Health Insurance SMART NC

|

|

|

- Patrick Daniel

- 8 years ago

- Views:

Transcription

1 Health Insurance SMART NC ANNUAL REPORT ON EXTERNAL REVIEW ACTIVITY 202 North Carolina Department of Insurance Wayne Goodwin, Commissioner

2

3 A REPORT ON EXTERNAL REVIEW REQUESTS IN NORTH CAROLINA Health Insurance Smart NC North Carolina Department of Insurance Dobbs Building 430 North Salisbury Street Raleigh, N.C Questions about the report should be directed to: Susan D. Nestor, RN, MSN Director Health Insurance Smart NC Telephone: (99) Fax Number: (99) E Mail: susan.nestor@ncdoi.gov All reports on external review are available on the N. C. Department of Insurance web site at:

4

5 EXECUTIVE SUMMARY... I INTRODUCTION... EXTERNAL REVIEW... 2 ELIGIBILITY... 2 FIGURE : DISPOSITION OF EXTERNAL REVIEW REQUESTS RECEIVED IN FIGURE 2: REASONS FOR NON ACCEPTANCE OF AN EXTERNAL REVIEW REQUEST IN OUTCOMES... 3 FIGURE 3: OUTCOMES OF CASES ACCEPTED FOR EXTERNAL REVIEW BY REQUEST TYPE IN ACTIVITY BY TYPE OF SERVICE REQUESTED... 4 FIGURE 4: ACCEPTED CASES BY TYPE OF SERVICE REQUESTED IN TABLE : PERCENTAGE OF OUTCOMES BY TYPE OF SERVICE REQUESTED IN TABLE 2: OUTCOMES OF ACCEPTED EXTERNAL REVIEW REQUESTS BY SERVICE TYPE AND... 7 NATURE OF DENIAL IN TABLE 3: OUTCOMES OF ALL REQUESTS BY GENERAL SERVICE TYPE AND REVIEW TYPE IN HEALTH PLAN OVERSIGHT... 8 EXTERNAL REVIEW ACTIVITY BY HEALTH PLAN AND TYPE OF SERVICE... 9 FIGURE 5: HEALTH PLANS SHARE OF ACCEPTED EXTERNAL REVIEW REQUESTS IN TABLE 4: ACCEPTED CASE ACTIVITY BY HEALTH PLAN AND TYPE OF SERVICE REQUESTED IN TABLE 4: ACCEPTED CASE ACTIVITY BY HEALTH PLAN AND TYPE OF SERVICE REQUESTED IN 202 (CONT.)... 2 IRO OVERSIGHT... 2 EXTERNAL REVIEW ACTIVITY BY IRO... 3 TABLE 5: IRO ACTIVITY SUMMARY FOR IRO DECISIONS BY TYPE OF SERVICE REQUESTED AND HEALTH PLAN... 4 TABLE 6: ACCEPTED CASE ACTIVITY BY IRO AND TYPE OF SERVICE REQUESTED IN TABLE 7: IRO DECISIONS BY HEALTH PLAN IN CAPTURED COSTS ON OVERTURNED OR REVERSED SERVICES... 7 FIGURE 6: YEARLY AND CUMULATIVE VALUE OF ALLOWED CHARGES FOR OVERTURNED OR REVERSED SERVICES... 7 COST OF EXTERNAL REVIEW CASES FOR TABLE 8: COST OF IRO REVIEW, AVERAGE AND CUMULATIVE ALLOWED CHARGES BY TYPE OF SERVICE REQUESTED... 8 HCR PROGRAM EVALUATION... 9 CONCLUSION... 9

6 Executive Summary Health Insurance Smart NC (Smart NC), a division of the North Carolina Department of Insurance (Department), administers the state s Health Benefit Plan External Review law, which was enacted in External review is the independent medical review of a health plan denial and offers another option for resolving coverage disputes between a covered person and their health plan. Requests for external review are made directly to the Department and screened for eligibility by HCR Program staff, but the actual medical reviews are conducted by independent review organizations (IROs) that are contracted with the Department. There is no charge to the consumer for requesting an external review. In 202, 26 individuals requested an external review and 44 cases were accepted. Of those accepted, 30 cases were processed on a standard basis and 4 cases were processed on an expedited basis. Overall, outcomes of accepted cases were decided in favor of the consumer 39.6 percent of the time. Smart NC captures the cost of allowed charges for overturned or reversed services each year, as well as the cumulative charges for these services. In 202, the average cost of allowed charges from all cases that were reversed by the health plan or overturned by an IRO was $0, with a cumulative total for the year of $483,887.8, not including the costs of cases yet to be captured due to the prospective nature of the services. Since July, 2002, the cumulative total of services provided to consumers as a result of external review is $5,4,29.3. Smart NC continues to utilize a consumer satisfaction survey with all accepted cases in order to obtain feedback from consumers regarding their external review experience. Overall, responders were generally pleased with the customer service they receive while contacting Smart NC. Consumers reported satisfaction with Smart NC staff and information about the external review process. Most individuals responding to the survey who went through the external review process stated they would tell a friend about external review, suggesting that external review is viewed to be a valued and important consumer protection. i

7 Introduction North Carolina s external review law (N. C. Gen. Stat through 95) provides for the independent medical review of a health plan noncertification, and offers another option for resolving coverage disputes between the covered person and their insurer. A noncertification is a decision made by a health plan that a requested service or treatment is not medically necessary, cosmetic or experimental for the person s condition. Ten years into operation, North Carolina s Health Insurance Smart NC (Smart NC) continues to provide North Carolinians with the opportunity to request an independent review of their health plan s noncertification if appeals made directly to the health plan have failed to win coverage. In North Carolina, external review is available to persons covered under a fully insured health plan, the North Carolina State Health Plan Preferred Provider Organization plan (North Carolina SHP PPO Plan), and the North Carolina High Risk Pool (Inclusive Health). For a request to be accepted for external review, the covered person must meet eligibility requirements. Requests for external review are made directly to Smart NC and each case is reviewed for completeness and eligibility. If accepted for external review, the case is assigned to an independent review organization (IRO) for clinical review and final decision. The Smart NC staff utilizes nurses with broad clinical, health plan and utilization review experiences to process external review requests. Smart NC contracts with two Board certified physicians to provide on call case evaluations of expedited external review requests. The scope of these evaluations is limited to determining whether a request warrants an expedited handling of the review. The consulting physician is available to consult with Program staff and review consumer requests for expedited review at all times. Smart NC also contracts with IROs to perform the independent medical review of external review cases. IROs are subject to many statutory requirements regarding the organization s structure and operations, the reviewers that they use, and their handling of individual cases. Smart NC engages in a variety of activities to provide appropriate monitoring, ensuring compliance with statutory and contract requirements. This report, which is required under N. C. Gen. Stat , is intended to provide a summary of the external review activities for the calendar year of 202, as it relates to the nature and outcomes of the requests accepted for review, the health plans whose decisions are subject to review, and the IROs whose performance of the reviews are essential to Smart NC s successful operations. Cumulative analysis is provided for the captured costs relating to the services that have been overturned or reversed as a result of external review services to demonstrate the ongoing value that is provided to North Carolina citizens.

