Health Care Administrators

|

|

|

- Malcolm Farmer

- 8 years ago

- Views:

Transcription

1 Health Care Administrators January 21, 2005 Depend on HCA to be your resource for news and information. Page 1 of 2 1 Important Clarifications Related to Health Savings Accounts You ve asked for more information about preventive care benefits with the health savings account rider CMM-HSA-PCB and combined medical/drug deductibles attached to health savings accounts. We know your customers are asking, too, so here is some information you can share with them. Combined medical/drug deductible Originally it was unclear whether or not customers would be allowed to move to a qualified, combined medical/drug deductible plan at renewal if their renewal date was after Jan. 1, According to a clarification from the U.S. Treasury Department, all HSA-qualified high-deductible health plans that have prescription drug coverage must include a combined medical/drug deductible or eliminate their drug coverage, effective Jan. 1, This clarification affects: All customers enrolled in our Blue HSA high-deductible health plans that have separate prescription drug coverage All customers who are considering enrolling in our Blue HSA high-deductible health plans with separate prescription drug coverage BCBSM Blue HSA products for 2005 do not have a combined medical/drug deductible option available. The 2005 HSA requirements allow groups to have a separate prescription drug plan outside the medical deductible. BCBSM is currently developing a new high-deductible product, which will be made available Jan. 1, 2006, that will include a combined medical and prescription drug deductible. As a result of the clarification, BCBSM sales staff and agents should make sure that customers are aware of this requirement and the impact it may have on their members, union contracts, etc., if they elect a Blue HSA option in In order for their employees to remain eligible for a health savings account in 2006, groups will need to move to one of our newly designed high deductible plans that will include a combined medical/drug deductible or eliminate prescription drug coverage. They will be required to submit a group-wide change in either case before Jan. 1, Some groups may want to delay moving to a Blue HSA plan until 2006 to avoid having to move to another plan before their renewal date. Additional information on the new HSA products in development and transitioning groups will be made available in the late third quarter Please note that customers enrolled in our Blue HSA high-deductible health plans with no prescription drug coverage are NOT affected by the clarification. HEALTH CARE ADMINISTRATORS, INC High Pointe Blvd., Suite 400 Novi, MI (800) Fax: HCA is an Authorized Independent Managing Agent for Blue Cross Blue Shield of Michigan and Blue Care Network. Blue Cross Blue Shield of Michigan and Blue Care Network are Non-profit Corporations and Independent Licensees of the Blue Cross Blue Shield Association.

2 Health Care Administrators Depend on HCA to be your resource for news and information. Page 2 of 2 2 Preventive care benefits rider Sales staff, agents, members and customers have asked whether preventive care benefits with rider CMM-HSA-PCB are subject to the deductible. Benefits under the preventive care rider (CMM-HSA-PCB) are not subject to the Blue HSA deductible or copays with the exception of mammography. Covered preventive services are payable at 100 percent of the approved amount, up to an annual combined benefit maximum of $500 per member, except for mammograms. Routine mammograms are subject to member cost-sharing requirements. Services (except mammograms) must be provided by a participating physician or a panel physician if the member is enrolled under rider CMM-PPO. Sales staff, agents, members and customers are also asking if the coverage for preventive services is the same for CMM-HSA-PCB and Community Blue. In our field alert dated, Sept. 1, 2004, we communicated that the preventive care benefits under CMM-HSA-PCB were similar to the preventive care benefits under Community Blue. However, there are some differences. The benefits under rider CMM-HSA-PCB have some age restrictions, while Community Blue preventive care benefits do not in most cases. Please see the Benefits-at-a-Glance charts for Community Blue and for Blue HSA with CMM-HSA-PCB plans available on the agent Web site at A copy of rider CMM-HSA-PCB rider is also attached. More information More information about BCBSM s Blue HSA products, please contact your Managing Agent or Regional Sales Office Agent Coordinator. HEALTH CARE ADMINISTRATORS, INC High Pointe Blvd., Suite 400 Novi, MI (800) Fax: HCA is an Authorized Independent Managing Agent for Blue Cross Blue Shield of Michigan and Blue Care Network. Blue Cross Blue Shield of Michigan and Blue Care Network are Non-profit Corporations and Independent Licensees of the Blue Cross Blue Shield Association.

