Overview 3 Chapter 1: Unsecured Debt Consolidation Loans 4-6 Chapter 2: Mortgages 7 12 Chapter 3: Consumer Proposals 13 15 Chapter

1 How to Cut Your Interest Rates 2 Table of Contents Contents Page Number Overview 3 Chapter 1: Unsecured Debt Consolidation Loans 4-6 Chapter 2: Mortgages 7 12 Chapter 3: Consumer Proposals 13 15 Chapter

8 WAYS TO AVOID FORECLOSURE

8 WAYS TO AVOID FORECLOSURE A Free Consumer Guide In this report, you will discover: The #1 Secret Your Lender Doesn t Want You to Know 8 Common Ways to Avoid Foreclosure How the Foreclosure Process Works

8 WAYS TO AVOID FORECLOSURE A Free Consumer Guide In this report, you will discover: The #1 Secret Your Lender Doesn t Want You to Know 8 Common Ways to Avoid Foreclosure How the Foreclosure Process Works

Credit History CREDIT REPORTS CREDIT SCORES BUILDING A STRONG CREDIT REPORT

CREDIT What You Should Know About... Credit History CREDIT REPORTS CREDIT SCORES BUILDING A STRONG CREDIT REPORT YourMoneyCounts Understanding what your credit history is what s in it, what s not in it

CREDIT What You Should Know About... Credit History CREDIT REPORTS CREDIT SCORES BUILDING A STRONG CREDIT REPORT YourMoneyCounts Understanding what your credit history is what s in it, what s not in it

Pathways Through Mortgage Arrears. Michelle Norris School of Applied Social Science University College Dublin

Pathways Through Mortgage Arrears Michelle Norris School of Applied Social Science University College Dublin Consistent growth in arrears since 2007: Background 8.1% of residential mortgages in arrears

Pathways Through Mortgage Arrears Michelle Norris School of Applied Social Science University College Dublin Consistent growth in arrears since 2007: Background 8.1% of residential mortgages in arrears

Dealing with a Drop in Income

Dealing with a Drop in Income February 2009 Peggy Olive, Family Living Agent Richland County UW-Extension 1100 Highway 14 West Richland Center, WI 53581 (608) 647-6148 peggy.olive@ces.uwex.edu When your

Dealing with a Drop in Income February 2009 Peggy Olive, Family Living Agent Richland County UW-Extension 1100 Highway 14 West Richland Center, WI 53581 (608) 647-6148 peggy.olive@ces.uwex.edu When your

Professional Development Grant Results Report Bridge Credit Union

Professional Development Grant Results Report Bridge Credit Union Results/Outcomes 1. State the goals and objectives of the professional development experience (as stated in your grant proposal to OCUF)

Professional Development Grant Results Report Bridge Credit Union Results/Outcomes 1. State the goals and objectives of the professional development experience (as stated in your grant proposal to OCUF)

QUESTIONS CONCERNING BANKRUPTCY

QUESTIONS CONCERNING BANKRUPTCY The Law Office of Paul D. Post, P.A. is a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code. The assistance provided to clients may

QUESTIONS CONCERNING BANKRUPTCY The Law Office of Paul D. Post, P.A. is a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code. The assistance provided to clients may

Dealing with Problem Debt

Dealing with Problem Debt Insolvency Service of Ireland Seirbhís Dócmhainneachta na héireann ISI Tackling problem debt together Insolvency Service of Ireland nseirbhís Dócmhainneachta na héirea n ISI Tackling

Dealing with Problem Debt Insolvency Service of Ireland Seirbhís Dócmhainneachta na héireann ISI Tackling problem debt together Insolvency Service of Ireland nseirbhís Dócmhainneachta na héirea n ISI Tackling

Thank you for your attention to these issues. Higher Ed, Not Debt

December 17, 2014 Dear Governor Brewer, On behalf of current and former Everest and WyoTech students in your state, we write to ask that you and your administration, through the Board for Private-Post

December 17, 2014 Dear Governor Brewer, On behalf of current and former Everest and WyoTech students in your state, we write to ask that you and your administration, through the Board for Private-Post

