COMPLAINT AND GRIEVANCE PROCESS

|

|

|

- Flora Butler

- 8 years ago

- Views:

Transcription

1 COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check your Certificate of Coverage or Summary Plan Description or ask your employer. These processes, and the differences between them, are noted in the following text. Please contact your Human Resources or Benefits department to determine whether you are a member of a fully insured group or a self-insured group. Self-insured groups may also customize their complaint and grievance process. If you are a member of a selfinsured group, contact your Human Resources or Benefits department to confirm that the group follows the standard complaint and grievance processes outlined in the following pages. If you have any questions or concerns regarding UPMC Health Plan s complaint and grievance process, you should call our Member Services Department at Your comments are important to us as we strive to improve the quality of the care and service we provide. When you call the Member Services Department at either UPMC Health Plan or UPMC Health Plan Behavioral Health Services, a representative will try to answer your questions or respond to your concerns. At any point in the process, if you are not satisfied with the response, you may ask to file a complaint or grievance through the UPMC Health Plan complaint and grievance process. UPMC Health Plan has established a set of formal procedures that you may use if you are in any way dissatisfied with UPMC Health Plan or a participating provider. The following is a brief overview of the UPMC Health Plan complaint and grievance process. Complaints. If you have a dispute or objection regarding a provider or the coverage, operations, or management policies of UPMC Health Plan, you should contact our Member Services Department. General information about complaints. You may file a complaint over the telephone with a Member Services Department representative by calling Or you may send a written complaint or written information to support a complaint to: UPMC Health Plan P.O. Box 2939 Pittsburgh, PA You must file a complaint within 180 days of the date you receive a claim denial or within 180 days of the event that is prompting your complaint. At any time during the course of the complaint process, you may choose to designate a representative to participate in the complaint process on your behalf. You must notify UPMC Health Plan in writing of this designation. You can contact our Member Services Department for the Personal Representative Designation Form. Just call the number on the back of your member ID card. If you wish to designate a representative, you must complete and return the Personal Representative Designation Form. Member Advocates are available Monday through Friday from 7 a.m. to 7 p.m. and Saturday from 8 a.m. to 3 p.m. TTY users should call You can also visit our website at and select the Commonly used forms link under the Members heading. Then click on the Personal Representative Designation Form link and download the form. Return your completed form to the address or fax number listed below: UPMC Health Plan P.O. Box 2965 Pittsburgh, Pennsylvania Fax: The complaint process consists of a two-step internal process as well as an external appeal process, should you remain dissatisfied with the internal complaint process results. The complaint process is summarized in the chart below. Complaints can involve many different issues, including, but not limited to, the quality of care or services, benefits exclusions, claim denials, rescission of coverage, or coordination of benefits. A complaint is different from a grievance. (See separate section on Grievances.)

2 The Internal Complaint Process First Level Complaint Process Acknowledgment Letter First Complaint Process First Complaint Committee Decision Letter Upon receipt of your oral or written complaint the complaint Within 5 business days of the decision UPMC Health Plan will provide you or your representative with written confirmation of receipt of the complaint. The First Complaint Committee (consisting of one or more employees of UPMC Health Plan who have not been involved in a prior decision on the issue under dispute) will investigate the details of the complaint. The Committee will make a decision within 30 days of receipt of the complaint. regarding your complaint, we will provide you or your UPMC Health Plan will send you or your representative written notification of the First Complaint Committee decision within 5 business days. Request for Second Level Within 60 days of receipt of the first complaint decision letter Second Level Complaint Process Acknowledgment Letter Upon receipt of your oral or written request a second level review If you or your representative request a Second Level Complaint of the First Complaint decision, the complaint will go to UPMC Health Plan s Second Level Complaint Committee. Upon receipt of your request for a Second Level Complaint, UPMC Health Plan will provide written confirmation to you or your representative. This letter will also advise you or your representative that you have the right to appear before the Second Level Complaint Committee and that UPMC Health Plan will provide you and your representative with 15 days advance written notice of the date and time scheduled for that review. Grievances. A grievance is different from a complaint. A grievance is a request on the part of a member, a member s representative, or a health care provider (with written member consent) to have a managed care plan reconsider a decision solely concerning the medical necessity and appropriateness of a health care service. A grievance may be filed regarding decisions to fully or partially deny payment for a requested health service, to approve provision of a requested health care service at a lesser level or duration than requested, or to disapprove payment for the provision of a requested service but approve payment for the provision of an alternative health care service. General information about grievances. You may send a written grievance or written information to support a grievance to: UPMC Health Plan P.O. Box 2939 Pittsburgh, PA While it is generally preferable that you file a grievance in writing, you or your representative may call our Member Services Department at to request assistance and file a grievance orally. You must file a grievance within 180 days of the date you receive a denial or within 180 days of the event that is prompting your grievance.

