California PCP Selected* Not Applicable

|

|

|

- Maurice Mosley

- 8 years ago

- Views:

Transcription

1 PLAN FEATURES Deductible (per calendar ) Member Coinsurance * Not Applicable ** Not Applicable Copay Maximum (per calendar ) $3,000 per Individual $6,000 per Family All member copays accumulate toward the Copay Maximum, excluding member cost for Prescription Drugs. No individual can contribute more than the Individual Copay Maximum toward satisfaction of the Family Copay Maximum. Once the Family Copay Maximum is met, all family members will be considered as having met their Copay Maximum for the remainder of the calendar. Lifetime Maximum Primary Care Physician Selection Unlimited Required Upon enrollment to a Vitalidad Plus plan, each Member must select a Primary Care Physician (PCP) either in California or Mexico. The selected PCP is responsible for coordinating the Member's care. Members who select a California PCP may change to another California PCP at any time. Members who select a Mexico PCP may change to another Mexico PCP at any time. However, it is important to note that members are only allowed to change PCPs one time every twelve months when the new PCP is not located in the country as the prior one. Refer to the evidence of Coverage for additional information regarding PCP selection and changes. Referral Requirement PHYSICIAN SERVICES Required for all non-emergency, non-urgent and non-primary Care Physician services, except Direct Access Services. Primary Care Physician Visits Specialist Office Visits Pre-Natal Maternity Maternity - Delivery and Post-Partum Care Allergy Testing Allergy Treatment PREVENTIVE CARE Routine Adult Physical Exams / Immunizations Limited to 1 exam every 12 months for members age 18 and older Well Child Exams / Immunizations Provides coverage for 7 exams in the first 12 months of life, 3 exams in the second 12 months of life, 3 exams in the third 12 months of life, I exam every 12 months thereafter. Includes immunizations. Routine Gynecological Exams*** Includes Pap smear and related lab fees One routine exam(s) per 365 days. Routine Mammograms One baseline mammogram for females age 35-39; and one annual mammogram for females age 40 and over. (v ) Aetna Life Insurance Company Page 1

2 Women's Health Includes: Screening for gestational diabetes; HPV (Human Papillomavirus) DNA testing, counseling for sexually transmitted infections; counseling and screening for human immunodeficiency virus; screening and counseling for interpersonal and domestic violence; breastfeeding support, supplies and counseling; and contraceptive methods and counseling. Limitations may apply. Routine Digital Rectal Exams / Prostate Specific Antigen Test For covered males age 40 and over. Colorectal Cancer Screening (includes routine sigmoidoscopy and preventive colonoscopy) For all members age 50 and over. Frequency schedule applies. place of service where it is rendered Routine Vision and Hearing Screening DIAGNOSTIC PROCEDURES Covered as part of a routine physical exam Diagnostic Laboratory Diagnostic X-ray (except for Complex Imaging Services) Complex Imaging Services Including, but not limited to, MRI, MRA, PET and CT Scans and any other outpatient diagnostic imaging service costing over $500. EMERGENCY MEDICAL CARE Urgent Care Provider Non-Urgent use of Urgent Care Provider Emergency Room Non-Emergency care in an Emergency Room $50 copay $100 copay $20 copay $20 copay Emergency Ambulance HOSPITAL CARE Inpatient Coverage Including maternity & transplants Outpatient Surgery - OP Hospital Provided in an outpatient hospital department Outpatient Surgery - Freestanding Facility Provided in a freestanding surgical facility MENTAL HEALTH SERVICES Inpatient Serious Mental Illness & Serious Emotional Disturbances of a Child Outpatient Serious Mental Illness & Serious Emotional Disturbances of a Child Inpatient Other than Serious Mental Illness & Serious Emotional Disturbances of a Child Outpatient Other than Serious Mental Illness & Serious Emotional Disturbances of a Child $100 copay $300 copay $150 copay $600 per day up to 3-days per admit $100 copay per day up to 7-days per $100 copay per day up to 7-days per (v ) Aetna Life Insurance Company Page 2

3 ALCOHOL/DRUG ABUSE SERVICES Inpatient Detoxification Outpatient Detoxification Inpatient Rehabilitation Outpatient Rehabilitation OTHER SERVICES Autism Treatment Skilled Nursing Facility Home Health Care Inpatient Hospice Care Outpatient Hospice Care Outpatient Speech Therapy Outpatient Physical and Occupational Therapy Chiropractic*** Durable Medical Equipment FAMILY PLANNING 100 days per member per calendar 100 days per member per calendar $0 copay $0 copay (home-based only). do not apply to autism.. do not apply to autism. $15 copay NA 50% Maximum benefit of $2,000 per member per calendar Infertility Treatment Coverage for only the diagnosis and surgical treatment of the underlying medical cause Voluntary Termination of Pregnancy Voluntary Sterilization - Vasectomy Voluntary Sterilization - Tubal Ligation Coverage is prohibited by law in Mexico except in the cases to preserve the life of the mother. $50 copay (v ) Aetna Life Insurance Company Page 3

4 PHARMACY - PRESCRIPTION DRUG BENEFITS Retail Up to a 30-day supply at participating pharmacies, includes insulin. CALIFORNIA PARTICIPATING PHARMACIES $15 copay for generic formulary drugs, $35 copay for brand name formulary drugs, and $50 copay for generic and brand name non-formulary drugs MEXICO PARTICIPATING PHARMACIES $10 Generic & Brand Mail Order day supply at participating pharmacies, includes insulin. for generic formulary drugs, $70 copay for brand name formulary drugs, and $100 copay for generic and brand name non-formulary drugs Formulary generic FDA-approved Women s Contraceptives covered 100% in network. Mandatory Generic with DAW override - The member pays the applicable copay/coinsurance] only, if the physician requires brand. If the member requests brand when a generic is available, the member pays the applicable copay/coinsurance plus the difference between the generic price and the brand price. Plan includes: Contraceptive drugs and devices obtainable from a pharmacy and diabetic supplies obtainable from a pharmacy. Lifestyle/performance drugs limited to 6 pills per month. Precertification included and 90-day Transition of Care (TOC) for Precertification included. *For this plan, "" refers to the Aetna California Vitalidad Plus Network providers. For any concerns about accessing and obtaining services from the California Vitalidad Plus network please call Member Services at AETNA ( ). **For this plan, "" refers to the SIMNSA Network participating providers. For any questions or concerns about accessing and obtaining services from the SIMNSA network please call Member Services at AETNA ( ). ***Members may directly access participating providers for certain services as outlined in the plan documents. What's This plan does not cover all health care expenses and includes exclusions and limitations. Members should refer to their plan documents to determine which health care services are covered and to what extent. The following is a partial list of services and supplies that are generally not covered. However, your plan documents may contain exceptions to this list based on state mandates or the plan design or rider(s) purchased. All medical or hospital services not specifically covered in, or which are limited or excluded by your plan documents, including costs of services before coverage begins and after coverage terminates Blood and blood byproducts, except as administered on an inpatient or emergency care basis Cosmetic surgery Custodial care Dental care and x-rays Donor egg retrieval Experimental and investigational procedures, except for coverage for medically necessary routine patient care costs for Members participating in a cancer clinical trial Hearing aids Home births (v ) Aetna Life Insurance Company Page 4