How to Stop and Avoid Foreclosure in Today's Market

How to Stop and Avoid Foreclosure in Today's Market This Guide Aims To Help You Navigate the foreclosure process [Type the company name] Discover all of your options [Pick the date] Find the solution or

How to Stop and Avoid Foreclosure in Today's Market This Guide Aims To Help You Navigate the foreclosure process [Type the company name] Discover all of your options [Pick the date] Find the solution or

Debt collector response template

Debt collector response template You re saying: This is not my debt. Use the sample letter on the next page if you want to tell a debt collector that you aren t responsible for this debt, and that you

Debt collector response template You re saying: This is not my debt. Use the sample letter on the next page if you want to tell a debt collector that you aren t responsible for this debt, and that you

Chapter 11 Bankruptcy

Understanding Bankruptcy Understanding Bankruptcy Chapter 7 and 13 https://www.youtube.com/watch?v=rwkjk3r8yas Chapter 11 https://www.youtube.com/watch?v=mxvwyzzmoxm Fair Debt Collection Practices Act

Understanding Bankruptcy Understanding Bankruptcy Chapter 7 and 13 https://www.youtube.com/watch?v=rwkjk3r8yas Chapter 11 https://www.youtube.com/watch?v=mxvwyzzmoxm Fair Debt Collection Practices Act

Instructor Guide Building: Knowledge, Security, Confidence FDIC Financial Education Curriculum

Loan to Own Building: Knowledge, Security, Confidence FDIC Financial Education Curriculum TABLE OF CONTENTS Page Module Overview 1 Purpose 1 Objectives 1 Time 1 Materials and Equipment Needed to Present

Loan to Own Building: Knowledge, Security, Confidence FDIC Financial Education Curriculum TABLE OF CONTENTS Page Module Overview 1 Purpose 1 Objectives 1 Time 1 Materials and Equipment Needed to Present

What is Credit? What Different Types of Credit Are Available?

Credit and Debt What is Credit? Credit is a contract between a lender, such as a bank, a credit card company, or a store, and an individual or company. The lender provides the money or access to money,

Credit and Debt What is Credit? Credit is a contract between a lender, such as a bank, a credit card company, or a store, and an individual or company. The lender provides the money or access to money,

What Does Bankruptcy Mean to Me?

What Can Bankruptcy Do for Me? Bankruptcy may make it possible for you to: Eliminate the legal obligation to pay most or all of your debts. This is called a discharge of debts. It is designed to give you

What Can Bankruptcy Do for Me? Bankruptcy may make it possible for you to: Eliminate the legal obligation to pay most or all of your debts. This is called a discharge of debts. It is designed to give you

The Consumer s Guide To Getting Out Of Debt Without Having To File Bankruptcy Or Debt Consolidation

Copyright 2010 The Consumer s Guide To Getting Out Of Debt Without Having To File Bankruptcy Or Debt Consolidation The Real Debt Solution, Inc. by Steven A Williams, Founder and President www.therealdebtsolution.com

Copyright 2010 The Consumer s Guide To Getting Out Of Debt Without Having To File Bankruptcy Or Debt Consolidation The Real Debt Solution, Inc. by Steven A Williams, Founder and President www.therealdebtsolution.com

CALL DEBT. Talk to an Aussie Who Cares

A Complete complete Guide Guide to to Debt Relief Debt Relief Solutions in Australia in Australia CALL 1800 00 3328 DEBT Talk to an Aussie Who Cares Contents Introduction... 3 About Debt Rescue... 4 The

A Complete complete Guide Guide to to Debt Relief Debt Relief Solutions in Australia in Australia CALL 1800 00 3328 DEBT Talk to an Aussie Who Cares Contents Introduction... 3 About Debt Rescue... 4 The

Life After Bankruptcy. By Jason Amerine

Life After Bankruptcy By Jason Amerine Bankruptcy: A Fresh Start for You Every day I have clients ask me about what life might be like after bankruptcy, and perhaps you re feeling that way, too. Sure,