3 IMPORTANT KEEP THIS RIDER WITH YOUR CERTIFICATE RIDER CMM-HSA-PCB HEALTH SAVINGS ACCOUNT PREVENTIVE CARE BENEFITS AMENDS COMPREHENSIVE HEALTH CARE COPAYMENT CERTIFICATES SERIES CMM SERIES CMM SERIES CMM Rider CMM-HSA-PCB amends the certificates named above to add coverage for certain preventive care benefits. This rider is effective when you, your employer or remitting agent is notified. [logo] A nonprofit corporation and independent licensee of the Blue Cross and Blue Shield Association

4 Your certificate is amended as follows: The Coverage for Physician and Other Professional Provider Services section of your certificate is amended to add the following subsection: Preventive Care Services We will pay 100 percent of our approved amount, up to an annual combined benefit maximum of $500 per member, for the preventive care services listed below, except mammograms. Services must be provided by a participating physician (or a panel physician if the member is enrolled under Rider CMM- PPO). Preventive services billed by a hospital or a facility are not covered. Health Maintenance Examination A comprehensive history and physical examination including blood pressure measurement, ocular tonometry (measurement of pressure in the eye), skin examination for malignancy, breast examination, testicular examination, rectal examination and health counseling regarding potential risk factors. We pay for health maintenance examinations as follows: Flexible Sigmoidoscopy Examination One routine flexible sigmoidoscopy examination for members age 50 and older once every five years. Gynecological Examination and Pap Smear For members age 18 and older, one gynecological examination and one Pap smear once every 12 months. Routine Mammogram Routine mammograms are subject to member cost-sharing requirements. They are covered whether obtained from a participating or non-participating physician, or a panel or non-panel physician. Mammograms are paid as follows: - Members age 35 to 40: one baseline mammogram - Members age 40 and older: one routine mammogram per calendar year Fecal Occult Blood Screening A laboratory test to detect blood in feces or stool, fecal occult blood screenings are paid as follows: Prostate Specific Antigen Screening One PSA screening for members age 40 and older, once per year.

5 Coverage for Physician and Other Professional Provider Services (continued) Preventive Care Services (continued) Chemical Profile This routine blood test is paid as follows: Cholesterol Screening We pay for one cholesterol screening once per member, per year. Complete Blood Count We pay for this routine laboratory test as follows: Urinalysis We pay for urine tests as follows: Routine Radiology Services We pay for the following services once per member, per year: - Chest X-ray - EKG Well-Baby and Child Care Visits and Immunizations We pay for well-baby and child care visits through age 15 as follows: - Six visits for children from birth through 12 months - Six visits for children 13 months through 23 months - Two visits for children 24 months through 35 months - Two visits for children 36 months through 47 months - One visit per birth year for children 48 months through age 15 We pay for childhood immunizations as recommended by the Advisory Committee on Immunization Practices and the American Academy of Pediatrics.

6 GENERAL Until further notice, all the terms, definitions, limitations, exclusions and conditions of your certificates and related riders remain unchanged and in full force and effect, except as otherwise provided in Rider CMM-HSA-PCB. BLUE CROSS BLUE SHIELD OF MICHIGAN Richard E. Whitmer President and Chief Executive Officer Form No. 2320

Flexible Blue SM Plan 2 Medical Coverage with Flexible Blue SM RX Prescription Drugs Benefits-at-a-Glance for Western Michigan Health Insurance Pool