3 Second Level Complaint Process (Continued) Second Level Complaint the complaint The Second Level Complaint Committee consists of three or more individuals who did not previously participate in the matter under review. At least one-third of the committee is made up of members who are not employed by UPMC Health Plan or a related subsidiary or affiliate. The members of the committee have the duty to be impartial in their review of the information and You or your representative have the right, but are not required, to attend the Second Level Complaint Committee meeting. When arranging the meeting, UPMC Health Plan will notify you or your representative in writing 15 days in advance of the date scheduled for the Second Level Complaint. UPMC Health Plan will also provide details of the review process and how the meeting will be conducted, including your rights at such meetings. Second Level Complaint Committee Decision Letter Within 5 business days of the decision If you or your representative cannot appear in person at the Second Level, UPMC Health Plan will provide you or your representative with the opportunity to communicate with the Committee by telephone or other appropriate means. The Second Level Complaint Committee will complete its review and will base its decision solely upon the materials and testimony presented at the review. regarding your complaint, we will provide you or your UPMC Health Plan will send you or your representative written notification of the Second Level Complaint Committee s Your health care provider may request your consent (in writing) to pursue a grievance at the time of treatment or service, but not as a condition of providing that treatment or service. Once you give a health care provider consent to file the grievance, the provider has 10 days from the receipt of the UPMC Health Plan denial to file the grievance. The provider needs to inform you only in the event he or she decides not to file the grievance. Your consent is automatically rescinded if the health care provider fails to file a grievance or fails to follow the grievance through the Second Level of the grievance process. If you or your representative wish to file a grievance, but have already given your provider written consent, you or your representative must rescind the consent to your provider in order for you or your representative to proceed with the filing of the grievance. You and your health care provider cannot file separate grievances for the same denied treatment or service. We have instructed all our providers on the required format for written member consents. As with the complaint process, the grievance process also consists of a two-step internal process as well as an external grievance appeal, should you remain dissatisfied with the results of the internal grievance process decisions. The grievance process is summarized in the chart below.

4 Expedited internal grievance process. If you feel that your life, health, or ability to regain maximum function are in jeopardy because of any delay that the time frame for an internal grievance might cause, or feel that UPMC Health Plan failed to provide medically necessary and appropriate covered services, you may request an expedited review. In such cases, please call the Member Services Department to request an expedited review. You or your representative must have certification in writing from your physician that your condition would be placed in jeopardy by the delay inherent in the regular time frame of the internal grievance process. The certification must include a clinical rationale and facts to support your provider s position. UPMC Health Plan will arrange to have expedited grievances reviewed by the UPMC Health Plan Medical Director within 48 hours of receipt. The Complaints and Grievances Department will send you or your representative a letter explaining the decision within 48 hours. A reasonable attempt will be made to verbally notify you or your representative of this decision as well. The Expedited Internal decision letter will advise you if you have the right to file an Expedited External Grievance. If applicable, you have 2 business days from the receipt of the Expedited Internal Grievance Decision letter to contact UPMC Health Plan and request an Expedited External Grievance. External grievance review process. Members should contact their employer or check their Certificate of Coverage or Summary Plan Description to determine if they have external grievance rights. If you have the right to file an external appeal, and you or your representative still are dissatisfied with UPMC Health Plan s decision regarding your grievance, you or your representative may file a request for an External Grievance with UPMC Health Plan within 4 months of receipt of the decision of UPMC Health Plan s Second Level Grievance Committee. If your provider is filing the request for an External Grievance, your provider must submit a copy of your written consent. The request must contain any materials, supporting information, or necessary justification for the external grievance. For more information regarding the External Grievance process, see your Certificate of Coverage or Summary Plan Description. The Internal Grievance Process First Level Grievance Process Acknowledgment Letter First Grievance Process First Grievance Committee Decision Letter Request for Second Level Upon receipt of your oral or written grievance your grievance Within 5 business days of the decision Within 60 days of receipt of the first grievance decision letter UPMC Health Plan will provide written confirmation of receipt to you or your representative, if one has been designated, and the health care provider, if the health care provider filed the grievance with written member consent. The First Grievance Committee (consisting of one or more employees of UPMC Health Plan who did not previously participate in the decision to deny payment for the health care service under dispute) will investigate the details of the grievance. This committee will include input from qualified personnel (for example, a licensed physician or, where appropriate, an approved licensed psychologist) with experience in the same or a similar specialty that typically manages or consults on the health care service under dispute. regarding your grievance, we will provide you or your UPMC Health Plan will send you or your representative written notification of the First Level Grievance Committee decision, within 5 business days. If you, your representative, or the health care provider with written member consent, requests a Second Level Grievance of the decision of the First Grievance Committee, the grievance will go to UPMC Health Plan s Second Level Grievance Committee.

5 Second Level Grievance Process Acknowledgement Letter Upon receipt of your oral or written request for a second level review Upon receipt of the request for the Second Level Grievance, UPMC Health Plan will provide written confirmation to you or your representative. Second Level Grievance Second Level Grievance Committee Decision Letter your grievance Within 5 business days of the decision This letter will also advise you or your representative that you have the right to appear before the Second Level Grievance Committee and that UPMC Health Plan will provide you or your representative with 15 days advance written notice of the date and time scheduled for that review. regarding your grievance, we will provide you or your The Second Level Grievance Committee consists of three or more individuals who did not previously participate in any decision to deny payment for the health care service under dispute. This committee will review input from qualified personnel (for example, a licensed physician or, where appropriate, an approved licensed psychologist) with experience in the same or a similar specialty that typically manages or consults on the health care service under dispute. You or your representative or the health care provider have the right, but are not required, to attend the Second Level Grievance Committee hearing. When arranging the review, UPMC Health Plan will notify you, your representative, or health care provider in writing at least 15 days in advance of the date scheduled for the Second Level Grievance. UPMC Health Plan will also provide details of how the review will be conducted, including your rights at such meetings. If you, your representative or health care provider cannot appear in person at the Second Level Grievance, UPMC Health Plan will provide you or your representative with the opportunity to communicate with the Committee by telephone or other appropriate means. The Second Level Grievance Committee will complete its review and shall base its decision solely upon the materials and testimony presented at the review. UPMC Health Plan will send you or your representative written notification of the Second Level Grievance Committee decision within 5 business days. If it is applicable to your group health plan, information on how to file an external grievance will also be provided in the event that you are dissatisfied with the results of the internal grievance