5 Immunizations for travel or work Implantable drugs and certain injectible drugs including injectible infertility drugs Infertility services including artificial insemination and advanced reproductive technologies such as IVF, ZIFT, GIFT, ICSI and other related services unless specifically listed as covered in your plan documents Long Term Rehabilitation Nonmedically necessary services or supplies Orthotics, except diabetic orthotics Over-the-counter medications and supplies other than for certain covered diabetic drugs and supplies and/or certain contraceptives Radial Keratotomy or related procedures Reversal of sterilization Services for the treatment of sexual dysfunction or inadequacies, including therapy, supplies, counseling and prescription drugs Special duty nursing Therapy or rehabilitation other than those listed as covered in the plan documents Treatment of behavioral disorders Weight reduction programs, or dietary supplements, except as pre-authorized by HMO for the Medically Necessary treatment of morbid obesity This material is for informational purposes only and is neither an offer of coverage nor medical advice. It contains only a partial, general description of plan benefits or programs and does not constitute a contract. Aetna does not provide health care services and, therefore, cannot guarantee results or outcomes. Consult the plan documents (i.e. Schedule of Benefits, Certificate of Coverage, Evidence of Coverage, Group Agreement, Group Insurance Certificate and/or Group Policy) to determine governing contractual provisions, including procedures, exclusions and limitations relating to the plan. The availability of a plan or program may vary by geographic service area. Some benefits are subject to limitations or visit maximums. Participating physicians, hospitals and other health care providers are independent contractors and are neither agents nor employees of Aetna. The availability of any particular provider cannot be guaranteed, and provider network composition is subject to change. Notice of the change shall be provided in accordance with applicable state law. Depending on the plan selected, new prescription drugs not yet reviewed by our medication review committee are either available at the highest copay under plans with an open formulary, or excluded from coverage unless a medical exception is obtained under plans that use a closed formulary. This may also be subject to precertification or step-therapy. Nonprescription drugs, and drugs in the Limitations and Exclusions section of the plan documents (received upon enrollment) are not covered, and medical exceptions are not available for them. If your plan covers outpatient prescription drugs, your plan may include a drug formulary (preferred drug list). A formulary is a list of prescription drugs generally covered under your prescription drug benefits plan on a preferred basis subject to applicable limitations and conditions. Your pharmacy benefit is generally not limited to the drugs listed on the formulary. The medications listed on the formulary are subject to change in accordance with applicable state law. For information regarding how medications are reviewed and selected for the formulary, formulary information, and information about other pharmacy programs such as precertification and step-therapy, please refer to Aetna's website at Aetna.com, or the Aetna Medication Formulary Guide. Many drugs, including many of those listed on the formulary, are subject to rebate arrangements between Aetna and the manufacturer of the drugs. Rebates received by Aetna from drug manufacturers are not reflected in the cost paid by a member for a prescription drug. In addition, in circumstances where your prescription plan utilizes copayments or coinsurance calculated on a percentage basis or a deductible, use of formulary drugs may not necessarily result in lower costs for the member. Members should consult with their treating physicians regarding questions about specific medications. Refer to your plan documents or contact Member Services for information regarding the terms and limitations of coverage. Aetna Rx Home Delivery refers to Aetna Rx Home Delivery, LLC, a subsidiary of Aetna, Inc., that is a licensed pharmacy providing mail-order pharmacy services. Aetna's negotiated charge with Aetna Rx Home Delivery may be higher than Aetna Rx Home Delivery's cost of purchasing drugs and providing mail-order pharmacy services. "Aetna" is the brand name used for products and services provided by one or more of the Aetna group of subsidiary companies. Plans are offered by Aetna health of California Inc. While this information is believed to be accurate as of the print date, it is subject to change. (v ) Aetna Life Insurance Company Page 5

CA Group Business 2-50 Employees

PLAN FEATURES Network Primary Care Physician Selection Deductible (per calendar year) Member Coinsurance Copay Maximum (per calendar year) Lifetime Maximum Referral Requirement PHYSICIAN SERVICES Primary

PLAN FEATURES Network Primary Care Physician Selection Deductible (per calendar year) Member Coinsurance Copay Maximum (per calendar year) Lifetime Maximum Referral Requirement PHYSICIAN SERVICES Primary

PLAN DESIGN AND BENEFITS Basic HMO Copay Plan 1-10

PLAN FEATURES Deductible (per calendar year) Member Coinsurance Not Applicable Not Applicable Out-of-Pocket Maximum $5,000 Individual (per calendar year) $10,000 Family Once the Family Out-of-Pocket Maximum

PLAN FEATURES Deductible (per calendar year) Member Coinsurance Not Applicable Not Applicable Out-of-Pocket Maximum $5,000 Individual (per calendar year) $10,000 Family Once the Family Out-of-Pocket Maximum

PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80

Georgia Health Network Option (POS Open Access) PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80 PLAN FEATURES PARTICIPATING PROVIDERS NON-PARTICIPATING PROVIDERS Deductible (per calendar year)

Georgia Health Network Option (POS Open Access) PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80 PLAN FEATURES PARTICIPATING PROVIDERS NON-PARTICIPATING PROVIDERS Deductible (per calendar year)

PARTICIPATING PROVIDERS / REFERRED Deductible (per calendar year)

Your HMO Plan Primary Care Physician - You choose a Primary Care Physician. The Aetna HMO Deductible provider network gives you access to a wide selection of Primary Care Physicians ( PCP's) and Specialists

Your HMO Plan Primary Care Physician - You choose a Primary Care Physician. The Aetna HMO Deductible provider network gives you access to a wide selection of Primary Care Physicians ( PCP's) and Specialists

PLAN DESIGN AND BENEFITS HMO Open Access Plan 912

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $2,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $2,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services

PLAN DESIGN AND BENEFITS POS Open Access Plan 1944

PLAN FEATURES PARTICIPATING Deductible (per calendar year) $3,000 Individual $9,000 Family $4,000 Individual $12,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being

PLAN FEATURES PARTICIPATING Deductible (per calendar year) $3,000 Individual $9,000 Family $4,000 Individual $12,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being

Bates College Effective date: 01-01-2010 HMO - Maine PLAN DESIGN AND BENEFITS PROVIDED BY AETNA HEALTH INC. - FULL RISK PLAN FEATURES

PLAN FEATURES Deductible (per calendar year) $500 Individual $1,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Once Family Deductible is met, all family

PLAN FEATURES Deductible (per calendar year) $500 Individual $1,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Once Family Deductible is met, all family

California Small Group MC Aetna Life Insurance Company

PLAN FEATURES Deductible (per calendar year) $3,000 Individual $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate separately

PLAN FEATURES Deductible (per calendar year) $3,000 Individual $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate separately

PREFERRED CARE. All covered expenses, including prescription drugs, accumulate toward both the preferred and non-preferred Payment Limit.