Life After Bankruptcy By Jason Amerine Bankruptcy: A Fresh Start for You Every day I have clients ask me about what life might be like after bankruptcy, and perhaps you re feeling that way, too. Sure,

Rapid Refund Costs Taxpayers Too Much $$$

the ALERT V. 2 6, N O. 1 A N E W S L E T T E R F O R S E N I O R S J A N / F E B / M A R C H / A P R I L 2 0 1 0 Rapid Refund Costs Taxpayers Too Much $$$ With more Seniors working to make ends meet, more

the ALERT V. 2 6, N O. 1 A N E W S L E T T E R F O R S E N I O R S J A N / F E B / M A R C H / A P R I L 2 0 1 0 Rapid Refund Costs Taxpayers Too Much $$$ With more Seniors working to make ends meet, more

The Business Cycle and The Great Depression of the 1930 s

The Business Cycle and The Great Depression of the 1930 s With the stock market crash in October, 1929, the U.S. entered a period in its history known as the Great Depression. This lasted for almost the

The Business Cycle and The Great Depression of the 1930 s With the stock market crash in October, 1929, the U.S. entered a period in its history known as the Great Depression. This lasted for almost the

lesson thirteen in trouble overheads

lesson thirteen in trouble overheads why consumers don t pay loss of income (48%) Unemployment (24%) Illness (16%) Other (divorce, death) (8%) overextension (25%) Poor money management Emergencies Materialism

lesson thirteen in trouble overheads why consumers don t pay loss of income (48%) Unemployment (24%) Illness (16%) Other (divorce, death) (8%) overextension (25%) Poor money management Emergencies Materialism

AND FORECLOSURE IN NEW JERSEY?

SECOND MORTGAGE AND FORECLOSURE IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY It is a terrible experience losing your home through foreclosure; however, what can happen after the

SECOND MORTGAGE AND FORECLOSURE IN NEW JERSEY? TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY It is a terrible experience losing your home through foreclosure; however, what can happen after the

True Stories: My Debt Crisis

Read the following article and consider the following questions for the individual involved: 1. What were the threats and poor decisions? 2. What were the positive actions and good decisions? 3. What would

Read the following article and consider the following questions for the individual involved: 1. What were the threats and poor decisions? 2. What were the positive actions and good decisions? 3. What would

Declaring Personal Bankruptcy

Declaring Personal Bankruptcy DECLARING PERSONAL BANKRUPTCY A declaration of personal bankruptcy doesn t carry the stigma it once did but it is, nonetheless, an admission that one is no longer able to

Declaring Personal Bankruptcy DECLARING PERSONAL BANKRUPTCY A declaration of personal bankruptcy doesn t carry the stigma it once did but it is, nonetheless, an admission that one is no longer able to

5 Minute Cheat Sheet Chapter 7, Chapter 13, and Non-Bankruptcy Options

5 Minute Cheat Sheet Chapter 7, Chapter 13, and Non-Bankruptcy Options Filing Bankruptcy in General Filing bankruptcy is a difficult but important decision. Even if it's very clear that you need to file

5 Minute Cheat Sheet Chapter 7, Chapter 13, and Non-Bankruptcy Options Filing Bankruptcy in General Filing bankruptcy is a difficult but important decision. Even if it's very clear that you need to file

How To Sell A Tired and Rundown House!

WARNING Strictly for Christchurch Homeowners Only Don't spend any money repairing your house until you have read this report How To Sell A Tired and Rundown House! The ultimate guide for anyone who wants

WARNING Strictly for Christchurch Homeowners Only Don't spend any money repairing your house until you have read this report How To Sell A Tired and Rundown House! The ultimate guide for anyone who wants

Debt Settlement Company Data

THE ASSOCIATION OF SETTLEMENT COMPANIES (TASC) STUDY ON THE DEBT SETTLEMENT INDUSTRY The following data was compiled as a preliminary study of the debt settlement industry conducted in September 2006,

THE ASSOCIATION OF SETTLEMENT COMPANIES (TASC) STUDY ON THE DEBT SETTLEMENT INDUSTRY The following data was compiled as a preliminary study of the debt settlement industry conducted in September 2006,

story: I have no problem lending money to family & friends as long as I can afford it.

