Guide to Appeals. 30 Winter Street, Suite 1004, Boston, MA Phone Fax

|

|

|

- Violet Ray

- 8 years ago

- Views:

Transcription

1 Guide to Appeals 30 Winter Street, Suite 1004, Boston, MA Phone Fax

2 This guide was made possible by funding from the Commonwealth Health Insurance Connector Authority. HLA is a public interest law firm dedicated to providing pro bono legal representation to lowincome residents experiencing difficulty accessing or paying for needed medical services. Please note: this information is not legal advice. The contents are intended for general purposes only. Table of Contents Introduction... 1 Your Appeal... 2 Step 1 Getting Organized... 2 Step 2 Do Your Homework... 2 Step 3 Understanding Your Insurance Plan... 2 Step 4 Requesting the Claim File... 5 Step 5 Talk to Your Doctor... 6 Step 6 Writing Your Appeal... 6 Step 7 After the Appeal, What Happens Next?... 8 Conclusion... 9 Glossary Additional Documents Sample Claim File Request Letter HLA s Suggestions for Providers Appeal Letter of Support Personal Statement Considerations Sample Appeal Letter Sample Representative Authorization Health Law Advocates, Inc. HLA encourages the use of this information for non-commercial advocacy or educational purposes, with appropriate attribution.

3 Introduction What is an insurance denial? When you receive medical services or treatment, your doctor or other health care provider (provider) will submit a request for payment to your insurance company. These requests are often submitted before you receive the treatment or service but sometimes they are submitted after. Usually, payment will be sent to the provider and you will receive an Explanation of Benefits (EOB) that includes the treatment, date of service, what is covered, and what the provider may bill you for (for example, if a co-payment, co-insurance, or deductible applies). However, if there is disagreement about the treatment your doctor provided or recommends, you will receive an EOB or a letter that says insurance coverage is not authorized. This is an insurance denial. Information about how to appeal the denial or ask the insurance company to reconsider the decision will be included with the EOB or denial notice. Under the Affordable Care Act, you can submit an appeal of a denial when your insurance company decides: that you are not eligible to enroll in the health plan to not pay for a service that is a benefit under your plan to reduce or terminate a covered service that you have been receiving under your health insurance that care is not medically necessary that you are not eligible for a particular benefit that the treatment is experimental or investigational to cancel your coverage What is not an insurance denial? If you have questions about your insurance, such as, what you pay for your premium, your deductible amount, or whether your doctor is in-network, these are not considered insurance denials. A denial involves a decision by the insurance company regarding whether a particular medical service should be paid for under your plan. If you have a complaint about your health plan that does not involve a specific treatment denial, you may still file a complaint or grievance with your insurance 1

4 company. For example, if your insurer says it will not pay for a service because of other health insurance you have, you may be able to submit a grievance. You should check your health plan or call the number on your insurance card to learn more about its grievance process. Your Appeal Step 1 Getting Organized Get organized and keep everything in one place. Have a notebook or file to help keep track of all of the documents, because it is likely there will be many. Keep good records and save all correspondence from your insurance company. Ask for a name and/or confirmation number each time you call your health insurer and keep complete notes. If you receive conflicting or confusing information, follow up with your health insurer in writing. Step 2 Do Your Homework You can appeal to your health plan when there has been a decision by the health plan to deny, reduce, or suspend a health insurance benefit, or a decision to terminate or rescind your health insurance coverage. This is commonly called a denial, but is also referred to as an adverse benefit determination. You should review the denial letter from your insurer carefully so you know what is being denied, and why. If you do not understand the denial, request a copy of the insurer s standards and records relating to the denial. This information should be provided free of charge by your insurance company. Determine what these documents say about appealing the decision, including when appeals must be submitted. Step 3 Understanding your Insurance Plan While most people have never reviewed their insurance plan documents, it is important to read them now because knowing what your plan covers will help you develop the basis for your appeal. Your plan may be on the insurer s website. If not, you should call your insurance company and request a complete copy of your plan and any riders that apply because they change your benefits. Be sure to ask for the entire plan and not a summary (it may be called the Member Handbook, Benefits 2

5 Handbook, or Evidence of Coverage). You are looking for the most comprehensive information that is available. Also, be sure to request and review the plan that was in effect at the time your treatment or service was requested. If, for example, your plan year is from January 1 through December 31, and your service was requested and the denial was issued in December 2012, you need the 2012 plan. If, on the other hand, the service was requested and denied in January 2013, make sure you request and review the plan in effect for If you have insurance through an employer, you should request the plan from your employer. If you have trouble obtaining a copy of the plan, you may want to call the U.S. Department of Labor s Employee Benefits Advisors at EBSA. If you are having trouble getting a copy of the plan and it is an individual (also known as a non-group) health plan, you may want to call the Massachusetts Division of Insurance at When reviewing your plan, you should pay particular attention to: 1. what kind of plan it is, fully-insured or self-insured; 2. all of the terms that appear in your denial and the plan s definition of them, such as medically necessary, excluded or exclusion, experimental, unproven, uncovered, etc.; 3. the sections relating to the denied service; for example, if you were denied mental health treatment, be sure to review the plan s mental health services section; 4. how to request the standards that applied to your service and other records relating to the denial, which should be available at no charge; 5. what the plan says about your right to appeal both internally and externally, including the deadline(s) for filing, and where appeals should be sent; and 6. the options available to you if your appeals are unsuccessful. After reviewing your plan, one question you should be able to answer is whether you have a full-insured or self-insured plan. In a fully-insured employer-based health plan, the employer purchases a health plan from a health insurance carrier and the health insurance carrier bears the financial responsibility for paying out the cost of the employee health benefits under the terms of the plan. In a self-insured (or self-funded) health plan, the employer acts as its own insurer. Though the employer may contract with a health insurance carrier to act as a claim 3

6 administrator, the employer is financially responsible for paying out the employee health benefits and bearing the total cost. Very large companies are more likely to offer employees a self-insured health plan. To find out what kind of plan you have, it is best to call your insurance company, employer s human resources office, or your insurance broker. If you have been enrolled in a plan since March 23, 2010, you may have what is known as a grandfathered plan and the Affordable Care Act s appeal protections do not apply. It is still best to call and find out what you have. If you receive your insurance through the Massachusetts Group Insurance Commission, you can find out information about your plan and member appeal rights on the GIC s website at If you purchase a Commonwealth Choice or Business Express health plan through the Health Connector, or purchase an individual health insurance plan through a broker or directly from a health insurance company in Massachusetts, you likely have a fully-insured health insurance plan. But, if you are unsure of what type of plan you have, ask your insurance company or broker. You should understand why your health insurer denied the service. For example, does the insurer consider it not medically necessary or unproven given your medical condition? Before you can lay the foundation for reversing a denial, you need to understand the criteria that are being applied. More information on how to request the standard and other documents, the claim file, from your insurer is on page 5. Another section of the plan that is important is the information about appeals. If your health plan sends you a denial or an adverse benefit determination with respect to your medical treatment, it must include information on your right to appeal and describe the appeal process. There are two types of appeals; an internal appeal that is reviewed by the insurance company itself, and an external appeal that is reviewed by an independent organization. External reviews are generally allowed only for questions regarding whether a service is medically necessary. You may be required to file two internal appeals before filing an external appeal. But when there is an urgent medical need, you may be able to file both an internal appeal and an external appeal at the same time. An internal appeal to the health plan must be submitted within 180 days from the date you receive notice of a denial or other adverse benefit determination. Appeals can be submitted either over the phone (orally) or in writing, but HLA strongly encourages you to submit any appeals in writing and to keep a complete copy of what you send. 4