PLAN FEATURES Deductible (per plan year) $300 Individual $300 Individual None Family None Family All covered expenses, excluding prescription drugs, accumulate toward both the preferred and non-preferred

PLAN FEATURES Deductible (per plan year) $300 Individual $300 Individual None Family None Family All covered expenses, excluding prescription drugs, accumulate toward both the preferred and non-preferred

PLAN DESIGN AND BENEFITS AETNA LIFE INSURANCE COMPANY - Insured

PLAN FEATURES Deductible (per calendar year) Individual $750 Individual $1,500 Family $2,250 Family $4,500 All covered expenses accumulate simultaneously toward both the preferred and non-preferred Deductible.

PLAN FEATURES Deductible (per calendar year) Individual $750 Individual $1,500 Family $2,250 Family $4,500 All covered expenses accumulate simultaneously toward both the preferred and non-preferred Deductible.

California Small Group MC Aetna Life Insurance Company

PLAN FEATURES Deductible (per calendar year) $1,000 per member $1,000 per member Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate

PLAN FEATURES Deductible (per calendar year) $1,000 per member $1,000 per member Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate

PLAN DESIGN AND BENEFITS - PA Health Network Option AHF HRA 1.3. Fund Pays Member Responsibility

HEALTHFUND PLAN FEATURES HealthFund Amount (Per plan year. Fund changes between tiers requires a life status change qualifying event.) Fund Coinsurance (Percentage at which the Fund will reimburse) Fund

HEALTHFUND PLAN FEATURES HealthFund Amount (Per plan year. Fund changes between tiers requires a life status change qualifying event.) Fund Coinsurance (Percentage at which the Fund will reimburse) Fund

SMALL GROUP PLAN DESIGN AND BENEFITS OPEN CHOICE OUT-OF-STATE PPO PLAN - $1,000

PLAN FEATURES PREFERRED CARE NON-PREFERRED CARE Deductible (per calendar year; applies to all covered services) $1,000 Individual $3,000 Family $2,000 Individual $6,000 Family Plan Coinsurance ** 80% 60%

PLAN FEATURES PREFERRED CARE NON-PREFERRED CARE Deductible (per calendar year; applies to all covered services) $1,000 Individual $3,000 Family $2,000 Individual $6,000 Family Plan Coinsurance ** 80% 60%

PLAN DESIGN AND BENEFITS - Tx OAMC 2500 08 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $5,000 Individual $7,500 3 Individuals per $15,000 3 Individuals per Unless otherwise indicated, the Deductible must be met prior to benefits

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $5,000 Individual $7,500 3 Individuals per $15,000 3 Individuals per Unless otherwise indicated, the Deductible must be met prior to benefits

1 exam every 12 months for members age 22 to age 65; 1 exam every 12 months for adults age 65 and older. Routine Well Child

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible (per calendar year) $1,000 Individual $1,000 Individual $2,000 Family $2,000 Family All covered expenses accumulate separately toward the preferred or

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible (per calendar year) $1,000 Individual $1,000 Individual $2,000 Family $2,000 Family All covered expenses accumulate separately toward the preferred or

Unlimited except where otherwise indicated.

PLAN FEATURES Deductible (per calendar year) $1,250 Individual $5,000 Individual $2,500 Family $10,000 Family All covered expenses including prescription drugs accumulate separately toward both the preferred

PLAN FEATURES Deductible (per calendar year) $1,250 Individual $5,000 Individual $2,500 Family $10,000 Family All covered expenses including prescription drugs accumulate separately toward both the preferred

Business Life Insurance - Health & Medical Billing Requirements

PLAN FEATURES Deductible (per plan year) $2,000 Employee $2,000 Employee $3,000 Employee + Spouse $3,000 Employee + Spouse $3,000 Employee + Child(ren) $3,000 Employee + Child(ren) $4,000 Family $4,000

PLAN FEATURES Deductible (per plan year) $2,000 Employee $2,000 Employee $3,000 Employee + Spouse $3,000 Employee + Spouse $3,000 Employee + Child(ren) $3,000 Employee + Child(ren) $4,000 Family $4,000

PLAN DESIGN AND BENEFITS - New York Open Access EPO 1-10/10

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $3,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $3,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN DESIGN AND BENEFITS - Tx OAMC Basic 2500-10 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $4,000 Individual $7,500 Family $12,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $4,000 Individual $7,500 Family $12,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

$100 Individual. Deductible

PLAN FEATURES Deductible $100 Individual (per calendar year) $200 Family Unless otherwise indicated, the deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible $100 Individual (per calendar year) $200 Family Unless otherwise indicated, the deductible must be met prior to benefits being payable. Member cost sharing for certain services,

Medical Plan - Healthfund

18 Medical Plan - Healthfund Oklahoma City Community College Effective Date: 07-01-2010 Aetna HealthFund Open Choice (PPO) - Oklahoma PLAN DESIGN AND BENEFITS PROVIDED BY AETNA LIFE INSURANCE COMPANY -

18 Medical Plan - Healthfund Oklahoma City Community College Effective Date: 07-01-2010 Aetna HealthFund Open Choice (PPO) - Oklahoma PLAN DESIGN AND BENEFITS PROVIDED BY AETNA LIFE INSURANCE COMPANY -

New York Small Group Indemnity Aetna Life Insurance Company Plan Effective Date: 10/01/2010. PLAN DESIGN AND BENEFITS - NY Indemnity 1-10/10*

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $7,500 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $7,500 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

IL Small Group PPO Aetna Life Insurance Company Plan Effective Date: 04/01/2009 PLAN DESIGN AND BENEFITS- PPO HSA HDHP $2,500 100/80 (04/09)

PLAN FEATURES OUT-OF- Deductible (per calendar ) $2,500 Individual $5,000 Individual $5,000 Family $10,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable.

PLAN FEATURES OUT-OF- Deductible (per calendar ) $2,500 Individual $5,000 Individual $5,000 Family $10,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable.

100% Fund Administration

FUND FEATURES HealthFund Amount $500 Employee $750 Employee + Spouse $750 Employee + Child(ren) $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at which the Fund

FUND FEATURES HealthFund Amount $500 Employee $750 Employee + Spouse $750 Employee + Child(ren) $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at which the Fund

PLAN DESIGN AND BENEFITS - Tx OAMC 1500-10 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $1,500 Individual $3,000 Individual $4,500 Family $9,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

PLAN FEATURES Deductible (per calendar year) $1,500 Individual $3,000 Individual $4,500 Family $9,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

$6,350 Individual $12,700 Individual

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible $5,000 Individual $10,000 Individual $10,000 Family $20,000 Family All covered expenses accumulate separately toward the preferred or non-preferred Deductible.