name: Emily state: Texas story: My husband has borrowed money from his parents many different times without my knowing. I think that if you expect repayment, a written loan agreement or share secured loan

name: Emily state: Texas story: My husband has borrowed money from his parents many different times without my knowing. I think that if you expect repayment, a written loan agreement or share secured loan

Written Testimony of Sonia Ellis Submitted to the Special Committee on Aging United States Senate Hearing on the Jamaican Lottery Scam March 13, 2013

Written Testimony of Sonia Ellis Submitted to the Special Committee on Aging United States Senate Hearing on the Jamaican Lottery Scam March 13, 2013 I would like to thank Chairman Nelson, Ranking member

Written Testimony of Sonia Ellis Submitted to the Special Committee on Aging United States Senate Hearing on the Jamaican Lottery Scam March 13, 2013 I would like to thank Chairman Nelson, Ranking member

How to Inform a Debt Collector You Are Collection-Proof

How to Inform a Debt Collector You Are Collection-Proof Note: Use these instructions and letter to inform a creditor or debt collector that they cannot use a court judgment to make you pay a debt, because

How to Inform a Debt Collector You Are Collection-Proof Note: Use these instructions and letter to inform a creditor or debt collector that they cannot use a court judgment to make you pay a debt, because

INFORMATION GUIDEBOOK

Welcome to the Law Offices of Robert Weed! I am Bob-Bot, your e-tutor and guide to understanding the in s and out s of bankruptcy. Today I will show you how you can clear your debt, get a fresh start on

Welcome to the Law Offices of Robert Weed! I am Bob-Bot, your e-tutor and guide to understanding the in s and out s of bankruptcy. Today I will show you how you can clear your debt, get a fresh start on

Chapter 6 Strategies for Financing College & Keeping Debt Under Control

The Big Picture 85 Key Concepts: financial aid Expected Family Contribution FAFSA (Free Application for Federal Student Aid) Chapter 6 Strategies for Financing College & Keeping Debt Under Control So far,

The Big Picture 85 Key Concepts: financial aid Expected Family Contribution FAFSA (Free Application for Federal Student Aid) Chapter 6 Strategies for Financing College & Keeping Debt Under Control So far,

Online Rumors. Lauren didn t think much of it when a classmate came. Lauren didn t have to ask where on the Internet;

Carol Adams Huntington Junior College Literary Material Marked in 20 Word Groups Online Rumors Lauren didn t think much of it when a classmate came into the band hall and said, Hey, Lauren, did you 1 hear

Carol Adams Huntington Junior College Literary Material Marked in 20 Word Groups Online Rumors Lauren didn t think much of it when a classmate came into the band hall and said, Hey, Lauren, did you 1 hear

Ididn t think I was an alcoholic. I thought my

(2) FEAR OF FEAR This lady was cautious. She decided she wouldn t let herself go in her drinking. And she would never, never take that morning drink! Ididn t think I was an alcoholic. I thought my problem

(2) FEAR OF FEAR This lady was cautious. She decided she wouldn t let herself go in her drinking. And she would never, never take that morning drink! Ididn t think I was an alcoholic. I thought my problem

RICK A. YARNALL Chapter 13 Bankruptcy Trustee for the United States Bankruptcy Court District of Nevada

CHAPTER 13 THE THIRTEEN (13) MOST COMMON QUESTIONS and ANSWERS Prepared for: Your Case Number is: YOUR FIRST PAYMENT IS DUE ON Payments are due on the day of each month thereafter. Your Trustee is: RICK

CHAPTER 13 THE THIRTEEN (13) MOST COMMON QUESTIONS and ANSWERS Prepared for: Your Case Number is: YOUR FIRST PAYMENT IS DUE ON Payments are due on the day of each month thereafter. Your Trustee is: RICK

Dealing with debt collectors. Your rights and responsibilities

Dealing with debt collectors Your rights and responsibilities About this booklet This booklet helps you understand: what your legal rights and responsibilities are if you owe a debt where you can get help