7 If your health or life is in jeopardy, you may be entitled to an expedited or urgent appeal. Your doctor may need to authorize your request for an urgent appeal. If an internal appeal is urgent, the insurer must respond within 72 hours of receipt. For an expedited external review, a decision must be issued within 4 days of receipt by the reviewing organization. You should check the appeals section of your plan very carefully and if you have questions, call the number on your insurance card. Step 4 Requesting the Claim File In order to make a successful appeal, you must first understand the basis for the health insurer s denial and be able to provide support for why you meet the standard that is being applied by your insurer. If you and/or your doctor do not understand the reason for the denial, you should request a copy of your claim file from the insurance company. Your claim file includes a copy of the criteria or standards that were used and all of the documents related to your claim. The denial letter or notice from your insurance company should explain how to request a copy of the claim file at no charge. The notice should provide information on how to request the information from the insurer. If there is no information in the denial about how to do so, call your insurance company and ask about it. It is important to submit your request for the claim file in writing and keep a copy so that you can keep track of when it was submitted. You should: 1. include a disclaimer that this is not an appeal, because sometimes a claim file request is mistaken as an appeal; 2. include your name, address and phone number; 3. send it by certified mail, return receipt requested; 4. include the date you are sending it; 5. confirm the fax number or address where the request should be sent; 6. include the patient s name, the subscriber name (if different), identification number, the service that was denied, the date of the denial, and the doctor s name; 7. state the reason for the letter as a request for all information relative to the denial; 8. include a copy of the denial letter (do not send the original); 9. provide the address where the requested documents should be sent; 5

8 10. include your phone number, should there be any questions; and 11. refer to the enclosed document (the denial letter). *Each numbered step corresponds to a section in the sample claim file request letter found on page 13 of this guide. If you have insurance through your employer and do not receive a response to your claim file request within 30 days, you may want to call the United States Department of Labor s Employee Benefits Security Administration at EBSA. If you have trouble obtaining the claim file from an individual (non-group) health plan, you may want to call the Massachusetts Division of Insurance Consumer Hotline at Step 5 Talk to Your Doctor Talk to your doctor(s) or someone in your doctor s office about the denial and provide a copy of the denial notice if they have not received it. Ask for any information and copies of all medical records that would support your appeal. Decide whether you want to ask your doctor to submit an appeal on your behalf. If your doctor agrees to do so, make sure s/he understands what is required. HLA s Suggestions for Providers, found on pages 14-17, is intended to help your provider submit an appeal on your behalf or to write a letter of support to be included in your appeal. Step 6 Writing Your Appeal Though an appeal may be submitted to your health insurer orally (over the phone), we strongly suggest that you submit your appeal in writing. Your appeal should identify the insurance company s decision you are appealing and clearly explain the reasons why it should be reversed with as much medical support and documentation as possible. After you have reviewed the denial and your plan, understand your appeal rights, obtained the claim file, talked to your doctor, and collected your medical records and letters of support from your providers, it is time to start writing your appeal. You may want to include a personal statement, but otherwise, it is best to stick to the facts. For help with a personal statement, see page 18. 6

9 In your appeal letter, be sure to: 1. Include your name, address and phone number. 2. Send it by certified mail, return receipt requested. 3. Include the date you are sending the appeal. 4. Make sure you are sending the appeal to the right place. This information should be in the denial letter. If not, call your insurer and confirm. 5. Include the member s name (if it is not you), the identification number, group name (if you receive insurance through your employer or another group), the type of plan you have, the provider name and treatment. 6. Start with exact language of the denial, the date, and the service 7. Quoting directly from the denial, state the criteria that the health plan applied. 8. Include a copy of the denial (be sure not to include the original). 9. List the reasons why you meet the criteria. Make sure you address each requirement separately. Try to be as clear as you can and provide references to your medical records and/or a doctor s letter of support. 10. Include a doctor s letter of support. 11. Provide copies of all pertinent medical records. 12. Include a personal statement about what this treatment means to you, your medical condition, impact on your day-to-day living, etc., 13. Reference that you are including documents with your appeal. *The numbered steps correspond to the sections in the sample appeal letter, found on pages of this guide. Once you have finished writing, get some feedback. Ask someone you know, like a family member, close friend, or your doctor, to read your appeal. Find out which parts of the appeal are most persuasive, whether you convinced them that you met the criteria, or, if not, if they have suggestions for how to improve it. Before sending your appeal, make a copy of it and all of the documents enclosed. Be sure to send it certified with proof of receipt so you will know when it was received. If you decide you would rather have someone else submit your appeal, you can authorize a representative to assist you in the appeal process. You will need to submit a signed authorization form to your health insurer that will authorize 7

10 communication with your representative on your behalf. This authorization is required when a family member, even a parent or spouse, is helping you. You can often find these forms on your health plan s website or by calling the customer service phone number on your member identification card. A sample authorization form is provided on page 21, but it is best to check with the health insurer in case it has an authorization form for this purpose. If you live in Massachusetts and need assistance submitting an appeal, you may call Health Law Advocates at HLA staff can answer your general questions about the appeal process and will talk with you to determine if we can provide assistance with your appeal. If you live in another state, you can find out about the resources that are available to help you with your health insurance appeal questions at Step 7 After the Appeal, What Happens Next? If you are appealing a denial of coverage for services you have not yet received, the health plan must issue a decision within 30 days. For a denial of treatment you have already received, the health insurer must issue an internal appeal decision within 60 days. While some insurance plans require only one internal appeal, others require you to complete a second internal appeal before you have a right to an external review. If your appeal pertains to urgent medical care, you may be able to obtain internal and external reviews at the same time. If your internal appeal was denied, you may be eligible to have a review of this decision by an independent review organization, or IRO, that is not associated with the health plan. Almost all health insurers are required to offer an external review process to members who have exhausted the internal appeal process, but still disagree with the health plan s decision. An external review decision must be issued within 60 days. However, for an urgent medical need, you may be eligible for expedited external review. Your denial letter should indicate whether you have received the insurance company s final decision on your appeal and whether you are eligible for an external review. An external review is typically only available for health plan decisions that are based on whether a requested service or treatment is medically necessary. You should keep in mind that you may (and it is a good idea to) submit additional relevant information in any other appeal you file. You also may want to contact your provider(s) and obtain additional medical records and/or letters of support for your next appeal. 8

11 If you are covered under a fully-insured health plan in Massachusetts, you must request an external review through the Office of Patient Protection (OPP). You can find out more about external appeals on the OPP website at or by calling If you have a self-insured or self-funded health plan and it was not in existence on or before March 23, 2010, your health insurer must provide an external review process that is compliant with federal rules. You should refer to your denial letter and specific health plan documents for information on the availability of an external review. If you have trouble finding information about your external review rights, you can call the United States Department of Labor s Employee Benefits Security Administration at EBSA. Conclusion It is true that appealing an insurance denial can be overwhelming and it is impossible to predict whether your appeal will be successful. By their very nature, insurance appeals are tremendously fact-specific. They relate to your medical history and current condition, the particulars of your insurance plan (which you often do not control), and the specific type of medical service that is being recommended. But there is another truth: you will never know unless you try. Never doubt that a small group of thoughtful committed citizens can change the world. In fact, it s the only thing that ever has. We hope that we have helped change your world. Margaret Mead 9

12 Glossary Adverse benefit determination a decision by your insurance company to deny or reduce payment for a particular medical service, or terminate your health insurance coverage. Affordable Care Act the national health care reform law signed by President Obama in Claim file all of the information and documents involved in an insurer s review of a requested treatment or service which should be provided at no cost to you. Co-insurance a percentage of your medical care costs that you are required to pay under your health plan for a particular type of care. Coordination of Benefits when an individual is covered by two or more insurance plans, this determines how much of a treatment or service each plan covers. Co-payment what you are required to pay each time you obtain a particular type of medical service, such as office visits or prescription drugs. Deductible the total amount you must pay for medical treatment before your health plan will start covering the cost of your medical care for you and/or your dependents. Denial a decision by an insurance company not to pay for treatment either before it is delivered or after you have already received it. Eligibility whether a person has the right to coverage. Eligibility can vary based on the particular health plan, the provider, service area, or the treatment/service sought. Exclusion a service or treatment that is not covered by your plan. Explanation of benefits or EOB this is the notification the insurance company sends after processing a claim. It should include the treatment, date of service, what is covered, and what the patient should pay (for example, if a co-payment, coinsurance, or deductible applies). 10