8 External Review Smart NC staff receives requests for external review from consumers or their authorized representative. In most cases, external review is available only after all appeals made directly to a health plan have failed to secure coverage. Upon receipt, requests are reviewed to determine eligibility and completeness. Cases accepted for review are assigned to an IRO. The IROs assign clinical experts to review each case, issuing a determination as to whether a health plan s denial should be upheld or overturned. Decisions are required to be made within 45 days of the request for a standard review. Cases accepted for expedited review require a decision to be rendered within four business days of the request. Eligibility During 202, Smart NC received 283 requests for external review. Of these requests, 22 involved a re submission of a previously incomplete request by the same individual. Therefore, 26 individuals requested external review. Figure shows the disposition of requests for external review made to the Program during 202. During this time, 55.2 percent of the requests received by Smart NC were determined to be eligible and were comprised of both standard and expedited requests. Figure : Disposition of External Review Requests Received in 202 Expedited: Not Accepted (33) 2.6% Standard: Not Accepted (84) 32.2% Standard: Accepted (30) 49.8% Expedited: Accepted (4) 5.4% The reason why a case would not be accepted falls into any number of specific categories. Generally, however, a request may be deemed ineligible if the request does not meet the 2

9 statutory requirements for eligibility or if the plan itself does not fall under North Carolina regulatory authority. Figure 2 shows the number of cases that were not accepted for review and the reasons for which they were not accepted for the year 202. During this time, of the 7 requests that were deemed to be not eligible, consumers who were not eligible because they were covered under a self funded employer plan made up the largest group of ineligible requests with 26 cases not accepted. Requests from consumers who had not yet exhausted the insurer s internal appeal process were the second largest group with 22 cases not accepted. Requests that involved consumers who had submitted requests that were not related to medical necessity made up the third greatest number of ineligible requests with 4 cases. These three reasons made up 52.9 percent of the cases not accepted for review. Figure 2: Reasons for Non Acceptance of an External Review Request in Expedited Criteria Not Met Insurance Type Not Subject to Law 0.9% 0.9% Missed 20 Day Time Frame for Request 4.3% No Authority to Make Request.7% No Denial Issued 4.3% No Medical Necessity Determination.9% No State Jurisdiction 6.0% Not a Benefit 3.4% Not Exhausted Internal Appeal Process 8.8% Request Incomplete, No Resubmission Request Withdrawn 2.8% 2.8% Self funded Employer Plan 22.2% Outcomes In 202, 44 cases were accepted for external review. Of those accepted, 30 were accepted to be processed on a standard basis. Fourteen cases throughout the year were processed on an expedited basis. Figure 3 shows the outcomes of all cases that were accepted for review during the year 202. Overall in 202, cases that were accepted for external review were decided in favor of the consumer 39.6 percent of the time. 3

10 Figure 3: Outcomes of Cases Accepted for External Review by Request Type in 202 Expedited: Upheld (8) 5.6% Expedited: Overturned (6) 4.2% Standard: Overturned (50) 34.7% Standard: Reversed by Insurer () 0.7% Standard: Upheld (79) 54.8% Activity by Type of Service Requested Smart NC classifies accepted cases into general service categories. Figure 4 shows the number of accepted cases for each general service category for 202. With 29 accepted cases, Oncology services had the largest number cases representing 20. percent of the cases. Surgical Services, representing a variety of different types of surgery, comprised 8. percent of the requests accepted in 202 with 26 cases and Durable Medical Equipment was the third largest number of requests with 25 requests, representing 7.4 percent each of the requests. All together, these three general service types made up over 50 percent of the accepted requests. 4

11 Figure 4: Accepted Cases by Type of Service Requested in Durable Medical Equipment Emergency Treatment Hospital Length of Stay Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Rehabilitation Services Skilled Nursing Services Surgical Services 0.7% 0.7%.4% 0.7% 8.3% 7.6% 0.4% 4.6% 7.4% 8.% 20.% Although Smart NC reports primarily on the basis of the general types of services under dispute, data on specific service types relating to the request is also kept by the Program to analyze activity and identify trends. Information regarding the specific service types is available upon request to Smart NC. Table shows the percentage of outcomes for all accepted cases by general service type as well as the percentage share of total outcomes for all services for 202. Oncology, the largest category of requests, was decided in favor of the consumer only 3 percent of the time. Requests involving Surgical Services were decided in favor of the consumer 46.2 percent of the time. Requests made for Durable Medical Equipment services had outcomes that favored the consumer 40 percent of the time. All requests made to Smart NC were overturned in favor of the consumer or reversed by the insurer 39.6 percent of the time. 5

12 Table : of Outcomes by Type of Service Requested in 202 Type of Service Overturned Reversed Upheld Durable Medical Equipment Emergency Services Hospital Length of Stay Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Rehabilitation Services Skilled Nursing Services Surgical Services of Outcomes for all Cases Because of the types of services that are denied and the basis upon which the noncertification is issued, it is important to differentiate between a denial based solely on medical necessity and other types of noncertification decisions (i.e., experimental/investigational or cosmetic). For example, a health plan may base its denial decision only on the medical necessity of the procedure, evaluating whether the procedure meets its guidelines for appropriateness for the covered person s condition. However, noncertifications may also include any situation where the health plan makes a decision about the covered person s condition to determine whether a requested treatment is experimental, investigational or cosmetic, and the extent of coverage is affected by that decision. Table 2 further analyzes the breakdown of case outcomes from decisions rendered by IROs as they relate to the service type and the nature of the noncertification for the year

13 Table 2: Outcomes of Accepted External Review Requests by Service Type and Nature of Denial in 202 Service Type Overturned/ Reversed Medical Necessity Upheld Experimental / Investigational Overturned/ Reversed Upheld Overturned/ Reversed Cosmetic Services Durable Medical Equipment Emergency Services Hospital Length of Stay Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Rehabilitation Services Skilled Nursing Facility Upheld Surgical Services of Outcomes 54.4% 34.5% 42.% 64.4% 3.5%.% of All Cases: 42.3% 55.6% 2.% In 202, 42.3 percent of the cases decided by IROs involved the medical necessity of the procedure. The remainder of the cases primarily involved whether the service was considered to be experimental or investigational for the patient s condition, with 55.6 percent of the cases decided on the experimental or investigational nature of the treatment and only 2. percent decided on whether the services were considered to be cosmetic. These percentages are similar to previous years. All of the general service types involved a medical necessity determination by the insurer. Cases involving Surgical Services (5) and Inpatient Mental Health (2) represented the categories with the most number of cases decided on the merits of medical necessity. Cases involving a determination by the insurer that the service is experimental or investigational did not involve Emergency Services, Hospital Length of Stay, Inpatient Mental Health, Rehabilitation Services and Skilled Nursing Facility. Oncology (25) and Durable Medical Equipment (20), involved the highest number of cases with an experimental denial. Lab, Imaging, Testing had 7 cases that were denied for experimental or investigational reasons. There were only three cases in 202 that were denied due to the insurer s decision that the service was cosmetic in nature and they all involved Surgical Services. In 202, the majority of cases that were accepted for review were those that were requested on a standard basis, with 90.3% of all cases falling into this 45 day time frame for processing cases. 7

14 Table 3 shows the outcomes of cases by the general type of service by type of review requested. The largest number of expedited cases fell into the general service type categories of Oncology, with 6 cases and Surgical Services case types having the second largest number at four. Standard cases involved all general service category types. Table 3: Outcomes of all Requests by General Service Type and Review Type in 202 Service Type Overturned/ Reversed Standard Review Upheld Overturned/ Reversed Expedited Review Durable Medical Equipment Emergency Services Hospital Length of Stay Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services 4 0 Rehabilitation Services 0 0 Skilled Nursing Facility Surgical Services 0 3 of Case Volume 90.3% 9.7% Upheld Health Plan Oversight The external review laws place several requirements on health plans. Health plans are required to provide notice of external review rights to covered persons in their noncertification decisions and notices of decision on appeals and grievances. Health plans are also required to include a description of external review rights and external review process in their certificate of coverage or policy language. When Smart NC receives a request for external review, the health plan is required to provide requested information to the Program within statutory time frames, so that an eligibility determination can be made. When a case is accepted for review, the health plan is required to provide information to the IRO assigned to the case and a copy of that same information to the covered person or the covered person s representative. The health plan is required to send the information to the covered person or the covered person s representative by the same time and same means as was sent to the IRO. When a case is decided in favor of the covered person, the health plan must provide notification that payment or coverage will be provided. This notice must be sent to the covered person and 8