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible $5,000 Individual $10,000 Individual $10,000 Family $20,000 Family All covered expenses accumulate separately toward the preferred or non-preferred Deductible.

PLAN DESIGN & BENEFITS - CONCENTRIC MODEL

PLAN FEATURES Deductible (per calendar year) Rice University None Family Member Coinsurance Applies to all expenses unless otherwise stated. Payment Limit (per calendar year) $1,500 Individual $3,000 Family

PLAN FEATURES Deductible (per calendar year) Rice University None Family Member Coinsurance Applies to all expenses unless otherwise stated. Payment Limit (per calendar year) $1,500 Individual $3,000 Family

20% 40% Individual Family

PLAN FEATURES NON-* Deductible (per calendar year) $2,500 Individual $3,000 Individual $5,000 Family $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable.

PLAN FEATURES NON-* Deductible (per calendar year) $2,500 Individual $3,000 Individual $5,000 Family $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable.

Employee + 2 Dependents

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at

PDS Tech, Inc Proposed Effective Date: 01-01-2012 Aetna HealthFund Aetna Choice POS ll - ASC

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance 100% Percentage

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance 100% Percentage

Rice University Effective Date: 07-01-2014 Aetna Choice POS ll - ASC PLAN DESIGN & BENEFITS ADMINISTERED BY AETNA LIFE INSURANCE COMPANY PLAN FEATURES

PLAN DESIGN & BENEFITS PLAN FEATURES NON- Deductible (per calendar year) None Individual $1,000 Individual None Family $3,000 Family All covered expenses, excluding prescription drugs, accumulate toward

PLAN DESIGN & BENEFITS PLAN FEATURES NON- Deductible (per calendar year) None Individual $1,000 Individual None Family $3,000 Family All covered expenses, excluding prescription drugs, accumulate toward

Aetna HealthFund Health Reimbursement Account Plan (Aetna HealthFund Open Access Managed Choice POS II )

Health Fund The Health Fund amount reflected is on a per calendar year basis. If you do not use the entire fund by 12/31/2015, it will be moved into a Limited-Purpose Flexible Spending Account. Health

Health Fund The Health Fund amount reflected is on a per calendar year basis. If you do not use the entire fund by 12/31/2015, it will be moved into a Limited-Purpose Flexible Spending Account. Health

PLAN DESIGN AND BENEFITS STANDARD HEALTH BENEFITS PLAN NJ HMO $30 PLAN (Also Marketed As: NJ SGB HMO $30/$300/D (5/10K) Plan)

PLAN FEATURES Deductible (per calendar year) Plan Coinsurance Maximum Out-of-Pocket (per calendar year) $5,000 Individual $10,000 Family All covered expenses apply toward the Maximum Out-of-Pocket. Once

PLAN FEATURES Deductible (per calendar year) Plan Coinsurance Maximum Out-of-Pocket (per calendar year) $5,000 Individual $10,000 Family All covered expenses apply toward the Maximum Out-of-Pocket. Once

100% Percentage at which the Fund will reimburse Fund Administration

FUND FEATURES HealthFund Amount $500 Employee $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per

FUND FEATURES HealthFund Amount $500 Employee $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per

$20 office visit copay; deductible 20%; after deductible. $30 office visit copay; deductible Not Covered. $30 office visit copay; deductible waived

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible (per calendar year) $300 Individual $600 Individual $600 Family $1,200 Family All covered expenses, accumulate separately toward the preferred or non-preferred

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible (per calendar year) $300 Individual $600 Individual $600 Family $1,200 Family All covered expenses, accumulate separately toward the preferred or non-preferred

IL Small Group MC Open Access Aetna Life Insurance Company Plan Effective Date: 10/01/2010 PLAN DESIGN AND BENEFITS- MC CDHP $2,500 90/70 (10/10)

PLAN FEATURES Deductible (per calendar ) $2,500 Individual $5,000 Individual $7,500 Family $15,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered

PLAN FEATURES Deductible (per calendar ) $2,500 Individual $5,000 Individual $7,500 Family $15,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered

Individual. Employee + 1 Family

FUND FEATURES HealthFund Amount Individual Employee + 1 Family $750 $1,125 $1,500 Amount contributed to the Fund by the employer is reflected above. Fund Amount reflected is on a per calendar year basis.

FUND FEATURES HealthFund Amount Individual Employee + 1 Family $750 $1,125 $1,500 Amount contributed to the Fund by the employer is reflected above. Fund Amount reflected is on a per calendar year basis.

SPIN Effective Date: 01-01-2013 Aetna HealthFund Aetna Choice POS ll - ASC PLAN DESIGN & BENEFITS ADMINISTERED BY AETNA LIFE INSURANCE COMPANY

HealthFund Amount $1,500 Employee $1,500 Employee + 1 Dependent $1,500 Employee + 2 Dependents $1,500 Family Amount contributed to Fund by employer Fund Coinsurance 100% Percentage at which Fund will reimburse

HealthFund Amount $1,500 Employee $1,500 Employee + 1 Dependent $1,500 Employee + 2 Dependents $1,500 Family Amount contributed to Fund by employer Fund Coinsurance 100% Percentage at which Fund will reimburse

THE MITRE CORPORATION PPO High Deductible Plan with a Health Saving Account (HSA)

THE MITRE CORPORATION PPO High Deductible Plan with a Health Saving Account (HSA) Effective Date: 01-01-2016 PLAN FEATURES Annual Deductible $1,500 Employee $3,000 Employee $3,000 Employee + 1 Dependent

THE MITRE CORPORATION PPO High Deductible Plan with a Health Saving Account (HSA) Effective Date: 01-01-2016 PLAN FEATURES Annual Deductible $1,500 Employee $3,000 Employee $3,000 Employee + 1 Dependent

PLAN DESIGN & BENEFITS MEDICAL PLAN PROVIDED BY AETNA LIFE INSURANCE COMPANY

Gettysburg College, Inc. PLAN FEATURES Deductible (per calendar year) $500 Individual $1,500 Individual $1,000 Family $3,000 Family All covered expenses accumulate separately toward the preferred or non-preferred

Gettysburg College, Inc. PLAN FEATURES Deductible (per calendar year) $500 Individual $1,500 Individual $1,000 Family $3,000 Family All covered expenses accumulate separately toward the preferred or non-preferred