13 External appeal or external review an appeal that is not reviewed by your insurance company, but is sent to an independent review organization for a decision. Fully-insured plan a health plan in which the insurance carrier bears the financial responsibility for paying out the cost of health benefits under the terms of the plan. A fully-insured plan may be an individual or group plan that is offered through your employer. Grandfathered plan a health plan that was in effect on March 23, 2010 and which has not changed substantially since that date. The appeal protections in the Affordable Care Act do not apply to grandfathered plans. Independent Review Organization or IRO an entity that conducts reviews of an insurance company s final decision not to cover a service or treatment. The IRO s decision is final. Internal appeal an appeal for a denial of medical treatment or cancellation of coverage that is submitted to and reviewed by your insurance company. A plan may require one or two internal appeals. Medically necessary or medical necessity a standard used by an insurance company to determine whether treatment or services are appropriate and effective given a patient s health needs. Frequently a health plan will include a list of requirements that must be met in making this determination. Out-of-Network Provider a medical provider (such as a doctor or treatment center) that has not contracted with your insurance plan to provide medical services at a negotiated rate. The patient may be responsible for all charges depending on what the specific health plan covers. Out-of-pocket maximum the total amount you will pay for medical care that includes your co-insurance and deductible amounts, but usually not co-payments. Once your out-of-pocket maximum is reached, your health plan covers all of your medical expenses. Preauthorization or prior authorization a request by your provider to have a particular service or treatment approved by your insurance company. Provider a doctor or someone else who is qualified to deliver medical services. 11

14 Rider a condition or additional provision that is added to a policy that changes the benefits provided. Self-insured plan a health plan in which the employer pays for the actual cost of the health benefits provided to employees. A self-insured plan is usually purchased by a large employer or union but which can be administered by a third party. Urgent appeal an expedited appeal you can make if withholding medical care places your life or health in jeopardy. 12

15 Additional Documents Sample Claim File Request Letter (3) [Date] (4) [Insurance Company] [Address or Fax Number] (5) Patient Name: Member Name: Member ID#: Service Denied: Date of Denial: Provider s Name: To Whom It May Concern: (1) PLEASE NOTE: THIS IS NOT AN APPEAL (2) Sent By Certified Mail Return Receipt Requested (6) I am writing to request a copy of all standards, policies, criteria and/or any other documents involved in issuing the denial referenced above. (7) I have enclosed a copy of the denial letter. (8) Please send the requested documents to me at [insert your address]. (9) If you have any questions about this request, please call me at [insert your phone number]. Sincerely, Your Name (10) Enclosure 13

16 Health Law Advocates Suggestions for Providers Appeal Health Law Advocates is a nonprofit law firm dedicated to assisting individuals with medical debt or when they have difficulty obtaining medical services. This information is meant to offer suggestions to you, as a provider, if your patient s health insurance company has denied the medical service or treatment you recommended. In general, a health insurer must cover a service when it is a covered benefit under the health plan and the patient s need for the service meets the health plan s medical necessity criteria. In submitting an appeal of a denial, it is important to provide information and documentation that supports how this service addresses the patient s specific medical needs. Before agreeing to submit an appeal on your patient s behalf, please consider the importance of taking this step because it may be the patient s only opportunity to obtain coverage for this service. Before drafting your patient s appeal, you should: 1) review the insurance company s denial to understand why coverage for this service was denied. If you do not understand it, please call the insurance company to get more information and request the criteria that was used; and 2) review the medical records to ensure there is supporting information and documentation for the treatment you are recommending. If you would prefer that the patient obtain this information, please let him/her know as soon as possible because appeals are time-sensitive. In the appeal, be sure to: 1) include the date and reason for the original denial and include a copy with your appeal; 2) state your expertise in recommending and/or providing this treatment (e.g., your particular training, education, specialized experience); 3) describe the patient s unique circumstances (e.g., when first diagnosed, other unsuccessful treatments, how this condition is unique); 14

17 4) describe how your patient s medical condition specifically meets the criteria used by the insurer using as much detail as possible; 5) refer as much as you can to the patient s medical records, preferably with specific cites to particular medical visits and diagnostic results; 6) explain unsuccessful treatments and how and why this service is expected to improve the patient s condition; 7) detail why this service is the most appropriate and cost-effective for this patient; 8) provide any peer-reviewed medical literature that supports this service if it is unique or considered experimental or unproven; and 9) include a copy of all medical records or other documents you reference. You should keep a copy of the appeal and all of the medical records that are included and send a complete copy to the patient. If this appeal is denied again, the patient may be entitled to another internal or an external appeal. In order to do so effectively, however, the patient will need a copy of everything that you submitted. Appealing a denial by a health insurance company can be a time-consuming process. Please understand that you and your staff play a very important role in this process and can make a huge difference in the outcome of a patient s appeal. If you are unable to submit the appeal on the patient s behalf, you can still help by writing a letter of support that can be included in your patient s appeal. 15

18 Health Law Advocates Suggestions for Providers Letter of Support Health Law Advocates is a nonprofit law firm dedicated to assisting individuals with medical debt or when they have difficulty obtaining medical services. This information is meant to offer suggestions to you, as a provider, if your patient s health insurance company has denied the medical service or treatment you recommended. Keep in mind that a patient has limited opportunities to appeal a denial issued by an insurance carrier. A provider s letter of support can mean the difference between whether an appeal is successful or not. In general, when drafting a letter of support, you should include as much detail as possible concerning the patient s particular medical needs, how the insurance plan s standards or criteria are met, and copies of all medical records that support your statements. If you do not have sufficient information or knowledge to draft such a letter, you should tell the patient so s/he can locate another provider to assist with the appeal. Here are some suggestions to keep in mind before you begin drafting the letter: 1. Review the denial. If you do not understand the criteria being applied, ask the insurance company to send you a full copy of their coverage guidelines. 2. Review the patient s medical history to make sure you can support the position that the patient s medical needs meet the insurance plan s criteria. 3. Identify those test results, pictures, and/or medical records that support the requested treatment or service and make copies. 4. If the treatment is considered experimental, investigational or unproven, gather the citations for studies, medical journals and articles that support the treatment. Drafting the letter: 1. Identify yourself and provide background information (e.g., how long you have known the patient, why the patient came to you, and your particular expertise that qualifies you to make this recommendation). 2. Provide the insurance plan s criteria and reason for the denial. 16

19 3. Articulate the reasons the denial should be overturned, including any information in the medical records that supports those reasons. Remember to link the patient s medical needs as closely as possible to the criteria that is being applied and address each criterion individually with supporting documents. 4. Describe how other treatments have been unsuccessful, using references to medical records if applicable. 5. Provide a clear explanation for why this is the most appropriate and costeffective treatment given the patient s medical condition. 6. Describe the expected positive effects of this treatment for your patient. Be sure to include a copy of all of the medical records you reference when you give the letter to your patient. 17

20 Personal Statement Considerations Some feel that they are profoundly affected by their insurance plan s denial of a service or treatment. If this is the case for you, consider whether you would like to put this in writing in a separate document, so you can keep the rest of your appeal as fact-specific as possible. Here are some questions for you to consider when thinking about writing a personal statement: 1. How long have you had this medical condition? 2. What does this medical condition mean for you? 3. How has your personal life been altered by this denial? 4. How has your work life been affected? 5. Are there other effects that you have noticed? 6. What are the short- and long-term effects of this denial? 7. What other treatments have you tried unsuccessfully? 8. What were you told by your provider concerning this treatment? 18