15 their provider, as well as the Program, and is required to be sent within three business days in the case of a standard review decision and one calendar day in the case of an expedited review decision. The Program then monitors the payment status of the claims. Additionally, Smart NC acts as the liaison between health plans and IROs for invoicing and payment of IRO services. As set forth in N. C. Gen. Stat , the health plan whose denial decision is the subject of the review provides payment to the IRO for conducting the external review to the Department. This may include a cancellation fee for work performed by the IRO for a case that was terminated prior to the health plan notifying the organization of the reversal of its own noncertification decision, or when a review is terminated because the health plan failed to provide information to the review organization. As the entity that is contracted with the IROs, it is the responsibility of the Department to insure that IROs are paid in a timely manner for their services. Weekly auditing of health plan compliance with payment for IRO services is conducted by the Program. The Program s experience to date has been that health plans are compliant with the handling of external review cases and are meeting their statutory obligations with respect to deadlines and payment notifications. External Review Activity by Health Plan and Type of Service Of the 44 cases that were accepted for external review in 202, cases originating from Blue Cross Blue Shield of North Carolina (60), the North Carolina SHP PPO Plan (6) comprised 84 percent of the external review activity. Eleven other health plans made up the remaining 6 percent of cases. Of these remaining health plans, only United Healthcare Insurance Company had more than three cases with nine cases accepted for external review. The volumes of cases for insurers and health plans are consistent with the numbers of accepted cases that the larger plans have had in past years. The percentage share of health plan activity for 202 is depicted in Figure 5. 9

16 Figure 5: Health Plans Share of Accepted External Review Requests in 202 Aetna Life Insurance Company 0.7% Blue Cross & Blue Shield of North Carolina 4.7% Connecticut General Insurance Company 0.7% Coventry Health and Life Insurance Company.4% UnitedHealthcare Insurance Company 6.% Trustmark Insurance Company 2.% Principal Life Insurance Company 0.7% North Carolina State Health Plan PPO 42.4% North Carolina Dental Society (MEWA).4% Federated Mutural Insurance Company 0.7% FirstCarolinaCare Insurance Company, Inc. 0.7% Inclusive Health (Federal) 0.7% National Union Fire Insurance Company of Philadelphia, PA 0.7% Table 4 demonstrates the outcomes of external review activity by the health plan whose decision is subject to review and the general type of service that the denial involved. This data is presented for informational purposes only. The number of requests per health plan is too small to draw any conclusions or identify trends as it relates to the health plan and the type of service that was denied. Blue Cross & Blue Shield of North Carolina s decisions were decided in favor of the consumer by IROs 30.3 percent of the time with 27 cases overturned by an IRO. The North Carolina SHP PPO Plan s decisions were decided in favor of the consumer by IROs 34.4 percent of the time and United Healthcare Insurance Company s cases were decided in favor of the consumer 55.6 percent of the time. Because an IRO is not involved in the outcome decision when a health plan reverses their own denial, this table only includes those 43 cases that were decided by an IRO. 0

17 Table 4: Accepted Case Activity by Health Plan and Type of Service Requested in 202 Health Plan and Type of Service Number of Requests Overturned Upheld Aetna Life Insurance Company Lab, Imaging, Testing Total for Health Plan Blue Cross Blue Shield of North Carolina 60 Durable Medical Equipment Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Surgical Services Total for Health Plan Connecticut General Insurance Company Lab, Imaging, Testing Total for Health Plan Coventry Health and Life Insurance 2 Company Emergency Treatment Inpatient Mental Health Total for Health Plan FirstCarolinaCareInsurance Company, Inc. Inpatient Mental Health Total for Health Plan Inclusive Health (Federal) Oncology Total for Health Plan National Union Fire insurance Company of Pittsburgh, PA. Surgical Services Total for Health Plan North Carolina Dental Society (MEWA) 2 Inpatient Mental Health Rehabilitative Services Total for Health Plan

18 Table 4: Accepted Case Activity by Health plan and Type of Service Requested in 202 (Cont.) Number Health Plan and Type of Service of Requests North Carolina State Health Plan PPO 6 Durable Medical Equipment Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Skilled Nursing Services Surgical Services Overturned Upheld Total for Health Plan Principal Life Insurance Company Hospital Length of Stay Total for Health Plan Trustmark Insurance Company 3 Lab, Imaging, Testing Oncology Physician Services Total for Health Plan United Healthcare Insurance Company 9 Durable Medical Equipment Lab, Imaging, Testing 2 Oncology Pharmacy 2 Physician Services Rehabilitative Services Surgical Services Total for Health Plan IRO Oversight The Program currently contracts with three IROs Maximus, Inc., Medwork of Wisconsin, Inc., and Michigan Peer Review Organization (MPRO). A contract with National Medical Review, Inc. (NMR) expired on June 30, 202 so this report will reflect decisions rendered by NMR prior to the expiration date of that contract. All IROs that are contracted with the Program to provide independent external reviews are companies that were determined via the solicitation and evaluation process, to meet the minimum qualifications set forth in N. C. Gen. Stat and have agreed to contractual terms and written requirements regarding the procedures for handling an external review. IROs are contracted to perform an independent medical review of contested health plan noncertifications. Specifically, the scope of service for the IRO is to: 2

19 Accept assignment of cases from a wide variety of health plans without the presence of conflict of interest. Identify the relevant clinical issues of the case and the question to be asked of the expert clinical peer reviewer. Identify and assign an appropriate expert clinical peer reviewer who is free from conflict and who meets the minimum qualifications of a clinical peer reviewer, to review the disputed case and render a decision regarding the appropriateness of the denial for the requested treatment of service. Issue determinations that are timely and complete, as defined in the statutory requirements for standard and expedited review. Notify all required parties of the decision made by the expert clinical reviewer. Provide timely and accurate updates regarding their business relationships, as requested by the Department. Smart NC is responsible for monitoring IRO compliance with statutory requirements on a continual basis. Smart NC staff screens each IRO case assignment to assure that no material conflict of interest exists between any person or organization associated with the IRO and any person or organization associated with the case. When a case is assigned to an IRO for a determination, the IRO must render a decision within the time frames mandated under North Carolina law. For a standard review, the decision must be rendered by the 45 th calendar day following the date of Smart NC s receipt of the request. For an expedited request, the IRO has until the 4 th business day following Smart NC s receipt of the request. Smart NC audits all IRO decisions for compliance with requirements pertaining to the time frame for issuing a decision and for the content of written notice of determinations. All decisions have been rendered within the required time frames. External Review Activity by IRO Although 44 cases were accepted for external review during this period, one case was reversed by the health plan prior to an IRO decision being rendered, so reporting on IRO activity will represent only those 43 cases actually reviewed by an IRO. Table 5 compares the number of cases assigned to each IRO that held a contract with Smart NC throughout the year, with the percentage of their review decisions for the year 202. The outcome of cases reviewed by IROs was decided in favor of the consumer 39.2 percent of the time during

20 Table 5: IRO Activity Summary for 202 IRO Number Assigned Overturned Upheld Maximus, Inc Medwork of Wisconsin, Inc MPRO NMR, Inc Total and of Outcomes for All Cases IRO Decisions by Type of Service Requested and Health Plan During 202, four IROs rendered 43 external review decisions for consumers: Maximus, Inc., Medwork of Wisconsin, Inc., MPRO, and NMR. External review cases are not assigned to an IRO if the IRO has a conflict of interest involving the health plan whose decision is the subject of the review or if the IRO does not have an appropriate reviewer available to whom they would assign the case. Table 6 breaks down the number of cases involving the general service type that each IRO reviewed for the calendar year 202. This table only gives an accounting of the cases assigned and does not analyze outcomes by virtue of the type of noncertification issued. This data is presented as informational only as the overall number of cases does not allow for trends to be identified or assumptions to be made. 4

21 Table 6: Accepted Case Activity by IRO and Type of Service Requested in 202 IRO and Type of Service Number of Accepted Cases Maximus, Inc. 4 Durable Medical Equipment Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Rehabilitation Services Surgical Services Overturned Upheld All Services: Medwork of Wisconsin, Inc. 43 Durable Medical Equipment Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Rehabilitative Services Surgical Services All Services: MPRO 40 Durable Medical Equipment Hospital Length of Stay Inpatient Mental Health Lab, Imaging, Testing Oncology Pharmacy Physician Services Skilled Nursing Services Surgical Services All Services: NMR 9 Durable Medical Equipment Emergency Services Inpatient Mental Health Lab, Imaging, Testing Oncology Physician Services Surgical Services All Services:

22 Table 7 shows each IRO s decisions by health plan for the year 202. The total number of cases for any IRO, and the number of assigned cases by health plan that were reviewed by an IRO is still too small to identify trends or make any evaluative statements. Table 7: IRO Decisions by Health plan in 202 IRO and Health plan Number of Decisions Overturned Upheld Maximus, Inc. 4 Blue Cross & Blue Shield of North Carolina Inclusive Health (Federal) North Carolina State Health Plan PPO Trustmark Insurance Company UnitedHealthcare of North Carolina, Inc All Health plans: Medwork of Wisconsin, Inc. 43 Blue Cross & Blue Shield of North Carolina National Union Fire Insurance Company of Pittsburgh, PA North Carolina Dental Society (MEWA) North Carolina SHP PPO United Healthcare Insurance Company All Health plans: MPRO 40 Aetna Life Insurance Company Blue Cross Blue Shield of North Carolina 5 Connecticut General Life Insurance Company FirstCarolinaCare Insurance Company, Inc. North Carolina SHP PPO 8 Principal Life Insurance Company Trustmark Insurance Company United Healthcare Insurance Company All Health plans: NMR, Inc. 9 Blue Cross & Blue Shield of North Carolina Coventry Health and Life Insurance Company North Carolina SHP PPO Trustmark Insurance Company All Health plans:

23 Captured Costs on Overturned or Reversed Services Figure 6 shows the total of the allowed charges for overturned or reversed services that Smart NC captured each year, as well as the cumulative total of allowed charges for these services. In 202, consumers received $483,887 worth of services that otherwise would have been denied but for the Program s assistance. While this amount alone may reflect the value that Smart NC brings to consumers, the data presented in its cumulative form shows that North Carolina consumers have been provided $5.4 million worth of services since the Program began and demonstrates the ongoing value that the Program provides. This chart is reflective of the concurrent and retrospective costs for services that were denied. It does not account for cases from 202 that have been overturned but the claims have not yet been captured due to the prospective nature of the services. Figure 6: Yearly and Cumulative Value of Allowed Charges for Overturned or Reversed Services $5,4, $4,366, $4,927, $3,06, $3,326, $2,296,476.6 $2,652, $,827,798.6 $,050, $468, $593, $353, $355, $,039,844.3 $265, $483, $697, $776,96.56 $409, $554, Cumulative Amount of Recovered Benefits Annual Amount of Recovered Benefits The total cost of services for each year may have changed with this report as a result of capturing the cost of previously overturned services that were completed during this past year. The average cost of allowed charges per year from all cases that have been reversed by the health plan or overturned by an IRO since the Program began is $49,935. 7

24 Cost of External Review Cases for 202 Table 8 shows the average cost of the IRO review and cost of allowed charges for cases that were reversed by the health plan or overturned (average and cumulative) in 202, by type of service requested. The totals include the IRO charges for all 43 cases decided by an IRO, but the average and cumulative figures do not include the costs associated with outstanding cases whose costs have yet to be captured due to the prospective nature of the service. Table 8: Cost of IRO Review, Average and Cumulative Allowed Charges By Type of Service Requested Type of Service Average Cost of IRO Review Average Cost of Service Cumulative Cost of Service Durable Medical Equipment $ $5, $ 36, Emergency Services Hospital Length of Stay , , Inpatient Mental Health , , Lab, Imaging, Testing , , Oncology ,38.6 2,08.90 Pharmacy , , Physician Services , ,29.05 Rehabilitation Services ,8.43 Skilled Nursing Facility Surgical Services , , Total for All Cases $ $0, $483,887.8 The contracted fees for IRO services that are reflected in this annual report are between $525 and $690 for a standard review, and $825 and $895 for an expedited review. These fees are fixed per case fees bid by each IRO; they do not vary by the type of service that is covered. The average cost to health plans for the 43 reviews performed during 202 was $609. An IRO may charge a health plan a cancellation fee if the health plan reverses its own decision after the IRO has proceeded with the review. These charges range from $50 to $395 for a standard review and $205 to $395 for an expedited review. 8

25 HCR Program Evaluation Smart NC continues to utilize its consumer satisfaction survey with all accepted cases in order to obtain feedback from consumers regarding the external review experience. A consumer satisfaction survey is mailed to the consumer or authorized representative at the completion of each accepted case. Overall, responders were generally pleased with the customer service they receive while contacting Smart NC. Consumers reported satisfaction with Smart NC staff and information about the external review process. Survey results also showed that most individuals responding to the survey who went through the external review process stated they would tell a friend about external review, suggesting that external review is viewed to be a valued and important consumer protection. Conclusion Since the Program s inception over ten years ago, consumers and authorized representatives acting on behalf of consumers have availed themselves of external review services. Feedback we receive from consumers and providers is positive regarding their external review experience. The Department believes that public faith in the integrity of the external review process is absolutely essential; the very foundation of an external review is to provide an unbiased way to resolve coverage disputes between a covered person and their health plan. While not all consumers receive the outcome they hoped for, their feedback regarding the external review process remains favorable. External review remains an important resource for North Carolina consumers and has provided measurable value to the lives of North Carolinians. To date, these services have resulted in consumers obtaining over $5.4 million worth of services that had been denied by their health plan. Smart NC will continue to track external review results and trends. The Department and Smart NC staff will also continue to monitor developments on the state and federal level which could impact patient protections in North Carolina. The Department is committed to assuring that consumers are informed and are able to access the critical protections that North Carolina s external review law provides. 9

HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

Appeals Provider Manual 15

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

Table of Contents Overview... 15.1 Commercial Member appeals... 15.1 Self-insured groups... 15.1 Traditional/CMM Members... 15.1 Who may appeal... 15.1 How to file an internal appeal on behalf of the Member...

Certain exceptions apply to Hospital Inpatient Confinement for childbirth as described below.

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

Tennessee Applicable Policies PRECERTIFICATION Benefits payable for Hospital Inpatient Confinement Charges and confinement charges for services provided in an inpatient confinement facility will be reduced

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

Medical and Rx Claims Procedures

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures.

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

CHAPTER 59A-23 WORKERS COMPENSATION MANAGED CARE ARRANGEMENTS 59A-23.001 Scope. 59A-23.002 Definitions. 59A-23.003 Authorization Procedures. 59A-23.004 Quality Assurance. 59A-23.005 Medical Records and

OUTLINE OF MEDICARE SUPPLEMENT COVERAGE BENEFIT CHART OF MEDICARE SUPPLEMENT PLANS SOLD FOR EFFECTIVE DATES ON OR AFTER JUNE 1, 2010

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

ADMINISTRATIVE POLICY TIMEFRAME STANDARDS FOR UTILIZATION MANAGEMENT (UM) INITIAL DECISIONS Policy Number: ADMINISTRATIVE 088.15 T0 Effective Date: November 1, 2015 Table of Contents APPLICABLE LINES OF

005. Independent Review Organization External Review Annual Report Form

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

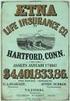

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

EXTERNAL REVIEW CONSUMER GUIDE

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

Exhibit 2.9 Utilization Management Program

Exhibit 2.9 Utilization Management Program Access HealthSource, Inc. Utilization Management Company is licensed as a Utilization Review Agent with the Texas Department of Insurance. The Access HealthSource,

Exhibit 2.9 Utilization Management Program Access HealthSource, Inc. Utilization Management Company is licensed as a Utilization Review Agent with the Texas Department of Insurance. The Access HealthSource,

Utilization Review Determinations Timeframe

Utilization Review s Timeframe The purpose of this chart is to reference utilization review determination timeframes. It is not meant to completely outline the UR process. See Policy: Prospective, Concurrent,

Utilization Review s Timeframe The purpose of this chart is to reference utilization review determination timeframes. It is not meant to completely outline the UR process. See Policy: Prospective, Concurrent,

VI. Appeals, Complaints & Grievances

A. Definition of Terms In compliance with State requirements, ValueOptions defines the following terms related to Enrollee or Provider concerns with the NorthSTAR program: Administrative Denial: A denial

A. Definition of Terms In compliance with State requirements, ValueOptions defines the following terms related to Enrollee or Provider concerns with the NorthSTAR program: Administrative Denial: A denial

Private Review Agent Application for Certification

2/3/16 Private Review Agent Application for Certification The items listed below may paraphrase the law or regulation. The checklist is not required to be included with the application. It should be used

2/3/16 Private Review Agent Application for Certification The items listed below may paraphrase the law or regulation. The checklist is not required to be included with the application. It should be used

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 2009 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO.