Small Business Solutions Medical Plan Options

Small Business Solutions Medical Plan Options Indiana Choice. Simplicity. Affordability. 14.02.927.1-IN (10/04) AETNA SMALL GROUP MEDICAL PLANS AETNA CHOICE PPO PLAN OPTIONS Plan Option 1 Plan Option 2

Small Business Solutions Medical Plan Options Indiana Choice. Simplicity. Affordability. 14.02.927.1-IN (10/04) AETNA SMALL GROUP MEDICAL PLANS AETNA CHOICE PPO PLAN OPTIONS Plan Option 1 Plan Option 2

Prepared: 04/06/2012 04:19 PM

PLAN FEATURES NON- Deductible (per calendar year) $2,000 Individual $4,000 Individual $6,000 Family $12,000 Family All covered expenses accumulate simultaneously toward both the preferred and non-preferred

PLAN FEATURES NON- Deductible (per calendar year) $2,000 Individual $4,000 Individual $6,000 Family $12,000 Family All covered expenses accumulate simultaneously toward both the preferred and non-preferred

Orthodox HealthPlan Effective: 05-01-2015 Aetna HealthFund Open Choice (PPO)

FUND FEATURES HealthFund Amount Orthodox HealthPlan $750 Employee $1,500 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per calendar year basis. The fund received may

FUND FEATURES HealthFund Amount Orthodox HealthPlan $750 Employee $1,500 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per calendar year basis. The fund received may

THE CITY OF HOPE Proposed Effective Date: 01-01-2012 HMO - California PLAN DESIGN & BENEFITS PROVIDED BY AETNA HEALTH OF CALIFORNIA INC.

PLAN FEATURES Deductible (per calendar year) Out-of-Pocket Maximum (per calendar year) None Individual None Family $1,500 Individual $3,000 Family Member cost sharing for certain services may not apply

PLAN FEATURES Deductible (per calendar year) Out-of-Pocket Maximum (per calendar year) None Individual None Family $1,500 Individual $3,000 Family Member cost sharing for certain services may not apply

None Individual. Deductible (per calendar year)

PLAN FEATURES Deductible (per calendar year) UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN None Individual None Family The family Deductible is a cumulative Deductible for all family members.

PLAN FEATURES Deductible (per calendar year) UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN None Individual None Family The family Deductible is a cumulative Deductible for all family members.

100% Percentage at which the Fund will reimburse Fund Administration

FUND FEATURES HealthFund Amount $750 Employee $1,500 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per calendar year basis, The fund received may be prorated based

FUND FEATURES HealthFund Amount $750 Employee $1,500 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per calendar year basis, The fund received may be prorated based

How To Get A Health Care Plan In Aiowa

PLAN FEATURES Deductible (per calendar year) None Individual None Family The family Deductible is a cumulative Deductible for all family members. The family Deductible can be met by a combination of family

PLAN FEATURES Deductible (per calendar year) None Individual None Family The family Deductible is a cumulative Deductible for all family members. The family Deductible can be met by a combination of family

PLAN DESIGN & BENEFITS PROVIDED BY AETNA HEALTH INC. - FULL RISK

PLAN FEATURES Deductible (per calendar year) PLAN DESIGN & BENEFITS None Individual None Family The family Deductible is a cumulative Deductible for all family members. The family Deductible can be met

PLAN FEATURES Deductible (per calendar year) PLAN DESIGN & BENEFITS None Individual None Family The family Deductible is a cumulative Deductible for all family members. The family Deductible can be met

$25 copay. One routine GYN visit and pap smear per 365 days. Direct access to participating providers.

HMO-1 Primary Care Physician Visits Office Hours After-Hours/Home Specialty Care Office Visits Diagnostic OP Lab/X Ray Testing (at facility) with PCP referral. Diagnostic OP Lab/X Ray Testing (at specialist)

HMO-1 Primary Care Physician Visits Office Hours After-Hours/Home Specialty Care Office Visits Diagnostic OP Lab/X Ray Testing (at facility) with PCP referral. Diagnostic OP Lab/X Ray Testing (at specialist)

1 exam every 12 months for members age 22 to age 65; 1 exam every 12 months for adults age 65 and older. Routine Well Child

Open Choice (O) Maine Aetna Consumer Choice (HSA) lan LAN DESIGN & BENEFITS ROVIDED BY AETNA LIFE INSURANCE COMANY LAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible (per calendar year) $1,800 Individual

Open Choice (O) Maine Aetna Consumer Choice (HSA) lan LAN DESIGN & BENEFITS ROVIDED BY AETNA LIFE INSURANCE COMANY LAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible (per calendar year) $1,800 Individual

PLAN FEATURES ACO TIER LEVEL 1 AETNA NETWORK TIER 2 OUT-OF-NETWORK Deductible

PLAN FEATURES ACO TIER LEVEL 1 AETNA NETWORK TIER 2 OUT-OF-NETWORK Deductible $250 Individual $2,000 Individual $3,000 Individual (per calendar year) $500 Family $4,000 Family $6,000 Family Unless otherwise

PLAN FEATURES ACO TIER LEVEL 1 AETNA NETWORK TIER 2 OUT-OF-NETWORK Deductible $250 Individual $2,000 Individual $3,000 Individual (per calendar year) $500 Family $4,000 Family $6,000 Family Unless otherwise

PLAN DESIGN & BENEFITS PROVIDED BY AETNA HEALTH INC. AND AETNA HEALTH INSURANCE COMPANY - FULL RISK

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible None Individual $750 Individual (per calendar year) None Family $2,250 Family Unless otherwise indicated, the deductible must be met prior to benefits

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible None Individual $750 Individual (per calendar year) None Family $2,250 Family Unless otherwise indicated, the deductible must be met prior to benefits

FUND FEATURES HealthFund Amount

FUND FEATURES HealthFund Amount Miami Dade College $750 Employee $1,500 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per calendar year basis. The fund received may

FUND FEATURES HealthFund Amount Miami Dade College $750 Employee $1,500 Family Amount contributed to the Fund by the employer Fund amount reflected is on a per calendar year basis. The fund received may

LOCKHEED MARTIN AERONAUTICS COMPANY PALMDALE 2011 IAM NEGOTIATIONS UNDER AGE 65 LM HEALTHWORKS SUMMARY

Annual Deductibles, Out-of-Pocket Maximums, Lifetime Maximum Benefits Calendar Year Deductible Calendar Year Out-of- Pocket Maximum Lifetime Maximum Per Individual Physician Office Visits Primary Care

Annual Deductibles, Out-of-Pocket Maximums, Lifetime Maximum Benefits Calendar Year Deductible Calendar Year Out-of- Pocket Maximum Lifetime Maximum Per Individual Physician Office Visits Primary Care

OverVIEW of Your Eligibility Class by determineing Benefits

OVERVIEW OF YOUR BENEFITS IMPORTANT PHONE NUMBERS Benefit Fund s Member Services Department (646) 473-9200 For answers to questions about your eligibility or prescription drug benefit. You can also visit