6 If your group health plan has External Grievance rights, your second level grievance decision notification letter will explain how to file an external appeal. If your group health plan does not have External Grievance rights, the decision of the Second Level Grievance Committee is final. External Grievance Process. If you and/or your provider still are dissatisfied with UPMC Health Plan s decision regarding your Grievance, you, your representative, or your provider may file a request with UPMC Health Plan for an External Grievance within four months of receipt of the decision of the Second Level Grievance Committee. External Grievances are reviewed by an Independent Organization (IRO). External Grievances should involve a question of medical necessity, appropriateness, health care setting, level of care, effectiveness of a covered benefit, or whether a treatment or service is experimental or investigational. If your provider is filing the request for an External Grievance, your provider must submit a copy of your written consent. The request must contain any materials, supporting information, or necessary justification for the External Grievance. When the request for an External Grievance is received, UPMC Health Plan will complete a preliminary review of the request within five business days. The purpose of the preliminary review is to determine whether (1) you are or were covered at the time the service/item was requested; (2) if the adverse benefit determination relates to your failure to meet the requirements for coverage; (3) you exhausted internal appeals; and (4) you provided all information and forms necessary to process the External Grievance. Within one day after completion of the preliminary review, UPMC Health Plan will issue a notification to you in writing as to whether your grievance is eligible for an external review. We will tell you if we need additional information to determine eligibility for an external review. If we need additional information, we will tell you what we need and allow you to submit the additional information within the four-month filing period or within the 48-hour period following your receipt of notification, whichever is later. If your Grievance is eligible for external review, we will notify you of the IRO name, address, and phone number. You, your representative, or your provider may supply additional information to the IRO to consider within five business days of notification that your grievance is eligible for external review. The IRO will then provide this information to UPMC Health Plan within one day so that the Health Plan has an opportunity to consider the additional information as well. Within five business days of determining that your appeal is eligible for external review, UPMC Health Plan will forward a copy of all written documentation regarding the adverse benefit determination to the IRO. Documentation will include the correspondence concerning the decision, all reasonable supporting documentation, and a summary of the clinical rationale for the adverse determination. At the same time, UPMC Health Plan will provide you, your representative, or your provider with the list of documents that are being forwarded to the IRO for the External Grievance. The IRO will review all information provided by UPMC Health Plan and you, your representative, or your provider. The IRO will make a determination under the terms of your plan as established by UPMC Health Plan. The IRO will issue a decision within 45 calendar days of receipt of the external appeal. The decision will be issued in writing to you or your representative and UPMC Health Plan. The decision notification will include the basis and clinical rationale for the decision, the credentials of the individual reviewer, and a list of information considered in the Complaints to a Governing Agency. If you have a complaint, the Pennsylvania Department of Health or Pennsylvania Insurance Department may be able to help you resolve the dispute. If you are dissatisfied with UPMC Health Plan s decision regarding your second level complaint, you may have the right to file an appeal of our decision with the Pennsylvania Department of Health or Pennsylvania Insurance Department. Your appeal must be filed within 15 calendar days after your receipt of our Second Level Complaint Committee s The Second Level Complaint decision letter will contain the contact information for both the Department of Health and the Insurance Department. Generally, the Department of Health reviews appeals that concern quality of care or quality of service issues, whereas the Insurance Department reviews appeals that concern problems relating to contract exclusions, coverage disputes, and other insurance-related issues, such as subrogation. The contact information for each department is below: Pennsylvania Department of Health, Bureau of Managed Care, P. O. Box 90, Harrisburg, PA (Toll-Free Phone Number: ) Bureau of Consumer Services of the Pennsylvania Insurance Department, 1209 Strawberry Square, Harrisburg, PA ( )

7 Your request for an appeal to a governing agency should be in writing, although each agency will make staff available to transcribe an oral appeal. Each agency requires that you provide the following information when requesting an appeal: Your name, address, and telephone number Name of the managed care plan Your identification number A brief description of the issue being appealed A copy of the adverse decision letter that we sent to you You also need to let the agency know if you will be represented by an attorney. ERISA Appeal Rights. You also may have appeal rights under section 502 (a) of the Employee Retirement Income Security Act (ERISA), if your benefit plan is an ERISA plan. You should contact your employer or plan sponsor to determine if your benefit plan is an ERISA plan and to inquire as to your appeal rights under that plan. Remember that you must exhaust your administrative remedies with UPMC Health Plan prior to exercising your right to file a claim in a court of competent jurisdiction under ERISA. For questions about your rights, this notice, or for assistance, you can contact the Employee Benefits Security Administration at EBSA (3272). This is a printable.pdf file, available as part of the Online Welcome Kit for new and renewing UPMC Health Plan members. If you have further questions, please contact UPMC Health Plan Member Services at the telephone number on the back of your member ID card. In this document, the terms UPMC Health Plan and the Health Plan refer to benefit plans offered by UPMC Health Network, Inc., as well as to plans offered by UPMC Health Plan, Inc. This managed care plan may not cover all your health care expenses. Read your contract carefully to determine which health services are covered. SPANISH (Español): Para obtener asistencia en Español, llame al TAGALOG (Tagalog): Kung kailangan niyo ang tulong sa Tagalog tumawag sa CHINESE ( 中 文 ): 如 果 需 要 中 文 的 帮 助, 请 拨 打 这 个 号 码 NAVAJO (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne Copyright 2012 UPMC Health Plan, Inc. All Rights Reserved. COMPLAINTS & GRIEVANCES C (CK)