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

LEGISLATURE OF THE STATE OF IDAHO Sixtieth Legislature First Regular Session 0 IN THE HOUSE OF REPRESENTATIVES HOUSE BILL NO. BY BUSINESS COMMITTEE 0 AN ACT RELATING TO HEALTH INSURANCE; AMENDING TITLE,

Services Available to Members Complaints & Appeals

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

What Happens When Your Health Insurance Carrier Says NO

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

AGENCY FOR HEALTH CARE ADMINISTRATION HEALTH QUALITY ASSURANCE BUREAU OF MANAGED HEALTH CARE 2727 Mahan Drive Tallahassee Florida 32308

AGENCY FOR HEALTH CARE ADMINISTRATION HEALTH QUALITY ASSURANCE BUREAU OF MANAGED HEALTH CARE 2727 Mahan Drive Tallahassee Florida 32308 WORKERS COMPENSATION MANAGED CARE ARRANGEMENT SURVEY REPORT NAME

AGENCY FOR HEALTH CARE ADMINISTRATION HEALTH QUALITY ASSURANCE BUREAU OF MANAGED HEALTH CARE 2727 Mahan Drive Tallahassee Florida 32308 WORKERS COMPENSATION MANAGED CARE ARRANGEMENT SURVEY REPORT NAME

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

RULES AND REGULATIONS FOR UTILIZATION REVIEW IN ARKANSAS ARKANSAS DEPARTMENT OF HEALTH

RULES AND REGULATIONS FOR UTILIZATION REVIEW IN ARKANSAS 2003 ARKANSAS DEPARTMENT OF HEALTH TABLE OF CONTENTS SECTION 1 Authority and Purpose.. 1 SECTION 2 Definitions...2 SECTION 3 Private Review Agents

RULES AND REGULATIONS FOR UTILIZATION REVIEW IN ARKANSAS 2003 ARKANSAS DEPARTMENT OF HEALTH TABLE OF CONTENTS SECTION 1 Authority and Purpose.. 1 SECTION 2 Definitions...2 SECTION 3 Private Review Agents

9. Claims and Appeals Procedure

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

9. Claims and Appeals Procedure Complaints, Expedited Appeals and Grievances Under Empire s Hospital Benefits or Retiree Health Benefits Plan Complaints If Empire denies a claim, wholly or partly, you

UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT

Model Regulation Service April 2010 UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT Table of Contents Section 1. Title Section 2. Purpose and Intent Section 3. Definitions Section 4. Applicability and

Model Regulation Service April 2010 UNIFORM HEALTH CARRIER EXTERNAL REVIEW MODEL ACT Table of Contents Section 1. Title Section 2. Purpose and Intent Section 3. Definitions Section 4. Applicability and

Utilization Management

Utilization Management Utilization Management (UM) is an organization-wide, interdisciplinary approach to balancing quality, risk, and cost concerns in the provision of patient care. It is the process

Utilization Management Utilization Management (UM) is an organization-wide, interdisciplinary approach to balancing quality, risk, and cost concerns in the provision of patient care. It is the process

How To Appeal A Health Insurance Claim

INTRODUCTION Most people now get their health care through some form of managed care plan a health maintenance organization (HMO), 1 preferred provider organization (PPO), 2 or point-of-service plan (POS).

INTRODUCTION Most people now get their health care through some form of managed care plan a health maintenance organization (HMO), 1 preferred provider organization (PPO), 2 or point-of-service plan (POS).

Provider Manual. Utilization Management

Provider Manual Utilization Management Utilization Management This section of the Manual was created to help guide you and your staff in working with Kaiser Permanente s Utilization Management (UM) policies

Provider Manual Utilization Management Utilization Management This section of the Manual was created to help guide you and your staff in working with Kaiser Permanente s Utilization Management (UM) policies

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C MEDICARE SUPPLEMENT SUBSCRIBER AGREEMENT This agreement describes your benefits from Blue Cross & Blue Shield of Rhode Island. This is a Medicare

Subscriber Agreement PLAN 65 Medicare Supplement Plan SELECT C MEDICARE SUPPLEMENT SUBSCRIBER AGREEMENT This agreement describes your benefits from Blue Cross & Blue Shield of Rhode Island. This is a Medicare

Having health insurance is a

Fully-Insured and Issued in New Jersey Having health insurance is a good thing, and health insurers usually do what they re supposed to do. They authorize coverage for services that are medically necessary

Fully-Insured and Issued in New Jersey Having health insurance is a good thing, and health insurers usually do what they re supposed to do. They authorize coverage for services that are medically necessary

HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

The Pennsylvania Insurance Department s. Your Guide to filing HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

211 CMR: DIVISION OF INSURANCE 211 CMR 52.00: MANAGED CARE CONSUMER PROTECTIONS AND ACCREDITATION OF CARRIERS Section 52.01: Authority 52.02: Applicability 52.03: Definitions 52.04: Accreditation of Carriers

Health Insurance in Ohio

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.cancerlegalresourcecenter.org

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.cancerlegalresourcecenter.org

Skilled Nursing Facility Coinsurance Part A Deductible Part A Deductible Part A Deductible Part A Deductible Part A Deductible

BLUE CROSS AND BLUE SHIELD OF SOUTH CAROLINA An Independent Licensee of the Blue Cross and Blue Shield Association OUTLINE OF BLUE SELECT COVERAGE COVER PAGE 1 of 2: BENEFIT PLANS TRADITIONAL A and BLUE

BLUE CROSS AND BLUE SHIELD OF SOUTH CAROLINA An Independent Licensee of the Blue Cross and Blue Shield Association OUTLINE OF BLUE SELECT COVERAGE COVER PAGE 1 of 2: BENEFIT PLANS TRADITIONAL A and BLUE

SHARP HEALTH PLAN POLICY AND PROCEDURE Product Line (check all that apply):

Title: Internal Claims Audit Policy SHARP HEALTH PLAN POLICY AND PROCEDURE Product Line (check all that apply): Division(s): Administration, Finance and Operations Group HMO Individual HMO PPO POS N/A

Title: Internal Claims Audit Policy SHARP HEALTH PLAN POLICY AND PROCEDURE Product Line (check all that apply): Division(s): Administration, Finance and Operations Group HMO Individual HMO PPO POS N/A

NORTH CAROLINA DEPARTMENT OF INSURANCE PROMPT PAY GUIDANCE ** Updated July 5, 2012 ** SECTION I. QUESTIONS AS OF July 5, 2012

NORTH CAROLINA DEPARTMENT OF INSURANCE PROMPT PAY GUIDANCE ** Updated July 5, 2012 ** SECTION I. QUESTIONS AS OF July 5, 2012 1. What is the definition of claimant? Does claimant include the insured? A

NORTH CAROLINA DEPARTMENT OF INSURANCE PROMPT PAY GUIDANCE ** Updated July 5, 2012 ** SECTION I. QUESTIONS AS OF July 5, 2012 1. What is the definition of claimant? Does claimant include the insured? A

The Appeals Process For Medical Billing

The Appeals Process For Medical Billing Steven M. Verno Professor, Medical Coding and Billing What is an Appeal? An appeal is a legal process where you are asking the insurance company to review it s adverse

The Appeals Process For Medical Billing Steven M. Verno Professor, Medical Coding and Billing What is an Appeal? An appeal is a legal process where you are asking the insurance company to review it s adverse

TIBLE. and Welfare Trust

HIGH DEDUC TIBLE A Guide to Your Benefits University of Colorado Health and Welfare Plan Funded by the Univers sity of Coloradoo Health and Welfare Trust Welcome Welcome to CU Health Plan High Deductible,

HIGH DEDUC TIBLE A Guide to Your Benefits University of Colorado Health and Welfare Plan Funded by the Univers sity of Coloradoo Health and Welfare Trust Welcome Welcome to CU Health Plan High Deductible,

Riverside Physician Network Utilization Management

Subject: Program Riverside Physician Network Author: Candis Kliewer, RN Department: Product: Commercial, Senior Revised by: Linda McKevitt, RN Approved by: Effective Date January 1997 Revision Date 1/21/15

Subject: Program Riverside Physician Network Author: Candis Kliewer, RN Department: Product: Commercial, Senior Revised by: Linda McKevitt, RN Approved by: Effective Date January 1997 Revision Date 1/21/15

SUBCHAPTER R. UTILIZATION REVIEWS FOR HEALTH CARE PROVIDED UNDER A HEALTH BENEFIT PLAN OR HEALTH INSURANCE POLICY 28 TAC 19.1701 19.