OVERVIEW OF YOUR BENEFITS IMPORTANT PHONE NUMBERS Benefit Fund s Member Services Department (646) 473-9200 For answers to questions about your eligibility or prescription drug benefit. You can also visit

IN-NETWORK MEMBER PAYS. Out-of-Pocket Maximum (Includes a combination of deductible, copayments and coinsurance for health and pharmacy services)

HMO-OA-CNT-30-45-500-500D-13 HMO Open Access Contract Year Plan Benefit Summary This is a brief summary of benefits. Refer to your Membership Agreement for complete details on benefits, conditions, limitations

HMO-OA-CNT-30-45-500-500D-13 HMO Open Access Contract Year Plan Benefit Summary This is a brief summary of benefits. Refer to your Membership Agreement for complete details on benefits, conditions, limitations

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/15-6/30/16

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/15-6/30/16 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/15-6/30/16 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/14-6/30/15

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/14-6/30/15 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/14-6/30/15 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

PPO Schedule of Payments (Maryland Large Group) Qualified High Deductible Health Plan National QA2000-20

PPO Schedule of Payments (Maryland Large Group) Qualified High Health Plan National QA2000-20 Benefit Year Individual Family (Amounts for Participating and s services are separated in calculating when

PPO Schedule of Payments (Maryland Large Group) Qualified High Health Plan National QA2000-20 Benefit Year Individual Family (Amounts for Participating and s services are separated in calculating when

FEATURES NETWORK OUT-OF-NETWORK

Schedule of Benefits Employer: The Vanguard Group, Inc. ASA: 697478-A Issue Date: January 1, 2014 Effective Date: January 1, 2014 Schedule: 3B Booklet Base: 3 For: Choice POS II - 950 Option - Retirees

Schedule of Benefits Employer: The Vanguard Group, Inc. ASA: 697478-A Issue Date: January 1, 2014 Effective Date: January 1, 2014 Schedule: 3B Booklet Base: 3 For: Choice POS II - 950 Option - Retirees

Sherwin-Williams Medical, Prescription Drug and Dental Plans Plan Comparison Charts

Sherwin-Williams Medical, Prescription Drug and Dental Plans Plan Comparison Charts You and Sherwin-Williams share the cost of certain benefits including medical and dental coverage and you have the opportunity

Sherwin-Williams Medical, Prescription Drug and Dental Plans Plan Comparison Charts You and Sherwin-Williams share the cost of certain benefits including medical and dental coverage and you have the opportunity

Greater Tompkins County Municipal Health Insurance Consortium

WHO IS COVERED Requires both Medicare A & B enrollment. Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement None None Medical Benefit Management Program Not

WHO IS COVERED Requires both Medicare A & B enrollment. Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement None None Medical Benefit Management Program Not

Additional Information Provided by Aetna Life Insurance Company

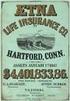

Additional Information Provided by Aetna Life Insurance Company Inquiry Procedure The plan of benefits described in the Booklet-Certificate is underwritten by: Aetna Life Insurance Company (Aetna) 151

Additional Information Provided by Aetna Life Insurance Company Inquiry Procedure The plan of benefits described in the Booklet-Certificate is underwritten by: Aetna Life Insurance Company (Aetna) 151

Blue Cross Premier Bronze Extra

An individual PPO health plan from Blue Cross Blue Shield of Michigan. You will have a broad choice of doctors and hospitals within Blue Cross Blue Shield of Michigan s unsurpassed statewide PPO network

An individual PPO health plan from Blue Cross Blue Shield of Michigan. You will have a broad choice of doctors and hospitals within Blue Cross Blue Shield of Michigan s unsurpassed statewide PPO network

Reliability and predictable costs for individuals and families

INDIVIDUAL & FAMILY PLANS HEALTH NET HMO PLANS Reliability and predictable costs for individuals and families If you re looking for a health plan that s simple to use and easy to understand, you ve found

INDIVIDUAL & FAMILY PLANS HEALTH NET HMO PLANS Reliability and predictable costs for individuals and families If you re looking for a health plan that s simple to use and easy to understand, you ve found

Greater Tompkins County Municipal Health Insurance Consortium

WHO IS COVERED Requires Covered Member to be Enrolled in Both Medicare Parts A & B Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement Not Applicable Not Applicable

WHO IS COVERED Requires Covered Member to be Enrolled in Both Medicare Parts A & B Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement Not Applicable Not Applicable

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC.

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC. CPOS II DEDUCTIBLE, COPAYS/COINSURANCE AND DOLLAR MAXIMUMS and Aligned Deductible

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC. CPOS II DEDUCTIBLE, COPAYS/COINSURANCE AND DOLLAR MAXIMUMS and Aligned Deductible

Benefit Summary - A, G, C, E, Y, J and M

Benefit Summary - A, G, C, E, Y, J and M Benefit Year: Calendar Year Payment for Services Deductible Individual $600 $1,200 Family (Embedded*) $1,200 $2,400 Coinsurance (the percentage amount the Covered

Benefit Summary - A, G, C, E, Y, J and M Benefit Year: Calendar Year Payment for Services Deductible Individual $600 $1,200 Family (Embedded*) $1,200 $2,400 Coinsurance (the percentage amount the Covered

2015 Medical Plan Options Comparison of Benefit Coverages

Member services 1-866-641-1689 1-866-641-1689 1-866-641-1689 1-866-641-1689 1-866-641-1689 1-800-464-4000 Web site www.anthem.com/ca/llns/ www.anthem.com/ca/llns/ www.anthem.com/ca/llns/ www.anthem.com/ca/llns/

Member services 1-866-641-1689 1-866-641-1689 1-866-641-1689 1-866-641-1689 1-866-641-1689 1-800-464-4000 Web site www.anthem.com/ca/llns/ www.anthem.com/ca/llns/ www.anthem.com/ca/llns/ www.anthem.com/ca/llns/

Medical plan options. Small Business Solutions. New York FOR BUSINESSES WITH 2 50 ELIGIBLE EMPLOYEES

Medical plan options Small Business Solutions New York FOR BUSINESSES WITH 2 50 ELIGIBLE EMPLOYEES Health insurance plans are offered, underwritten or administered by Aetna Life Insurance Company. 14.02.929.1-NY

Medical plan options Small Business Solutions New York FOR BUSINESSES WITH 2 50 ELIGIBLE EMPLOYEES Health insurance plans are offered, underwritten or administered by Aetna Life Insurance Company. 14.02.929.1-NY

SUMMARY OF BENEFITS. Cigna Health and Life Insurance Co. Grand County Open Access Plus Effective 1/1/2015

SUMMARY OF BENEFITS Cigna Health and Life Insurance Co. Grand County Open Access Plus Effective General Services In-Network Out-of-Network Primary care physician You pay $25 copay per visit Physician office