21 Sample Appeal Letter (1) [Your Name] [Address] [Phone Number] (2) Sent by Certified Mail Return Receipt Requested (3) [Date] (4) [Insurer Name/Address] (5) Patient Name: Member Name (if different): ID#: Group (if through an employer or group): Plan: Provider: Treatment: Treatment Date: To Whom It May Concern: (6) I am appealing the denial of [name of treatment] dated [date of denial] for service provided/requested on [date of service or authorization submission]. (7) The standard that is being applied to this treatment is [include the exact language from the denial notice]. (8) I have included a copy of the denial. (9) I believe this denial should be overturned for the following reasons [list each of the reasons you meet the criteria, including, e.g., your medical needs, prior unsuccessful treatments, expected result]. (10) I have enclosed a letter of support from my doctor that states [summarize the information in the doctor s letter]. (11) I have included the following medical records [list the copies of documents (not originals) you are including]. 19

22 (12) I have included a personal statement [if you are and briefly summarize it]. For the reasons outlined above, I request that the denial be reversed. Please do not hesitate to call me if you require additional information or have any questions. Sincerely, Your Name (13) Enclosures 20

23 Sample Representative Authorization Letter [Insurer Name/Address] To Whom It May Concern: I, [insert your name], freely and willingly consent to allow [name of authorized individual, medical or legal entity], to obtain and review my medical records and discuss my health information concerning [describe the denial] with [insert the name of the insurer]. I also consent to allow [name of authorized individual, medical or legal entity] to represent me in this dispute with [insert the name of the insurer] concerning my appeal. I understand that I may revoke this consent at any time and will provide written notice to do so. Signature Address Phone Number Subscriber ID# Date 21

A Consumer s Guide to Internal Appeals and External Reviews

A Consumer s Guide to Internal Appeals and External Reviews The Iowa Insurance Division, Consumer Advocate Bureau http://www.insuranceca.iowa.gov June 2012 Table of Contents Introduction Page 3 Chapter

A Consumer s Guide to Internal Appeals and External Reviews The Iowa Insurance Division, Consumer Advocate Bureau http://www.insuranceca.iowa.gov June 2012 Table of Contents Introduction Page 3 Chapter

Patient Assistance Resource Center Health Insurance Appeal Guide 03/14

Health Insurance Appeal Guide 03/14 Filing a Health Insurance Appeal Use this reference guide to understand the health insurance appeal process, and the steps to take to have a health plan reconsider its

Health Insurance Appeal Guide 03/14 Filing a Health Insurance Appeal Use this reference guide to understand the health insurance appeal process, and the steps to take to have a health plan reconsider its

HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

The Pennsylvania Insurance Department s. Your Guide to filing HEALTH INSURANCE APPEALS

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Your Guide to filing HEALTH INSURANCE APPEALS Sometimes a health plan will make a decision that you disagree with. The plan may deny your application for coverage, determine that the healthcare services

Medical and Rx Claims Procedures

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

This section of the Stryker Benefits Summary describes the procedures for filing a claim for medical and prescription drug benefits and how to appeal denied claims. Medical and Rx Benefits In-Network Providers

005. Independent Review Organization External Review Annual Report Form

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

Title 210 NEBRASKA DEPARTMENT OF INSURANCE Chapter 87 HEALTH CARRIER EXTERNAL REVIEW 001. Authority This regulation is adopted by the director pursuant to the authority in Neb. Rev. Stat. 44-1305 (1)(c),

CALIFORNIA: A CONSUMER S STEP-BY-STEP GUIDE TO NAVIGATING THE INSURANCE APPEALS PROCESS

Loyola Law School Public Interest Law Center 800 S. Figueroa Street, Suite 1120 Los Angeles, CA 90017 Direct Line: 866-THE-CLRC (866-843-2572) Fax: 213-736-1428 TDD: 213-736-8310 E-mail: CLRC@LLS.edu www.cancerlegalresourcecenter.org

Loyola Law School Public Interest Law Center 800 S. Figueroa Street, Suite 1120 Los Angeles, CA 90017 Direct Line: 866-THE-CLRC (866-843-2572) Fax: 213-736-1428 TDD: 213-736-8310 E-mail: CLRC@LLS.edu www.cancerlegalresourcecenter.org

What Happens When Your Health Insurance Carrier Says NO

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

* What Happens When Your Health Insurance Carrier Says NO Most health carriers today carefully evaluate requests to see a specialist or have certain medical procedures performed. A medical professional

EXTERNAL REVIEW CONSUMER GUIDE

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

EXTERNAL REVIEW CONSUMER GUIDE STATE OF CONNECTICUT INSURANCE DEPARTMENT Rev. 7-11 CONNECTICUT INSURANCE DEPARTMENT EXTERNAL REVIEW CONSUMER GUIDE OVERVIEW Connecticut Public Act 11-58 gives you the right

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction This guide

REQUEST FOR INDEPENDENT EXTERNAL REVIEW OF A HEALTH INSURANCE GRIEVANCE THROUGH THE OFFICE OF PATIENT PROTECTION

The Commonwealth of Massachusetts Health Policy Commission Office of Patient Protection 50 Milk Street, 8 th Floor Boston, MA 02109 (800)436-7757 (phone) (617)624-5046 (fax) REQUEST FOR INDEPENDENT EXTERNAL

The Commonwealth of Massachusetts Health Policy Commission Office of Patient Protection 50 Milk Street, 8 th Floor Boston, MA 02109 (800)436-7757 (phone) (617)624-5046 (fax) REQUEST FOR INDEPENDENT EXTERNAL

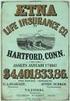

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-GrpAppealsER 03) Policyholder: Group Policy No.: Effective Date: GP- This Amendment is effective on the later of: July 12, 2012; or

How To Appeal An Adverse Benefit Determination In Aetna

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: University Of Pennsylvania Postdoctoral Insurance Plan GP-861472 This Amendment is effective

Consumer s Guide to Health Insurance Grievances and Complaints

Consumer s Guide to Health Insurance Grievances and Complaints A Consumer s Guide to Resolving Disputes with Your Health Plan State of Wisconsin Office of the Commissioner of Insurance P.O. Box 7873 Madison,

Consumer s Guide to Health Insurance Grievances and Complaints A Consumer s Guide to Resolving Disputes with Your Health Plan State of Wisconsin Office of the Commissioner of Insurance P.O. Box 7873 Madison,

External Review Request Form

External Review Request Form This EXTERNAL REVIEW REQUEST FORM must be filed with the Nebraska Department of Insurance within FOUR (4) MONTHS after receipt from your insurer of a denial of payment on a

External Review Request Form This EXTERNAL REVIEW REQUEST FORM must be filed with the Nebraska Department of Insurance within FOUR (4) MONTHS after receipt from your insurer of a denial of payment on a

A Consumer s Guide to Appealing Health Insurance Denials

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

STATE OF CONNECTICUT Insurance Department Appeals & External Review Guide RIGHTS GUIDANCE APPEAL ASSISTANCE October 2013 A Consumer s Guide to Appealing Health Insurance Denials Introduction How do I appeal

The Health Insurance Marketplace: Know Your Rights

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a health plan in the Marketplace. These rights include: Getting easy-to-understand information about what your

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a health plan in the Marketplace. These rights include: Getting easy-to-understand information about what your

List of Insurance Terms and Definitions for Uniform Translation

Term actuarial value Affordable Care Act allowed charge Definition The percentage of total average costs for covered benefits that a plan will cover. For example, if a plan has an actuarial value of 70%,

Term actuarial value Affordable Care Act allowed charge Definition The percentage of total average costs for covered benefits that a plan will cover. For example, if a plan has an actuarial value of 70%,

How to Appeal a Health Care Insurance Decision

How to Appeal a Health Care Insurance Decision A Guide for Consumers in Washington State August 2011 Version 4.0 Produced by: www.insurance.wa.gov With funds provided by The Affordable Care Act and administered