Part I. Texas Department of Insurance Page 1 of 244 SUBCHAPTER R. UTILIZATION REVIEWS FOR HEALTH CARE PROVIDED UNDER A HEALTH BENEFIT PLAN OR HEALTH INSURANCE POLICY 28 TAC 19.1701 19.1719 SUBCHAPTER U.

Part I. Texas Department of Insurance Page 1 of 244 SUBCHAPTER R. UTILIZATION REVIEWS FOR HEALTH CARE PROVIDED UNDER A HEALTH BENEFIT PLAN OR HEALTH INSURANCE POLICY 28 TAC 19.1701 19.1719 SUBCHAPTER U.

NEW YORK STATE EXTERNAL APPEAL

NEW YORK STATE EXTERNAL APPEAL You have the right to appeal to the Department of Financial Services (DFS) when your insurer or HMO denies health care services as not medically necessary, experimental/investigational

NEW YORK STATE EXTERNAL APPEAL You have the right to appeal to the Department of Financial Services (DFS) when your insurer or HMO denies health care services as not medically necessary, experimental/investigational

MEDICAL MANAGEMENT OVERVIEW MEDICAL NECESSITY CRITERIA RESPONSIBILITY FOR UTILIZATION REVIEWS MEDICAL DIRECTOR AVAILABILITY

4 MEDICAL MANAGEMENT OVERVIEW Our medical management philosophy and approach focus on providing both high quality and cost-effective healthcare services to our members. Our Medical Management Department

4 MEDICAL MANAGEMENT OVERVIEW Our medical management philosophy and approach focus on providing both high quality and cost-effective healthcare services to our members. Our Medical Management Department

Credentialing CREDENTIALING

CREDENTIALING Based on standards set forth by the National Committee for Quality Assurance (NCQA) all Providers listed in literature for Molina Healthcare will be credentialed. All designated practitioners,

CREDENTIALING Based on standards set forth by the National Committee for Quality Assurance (NCQA) all Providers listed in literature for Molina Healthcare will be credentialed. All designated practitioners,

NC WORKERS COMPENSATION: BASIC INFORMATION FOR MEDICAL PROVIDERS

NC WORKERS COMPENSATION: BASIC INFORMATION FOR MEDICAL PROVIDERS CURRENT AS OF APRIL 1, 2010 I. INFORMATION SOURCES Where is information available for medical providers treating patients with injuries/conditions

NC WORKERS COMPENSATION: BASIC INFORMATION FOR MEDICAL PROVIDERS CURRENT AS OF APRIL 1, 2010 I. INFORMATION SOURCES Where is information available for medical providers treating patients with injuries/conditions

52ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, 2015

SENATE JUDICIARY COMMITTEE SUBSTITUTE FOR SENATE BILL ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, AN ACT RELATING TO MANAGED HEALTH CARE; AMENDING AND ENACTING SECTIONS OF THE NEW MEXICO INSURANCE

SENATE JUDICIARY COMMITTEE SUBSTITUTE FOR SENATE BILL ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, AN ACT RELATING TO MANAGED HEALTH CARE; AMENDING AND ENACTING SECTIONS OF THE NEW MEXICO INSURANCE

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP)

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP) 2014 Magellan Health Services Table of Contents SECTION 1: INTRODUCTION... 3 Welcome... 3 Covered

Magellan Behavioral Care of Iowa, Inc. Provider Handbook Supplement for Iowa Autism Support Program (ASP) 2014 Magellan Health Services Table of Contents SECTION 1: INTRODUCTION... 3 Welcome... 3 Covered

Unit 1 Core Care Management Activities

Unit 1 Core Care Management Activities Healthcare Management Services Healthcare Management Services (HMS) is responsible for all the medical management services provided to Highmark Blue Shield members,

Unit 1 Core Care Management Activities Healthcare Management Services Healthcare Management Services (HMS) is responsible for all the medical management services provided to Highmark Blue Shield members,

CHAPTER 17 CREDIT AND COLLECTION

CHAPTER 17 CREDIT AND COLLECTION 17101. Credit and Collection Section 17102. Purpose 17103. Policy 17104. Procedures NOTE: Rule making authority cited for the formulation of regulations for the Credit

CHAPTER 17 CREDIT AND COLLECTION 17101. Credit and Collection Section 17102. Purpose 17103. Policy 17104. Procedures NOTE: Rule making authority cited for the formulation of regulations for the Credit

CHAPTER 7: UTILIZATION MANAGEMENT

OVERVIEW The Plan s Utilization Management (UM) program is collaboration with providers to promote and document the appropriate use of health care resources. The program reflects the most current utilization

OVERVIEW The Plan s Utilization Management (UM) program is collaboration with providers to promote and document the appropriate use of health care resources. The program reflects the most current utilization

Outline of Coverage. Medicare Supplement

Outline of Coverage Medicare Supplement 2015 Security Health Plan of Wisconsin, Inc. Medicare Supplement Outline of Coverage Medicare Supplement policy The Wisconsin Insurance Commissioner has set standards

Outline of Coverage Medicare Supplement 2015 Security Health Plan of Wisconsin, Inc. Medicare Supplement Outline of Coverage Medicare Supplement policy The Wisconsin Insurance Commissioner has set standards

Guide to Appeals. 30 Winter Street, Suite 1004, Boston, MA 02108 Phone +1 617-338-5241 Fax +1 617-338-5242 www.healthlawadvocates.

Guide to Appeals 30 Winter Street, Suite 1004, Boston, MA 02108 Phone +1 617-338-5241 Fax +1 617-338-5242 www.healthlawadvocates.org This guide was made possible by funding from the Commonwealth Health

Guide to Appeals 30 Winter Street, Suite 1004, Boston, MA 02108 Phone +1 617-338-5241 Fax +1 617-338-5242 www.healthlawadvocates.org This guide was made possible by funding from the Commonwealth Health

MARKET CONDUCT REPORT ON EXAMINATION MVP HEALTH PLAN, INC. MVP HEALTH INSURANCE COMPANY MVP HEALTH SERVICES CORP. PREFERRED ASSURANCE COMPANY, INC.

MARKET CONDUCT REPORT ON EXAMINATION OF MVP HEALTH PLAN, INC. MVP HEALTH INSURANCE COMPANY MVP HEALTH SERVICES CORP. PREFERRED ASSURANCE COMPANY, INC. AS OF DECEMBER 31, 2010 DATE OF REPORT MAY 24, 2013

MARKET CONDUCT REPORT ON EXAMINATION OF MVP HEALTH PLAN, INC. MVP HEALTH INSURANCE COMPANY MVP HEALTH SERVICES CORP. PREFERRED ASSURANCE COMPANY, INC. AS OF DECEMBER 31, 2010 DATE OF REPORT MAY 24, 2013

CALIFORNIA: A CONSUMER S STEP-BY-STEP GUIDE TO NAVIGATING THE INSURANCE APPEALS PROCESS

Loyola Law School Public Interest Law Center 800 S. Figueroa Street, Suite 1120 Los Angeles, CA 90017 Direct Line: 866-THE-CLRC (866-843-2572) Fax: 213-736-1428 TDD: 213-736-8310 E-mail: CLRC@LLS.edu www.cancerlegalresourcecenter.org

Loyola Law School Public Interest Law Center 800 S. Figueroa Street, Suite 1120 Los Angeles, CA 90017 Direct Line: 866-THE-CLRC (866-843-2572) Fax: 213-736-1428 TDD: 213-736-8310 E-mail: CLRC@LLS.edu www.cancerlegalresourcecenter.org