SUMMARY OF BENEFITS Cigna Health and Life Insurance Co. Grand County Open Access Plus Effective General Services In-Network Out-of-Network Primary care physician You pay $25 copay per visit Physician office

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN GP-861472 This Amendment is effective

OAKLAND COMMUNITY COLLEGE

OAKLAND COMMUNITY COLLEGE Flexible Compensation Plan Flex Comp Exempt Administration and Management Staff Plan Year January 1, - December 31, The benefits described in this booklet do not constitute a

OAKLAND COMMUNITY COLLEGE Flexible Compensation Plan Flex Comp Exempt Administration and Management Staff Plan Year January 1, - December 31, The benefits described in this booklet do not constitute a

SUMMARY OF BENEFITS. Cigna Health and Life Insurance Co. Laramie County School District 2 Open Access Plus Base - Effective 7/1/2015

SUMMARY OF BENEFITS Cigna Health and Life Insurance Co. Laramie County School District 2 Open Access Plus Base - Effective General Services In-Network Out-of-Network Physician office visit Urgent care

SUMMARY OF BENEFITS Cigna Health and Life Insurance Co. Laramie County School District 2 Open Access Plus Base - Effective General Services In-Network Out-of-Network Physician office visit Urgent care

Carnegie Mellon University Policy #02424 Benefits at a Glance Effective Date: January 1, 2014

Carnegie Mellon University is offering Medical, Dental, Vision, Pharmacy, Medical Evacuation and Repatriation benefits through Cigna Global Health Benefits to our employees. This comprehensive international

Carnegie Mellon University is offering Medical, Dental, Vision, Pharmacy, Medical Evacuation and Repatriation benefits through Cigna Global Health Benefits to our employees. This comprehensive international

AVMED POS PLAN. Allergy Injections No charge 30% co-insurance after deductible Allergy Skin Testing $30 per visit 30% co-insurance after deductible

AVMED POS PLAN This Schedule of Benefits reflects the higher provider and prescription copays for 2015. This is not a contract, it s a summary of the plan highlights and is subject to change. For specific

AVMED POS PLAN This Schedule of Benefits reflects the higher provider and prescription copays for 2015. This is not a contract, it s a summary of the plan highlights and is subject to change. For specific

Member s responsibility (deductibles, copays, coinsurance and dollar maximums)

MICHIGAN CATHOLIC CONFERENCE January 2015 Benefit Summary This is intended as an easy-to-read summary and provides only a general overview of your benefits. It is not a contract. Additional limitations

MICHIGAN CATHOLIC CONFERENCE January 2015 Benefit Summary This is intended as an easy-to-read summary and provides only a general overview of your benefits. It is not a contract. Additional limitations

Summary of Services and Cost Shares

Summary of Services and Cost Shares This summary does not describe benefits. For the description of a benefit, including any limitations or exclusions, please refer to the identical heading in the Benefits

Summary of Services and Cost Shares This summary does not describe benefits. For the description of a benefit, including any limitations or exclusions, please refer to the identical heading in the Benefits

National PPO 1000. PPO Schedule of Payments (Maryland Small Group)

PPO Schedule of Payments (Maryland Small Group) National PPO 1000 The benefits outlined in this Schedule are in addition to the benefits offered under Coventry Health & Life Insurance Company Small Employer

PPO Schedule of Payments (Maryland Small Group) National PPO 1000 The benefits outlined in this Schedule are in addition to the benefits offered under Coventry Health & Life Insurance Company Small Employer

2015 Medical Plan Summary

2015 Medical Plan Summary AVMED POS PLAN This Schedule of Benefits reflects the higher provider and prescription copayments for 2015. This is not a contract, it s a summary of the plan highlights and is

2015 Medical Plan Summary AVMED POS PLAN This Schedule of Benefits reflects the higher provider and prescription copayments for 2015. This is not a contract, it s a summary of the plan highlights and is

FCPS BENEFITS COMPARISON Active Employees and Retirees Under 65

FCPS S COMPARISON Medical Lifetime Maximum Unlimited Unlimited Unlimited Unlimited Unlimited Individual Annual Deductible None $250 None $250 None Family Annual Deductible Limit None $500 None $500 None

FCPS S COMPARISON Medical Lifetime Maximum Unlimited Unlimited Unlimited Unlimited Unlimited Individual Annual Deductible None $250 None $250 None Family Annual Deductible Limit None $500 None $500 None

SERVICES IN-NETWORK COVERAGE OUT-OF-NETWORK COVERAGE

COVENTRY HEALTH AND LIFE INSURANCE COMPANY 3838 N. Causeway Blvd. Suite 3350 Metairie, LA 70002 1-800-341-6613 SCHEDULE OF BENEFITS BENEFITS AND PRIOR AUTHORIZATION REQUIREMENTS ARE SET FORTH IN ARTICLES

COVENTRY HEALTH AND LIFE INSURANCE COMPANY 3838 N. Causeway Blvd. Suite 3350 Metairie, LA 70002 1-800-341-6613 SCHEDULE OF BENEFITS BENEFITS AND PRIOR AUTHORIZATION REQUIREMENTS ARE SET FORTH IN ARTICLES

Plans. Who is eligible to enroll in the Plan? Blue Care Network (BCN) Health Alliance Plan (HAP) Health Plus. McLaren Health Plan

Who is eligible to enroll in the Plan? All State of Michigan Employees who reside in the coverage area determined by zip code. All State of Michigan Employees who reside in the coverage area determined

Who is eligible to enroll in the Plan? All State of Michigan Employees who reside in the coverage area determined by zip code. All State of Michigan Employees who reside in the coverage area determined

Cost Sharing Definitions

SU Pro ( and ) Annual Deductible 1 Coinsurance Cost Sharing Definitions $200 per individual with a maximum of $400 for a family 5% of allowable amount for inpatient hospitalization - or - 50% of allowable

SU Pro ( and ) Annual Deductible 1 Coinsurance Cost Sharing Definitions $200 per individual with a maximum of $400 for a family 5% of allowable amount for inpatient hospitalization - or - 50% of allowable

Lesser of $200 or 20% (surgery) $10 per visit. $35 $100/trip $50/trip $75/trip $50/trip

HOSPITAL SERVICES Hospital Inpatient : Paid in full, Non-network: Hospital charges subject to 10% of billed charges up to coinsurance maximum. Non-participating provider charges subject to Basic Medical

HOSPITAL SERVICES Hospital Inpatient : Paid in full, Non-network: Hospital charges subject to 10% of billed charges up to coinsurance maximum. Non-participating provider charges subject to Basic Medical

Benefits at a Glance: Visa Inc. Policy Number: 00784A

Benefits at a Glance: Visa Inc. Policy Number: 00784A Visa Inc. Benefits at a Glance Policy #00784A Effective Date: January 1, 2016 Visa Inc. offers Medical, Pharmacy, Vision, Dental and Medical Evacuation

Benefits at a Glance: Visa Inc. Policy Number: 00784A Visa Inc. Benefits at a Glance Policy #00784A Effective Date: January 1, 2016 Visa Inc. offers Medical, Pharmacy, Vision, Dental and Medical Evacuation

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview of your benefits.