How to Appeal a Health Care Insurance Decision A Guide for Consumers in Washington State August 2011 Version 4.0 Produced by: www.insurance.wa.gov With funds provided by The Affordable Care Act and administered

Affordable Care Act Implementation

Affordable Care Act Implementation August 2012 Small Business Employers Disclaimer This document is designed to provide a general overview of portions of the health reform law - Affordable Care Act. It

Affordable Care Act Implementation August 2012 Small Business Employers Disclaimer This document is designed to provide a general overview of portions of the health reform law - Affordable Care Act. It

The Health Insurance Marketplace: Know Your Rights

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a Marketplace health plan. These rights include: Getting easy-to-understand information about what your plan

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a Marketplace health plan. These rights include: Getting easy-to-understand information about what your plan

A PATIENT S GUIDE TO. Navigating the Insurance Appeals Process

A PATIENT S GUIDE TO Navigating the Insurance Appeals Process Dealing with an injury or illness is a stressful time for any patient as well as for their family members. This publication has been created

A PATIENT S GUIDE TO Navigating the Insurance Appeals Process Dealing with an injury or illness is a stressful time for any patient as well as for their family members. This publication has been created

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment (GR-9N-Appeals 01-01 01) Policyholder The TLC Companies Group Policy No. GP-811431 Rider Arizona Complaint and Appeals Health Rider Issue

Health Care Insurer Appeals Process Information Packet

{PAGE} Health Care Insurer Appeals Process Information Packet CAREFULLY READ THE INFORMATION IN THIS PACKET AND KEEP IT FOR FUTURE REFERENCE. IT HAS IMPORTANT INFORMATION ABOUT HOW TO APPEAL DECISIONS

{PAGE} Health Care Insurer Appeals Process Information Packet CAREFULLY READ THE INFORMATION IN THIS PACKET AND KEEP IT FOR FUTURE REFERENCE. IT HAS IMPORTANT INFORMATION ABOUT HOW TO APPEAL DECISIONS

Laborers Health & Welfare Bulletin

What Is An EOB Notice? An Explanation of Benefits notice (EOB) is a summary of your recent medical benefit claim that has been processed for payment. The notice will show the dates and what types of services

What Is An EOB Notice? An Explanation of Benefits notice (EOB) is a summary of your recent medical benefit claim that has been processed for payment. The notice will show the dates and what types of services

A PATIENT S GUIDE Understanding Your Healthcare Benefits

A PATIENT S GUIDE Understanding Your Healthcare Benefits This guide includes useful information about how health insurance works and the reimbursement process used to pay for treatments. TABLE OF CONTENTS

A PATIENT S GUIDE Understanding Your Healthcare Benefits This guide includes useful information about how health insurance works and the reimbursement process used to pay for treatments. TABLE OF CONTENTS

The Appeals Process For Medical Billing

The Appeals Process For Medical Billing Steven M. Verno Professor, Medical Coding and Billing What is an Appeal? An appeal is a legal process where you are asking the insurance company to review it s adverse

The Appeals Process For Medical Billing Steven M. Verno Professor, Medical Coding and Billing What is an Appeal? An appeal is a legal process where you are asking the insurance company to review it s adverse

I Have Health Insurance! Now What?

I Have Health Insurance! Now What? A Guide to Using Your Private Health Insurance Plan Brought to you by: Congratulations on Your New Health Plan! This guide is an overview of private insurance plans and

I Have Health Insurance! Now What? A Guide to Using Your Private Health Insurance Plan Brought to you by: Congratulations on Your New Health Plan! This guide is an overview of private insurance plans and

The Health Insurance Marketplace: Know Your Rights

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a health plan in the Marketplace. These rights include: Getting easy-to-understand information about what your

The Health Insurance Marketplace: Know Your Rights You have certain rights when you enroll in a health plan in the Marketplace. These rights include: Getting easy-to-understand information about what your

Having health insurance is a

Fully-Insured and Issued in New Jersey Having health insurance is a good thing, and health insurers usually do what they re supposed to do. They authorize coverage for services that are medically necessary

Fully-Insured and Issued in New Jersey Having health insurance is a good thing, and health insurers usually do what they re supposed to do. They authorize coverage for services that are medically necessary

NEW YORK STATE EXTERNAL APPEAL

NEW YORK STATE EXTERNAL APPEAL You have the right to appeal to the Department of Financial Services (DFS) when your insurer or HMO denies health care services as not medically necessary, experimental/investigational

NEW YORK STATE EXTERNAL APPEAL You have the right to appeal to the Department of Financial Services (DFS) when your insurer or HMO denies health care services as not medically necessary, experimental/investigational

I Have Health Insurance! Now What?

I Have Health Insurance! Now What? A Guide to Using Your Private Health Insurance Plan Brought to you by: Congratulations on Your New Health Plan! This guide is an overview of private insurance plans and

I Have Health Insurance! Now What? A Guide to Using Your Private Health Insurance Plan Brought to you by: Congratulations on Your New Health Plan! This guide is an overview of private insurance plans and

956 CMR COMMONWEALTH HEALTH INSURANCE CONNECTOR AUTHORITY 956 CMR 8.00: STUDENT HEALTH INSURANCE PROGRAM

Section 8.01: General Provisions 8.02: Definitions 8.03: Mandatory Health Insurance Coverage 8.04: Student Health Insurance Program Requirements 8.05: Waiver of Participation due to Comparable Coverage

Section 8.01: General Provisions 8.02: Definitions 8.03: Mandatory Health Insurance Coverage 8.04: Student Health Insurance Program Requirements 8.05: Waiver of Participation due to Comparable Coverage

Your Health Care Benefit Program. BlueAdvantage Entrepreneur Participating Provider Option

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Your Health Care Benefit Program BlueAdvantage Entrepreneur Participating Provider Option GROUP CERTIFICATE RIDER Changes in state or federal law or regulations or interpretations thereof may change the

Early Start Program. A Guide to Health Insurance For Parents of Children from Birth to 3 Years with Developmental Delays

Early Start Program A Guide to Health Insurance For Parents of Children from Birth to 3 Years with Developmental Delays 1 TABLE OF CONTENTS INTRODUCTION 4 Why did I get this booklet and why is it important?

Early Start Program A Guide to Health Insurance For Parents of Children from Birth to 3 Years with Developmental Delays 1 TABLE OF CONTENTS INTRODUCTION 4 Why did I get this booklet and why is it important?

OUTLINE OF MEDICARE SUPPLEMENT COVERAGE BENEFIT CHART OF MEDICARE SUPPLEMENT PLANS SOLD FOR EFFECTIVE DATES ON OR AFTER JUNE 1, 2010

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

A Medicare Supplement Program An independent licensee of the Blue Cross and Blue Shield Association. This chart shows the benefits included in each of the standard Medicare supplement plans. Every company

KNOW YOUR RIGHTS A PAMPHLET OF USEFUL INFORMATION ON MANAGED CARE

KNOW YOUR RIGHTS A PAMPHLET OF USEFUL INFORMATION ON MANAGED CARE December 2012 CONTENTS KNOW THE BASIC TERMS KNOW YOUR OPTIONS KNOW YOUR RESPONSIBILITIES KNOW YOUR RIGHTS KNOW HOW TO ENFORCE YOUR RIGHTS

KNOW YOUR RIGHTS A PAMPHLET OF USEFUL INFORMATION ON MANAGED CARE December 2012 CONTENTS KNOW THE BASIC TERMS KNOW YOUR OPTIONS KNOW YOUR RESPONSIBILITIES KNOW YOUR RIGHTS KNOW HOW TO ENFORCE YOUR RIGHTS

Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan

ConneCtiCut insurance DePARtMent Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

ConneCtiCut insurance DePARtMent Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

Alcatel-Lucent Group Life Insurance Plan for Retired Employees; Alcatel-Lucent Group Term Life Insurance Plan Summary Plan Description-- Former

Alcatel-Lucent Group Life Insurance Plan for Retired Employees; Alcatel-Lucent Group Term Life Insurance Plan Summary Plan Description-- Former Full-Time Management Employees Retiring On Or After January

Alcatel-Lucent Group Life Insurance Plan for Retired Employees; Alcatel-Lucent Group Term Life Insurance Plan Summary Plan Description-- Former Full-Time Management Employees Retiring On Or After January

How To Appeal A Health Insurance Claim

INTRODUCTION Most people now get their health care through some form of managed care plan a health maintenance organization (HMO), 1 preferred provider organization (PPO), 2 or point-of-service plan (POS).