Your Cost If You Use a Participating Provider

Common Medical Event Services You May Need Your Cost If You Use a Participating Provider Your Cost If You Use a Non-Participating Provider Limitations & Exceptions If you need drugs to treat your illness

Common Medical Event Services You May Need Your Cost If You Use a Participating Provider Your Cost If You Use a Non-Participating Provider Limitations & Exceptions If you need drugs to treat your illness

Services Available to Members Complaints & Appeals

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

EXTERNAL REVIEW CONSUMER GUIDE

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

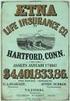

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Coventry Health and Life Insurance Company: Bronze Deductible Only PPO HSA Eligible OH

Coventry Health and Life Insurance Company: Bronze Deductible Only PPO HSA Eligible OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual, Family Coverage

Coventry Health and Life Insurance Company: Bronze Deductible Only PPO HSA Eligible OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual, Family Coverage

Coverage Period : 01/01/2014-12/31/2014

Coventry Health and Life Insurance Company: Bronze Deductible Only PPO HSA Eligible OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary. If you want more detail

Coventry Health and Life Insurance Company: Bronze Deductible Only PPO HSA Eligible OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary. If you want more detail

HealthAmerica, Pennsylvania Inc.: CMU: HealthAmerica HMO Summary of Benefits and Coverage: What this Plan Covers & What it Costs

HealthAmerica, Pennsylvania Inc.: CMU: HealthAmerica HMO Summary of Benefits and Coverage: What this Plan Covers & What it Costs Important Questions Answers Why This Matters: What is the overall deductible?

HealthAmerica, Pennsylvania Inc.: CMU: HealthAmerica HMO Summary of Benefits and Coverage: What this Plan Covers & What it Costs Important Questions Answers Why This Matters: What is the overall deductible?

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

How To Appeal An Adverse Benefit Determination In Aetna

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

HealthAmerica Pennsylvania, Inc: Silver $10 Copay HMO CSR 73

HealthAmerica Pennsylvania, Inc: Silver $10 Copay HMO CSR 73 Coverage Period : 01/01/2015-12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Western Pennsylvania/Ohio 1-800-735-4404.

HealthAmerica Pennsylvania, Inc: Silver $10 Copay HMO CSR 73 Coverage Period : 01/01/2015-12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Western Pennsylvania/Ohio 1-800-735-4404.

Coventry Health and Life Insurance Company: Silver PPO Indian NCS OH

Coventry Health and Life Insurance Company: Silver PPO Indian NCS OH Coverage Period : 01/01/2014-12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual,

Coventry Health and Life Insurance Company: Silver PPO Indian NCS OH Coverage Period : 01/01/2014-12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual,

Sutter Health Plus: SG Gold Copay $30 Summary of Benefits and Coverage: What this Plan Covers & What it Costs

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling 1-855-315-5800. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling 1-855-315-5800. Important

Coventry Health and Life Insurance Company: Bronze $10 Copay PPO Plan OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs

Coventry Health and Life Insurance Company: Bronze $10 Copay PPO Plan OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary. If you want more detail about your

Coventry Health and Life Insurance Company: Bronze $10 Copay PPO Plan OH Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary. If you want more detail about your

Kaiser Permanente: Bronze 5000/60

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.kp.org or by calling 1-800-278-3296. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.kp.org or by calling 1-800-278-3296. Important Questions

HMSA: MED 867/DRG 777 Coverage Period: 01/01/2016-12/31/2016

HMSA: MED 867/DRG 777 Coverage Period: 01/01/2016-12/31/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual / Family Plan Type: PPO This is only a summary.

HMSA: MED 867/DRG 777 Coverage Period: 01/01/2016-12/31/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual / Family Plan Type: PPO This is only a summary.

Trustmark Life Insurance Company: LewerMark Coverage Period: Beginning on or after Aug 1, 2015

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.lewermark.com or by calling 1-800-821-7710. Request a

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.lewermark.com or by calling 1-800-821-7710. Request a

Kaiser Permanente California Service Center P.O. Box 23448 San Diego, CA 92193-3448

Kaiser Permanente California Service Center P.O. Box 23448 San Diego, CA 92193-3448 THE CITY OF HOPE TRAINEE AND AFFILIATE BENEFIT PROGRAM Monica Desmond --- 1500 DUARTE RD DUARTE, CA 91010-3012 October

Kaiser Permanente California Service Center P.O. Box 23448 San Diego, CA 92193-3448 THE CITY OF HOPE TRAINEE AND AFFILIATE BENEFIT PROGRAM Monica Desmond --- 1500 DUARTE RD DUARTE, CA 91010-3012 October

Health Insurance - How Does This Plan Work

: Nationwide Mutual Insurance - Georgia Coverage Period: 01/01/2015 12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual + Family Plan Type: HMO This

: Nationwide Mutual Insurance - Georgia Coverage Period: 01/01/2015 12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual + Family Plan Type: HMO This

Important Questions Answers Why this Matters: What is the overall deductible? Are there other deductibles for specific services?