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview of your benefits.

Research Triangle Institute Policy #04806A Benefits at a Glance Effective Date: January 1, 2013

Research Triangle Institute Research Triangle Institute is offering Medical, Dental, Vision, Pharmacy, Medical Evacuation and Repatriation, and Long Term Disability> benefits through Cigna Global Health

Research Triangle Institute Research Triangle Institute is offering Medical, Dental, Vision, Pharmacy, Medical Evacuation and Repatriation, and Long Term Disability> benefits through Cigna Global Health

SISC Custom SaveNet Zero Admit 10 Benefit Summary (Uniform Health Plan Benefits and Coverage Matrix)

SISC Custom SaveNet Zero Admit 10 Benefit Summary (Uniform Health Plan Benefits and Coverage Matrix) Blue Shield of California Highlights: A description of the prescription drug coverage is provided separately

SISC Custom SaveNet Zero Admit 10 Benefit Summary (Uniform Health Plan Benefits and Coverage Matrix) Blue Shield of California Highlights: A description of the prescription drug coverage is provided separately

Flexible Blue SM Plan 2 Medical Coverage with Flexible Blue SM RX Prescription Drugs Benefits-at-a-Glance for Western Michigan Health Insurance Pool

Flexible Blue SM Plan 2 Medical Coverage with Flexible Blue SM RX Prescription Drugs Benefits-at-a-Glance for Western Michigan Health Insurance Pool The information in this document is based on BCBSM s

Flexible Blue SM Plan 2 Medical Coverage with Flexible Blue SM RX Prescription Drugs Benefits-at-a-Glance for Western Michigan Health Insurance Pool The information in this document is based on BCBSM s

No Charge (Except as described under "Rehabilitation Benefits" and "Speech Therapy Benefits")

An Independent Licensee of the Blue Shield Association Custom Access+ HMO Plan Certificated & Management Benefit Summary (For groups of 300 and above) (Uniform Health Plan Benefits and Coverage Matrix)

An Independent Licensee of the Blue Shield Association Custom Access+ HMO Plan Certificated & Management Benefit Summary (For groups of 300 and above) (Uniform Health Plan Benefits and Coverage Matrix)

GIC Medicare Enrolled Retirees

GIC Medicare Enrolled Retirees HMO Summary of Benefits Chart This chart provides a summary of key services offered by your HNE plan. Consult your Member Handbook for a full description of your plan s benefits

GIC Medicare Enrolled Retirees HMO Summary of Benefits Chart This chart provides a summary of key services offered by your HNE plan. Consult your Member Handbook for a full description of your plan s benefits

BENEFIT PLAN. What Your Plan Covers and How Benefits are Paid. Appendix A. Prepared Exclusively for The Dow Chemical Company

Appendix A BENEFIT PLAN Prepared Exclusively for The Dow Chemical Company What Your Plan Covers and How Benefits are Paid Choice POS II (MAP Plus Option 2 - High Deductible Health Plan (HDHP) with Prescription

Appendix A BENEFIT PLAN Prepared Exclusively for The Dow Chemical Company What Your Plan Covers and How Benefits are Paid Choice POS II (MAP Plus Option 2 - High Deductible Health Plan (HDHP) with Prescription

STATE STANDARD 20-40/400D HMO SCHEDULE OF BENEFITS

CALIFORNIA STATE STANDARD 20-40/400D HMO SCHEDULE OF BENEFITS These services are covered as indicated when authorized through your Primary Care Physician in your Participating Medical Group. General Features

CALIFORNIA STATE STANDARD 20-40/400D HMO SCHEDULE OF BENEFITS These services are covered as indicated when authorized through your Primary Care Physician in your Participating Medical Group. General Features

Covered 100% No deductible Not Applicable (exam, related tests and x-rays, immunizations, pap smears, mammography and screening tests)

A AmeriHealth EPO Individual Summary of Benefits Value Network IHC EPO $30/50% Benefit Network Non network Benefit Period+ Calendar year Individual deductible $2,500 Family deductible $5,000 50% Individual

A AmeriHealth EPO Individual Summary of Benefits Value Network IHC EPO $30/50% Benefit Network Non network Benefit Period+ Calendar year Individual deductible $2,500 Family deductible $5,000 50% Individual

COVERAGE SCHEDULE. The following symbols are used to identify Maximum Benefit Levels, Limitations, and Exclusions:

Exhibit D-3 HMO 1000 Coverage Schedule ROCKY MOUNTAIN HEALTH PLANS GOOD HEALTH HMO $1000 DEDUCTIBLE / 75 PLAN EVIDENCE OF COVERAGE LARGE GROUP Underwritten by Rocky Mountain Health Maintenance Organization,

Exhibit D-3 HMO 1000 Coverage Schedule ROCKY MOUNTAIN HEALTH PLANS GOOD HEALTH HMO $1000 DEDUCTIBLE / 75 PLAN EVIDENCE OF COVERAGE LARGE GROUP Underwritten by Rocky Mountain Health Maintenance Organization,

Prescription Drugs and Vision Benefits

Medical Plans Prescription Drugs and Vision Benefits Salaried Employees. may enroll for coverage in either the Cigna Open Access Plus Plan or the Cigna Choice Fund (Health Savings Account [HSA] Eligible)

Medical Plans Prescription Drugs and Vision Benefits Salaried Employees. may enroll for coverage in either the Cigna Open Access Plus Plan or the Cigna Choice Fund (Health Savings Account [HSA] Eligible)

Your Plan: Value HMO 25/40/20% (RX $10/$30/$45/30%) Your Network: Select Plus HMO

Your Plan: Value HMO 25/40/20% (RX $10/$30/$45/30%) Your Network: Select Plus HMO This summary of benefits is a brief outline of coverage, designed to help you with the selection process. This summary

Your Plan: Value HMO 25/40/20% (RX $10/$30/$45/30%) Your Network: Select Plus HMO This summary of benefits is a brief outline of coverage, designed to help you with the selection process. This summary

Aetna Savings Plus Plan Guide

Aetna Savings Plus Plan Guide For businesses with 2 50 eligible employees in Northeast Ohio Aetna Avenue Your Destination for Small Business Solutions Health Insurance plans are offered and/or underwritten

Aetna Savings Plus Plan Guide For businesses with 2 50 eligible employees in Northeast Ohio Aetna Avenue Your Destination for Small Business Solutions Health Insurance plans are offered and/or underwritten