INTRODUCTION Most people now get their health care through some form of managed care plan a health maintenance organization (HMO), 1 preferred provider organization (PPO), 2 or point-of-service plan (POS).

407-767-8554 Fax 407-767-9121

Florida Consumers Notice of Rights Health Insurance, F.S.C.A.I, F.S.C.A.I., FL 32832, FL 32703 Introduction The Office of the Insurance Consumer Advocate has created this guide to inform consumers of some

Florida Consumers Notice of Rights Health Insurance, F.S.C.A.I, F.S.C.A.I., FL 32832, FL 32703 Introduction The Office of the Insurance Consumer Advocate has created this guide to inform consumers of some

Zimmer Payer Coverage Approval Process Guide

Zimmer Payer Coverage Approval Process Guide Market Access You ve Got Questions. We ve Got Answers. INSURANCE VERIFICATION PROCESS ELIGIBILITY AND BENEFITS VERIFICATION Understanding and verifying a patient

Zimmer Payer Coverage Approval Process Guide Market Access You ve Got Questions. We ve Got Answers. INSURANCE VERIFICATION PROCESS ELIGIBILITY AND BENEFITS VERIFICATION Understanding and verifying a patient

Consumer Guide to. Health Insurance. Oregon Insurance Division

Consumer Guide to Health Insurance Oregon Insurance Division The Department of Consumer and Business Services, Oregon s largest business regulatory and consumer protection agency, produced this guide.

Consumer Guide to Health Insurance Oregon Insurance Division The Department of Consumer and Business Services, Oregon s largest business regulatory and consumer protection agency, produced this guide.

Chapter 15 Claim Disputes and Member Appeals

15 Claim Disputes and Member Appeals CLAIM DISPUTE AND STATE FAIR HEARING PROCESS (FOR PROVIDERS) Health Choice Arizona processes provider Claim Disputes and State Fair Hearings in accordance with established

15 Claim Disputes and Member Appeals CLAIM DISPUTE AND STATE FAIR HEARING PROCESS (FOR PROVIDERS) Health Choice Arizona processes provider Claim Disputes and State Fair Hearings in accordance with established

Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan

CONNECTICUT INSURANCE DEPARTMENT Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

CONNECTICUT INSURANCE DEPARTMENT Consumer Toolkit for Navigating Behavioral Health and Substance Abuse Care Through Your Health Insurance Plan What consumers need to know about seeking approval for behavioral

STAYING HEALTHY. A Guide to Keeping Health Insurance After Divorce. Office of Attorney General Tom Reilly and Health Law Advocates

STAYING HEALTHY A Guide to Keeping Health Insurance After Divorce Office of Attorney General Tom Reilly and Health Law Advocates November 2002 A Message from Attorney General Tom Reilly Going through a

STAYING HEALTHY A Guide to Keeping Health Insurance After Divorce Office of Attorney General Tom Reilly and Health Law Advocates November 2002 A Message from Attorney General Tom Reilly Going through a

A Guide to Health Insurance

A Guide to Health Insurance Your health matters. A healthier you makes a healthier Cleveland! Healthy Cleveland Insurance Guide Dial Dial Acknowledgements On behalf of the City of Cleveland Department

A Guide to Health Insurance Your health matters. A healthier you makes a healthier Cleveland! Healthy Cleveland Insurance Guide Dial Dial Acknowledgements On behalf of the City of Cleveland Department

HEALTH REFORM UPDATE GRANDFATHERED GROUP HEALTH PLANS August 3, 2010

HEALTH REFORM UPDATE GRANDFATHERED GROUP HEALTH PLANS August 3, In July, the Departments of Treasury, Labor, and Health and Human Services jointly released the Interim Final Rules for Group Health Plans

HEALTH REFORM UPDATE GRANDFATHERED GROUP HEALTH PLANS August 3, In July, the Departments of Treasury, Labor, and Health and Human Services jointly released the Interim Final Rules for Group Health Plans

HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

CONSUMER'SGUIDE A Consumer s Guide to HEALTH INSURANCE UTILIZATION REVIEW, APPEALS AND GRIEVANCES YOUR RIGHTS AS A HEALTH INSURANCE CONSUMER from your North Carolina Department of Insurance A MESSAGE

SUMMARY PLAN DESCRIPTION. for. the Retiree Medical and Dental Benefits of the. Bentley University. Employee Health and Welfare Benefit Plan

SUMMARY PLAN DESCRIPTION for the Retiree Medical and Dental Benefits of the Bentley University Employee Health and Welfare Benefit Plan Effective January 1, 2015 Table of Contents page Introduction...

SUMMARY PLAN DESCRIPTION for the Retiree Medical and Dental Benefits of the Bentley University Employee Health and Welfare Benefit Plan Effective January 1, 2015 Table of Contents page Introduction...

FOR GROUP MEMBERS. Member Guidebook. Inspiring healthy living. HMO 11-12258 (6/2012)

FOR GROUP MEMBERS Member Guidebook HMO 11-12258 (6/2012) Inspiring healthy living. Table of contents About this guidebook... 5 At your service... 5 Language access... 6 Collection of race, ethnicity,

FOR GROUP MEMBERS Member Guidebook HMO 11-12258 (6/2012) Inspiring healthy living. Table of contents About this guidebook... 5 At your service... 5 Language access... 6 Collection of race, ethnicity,

Services Available to Members Complaints & Appeals

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

Services Available to Members Complaints & Appeals Blue Cross and Blue Shield of Texas (BCBSTX) resolves complaints and appeals related to any aspect of service provided by itself or any subcontractor

2016 Evidence of Coverage for Passport Advantage

2016 Evidence of Coverage for Passport Advantage EVIDENCE OF COVERAGE January 1, 2016 - December 31, 2016 Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Passport

2016 Evidence of Coverage for Passport Advantage EVIDENCE OF COVERAGE January 1, 2016 - December 31, 2016 Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Passport

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Customer Trinity University Agreement No. 2 Amendment Complaint and Appeals Health Amendment Issue Date July 16, 2009 Effective Date June

ifuse Implant System Patient Appeal Guide

ifuse Implant System Patient Appeal Guide Table of Contents PURPOSE OF THIS BOOKLET...................................................... 2 GUIDE TO THE APPEALS PROCESS..................................................

ifuse Implant System Patient Appeal Guide Table of Contents PURPOSE OF THIS BOOKLET...................................................... 2 GUIDE TO THE APPEALS PROCESS..................................................