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual+Family Plan Type: DHMO

Kaiser Permanente: DEDUCTIBLE PLAN Coverage Period: 06/01/2015-05/31/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual+Family Plan Type: DHMO Kaiser

Kaiser Permanente: DEDUCTIBLE PLAN Coverage Period: 06/01/2015-05/31/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual+Family Plan Type: DHMO Kaiser

Ultimate Full HMO for Small Business $25 Coverage Period: Beginning On or After 1/1/2014

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.blueshieldca.com or by calling 1-888-319-5999. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.blueshieldca.com or by calling 1-888-319-5999. Important

NEWSPAPER GUILD HEALTH AND WELFARE FUND : Aetna HealthFund Health Network Option SM

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthreformplansbc.com or by calling 1-800-370-4526.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthreformplansbc.com or by calling 1-800-370-4526.

Sutter Health Plus: SG Silver Copay $45 Summary of Benefits and Coverage: What this Plan Covers & What it Costs

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling 1-855-315-5800. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling 1-855-315-5800. Important

HMSA's Small Business Preferred Provider Plan - A

HMSA's Small Business Preferred Provider Plan - A Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2015-12/31/2015 Coverage for: Individual / Family Plan Type:

HMSA's Small Business Preferred Provider Plan - A Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2015-12/31/2015 Coverage for: Individual / Family Plan Type:

Coverage for: Large Group Plan Type: HMO

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling 1-855-315-5800. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling 1-855-315-5800. Important

HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

The Pennsylvania Insurance Department s. Your Guide to filing HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO

Coverage Period: 7/1/2013-6/30/2014 This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com

Coverage Period: 7/1/2013-6/30/2014 This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com

Important Questions Answers Why this Matters: What is the overall deductible? Are there other deductibles for specific services?

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com/uc or by calling 1-800-539-4072. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com/uc or by calling 1-800-539-4072. Important

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-866-801-1446. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-866-801-1446. Important

Silver 70 HMO. Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.cchphmo.com or by calling 1-888-681-3888. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.cchphmo.com or by calling 1-888-681-3888. Important Questions

Important Questions Answers Why this Matters: What is the overall deductible? Are there other deductibles for specific services?

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com/cardinalcare or by calling 1-800-250-5226.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com/cardinalcare or by calling 1-800-250-5226.

Health Net Life Ins. Co.: PPO HSA C6B HD 1300/2600

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

for health care expenses. You don t have to meet deductibles for specific services, but see the chart starting

Kaiser Permanente: HSA-QUALIFIED DEDUCTIBLE HMO Coverage Period: 01/01/2013-12/31/2013 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Family Plan Type: DHMO This

Kaiser Permanente: HSA-QUALIFIED DEDUCTIBLE HMO Coverage Period: 01/01/2013-12/31/2013 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Family Plan Type: DHMO This

Important Questions Answers Why this Matters: What is the overall deductible?

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

Yes. $125 per person for prescription drug expenses Yes. HSHS Facility/HSHS Preferred PCP/Network Specialist

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www. hshs.org/benefits or by calling Dean Health Plan at

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www. hshs.org/benefits or by calling Dean Health Plan at

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

Kaiser Permanente: TRADITIONAL PLAN

Kaiser Permanente: TRADITIONAL PLAN Coverage Period: 10/01/2014-09/30/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual+Family Plan Type: HMO This is

Kaiser Permanente: TRADITIONAL PLAN Coverage Period: 10/01/2014-09/30/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual+Family Plan Type: HMO This is

Important Questions Answers Why this Matters:

Sutter Health Plus: Schools Insurance Group_HDHP_HE06/HE56 Coverage Period: 07/01/2015 06/30/2016 This is only a summary. If you want more detail about your coverage and costs, you can get the complete

Sutter Health Plus: Schools Insurance Group_HDHP_HE06/HE56 Coverage Period: 07/01/2015 06/30/2016 This is only a summary. If you want more detail about your coverage and costs, you can get the complete

Panther Gold Advantage: UPMC Health Plan Coverage Period: 07/01/2016-06/30/2017 Summary of Coverage: What this Plan Covers & What it Costs

Panther Gold Advantage: UPMC Health Plan Coverage Period: 07/01/2016-06/30/2017 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type: HMO This is only

Panther Gold Advantage: UPMC Health Plan Coverage Period: 07/01/2016-06/30/2017 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type: HMO This is only

Panther Basic: UPMC Health Plan Coverage Period: 07/01/2015-06/30/2016 Summary of Coverage: What this Plan Covers & What it Costs

Panther Basic: UPMC Health Plan Coverage Period: 07/01/2015-06/30/2016 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type: HSA PPO This is only a summary.