Flexible Blue SM Plan 2 Medical Coverage with Flexible Blue SM RX Prescription Drugs Benefits-at-a-Glance for Western Michigan Health Insurance Pool The information in this document is based on BCBSM s

Flexible Blue SM Plan 2 Medical Coverage with Flexible Blue SM RX Prescription Drugs Benefits-at-a-Glance for Western Michigan Health Insurance Pool The information in this document is based on BCBSM s

Dickinson Wright, PLLC 03956-006

Dickinson Wright, PLLC 03956-006 Flexible Blue SM Plan 3 Medical Coverage with Preventive Care and Mammography Benefits Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only

Dickinson Wright, PLLC 03956-006 Flexible Blue SM Plan 3 Medical Coverage with Preventive Care and Mammography Benefits Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview of your benefits.

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview of your benefits.

Member s responsibility (deductibles, copays, coinsurance and dollar maximums)

MICHIGAN CATHOLIC CONFERENCE January 2015 Benefit Summary This is intended as an easy-to-read summary and provides only a general overview of your benefits. It is not a contract. Additional limitations

MICHIGAN CATHOLIC CONFERENCE January 2015 Benefit Summary This is intended as an easy-to-read summary and provides only a general overview of your benefits. It is not a contract. Additional limitations

Health Plans Coverage Summary

www.hr.msu.edu/openenrollment Faculty & Staff Health Plans Coverage Summary PREVENTIVE SERVICES Health Maintenance Exam (1) Annual Gynecological Exam Pap Smear Screening (lab services only) Mammography

www.hr.msu.edu/openenrollment Faculty & Staff Health Plans Coverage Summary PREVENTIVE SERVICES Health Maintenance Exam (1) Annual Gynecological Exam Pap Smear Screening (lab services only) Mammography

Delta College 007000338-0001, 0002, 0003, 0004, 0005, 0006, 0007 Community Blue SM PPO Medical Coverage Benefits-at-a-Glance

Delta College 007000338-0001, 0002, 0003, 0004, 0005, 0006, 0007 Community Blue SM PPO Medical Coverage Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

Delta College 007000338-0001, 0002, 0003, 0004, 0005, 0006, 0007 Community Blue SM PPO Medical Coverage Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

Michigan Electrical Employees Health Plan Benefits & Eligibility-at-a Glance Supplement to Medicare - Medicare Enrollees

Medicare Coverage BCBSM Supp Coverage Preventive Services 12 months, if age 50 and older Colonoscopy - one per calendar year 1 0 years (if at high risk every 24 months) approved amount**, once per flu

Medicare Coverage BCBSM Supp Coverage Preventive Services 12 months, if age 50 and older Colonoscopy - one per calendar year 1 0 years (if at high risk every 24 months) approved amount**, once per flu

Health Insurance Benefits Summary

Independent licensee of the Blue Cross and Blue Shield Association Health Insurance Benefits Summary Community Blue SM PPO Health Maintenance Exam (1) Covered 100%, one per calendar year, includes select

Independent licensee of the Blue Cross and Blue Shield Association Health Insurance Benefits Summary Community Blue SM PPO Health Maintenance Exam (1) Covered 100%, one per calendar year, includes select

Southern Healthcare Agency Network Blue Summary of Benefits

Southern Healthcare Agency Network Blue Summary of Benefits This summary is designed for the purpose of presenting general information only and is not intended as a guarantee of benefits. It is not a Summary

Southern Healthcare Agency Network Blue Summary of Benefits This summary is designed for the purpose of presenting general information only and is not intended as a guarantee of benefits. It is not a Summary

CATEGORY AFSCME Comprehensive Plan OU PPO

APPENDIX B BENEFIT PLAN SUMMARY CHART CATEGORY AFSCME Comprehensive Plan OU PPO Premiums 2010-2011 Plan Year 2010-2011 Plan Year Annual Wages: $0 - $34,600 $13.50 EE only $24.00 EE + Child $24.00 EE +