Welcome to American Specialty Health Insurance Company

CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health

CA PPO Welcome to American Specialty Health Insurance Company American Specialty Health Insurance Company (ASH Insurance) is committed to promoting high quality insurance coverage for complementary health

How to Ensure Your Healthcare Gets Paid For West Virginia

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.disabilityrightslegalcenter.org

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.disabilityrightslegalcenter.org

A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR

HOUSE BILL NO. INTRODUCED BY G. MACLAREN BY REQUEST OF THE STATE AUDITOR 0 A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR UTILIZATION REVIEW, GRIEVANCE, AND EXTERNAL

HOUSE BILL NO. INTRODUCED BY G. MACLAREN BY REQUEST OF THE STATE AUDITOR 0 A BILL FOR AN ACT ENTITLED: "AN ACT ADOPTING AND REVISING PROCESSES THAT PROVIDE FOR UTILIZATION REVIEW, GRIEVANCE, AND EXTERNAL

Insurance 101 for Students

Insurance 101 for Students Health Care in the United States The U.S. does not offer free medical care to the general public Medical care is very expensive Doctor office visit: $150 - $200 Annual asthma

Insurance 101 for Students Health Care in the United States The U.S. does not offer free medical care to the general public Medical care is very expensive Doctor office visit: $150 - $200 Annual asthma

Health Insurance in Ohio

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.cancerlegalresourcecenter.org

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.cancerlegalresourcecenter.org

A Guide to Appealing Disability Benefits in the Broader Public Service (BPS)

A Guide to Appealing Disability Benefits in the Broader Public Service (BPS) OPSEU Pensions and Benefits Unit April 2013 Table of Contents Introduction... 3 Overview... 3 Know and Meet the Deadline(s)

A Guide to Appealing Disability Benefits in the Broader Public Service (BPS) OPSEU Pensions and Benefits Unit April 2013 Table of Contents Introduction... 3 Overview... 3 Know and Meet the Deadline(s)

Making it happen HOW TO ACCESS BEHAVIORAL HEALTH TREATMENT SERVICES FROM PRIVATE HEALTH INSURANCE FOR INDIVIDUALS WITH AUTISM A GUIDE FOR PARENTS

Making it happen HOW TO ACCESS BEHAVIORAL HEALTH TREATMENT SERVICES FROM PRIVATE HEALTH INSURANCE FOR INDIVIDUALS WITH AUTISM SPECTRUM DISORDERS A GUIDE FOR PARENTS SECTION 1 SECTION 2 SECTION 3 SECTION

Making it happen HOW TO ACCESS BEHAVIORAL HEALTH TREATMENT SERVICES FROM PRIVATE HEALTH INSURANCE FOR INDIVIDUALS WITH AUTISM SPECTRUM DISORDERS A GUIDE FOR PARENTS SECTION 1 SECTION 2 SECTION 3 SECTION

COMPLAINT AND GRIEVANCE PROCESS

COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check

COMPLAINT AND GRIEVANCE PROCESS The complaint and grievance process for fully insured employer groups may differ from the standard complaint and grievance process for self-insured groups. Always check

Medical Insurance Guide

1 of 12 11-11-20 8:17 AM Medical Insurance Guide Medical Necessity form Frequently Asked Questions Glossary of Insurance Terminology Suggestions for contacting your health plan Links to Major Health Insurance

1 of 12 11-11-20 8:17 AM Medical Insurance Guide Medical Necessity form Frequently Asked Questions Glossary of Insurance Terminology Suggestions for contacting your health plan Links to Major Health Insurance

NOTICE OF PRIVACY PRACTICES. for Sony Pictures Entertainment Inc.

NOTICE OF PRIVACY PRACTICES for Sony Pictures Entertainment Inc. [Para recibir esta notificación en español por favor llamar al número proviso en este documento.] This notice describes how medical information

NOTICE OF PRIVACY PRACTICES for Sony Pictures Entertainment Inc. [Para recibir esta notificación en español por favor llamar al número proviso en este documento.] This notice describes how medical information

How To Contact Us

Molina Medicare Options Plus HMO SNP Member Services Method Member Services Contact Information CALL (800) 665-1029 Calls to this number are free. 7 days a week, 8 a.m. to 8 p.m., local time. Member Services

Molina Medicare Options Plus HMO SNP Member Services Method Member Services Contact Information CALL (800) 665-1029 Calls to this number are free. 7 days a week, 8 a.m. to 8 p.m., local time. Member Services

Maximizing Coverage Under the New Jersey Autism & Other Developmental Disabilities Insurance Mandate: A Guide for Parents and Professionals

Maximizing Coverage Under the New Jersey Autism & Other Developmental Disabilities Insurance Mandate: A Guide for Parents and Professionals About Autism New Jersey Autism New Jersey is the state s leading

Maximizing Coverage Under the New Jersey Autism & Other Developmental Disabilities Insurance Mandate: A Guide for Parents and Professionals About Autism New Jersey Autism New Jersey is the state s leading

Medicare Appeals: Part D Drug Denials. December 16, 2014

Medicare Appeals: Part D Drug Denials December 16, 2014 2013 Appeals Statistics by Type 23,716 Part D Reconsideration Appeals* Appeals Type Percentage of Total Appeals Appeals Per Million Medicare Beneficiaries

Medicare Appeals: Part D Drug Denials December 16, 2014 2013 Appeals Statistics by Type 23,716 Part D Reconsideration Appeals* Appeals Type Percentage of Total Appeals Appeals Per Million Medicare Beneficiaries

Maryland Insurance Administration

Maryland Insurance Administration Today s Date: COMPLAINT FORM Life and Health Insurance Please use this form to submit a complaint about an insurance company The Maryland Insurance Administration (MIA)

Maryland Insurance Administration Today s Date: COMPLAINT FORM Life and Health Insurance Please use this form to submit a complaint about an insurance company The Maryland Insurance Administration (MIA)

CHAPTER 7: RIGHTS AND RESPONSIBILITIES

We want to make sure you are aware of your rights and responsibilities, as well as those of your Tufts Health Together (MassHealth), Tufts Health Forward (Commonwealth Care), Tufts Health Extend, Network

We want to make sure you are aware of your rights and responsibilities, as well as those of your Tufts Health Together (MassHealth), Tufts Health Forward (Commonwealth Care), Tufts Health Extend, Network

Covered Person/Applicant Authorized Representative (please complete the Appointment of Authorized Representative section)

REQUEST FOR EXTERNAL REVIEW Instructions 1. If you are eligible and have completed the appeal process, you may request an external review of the denial by an External Review Organization (ERO). ERO reviews

REQUEST FOR EXTERNAL REVIEW Instructions 1. If you are eligible and have completed the appeal process, you may request an external review of the denial by an External Review Organization (ERO). ERO reviews

Health care insurer appeals process information packet Aetna Life Insurance Company

Quality health plans & benefits Healthier living Financial well-being Intelligent solutions Health care insurer appeals process information packet Aetna Life Insurance Company Please read this notice carefully

Quality health plans & benefits Healthier living Financial well-being Intelligent solutions Health care insurer appeals process information packet Aetna Life Insurance Company Please read this notice carefully

HOW TO COMPLETE THIS FORM

HOW TO COMPLETE THIS FORM For your convenience, Sharp Health plan makes this reimbursement form available for your use. All requests for reimbursement received in writing shall be processed. 1. The Member

HOW TO COMPLETE THIS FORM For your convenience, Sharp Health plan makes this reimbursement form available for your use. All requests for reimbursement received in writing shall be processed. 1. The Member

Managed Care 101. What is Managed Care?

Managed Care 101 What is Managed Care? Managed care is a system to provide health care that controls how health care services are delivered and paid. Managed care has grown quickly because it offers a

Managed Care 101 What is Managed Care? Managed care is a system to provide health care that controls how health care services are delivered and paid. Managed care has grown quickly because it offers a

NOTICE OF PRIVACY PRACTICES for the HARVARD UNIVERSITY MEDICAL, DENTAL, VISION AND MEDICAL REIMBURSEMENT PLANS

NOTICE OF PRIVACY PRACTICES for the HARVARD UNIVERSITY MEDICAL, DENTAL, VISION AND MEDICAL REIMBURSEMENT PLANS THIS NOTICE DESCRIBES HOW MEDICAL INFORMATION ABOUT YOU MAY BE USED AND DISCLOSED AND HOW

NOTICE OF PRIVACY PRACTICES for the HARVARD UNIVERSITY MEDICAL, DENTAL, VISION AND MEDICAL REIMBURSEMENT PLANS THIS NOTICE DESCRIBES HOW MEDICAL INFORMATION ABOUT YOU MAY BE USED AND DISCLOSED AND HOW

Autism and Health Insurance Coverage: Making Your Benefits Work For Your Child

Autism and Health Insurance Coverage: Making Your Benefits Work For Your Child Karen Fessel, Dr P.H., Feda Almaliti, For more information visit please visit: www.autismhealthinsurance.org ww.asdhealth.com

Autism and Health Insurance Coverage: Making Your Benefits Work For Your Child Karen Fessel, Dr P.H., Feda Almaliti, For more information visit please visit: www.autismhealthinsurance.org ww.asdhealth.com

Your Pharmacy Benefit: Make it Work for You!