Panther Basic: UPMC Health Plan Coverage Period: 07/01/2015-06/30/2016 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type: HSA PPO This is only a summary.

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

Enhanced Exclusive HMO for Small Business $55 Coverage Period: Beginning On or After 1/1/2014

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.blueshieldca.com or by calling 1-888-256-3520. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.blueshieldca.com or by calling 1-888-256-3520. Important

Appealing a coverage decision made by your Medical Assistance plan

Appealing a coverage decision made by your Medical Assistance plan A Guide to Grievances, Complaints, and Fair Hearings in Pennsylvania s Medical Assistance Program. Prepared by: The Pennsylvania Health

Appealing a coverage decision made by your Medical Assistance plan A Guide to Grievances, Complaints, and Fair Hearings in Pennsylvania s Medical Assistance Program. Prepared by: The Pennsylvania Health

Laborers Funds Administrative Office of Northern California, Inc.

Date: April 24, 2015 Laborers Funds Administrative Office of Northern California, Inc. 220 Campus Lane, Fairfield, CA 94534-1498 Telephone: 707 864 2800 or 800 244 4530 Important Information Regarding

Date: April 24, 2015 Laborers Funds Administrative Office of Northern California, Inc. 220 Campus Lane, Fairfield, CA 94534-1498 Telephone: 707 864 2800 or 800 244 4530 Important Information Regarding

HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

: The Ohio State University 2015-1098-4 Summary of Benefits and Coverage: What this Plan Covers & What it Costs

Coverage Period: - 08/15/2016 This is only a summary. It in no way modifies your benefits as described in your plan documents. If you want more detail about your coverage and costs, you can get the complete

Coverage Period: - 08/15/2016 This is only a summary. It in no way modifies your benefits as described in your plan documents. If you want more detail about your coverage and costs, you can get the complete

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbsnm.com/coverage or by calling 1-877-878-LANL (5265).

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbsnm.com/coverage or by calling 1-877-878-LANL (5265).

You can see the specialist you choose without permission from this plan.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbsnm.com/coverage or by calling 1-877-878-LANL (5265).

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbsnm.com/coverage or by calling 1-877-878-LANL (5265).

UPMC Advantage Enhanced Silver: UPMC Health Plan Coverage Period: Beginning on or after 01/01/2014

UPMC Advantage Enhanced Silver: UPMC Health Plan Coverage Period: Beginning on or after 01/01/2014 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type:

UPMC Advantage Enhanced Silver: UPMC Health Plan Coverage Period: Beginning on or after 01/01/2014 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type:

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthnet.com or by calling 1-800-522-0088. Important

HMSA's Bronze PPO 6600

HMSA's Bronze PPO 6600 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2015-12/31/2015 Coverage for: Individual / Family Plan Type: PPO This is only a summary.

HMSA's Bronze PPO 6600 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2015-12/31/2015 Coverage for: Individual / Family Plan Type: PPO This is only a summary.

$1,250person/ $2,500Family. Doesn t apply to preventive care. Important Questions. Why this Matters:

Virginia Mason Medical Center: Health Savings Plan Coverage Period: 01/01/2014 12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual + Family Plan

Virginia Mason Medical Center: Health Savings Plan Coverage Period: 01/01/2014 12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual + Family Plan

How To Pay For A Health Care Plan With A Macy Insurance Plan

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthreformplansbc.com or by calling 1-855-586-6963.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthreformplansbc.com or by calling 1-855-586-6963.

$0 See the chart starting on page 2 for your costs for services this plan covers. Are there other deductibles

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-800-447-8255. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-800-447-8255. Important

BlueCare 1485. No. No. Yes. For a list of participating providers, see www.floridablue.com or call 1-800-352-2583.

BlueCare 1485 Coverage Period: 01/01/2016-12/31/2016 Everyday Health Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual and/or Family Plan Type: HMO This is

BlueCare 1485 Coverage Period: 01/01/2016-12/31/2016 Everyday Health Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual and/or Family Plan Type: HMO This is

You can see the specialist you choose without permission from this plan.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbsil.com or by calling 1-866-826-0913. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbsil.com or by calling 1-866-826-0913. Important Questions

9. Claims and Appeals Procedure

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

PENDING REGULATORY APPROVAL. Coverage for: Individual Plan Type: HMO. Important Questions Answers Why this Matters: What is the overall deductible?

PENDING REGULATORY APPROVAL This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling

PENDING REGULATORY APPROVAL This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling

City of New York CBP Basic Program

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-800-624-2414. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-800-624-2414. Important

What Happens When Your Health Insurance Carrier Says NO

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

: Self-Funded Aetna Open Access Managed Choice HIGH DEDUCTIBLE HEALTH PLAN Summary of Benefits and Coverage: What this Plan Covers & What it Costs

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthreformplansbc.com or by calling 1-800-334-0299.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthreformplansbc.com or by calling 1-800-334-0299.

Kaiser Permanente: Platinum 90 HMO

Kaiser Permanente: Platinum 90 HMO Coverage Period: Beginning on or after 01/01/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO

Kaiser Permanente: Platinum 90 HMO Coverage Period: Beginning on or after 01/01/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO

Important Questions Answers Why this Matters:

WPE HDHP Uniform Benefits Coverage Period: 01/01/2015-12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO This is only a summary.