Dealing with debt collectors Your rights and responsibilities About this booklet This booklet helps you understand: what your legal rights and responsibilities are if you owe a debt where you can get help

YOUR CONCERNS ABOUT FILING BANKRUPTCY IN NEW JERSEY

YOUR CONCERNS ABOUT FILING BANKRUPTCY IN NEW JERSEY TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY When I meet with a person for the first time to discuss bankruptcy, he or she usually has several

YOUR CONCERNS ABOUT FILING BANKRUPTCY IN NEW JERSEY TRAVIS J. RICHARDS SOUTH NEW JERSEY BANKRUPTCY ATTORNEY When I meet with a person for the first time to discuss bankruptcy, he or she usually has several

PRACTICAL MONEY GUIDES CREDIT CARD BASICS. What you need to know about managing your credit cards

PRACTICAL MONEY GUIDES CREDIT CARD BASICS What you need to know about managing your credit cards TAKE CHARGE WHEN YOU CHARGE Credit cards can be powerful financial tools for you and your family, and as

PRACTICAL MONEY GUIDES CREDIT CARD BASICS What you need to know about managing your credit cards TAKE CHARGE WHEN YOU CHARGE Credit cards can be powerful financial tools for you and your family, and as

What is a day trade?

Greg Weitzman DISCLAIMERS THERE IS SUBSTANTIAL RISK INVOLVED IN TRADING AND IT IS NOT SUITABLE FOR ALL INVESTORS. A LOSS INCURRED IN CONNECTION WITH STOCK, FUTURES OR OPTIONS TRADING CAN BE SIGNIFICANT

Greg Weitzman DISCLAIMERS THERE IS SUBSTANTIAL RISK INVOLVED IN TRADING AND IT IS NOT SUITABLE FOR ALL INVESTORS. A LOSS INCURRED IN CONNECTION WITH STOCK, FUTURES OR OPTIONS TRADING CAN BE SIGNIFICANT

I lost my daughter Pamela on March 27th 2010 to a heroin. Pamela's struggle began when she was a senior in high school.

Tricia Stouch I lost my daughter Pamela on March 27th 2010 to a heroin overdose. She was nineteen years old. Pamela's struggle began when she was a senior in high school. Pamela left me a journal on her

Tricia Stouch I lost my daughter Pamela on March 27th 2010 to a heroin overdose. She was nineteen years old. Pamela's struggle began when she was a senior in high school. Pamela left me a journal on her

CREATE TAX ADVANTAGED RETIREMENT INCOME YOU CAN T OUTLIVE. create tax advantaged retirement income you can t outlive

create tax advantaged retirement income you can t outlive 1 Table Of Contents Insurance Companies Don t Just Sell Insurance... 4 Life Insurance Investing... 5 Guarantees... 7 Tax Strategy How to Get Tax-Free

create tax advantaged retirement income you can t outlive 1 Table Of Contents Insurance Companies Don t Just Sell Insurance... 4 Life Insurance Investing... 5 Guarantees... 7 Tax Strategy How to Get Tax-Free

How to Settle Your Debts and Repair Your Credit

How to Settle Your Debts and Repair Your Credit 1 Thomas L Stephani Copyright 2006 Thomas L Stephani ISBN XXXXXXXX (we will automatically assign one of ours if you don t include one here) All rights reserved.

How to Settle Your Debts and Repair Your Credit 1 Thomas L Stephani Copyright 2006 Thomas L Stephani ISBN XXXXXXXX (we will automatically assign one of ours if you don t include one here) All rights reserved.

Q. How long does it. take a college student to pay off a $5,000 credit card balance?

Q. How long does it take a college student to pay off a $5,000 credit card balance? A. Over 39 years. Look how long it takes to pay off a credit card debt of $5,000, if your interest rate is 18% APR and

Q. How long does it take a college student to pay off a $5,000 credit card balance? A. Over 39 years. Look how long it takes to pay off a credit card debt of $5,000, if your interest rate is 18% APR and

Bankruptcy Questions. FAQ > Bankruptcy Questions WHAT IS CHAPTER 7 BANKRUPTCY?