Your Pharmacy Benefit: Make it Work for You! www.yourpharmacybenefit.org Table of Contents Choose Your Plan.............................................2 Steps in Choosing Your Pharmacy Benefits.........................

Your Pharmacy Benefit: Make it Work for You! www.yourpharmacybenefit.org Table of Contents Choose Your Plan.............................................2 Steps in Choosing Your Pharmacy Benefits.........................

Evidence of Coverage:

January 1 December 31, 2016 Evidence of Coverage: Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Advantra Silver (HMO) This booklet gives you the details about

January 1 December 31, 2016 Evidence of Coverage: Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Advantra Silver (HMO) This booklet gives you the details about

Guide to the Summary and Benefits of Coverage

Guide to the Summary and Benefits of Coverage The Affordable Care Act (ACA) makes health insurance available to nearly all Americans. Each state has a health insurance marketplace, also known as a health

Guide to the Summary and Benefits of Coverage The Affordable Care Act (ACA) makes health insurance available to nearly all Americans. Each state has a health insurance marketplace, also known as a health

Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Molina Medicare Options Plus HMO SNP

January 1 December 31, 2015 Evidence of Coverage: Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Molina Medicare Options Plus HMO SNP This booklet gives you the

January 1 December 31, 2015 Evidence of Coverage: Your Medicare Health Benefits and Services and Prescription Drug Coverage as a Member of Molina Medicare Options Plus HMO SNP This booklet gives you the

Individual/Family Health Insurance Non-Underwriting Change Form

Individual/Family Health Insurance Non-Underwriting Change Form READ ALL INSTRUCTIONS BEFORE COMPLETING THIS CHANGE FORM. CHANGE FORM MUST BE COMPLETED IN ITS ENTIRETY AND ALL PAGES MUST BE SUBMITTED IN

Individual/Family Health Insurance Non-Underwriting Change Form READ ALL INSTRUCTIONS BEFORE COMPLETING THIS CHANGE FORM. CHANGE FORM MUST BE COMPLETED IN ITS ENTIRETY AND ALL PAGES MUST BE SUBMITTED IN

Appeals: Eligibility & Health Plan Decisions in the Health Insurance Marketplace

Appeals: Eligibility & Health Plan Decisions in the Health Insurance Marketplace There are 2 kinds of appeals you can make once you ve applied and enrolled in coverage through the Health Insurance Marketplace:

Appeals: Eligibility & Health Plan Decisions in the Health Insurance Marketplace There are 2 kinds of appeals you can make once you ve applied and enrolled in coverage through the Health Insurance Marketplace:

Member Rights, Complaints and Appeals/Grievances 5.0

Member Rights, Complaints and Appeals/Grievances 5.0 5.1 Referring Members for Assistance The Member Services Department has representatives to assist with calls for: General verification of member eligibility

Member Rights, Complaints and Appeals/Grievances 5.0 5.1 Referring Members for Assistance The Member Services Department has representatives to assist with calls for: General verification of member eligibility

How to Ensure Your Healthcare Gets Paid For - Kentucky

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.disabilityrightslegalcenter.org

Cancer Legal Resource Center 919 Albany Street Los Angeles, CA 90015 Toll Free: 866.THE.CLRC (866.843.2572) Phone: 213.736.1455 TDD: 213.736.8310 Fax: 213.736.1428 Email: CLRC@LLS.edu Web: www.disabilityrightslegalcenter.org

Getting the Medications and Treatments You Need

Neuropathy Action Foundation Awareness Education Empowerment Getting the Medications and Treatments You Need Understanding Your Rights in Arizona As you search for a health insurance plan or coverage for

Neuropathy Action Foundation Awareness Education Empowerment Getting the Medications and Treatments You Need Understanding Your Rights in Arizona As you search for a health insurance plan or coverage for

52ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, 2015

SENATE JUDICIARY COMMITTEE SUBSTITUTE FOR SENATE BILL ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, AN ACT RELATING TO MANAGED HEALTH CARE; AMENDING AND ENACTING SECTIONS OF THE NEW MEXICO INSURANCE

SENATE JUDICIARY COMMITTEE SUBSTITUTE FOR SENATE BILL ND LEGISLATURE - STATE OF NEW MEXICO - FIRST SESSION, AN ACT RELATING TO MANAGED HEALTH CARE; AMENDING AND ENACTING SECTIONS OF THE NEW MEXICO INSURANCE

Managing the Cost of Cancer Care

Managing the Cost of Cancer Care Cancer treatment can be costly. Sometimes cancer patients have a hard time handling the physical aspects of treatment and managing their finances, and often have no one

Managing the Cost of Cancer Care Cancer treatment can be costly. Sometimes cancer patients have a hard time handling the physical aspects of treatment and managing their finances, and often have no one

Health Reimbursement Account (HRA) Frequently Asked Questions

Health Reimbursement Account (HRA) Frequently Asked Questions Q. What is a Health Reimbursement Account (HRA)? A. A Health Reimbursement Account (HRA) is part of the benefit plan offered to you by Brookhaven

Health Reimbursement Account (HRA) Frequently Asked Questions Q. What is a Health Reimbursement Account (HRA)? A. A Health Reimbursement Account (HRA) is part of the benefit plan offered to you by Brookhaven

ERISA Copyright 2005 Steven M. Verno, CMBSI

ERISA Copyright 2005 Steven M. Verno, CMBSI WHAT IS ERISA: ERISA is a Federal Law called the Employee Retirement Income Security Act. It was enacted in 1974 to protect an employee s pension plan but as

ERISA Copyright 2005 Steven M. Verno, CMBSI WHAT IS ERISA: ERISA is a Federal Law called the Employee Retirement Income Security Act. It was enacted in 1974 to protect an employee s pension plan but as

Overview of appeals process Tip sheet Sample appeals letter Sample doctor s letter

Date: Dear Helpline Caller: The Medicare Rights Center is a national, nonprofit organization. We help older adults and people with disabilities with their Medicare problems. We support caregivers and train

Date: Dear Helpline Caller: The Medicare Rights Center is a national, nonprofit organization. We help older adults and people with disabilities with their Medicare problems. We support caregivers and train

SUBCHAPTER R. UTILIZATION REVIEWS FOR HEALTH CARE PROVIDED UNDER A HEALTH BENEFIT PLAN OR HEALTH INSURANCE POLICY 28 TAC 19.1701 19.

Part I. Texas Department of Insurance Page 1 of 244 SUBCHAPTER R. UTILIZATION REVIEWS FOR HEALTH CARE PROVIDED UNDER A HEALTH BENEFIT PLAN OR HEALTH INSURANCE POLICY 28 TAC 19.1701 19.1719 SUBCHAPTER U.

Part I. Texas Department of Insurance Page 1 of 244 SUBCHAPTER R. UTILIZATION REVIEWS FOR HEALTH CARE PROVIDED UNDER A HEALTH BENEFIT PLAN OR HEALTH INSURANCE POLICY 28 TAC 19.1701 19.1719 SUBCHAPTER U.

Agent Instruction Sheet for PriorityHRA Plan Document

Agent Instruction Sheet for PriorityHRA Plan Document Thank you for choosing PriorityHRA! Here are some instructions as to what to do with each PriorityHRA document. Required Documents: HRA Application