WPE HDHP Uniform Benefits Coverage Period: 01/01/2015-12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO This is only a summary.

Cigna Health and Life Insurance Co.: HDHP Open Access Plus. IN ($3,500/$7,000) Summary of Benefits and Coverage: What this Plan Covers & What it Costs

Cigna Health and Life Insurance Co.: HDHP Open Access Plus Coverage Period: 07/01/2014-06/30/2015 IN ($3,500/$7,000) Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for:

Cigna Health and Life Insurance Co.: HDHP Open Access Plus Coverage Period: 07/01/2014-06/30/2015 IN ($3,500/$7,000) Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for:

What is the overall deductible? Are there other deductibles for specific services?

Cigna Health and Life Insurance Co.: Open Access Plus IN Coverage Period: 01/01/2016-12/31/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

Cigna Health and Life Insurance Co.: Open Access Plus IN Coverage Period: 01/01/2016-12/31/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

Kaiser Permanente California Service Center P.O. Box 23448 San Diego, CA 92193-3448

Kaiser Permanente California Service Center P.O. Box 23448 San Diego, CA 92193-3448 STRYKER CORPORATION Mary Frank 2825 AIRVIEW BOULEVARD --- KALAMAZOO, MI 49002-NA October 06, 2012 Please find enclosed

Kaiser Permanente California Service Center P.O. Box 23448 San Diego, CA 92193-3448 STRYKER CORPORATION Mary Frank 2825 AIRVIEW BOULEVARD --- KALAMAZOO, MI 49002-NA October 06, 2012 Please find enclosed

HMSA: Platinum HMO Coverage Period: 01/01/2016-12/31/2016 Summary of Benefits and Coverage: Coverage for: Plan Type: HMO This is only a summary.

HMSA: Platinum HMO Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2016-12/31/2016 Coverage for: Individual / Family Plan Type: HMO This is only a summary.

HMSA: Platinum HMO Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2016-12/31/2016 Coverage for: Individual / Family Plan Type: HMO This is only a summary.

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.consumersmutual.org or by calling 1-877-371-9112. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.consumersmutual.org or by calling 1-877-371-9112. Important

Important Questions Answers Why this Matters: $2,200 Does not apply to preventive care or amounts over the plan s allowable charge.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.cernerhealth.com or by calling 1-877-765-1033. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.cernerhealth.com or by calling 1-877-765-1033. Important

Blue Shield of CA Life & Health Insurance: Shield Spectrum PPO SM 250-70/50 Foundation Coverage Period: 1/1/2014-12/31/2014

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.blueshieldca.com or by calling 1-800-200-3242. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.blueshieldca.com or by calling 1-800-200-3242. Important

Nationwide Life Insurance Co.: Gold Plan Roger Williams University Coverage Period: 8/14/15-8/13/16

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.chpstudent.com or by calling 1-800-633-7867. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.chpstudent.com or by calling 1-800-633-7867. Important

PENDING REGULATORY APPROVAL. Coverage for: Individual Plan Type: HMO. Important Questions Answers Why this Matters: What is the overall deductible?

PENDING REGULATORY APPROVAL This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling

PENDING REGULATORY APPROVAL This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at sutterhealthplus.org or by calling

How To Know What Your Health Care Plan Costs

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbstx.com or by calling 1-800-521-2227. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bcbstx.com or by calling 1-800-521-2227. Important Questions

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

005. Independent Review Organization External Review Annual Report Form

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

: BlueCross Platinum P02S-AI1 Coverage Period: Beginning on or after 01/01/2014

: BlueCross Platinum P02S-AI1 Coverage Period: Beginning on or after 01/01/2014 Summary of Benefits & Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family Plan Type: PPO This

: BlueCross Platinum P02S-AI1 Coverage Period: Beginning on or after 01/01/2014 Summary of Benefits & Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family Plan Type: PPO This

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-800-447-8255. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-800-447-8255. Important

Gold $750/$10 Partner Network: UPMC Health Plan Coverage Period: 01/01/2015-12/31/2015 Summary of Coverage: What this Plan Covers & What it Costs

Gold $750/$10 Partner Network: UPMC Health Plan Coverage Period: 01/01/2015-12/31/2015 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type: EPO This is

Gold $750/$10 Partner Network: UPMC Health Plan Coverage Period: 01/01/2015-12/31/2015 Summary of Coverage: What this Plan Covers & What it Costs Coverage for: All coverage levels Plan Type: EPO This is

Companion Life Insurance Co.: Platinum Plan - St. Louis College of Pharmacy Coverage Period: 8/1/15 7/31/16

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.chpstudent.com or by calling 1-800-633-7867. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.chpstudent.com or by calling 1-800-633-7867. Important

Coventry Health Care of Illinois: Gold $10 Copay PPO Plan

Coventry Health Care of Illinois: Gold $10 Copay PPO Plan Coverage Period : 01/01/2014-12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary. If you

Coventry Health Care of Illinois: Gold $10 Copay PPO Plan Coverage Period : 01/01/2014-12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary. If you

Compass Rose Health Plan: High Option Coverage Period: 01/01/2015 12/31/2015

This is only a summary. Please read the FEHB Plan RI 72-007 that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth in the FEHB

This is only a summary. Please read the FEHB Plan RI 72-007 that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth in the FEHB

Northwest Hospital: Basic Plan Coverage Period: 01/01/2014 12/31/2014

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www. myfirstchoice.fchn.com or by calling 1-888-299-1051.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www. myfirstchoice.fchn.com or by calling 1-888-299-1051.