FAQ > Bankruptcy Questions Bankruptcy Questions WHAT IS CHAPTER 7 BANKRUPTCY? Chapter 7 bankruptcy is sometimes called a straight bankruptcy or a liquidation proceeding. The number one goal in an individual

FAQ > Bankruptcy Questions Bankruptcy Questions WHAT IS CHAPTER 7 BANKRUPTCY? Chapter 7 bankruptcy is sometimes called a straight bankruptcy or a liquidation proceeding. The number one goal in an individual

A Debtor s Guide to the role of a PIP

A Debtor s Guide to the role of a A guide to the role of your professional advisor for a DSA or a PIA Insolvency Service of Ireland nseirbhís Dócmhainneachta na héirea n ISI Tackling problem debt together

A Debtor s Guide to the role of a A guide to the role of your professional advisor for a DSA or a PIA Insolvency Service of Ireland nseirbhís Dócmhainneachta na héirea n ISI Tackling problem debt together

Problems with repayments

1 6. Problems with Repayments One of the drawbacks of using credit, especially by families on low incomes, is the risk of falling into difficulties with repayments. Concern is often expressed at the number

1 6. Problems with Repayments One of the drawbacks of using credit, especially by families on low incomes, is the risk of falling into difficulties with repayments. Concern is often expressed at the number

WHAT BANKRUPTCY CAN T DO

A decision to file for bankruptcy should only be made after determining that bankruptcy is the best way to deal with your financial problems. This brochure cannot explain every aspect of the bankruptcy

A decision to file for bankruptcy should only be made after determining that bankruptcy is the best way to deal with your financial problems. This brochure cannot explain every aspect of the bankruptcy

Welfare Reform Targeted Support Scheme Evaluation Report June 2014

Welfare Reform Targeted Support Scheme Evaluation Report June 2014 The Welfare Reform Targeted Support Scheme was created by City of York Council after it received 35,000 from central government to support

Welfare Reform Targeted Support Scheme Evaluation Report June 2014 The Welfare Reform Targeted Support Scheme was created by City of York Council after it received 35,000 from central government to support

Jade Education Award Story: Smart Loan Strategies Page 1. This is Jade.

Jade Education Award Story: Smart Loan Strategies Page 1 This is Jade. Jade borrowed a lot of money to pay for her two degrees. She consolidated several smaller loans into one big one. She wants to use

Jade Education Award Story: Smart Loan Strategies Page 1 This is Jade. Jade borrowed a lot of money to pay for her two degrees. She consolidated several smaller loans into one big one. She wants to use

THE DEBT SETTLEMENT TRAP: THE #1 THREAT FACING DEEPLY INDEBTED AMERICANS

THE DEBT SETTLEMENT TRAP: THE #1 THREAT FACING DEEPLY INDEBTED AMERICANS Already struggling with home foreclosures, harsh bank and credit card fees, and other major financial challenges, America s most

THE DEBT SETTLEMENT TRAP: THE #1 THREAT FACING DEEPLY INDEBTED AMERICANS Already struggling with home foreclosures, harsh bank and credit card fees, and other major financial challenges, America s most

How to STOP Foreclosure

1 How to STOP Foreclosure A Free Report from KentuckySolutions.com Kentucky s Real Estate Problem Solvers (Press Control-P to Print) 2 Introduction As Local Investors experienced in the Kentucky foreclosure

1 How to STOP Foreclosure A Free Report from KentuckySolutions.com Kentucky s Real Estate Problem Solvers (Press Control-P to Print) 2 Introduction As Local Investors experienced in the Kentucky foreclosure

How To Buy Stock On Margin

LESSON 8 BUYING ON MARGIN AND SELLING SHORT ACTIVITY 8.1 A MARGINAL PLAY Stockbroker Luke, Katie, and Jeremy are sitting around a desk near a sign labeled Brokerage Office. The Moderator is standing in

LESSON 8 BUYING ON MARGIN AND SELLING SHORT ACTIVITY 8.1 A MARGINAL PLAY Stockbroker Luke, Katie, and Jeremy are sitting around a desk near a sign labeled Brokerage Office. The Moderator is standing in

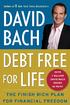

LiveRich! David Bach Founder FinishRich Media www.finishrich.com Join us now at www.facebook.com/davidbach.