Medicare Supplement Insurance Approved Policies 2011

Medicare Supplement Insurance Approved Policies 2011 For more information on health insurance call: MEDIGAP HELPLINE 1-800-242-1060 This is a statewide toll-free number set up by the Wisconsin Board on

Medicare Supplement Insurance Approved Policies 2011 For more information on health insurance call: MEDIGAP HELPLINE 1-800-242-1060 This is a statewide toll-free number set up by the Wisconsin Board on

Outline of Coverage. Medicare Supplement

Outline of Coverage Medicare Supplement 2016 Security Health Plan of Wisconsin, Inc. Medicare Supplement Outline of Coverage Medicare Supplement policy The Wisconsin Insurance Commissioner has set standards

Outline of Coverage Medicare Supplement 2016 Security Health Plan of Wisconsin, Inc. Medicare Supplement Outline of Coverage Medicare Supplement policy The Wisconsin Insurance Commissioner has set standards

CHAPTER 267. BE IT ENACTED by the Senate and General Assembly of the State of New Jersey:

CHAPTER 267 AN ACT concerning third party administrators of health benefits plans and third party billing services and supplementing Title 17B of the New Jersey Statutes. BE IT ENACTED by the Senate and

CHAPTER 267 AN ACT concerning third party administrators of health benefits plans and third party billing services and supplementing Title 17B of the New Jersey Statutes. BE IT ENACTED by the Senate and

Your Health Care Benefit Program. BlueAdvantage Entrepreneur Participating Provider Option

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Functions: The UM Program consists of the following components:

1.0 Introduction Alameda County Behavioral Health Care Services (ACBHCS) includes a Utilization Management (UM) Program and Behavioral Health Managed Care Plan (MCP). They are dedicated to delivering cost

1.0 Introduction Alameda County Behavioral Health Care Services (ACBHCS) includes a Utilization Management (UM) Program and Behavioral Health Managed Care Plan (MCP). They are dedicated to delivering cost

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS Title 15: Mississippi State Department of Health Part 3: Office of Health Protection Subpart 1: Health Facilities Licensure and Certification Post Office

MINIMUM STANDARDS FOR UTILIZATION REVIEW AGENTS Title 15: Mississippi State Department of Health Part 3: Office of Health Protection Subpart 1: Health Facilities Licensure and Certification Post Office

Patient Assistance Resource Center Health Insurance Appeal Guide 03/14

Health Insurance Appeal Guide 03/14 Filing a Health Insurance Appeal Use this reference guide to understand the health insurance appeal process, and the steps to take to have a health plan reconsider its

Health Insurance Appeal Guide 03/14 Filing a Health Insurance Appeal Use this reference guide to understand the health insurance appeal process, and the steps to take to have a health plan reconsider its

A Consumer s Guide to Internal Appeals and External Reviews

A Consumer s Guide to Internal Appeals and External Reviews The Iowa Insurance Division, Consumer Advocate Bureau http://www.insuranceca.iowa.gov June 2012 Table of Contents Introduction Page 3 Chapter

A Consumer s Guide to Internal Appeals and External Reviews The Iowa Insurance Division, Consumer Advocate Bureau http://www.insuranceca.iowa.gov June 2012 Table of Contents Introduction Page 3 Chapter

Provider Appeals and Billing Disputes

Provider Appeals and Billing Disputes UniCare Billing Dispute Internal Review Process A claim appeal is a formal written request from a physician or provider for reconsideration of a claim already processed

Provider Appeals and Billing Disputes UniCare Billing Dispute Internal Review Process A claim appeal is a formal written request from a physician or provider for reconsideration of a claim already processed

Overview of the BCBSRI Prescription Management Program

Definitions Overview of the BCBSRI Prescription Management Program DISPENSING GUIDELINES mean: the prescription order or refill must be limited to the quantities authorized by your doctor not to exceed

Definitions Overview of the BCBSRI Prescription Management Program DISPENSING GUIDELINES mean: the prescription order or refill must be limited to the quantities authorized by your doctor not to exceed

A Bill Regular Session, 2015 SENATE BILL 318

Stricken language would be deleted from and underlined language would be added to present law. Act 0 of the Regular Session 0 State of Arkansas 0th General Assembly As Engrossed: S// A Bill Regular Session,

Stricken language would be deleted from and underlined language would be added to present law. Act 0 of the Regular Session 0 State of Arkansas 0th General Assembly As Engrossed: S// A Bill Regular Session,

How To Manage Health Care Needs

HEALTH MANAGEMENT CUP recognizes the importance of promoting effective health management and preventive care for conditions that are relevant to our populations, thereby improving health care outcomes.

HEALTH MANAGEMENT CUP recognizes the importance of promoting effective health management and preventive care for conditions that are relevant to our populations, thereby improving health care outcomes.

Chapter 15 Claim Disputes and Member Appeals

15 Claim Disputes and Member Appeals CLAIM DISPUTE AND STATE FAIR HEARING PROCESS (FOR PROVIDERS) Health Choice Arizona processes provider Claim Disputes and State Fair Hearings in accordance with established

15 Claim Disputes and Member Appeals CLAIM DISPUTE AND STATE FAIR HEARING PROCESS (FOR PROVIDERS) Health Choice Arizona processes provider Claim Disputes and State Fair Hearings in accordance with established

AETNA LIFE INSURANCE COMPANY PO Box 1188, Brentwood, TN 37024 (800) 345-6022

AETNA LIFE INSURANCE COMPANY PO Box 1188, Brentwood, TN 37024 (800) 345-6022 OUTLINE OF MEDICARE SUPPLEMENT INSURANCE OUTLINE OF COVERAGE FOR POLICY FORM GR-11613-WI 01 MEDICARE SUPPLEMENT INSURANCE The

AETNA LIFE INSURANCE COMPANY PO Box 1188, Brentwood, TN 37024 (800) 345-6022 OUTLINE OF MEDICARE SUPPLEMENT INSURANCE OUTLINE OF COVERAGE FOR POLICY FORM GR-11613-WI 01 MEDICARE SUPPLEMENT INSURANCE The

LONG TERM DISABILITY INSURANCE CERTIFICATE BOOKLET

LONG TERM DISABILITY INSURANCE CERTIFICATE BOOKLET GROUP INSURANCE FOR WAYNE WESTLAND COMMUNITY SCHOOLS SCHOOL NUMBER 944 TEACHERS The benefits for which you are insured are set forth in the pages of this

LONG TERM DISABILITY INSURANCE CERTIFICATE BOOKLET GROUP INSURANCE FOR WAYNE WESTLAND COMMUNITY SCHOOLS SCHOOL NUMBER 944 TEACHERS The benefits for which you are insured are set forth in the pages of this

CHAPTER 11 APPEALS AND DISPUTES

CHAPTER 11 APPEALS AND DISPUTES In this Chapter look for... 11. General 11.1 Deleted 11.2 Administrative Appeals 11.3 Disputes 11.4 Alternative Dispute Resolution (ADR) 11. General. The Virginia Public

CHAPTER 11 APPEALS AND DISPUTES In this Chapter look for... 11. General 11.1 Deleted 11.2 Administrative Appeals 11.3 Disputes 11.4 Alternative Dispute Resolution (ADR) 11. General. The Virginia Public

V. Quality and Network Management

V. Quality and Network Management The primary goal of Beacon Health Options Quality and Network Management Program is to continuously improve patient/member care and services. Through data collection,

V. Quality and Network Management The primary goal of Beacon Health Options Quality and Network Management Program is to continuously improve patient/member care and services. Through data collection,

2013 OUTLINE OF MEDICARE SUPPLEMENT COVERAGE

Hospitalization Medical Expenses Blood Hospice 2013 OUTLINE OF MEDICARE SUPPLEMENT COVERAGE Benefit Chart of Medicare Supplement Plans Sold for Effective Dates on or After June 1, 2010 These charts show

Hospitalization Medical Expenses Blood Hospice 2013 OUTLINE OF MEDICARE SUPPLEMENT COVERAGE Benefit Chart of Medicare Supplement Plans Sold for Effective Dates on or After June 1, 2010 These charts show

POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS

POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS Prepared by The Kansas Insurance Department August 23, 2007 POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS

POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS Prepared by The Kansas Insurance Department August 23, 2007 POLICY AND PROCEDURE RELATING TO HEALTH UTILIZATION MANAGEMENT STANDARDS

Long Term Disability Insurance

Long Term Disability Insurance Group Insurance for School Employees FERRIS STATE UNIVERSITY INSTRUCTOR,FACULTY,LIBRARIAN Underwritten by Connecticut General Life Insurance Company 1475 Kendale Boulevard

Long Term Disability Insurance Group Insurance for School Employees FERRIS STATE UNIVERSITY INSTRUCTOR,FACULTY,LIBRARIAN Underwritten by Connecticut General Life Insurance Company 1475 Kendale Boulevard

BCBSM MENTAL HEALTH AND SUBSTANCE ABUSE MANAGED CARE PROGRAM

BCBSM MENTAL HEALTH AND SUBSTANCE ABUSE MANAGED CARE PROGRAM Professional Provider Participation Agreement This agreement (Agreement) is between Blue Cross Blue Shield of Michigan (BCBSM), and the provider

BCBSM MENTAL HEALTH AND SUBSTANCE ABUSE MANAGED CARE PROGRAM Professional Provider Participation Agreement This agreement (Agreement) is between Blue Cross Blue Shield of Michigan (BCBSM), and the provider

QUALCARE AMENDMENT TO PROVIDER NETWORK PARTICIPATION AGREEMENT

QUALCARE AMENDMENT TO PROVIDER NETWORK PARTICIPATION AGREEMENT This AMENDMENT (the Amendment ) amends that certain Provider Network Participation Agreement (the Agreement ) by and between QualCare and

QUALCARE AMENDMENT TO PROVIDER NETWORK PARTICIPATION AGREEMENT This AMENDMENT (the Amendment ) amends that certain Provider Network Participation Agreement (the Agreement ) by and between QualCare and

CLAIM FORM REQUIREMENTS

CLAIM FORM REQUIREMENTS When billing for services, please pay attention to the following points: Submit claims on a current CMS 1500 or UB04 form. Please include the following information: 1. Patient s

CLAIM FORM REQUIREMENTS When billing for services, please pay attention to the following points: Submit claims on a current CMS 1500 or UB04 form. Please include the following information: 1. Patient s

Eligibility and Enrollment for Small Business Health Option Program (SHOP) Participant Guide. Version 2.0

Eligibility and Enrollment for Small Business Health Option Program (SHOP) Participant Guide Version 2.0 Course Name: Eligibility and Enrollment for SHOP Version 2.0 TABLE OF CONTENTS 1 INTRODUCTION...

Eligibility and Enrollment for Small Business Health Option Program (SHOP) Participant Guide Version 2.0 Course Name: Eligibility and Enrollment for SHOP Version 2.0 TABLE OF CONTENTS 1 INTRODUCTION...

UTILIZATION MANGEMENT

UTILIZATION MANGEMENT The Anthem Health Care Management Division has a singular dynamic focus - to continually improve the system of health care delivery that influences utilization and cost of services

UTILIZATION MANGEMENT The Anthem Health Care Management Division has a singular dynamic focus - to continually improve the system of health care delivery that influences utilization and cost of services

COMPLAINT AND GRIEVANCE PROCESS

COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check

COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check

NC General Statutes - Chapter 108D 1

Chapter 108D. Medicaid Managed Care for Behavioral Health Services. Article 1. General Provisions. 108D-1. Definitions. The following definitions apply in this Chapter, unless the context clearly requires

Chapter 108D. Medicaid Managed Care for Behavioral Health Services. Article 1. General Provisions. 108D-1. Definitions. The following definitions apply in this Chapter, unless the context clearly requires

Zenith Insurance Company ZNAT Insurance Company 21255 Califa Street Woodland Hills, CA 91367. California Utilization Review Plan.

Zenith Insurance Company ZNAT Insurance Company 21255 Califa Street Woodland Hills, CA 91367 California Utilization Review Plan October 19, 2015 Table of Contents Definitions 3 Utilization Review Plan

Zenith Insurance Company ZNAT Insurance Company 21255 Califa Street Woodland Hills, CA 91367 California Utilization Review Plan October 19, 2015 Table of Contents Definitions 3 Utilization Review Plan

HOUSTON LAWYER REFERRAL SERVICE, INC. RULES OF MEMBERSHIP

HOUSTON LAWYER REFERRAL SERVICE, INC. RULES OF MEMBERSHIP The Houston Lawyer Referral Service, Inc. (HLRS) is a non-profit corporation sponsored by the Houston Bar Association, Houston Young Lawyers Association,

HOUSTON LAWYER REFERRAL SERVICE, INC. RULES OF MEMBERSHIP The Houston Lawyer Referral Service, Inc. (HLRS) is a non-profit corporation sponsored by the Houston Bar Association, Houston Young Lawyers Association,

WORKERS COMPENSATION CLAIMS ADMINISTRATION STANDARDS

Proposal No. 961-4891 Page 1 WORKERS COMPENSATION CLAIMS ADMINISTRATION STANDARDS WORKERS' COMPENSATION CLAIMS ADMINISTRATION GUIDELINES The following Guidelines have been adopted by the CSAC Excess Insurance

Proposal No. 961-4891 Page 1 WORKERS COMPENSATION CLAIMS ADMINISTRATION STANDARDS WORKERS' COMPENSATION CLAIMS ADMINISTRATION GUIDELINES The following Guidelines have been adopted by the CSAC Excess Insurance

LONG TERM DISABILITY INSURANCE CERTIFICATE BOOKLET

LONG TERM DISABILITY INSURANCE CERTIFICATE BOOKLET GROUP INSURANCE FOR SOUTH LYON COMMUNITY SCHOOL NUMBER 143 TEACHERS The benefits for which you are insured are set forth in the pages of this booklet.

LONG TERM DISABILITY INSURANCE CERTIFICATE BOOKLET GROUP INSURANCE FOR SOUTH LYON COMMUNITY SCHOOL NUMBER 143 TEACHERS The benefits for which you are insured are set forth in the pages of this booklet.

Health Care Management Policy and Procedure

Utilization Management... 2 Pharmaceutical Management... 3 Member Clinical Appeal and Independent External Review ASO Groups Not Voluntarily Complying with the Illinois External Review Act (Federal)...

Utilization Management... 2 Pharmaceutical Management... 3 Member Clinical Appeal and Independent External Review ASO Groups Not Voluntarily Complying with the Illinois External Review Act (Federal)...

How To Appeal An Adverse Benefit Determination In Aetna

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Florida Managed Care Arrangement. Employer s Handbook

Florida Managed Care Arrangement Employer s Handbook Contents Introduction... 1 Employer Guidelines... 2 Identification Form... 5 Employee Information... 6 Coventry s & HDi s Responsibilities... 8 Frequently

Florida Managed Care Arrangement Employer s Handbook Contents Introduction... 1 Employer Guidelines... 2 Identification Form... 5 Employee Information... 6 Coventry s & HDi s Responsibilities... 8 Frequently

Final. National Health Care Billing Audit Guidelines. as amended by. The American Association of Medical Audit Specialists (AAMAS)

Final National Health Care Billing Audit Guidelines as amended by The American Association of Medical Audit Specialists (AAMAS) May 1, 2009 Preface Billing audits serve as a check and balance to help ensure

Final National Health Care Billing Audit Guidelines as amended by The American Association of Medical Audit Specialists (AAMAS) May 1, 2009 Preface Billing audits serve as a check and balance to help ensure

New York Consumer Guide to Health Insurance Companies. New York State Andrew M. Cuomo, Governor

New York Consumer Guide to Health Insurance Companies 2013 New York State Andrew M. Cuomo, Governor Table of Contents ABOUT THIS GUIDE... 2 COMPLAINTS... 3 PROMPT PAY COMPLAINTS... 8 INTERNAL APPEALS...

New York Consumer Guide to Health Insurance Companies 2013 New York State Andrew M. Cuomo, Governor Table of Contents ABOUT THIS GUIDE... 2 COMPLAINTS... 3 PROMPT PAY COMPLAINTS... 8 INTERNAL APPEALS...

DEPARTMENT PROCEDURE. Purpose