Coventry Health Care of Illinois: Silver $10 Copay Carelink St. John's

Coventry Health Care of Illinois: Silver $10 Copay Carelink St. John's Coverage Period : 01/01/2014-12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary.

Coventry Health Care of Illinois: Silver $10 Copay Carelink St. John's Coverage Period : 01/01/2014-12/31/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs This is only a summary.

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

: State Teachers Retirement System Medicare Coverage Period: 01/01/2015-12/31/2015

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.aultcare.com or by calling 330-363-6360 or 1-800-344-8858.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.aultcare.com or by calling 330-363-6360 or 1-800-344-8858.

Federal Employees Health Benefits Program: Standard Option Coverage Period: 01/01/2015-12/31/2015

This is only a summary. Please read the FEHB Plan brochure (RI 73-168) that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth

This is only a summary. Please read the FEHB Plan brochure (RI 73-168) that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth

Cigna Health and Life Insurance Co.: Open Access Plus IN- Basic Plan Summary of Benefits and Coverage: What this Plan Covers & What it Costs

Cigna Health and Life Insurance Co.: Open Access Plus IN- Coverage Period: 01/01/2016-12/31/2016 Basic Plan Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

Cigna Health and Life Insurance Co.: Open Access Plus IN- Coverage Period: 01/01/2016-12/31/2016 Basic Plan Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

What is the overall deductible? is the only person covered under the plan.

Cigna Health and Life Insurance Co.: Open Access Plus Coverage Period: 01/01/2015-12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

Cigna Health and Life Insurance Co.: Open Access Plus Coverage Period: 01/01/2015-12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

Cigna Health and Life Insurance Co.: Choice Fund Open. Access Plus HSA Summary of Benefits and Coverage: What this Plan Covers & What it Costs

Cigna Health and Life Insurance Co.: Choice Fund Open Coverage Period: 08/01/2015-07/31/2016 Access Plus HSA Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

Cigna Health and Life Insurance Co.: Choice Fund Open Coverage Period: 08/01/2015-07/31/2016 Access Plus HSA Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Individual

What is the overall deductible?

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at http://www.aetnastudenthealth.com/uva or by calling 1-800-466-3027.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at http://www.aetnastudenthealth.com/uva or by calling 1-800-466-3027.

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

DC37 Med Team PPO Plan Retirees

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-877-842-3625. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.emblemhealth.com or by calling 1-877-842-3625. Important

BlueSelect 1449. No. Even though you pay these expenses, they don t count toward the out-of-pocket limit.

BlueSelect 1449 Coverage Period: 01/01/2015-12/31/2015 Everyday Health Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual and/or Family Plan Type: PPO/EPO

BlueSelect 1449 Coverage Period: 01/01/2015-12/31/2015 Everyday Health Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual and/or Family Plan Type: PPO/EPO

Aetna Open Access Managed Choice - HDHP 3000

Important Questions Answers Why this Matters: What is the overall For each Calendar Year, In-network: You must pay all the costs up to the deductible amount before this plan deductible? Individual $3,000

Important Questions Answers Why this Matters: What is the overall For each Calendar Year, In-network: You must pay all the costs up to the deductible amount before this plan deductible? Individual $3,000

: SimplyBlue GI - T1 without Maternity - S Coverage Period: Beginning on or after 07/01/2014

: SimplyBlue GI - T1 without Maternity - S Coverage Period: Beginning on or after 07/01/2014 Summary of Benefits & Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family Plan

: SimplyBlue GI - T1 without Maternity - S Coverage Period: Beginning on or after 07/01/2014 Summary of Benefits & Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family Plan

2015 Summaries of Medical Benefits and Coverage Glossary of Health Coverage and Medical Terms

2015 Summaries of Medical Benefits and Coverage Glossary of Health Coverage and Medical Terms University of Chicago Colleagues: The University of Chicago is required under Health Care Reform to provide

2015 Summaries of Medical Benefits and Coverage Glossary of Health Coverage and Medical Terms University of Chicago Colleagues: The University of Chicago is required under Health Care Reform to provide

Highmark Blue Cross Blue Shield: PPOBlue Coverage Period: 08/01/2013-07/31/2014

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.highmarkbcbs.com or by calling 1-800-241-5704. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.highmarkbcbs.com or by calling 1-800-241-5704. Important

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan Type: HMO. meet the deductible.

Kaiser Permanente: KP GA Bronze 6000/40%/HSA Coverage Period: Beginning on or after 01/01/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan

Kaiser Permanente: KP GA Bronze 6000/40%/HSA Coverage Period: Beginning on or after 01/01/2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual/Family Plan

Excellus BCBS:Excellus BluePPO

Excellus BCBS:Excellus BluePPO A nonprofit independent licensee of the Blue Cross Blue Shield Association Summary of Benefits and Coverage: What this Plan Covers & What it Costs COLGATE UNIVERSITY Coverage

Excellus BCBS:Excellus BluePPO A nonprofit independent licensee of the Blue Cross Blue Shield Association Summary of Benefits and Coverage: What this Plan Covers & What it Costs COLGATE UNIVERSITY Coverage