D a v i d B a c h Dear Friends, Thank you for taking an exclusive look inside my soon to be released book, Debt-Free for Life. For more resources and tools, please visit my website, www.finishrich.com.

D a v i d B a c h Dear Friends, Thank you for taking an exclusive look inside my soon to be released book, Debt-Free for Life. For more resources and tools, please visit my website, www.finishrich.com.

According to the United States Bankruptcy Code there are 6 types of bankruptcies, called chapters :

FAQ Bankruptcy What does bankruptcy mean? Bankruptcy is a legal procedure that allows people to legally avoid their debts or reorganize their financial obligations through a payment plan. How many bankruptcy

FAQ Bankruptcy What does bankruptcy mean? Bankruptcy is a legal procedure that allows people to legally avoid their debts or reorganize their financial obligations through a payment plan. How many bankruptcy

TOO MANY DEBTS? HOW TO DEAL WITH YOUR DEBTS AND STOP DEBT COLLECTORS FROM HARASSING YOU

LEGAL AID CONSUMER FACT SHEET # 1 TOO MANY DEBTS? HOW TO DEAL WITH YOUR DEBTS AND STOP DEBT COLLECTORS FROM HARASSING YOU Important Note: The following fact sheet is not intended to substitute for legal

LEGAL AID CONSUMER FACT SHEET # 1 TOO MANY DEBTS? HOW TO DEAL WITH YOUR DEBTS AND STOP DEBT COLLECTORS FROM HARASSING YOU Important Note: The following fact sheet is not intended to substitute for legal

Car Title Loans. What is a car title loan? How does a car title loan work?

Car Title Loans What is a car title loan? When you take out a car title loan, you are borrowing money and giving the lender the title to your car as collateral. This means that the lender can repossess

Car Title Loans What is a car title loan? When you take out a car title loan, you are borrowing money and giving the lender the title to your car as collateral. This means that the lender can repossess

Overcoming the Credit Barrier. Poor Credit Affects Your Ability to Plan

Overcoming the Credit Barrier: Clearing the Way to Your Financial Goals was written and designed for The National Foundation for Credit Counseling (NFCC ) and the Financial Planning Association (FPA )

Overcoming the Credit Barrier: Clearing the Way to Your Financial Goals was written and designed for The National Foundation for Credit Counseling (NFCC ) and the Financial Planning Association (FPA )

FACTS YOU SHOULD KNOW ABOUT NEGOTIATED DEBT SETTLEMENTS

FACTS YOU SHOULD KNOW ABOUT NEGOTIATED DEBT SETTLEMENTS Cornerstone Financial Counselors Copyright July 2003 FACTS YOU SHOULD KNOW ABOUT NEGOTIATED DEBT SETTLEMENTS Introduction Negotiating debt settlements

FACTS YOU SHOULD KNOW ABOUT NEGOTIATED DEBT SETTLEMENTS Cornerstone Financial Counselors Copyright July 2003 FACTS YOU SHOULD KNOW ABOUT NEGOTIATED DEBT SETTLEMENTS Introduction Negotiating debt settlements

NYC Bankruptcy Assistance Project

NYC Bankruptcy Assistance Project A Project of Legal Services for New York City Answers to Common Bankruptcy Questions A decision to file for bankruptcy should be made only after determining that bankruptcy

NYC Bankruptcy Assistance Project A Project of Legal Services for New York City Answers to Common Bankruptcy Questions A decision to file for bankruptcy should be made only after determining that bankruptcy

Bankruptcy Proposal Form

INTRODUCTION Many Canadians will face a financial crisis at some point in their lives. Many debt problems are easy to solve while others need professional assistance. The first step in dealing with financial

INTRODUCTION Many Canadians will face a financial crisis at some point in their lives. Many debt problems are easy to solve while others need professional assistance. The first step in dealing with financial

WHAT SHOULD YOU DO IF A CREDITOR OR DEBT COLLECTOR DEMANDS PAYMENT OF A DEBT?

DEALING WITH DEBT COLLECTION This fact sheet is for information only. It is recommended that you get legal advice about your situation. CASE STUDY Peter received a letter from a debt collector stating

DEALING WITH DEBT COLLECTION This fact sheet is for information only. It is recommended that you get legal advice about your situation. CASE STUDY Peter received a letter from a debt collector stating

PLAN TO PAY CREDITORS AND PROTECT FAMILY WELFARE

February 2002 FL/FF-I-06 PLAN TO PAY CREDITORS AND PROTECT FAMILY WELFARE Barbara R. Rowe, Ph.D. Professor and Family Resource Management Specialist Utah State University 1 Many circumstances can lead

February 2002 FL/FF-I-06 PLAN TO PAY CREDITORS AND PROTECT FAMILY WELFARE Barbara R. Rowe, Ph.D. Professor and Family Resource Management Specialist Utah State University 1 Many circumstances can lead

CFPB s Advice to the Consumer

OVERVIEW CFPB s Advice to the Consumer The Consumer Financial Protection Bureau answers more than 80 commonly asked questions Now Updated Through March 2016 PROFESSIONALS FORUM Copyright insidearm LLC.

OVERVIEW CFPB s Advice to the Consumer The Consumer Financial Protection Bureau answers more than 80 commonly asked questions Now Updated Through March 2016 PROFESSIONALS FORUM Copyright insidearm LLC.

Club Accounts. 2011 Question 6.

Club Accounts. 2011 Question 6. Anyone familiar with Farm Accounts or Service Firms (notes for both topics are back on the webpage you found this on), will have no trouble with Club Accounts. Essentially

Club Accounts. 2011 Question 6. Anyone familiar with Farm Accounts or Service Firms (notes for both topics are back on the webpage you found this on), will have no trouble with Club Accounts. Essentially

TABLE OF CONTENTS. Introduction...3 What is Debt Consolidation?...5. Debt Consolidation Program Processes...19

TABLE OF CONTENTS Introduction...3 What is Debt Consolidation?...5 A) CHAPTER 13 B) WHAT DEBTS ARE ADDRESSED? Debt Consolidation Program Processes...19 A) DEBT MANAGEMENT PROGRAM B) DEBT SETTLEMENT PROGRAM

TABLE OF CONTENTS Introduction...3 What is Debt Consolidation?...5 A) CHAPTER 13 B) WHAT DEBTS ARE ADDRESSED? Debt Consolidation Program Processes...19 A) DEBT MANAGEMENT PROGRAM B) DEBT SETTLEMENT PROGRAM

K.2 Answers to Common Bankruptcy Questions

Adapted from Consumer Bankruptcy Law and Practice, 10 th Edition, National Consumer Law Center, copyright 2012. Used by permission. K.2 Answers to Common Bankruptcy Questions A decision to file for bankruptcy

Adapted from Consumer Bankruptcy Law and Practice, 10 th Edition, National Consumer Law Center, copyright 2012. Used by permission. K.2 Answers to Common Bankruptcy Questions A decision to file for bankruptcy

Bankruptcy may make it possible for you to:

A decision to file for bankruptcy should be made only after determining that bankruptcy is the best way to deal with your financial problems. This brochure cannot explain every aspect of the bankruptcy

A decision to file for bankruptcy should be made only after determining that bankruptcy is the best way to deal with your financial problems. This brochure cannot explain every aspect of the bankruptcy

100% graduate early from our program 96% customer retention rate 100% partnership with our clients

Roundleaf is a wealth restoration company. We help people RESET, REBUILD, and REFOCUS their wealth. RESET Reset your debt Eliminate your 2 nd mortgage REBUILD Rebuild your credit and wealth Recover your

Roundleaf is a wealth restoration company. We help people RESET, REBUILD, and REFOCUS their wealth. RESET Reset your debt Eliminate your 2 nd mortgage REBUILD Rebuild your credit and wealth Recover your