APPENDIX B BENEFIT PLAN SUMMARY CHART CATEGORY AFSCME Comprehensive Plan OU PPO Premiums 2010-2011 Plan Year 2010-2011 Plan Year Annual Wages: $0 - $34,600 $13.50 EE only $24.00 EE + Child $24.00 EE +

FEATURES NETWORK OUT-OF-NETWORK

Schedule of Benefits Employer: The Vanguard Group, Inc. ASA: 697478-A Issue Date: January 1, 2014 Effective Date: January 1, 2014 Schedule: 3B Booklet Base: 3 For: Choice POS II - 950 Option - Retirees

Schedule of Benefits Employer: The Vanguard Group, Inc. ASA: 697478-A Issue Date: January 1, 2014 Effective Date: January 1, 2014 Schedule: 3B Booklet Base: 3 For: Choice POS II - 950 Option - Retirees

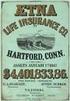

Aetna Life Insurance Company

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN GP-861472 This Amendment is effective

Sherwin-Williams Medical, Prescription Drug and Dental Plans Plan Comparison Charts

Sherwin-Williams Medical, Prescription Drug and Dental Plans Plan Comparison Charts You and Sherwin-Williams share the cost of certain benefits including medical and dental coverage and you have the opportunity

Sherwin-Williams Medical, Prescription Drug and Dental Plans Plan Comparison Charts You and Sherwin-Williams share the cost of certain benefits including medical and dental coverage and you have the opportunity

UNITED TEACHER ASSOCIATES INSURANCE COMPANY P.O. Box 26580 Austin, Texas 78755-0580 (800) 880-8824

UNITED TEACHER ASSOCIATES INSURANCE COMPANY P.O. Box 26580 Austin, Texas 78755-0580 (800) 880-8824 OUTLINE OF MEDICARE SUPPLEMENT COVERAGE - COVER PAGE BASIC AND EXTENDED BASIC PLANS The Commissioner of

UNITED TEACHER ASSOCIATES INSURANCE COMPANY P.O. Box 26580 Austin, Texas 78755-0580 (800) 880-8824 OUTLINE OF MEDICARE SUPPLEMENT COVERAGE - COVER PAGE BASIC AND EXTENDED BASIC PLANS The Commissioner of

PLAN DESIGN AND BENEFITS HMO Open Access Plan 912

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $2,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $2,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services

2015HEALTH PLAN PROFILES

2015HEALTH PLAN PROFILES PLAN TYPE MANAGED CARE PLANS TRADITIONAL PLAN TRADITIONAL PPO PLAN U-M Premier Care Health Alliance Plan Comprehensive Major Medical PPO Address 2311 Green Road Ann Arbor, MI 48105

2015HEALTH PLAN PROFILES PLAN TYPE MANAGED CARE PLANS TRADITIONAL PLAN TRADITIONAL PPO PLAN U-M Premier Care Health Alliance Plan Comprehensive Major Medical PPO Address 2311 Green Road Ann Arbor, MI 48105

PLAN DESIGN AND BENEFITS POS Open Access Plan 1944

PLAN FEATURES PARTICIPATING Deductible (per calendar year) $3,000 Individual $9,000 Family $4,000 Individual $12,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being

PLAN FEATURES PARTICIPATING Deductible (per calendar year) $3,000 Individual $9,000 Family $4,000 Individual $12,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being

SMALL GROUP PLAN DESIGN AND BENEFITS OPEN CHOICE OUT-OF-STATE PPO PLAN - $1,000

PLAN FEATURES PREFERRED CARE NON-PREFERRED CARE Deductible (per calendar year; applies to all covered services) $1,000 Individual $3,000 Family $2,000 Individual $6,000 Family Plan Coinsurance ** 80% 60%

PLAN FEATURES PREFERRED CARE NON-PREFERRED CARE Deductible (per calendar year; applies to all covered services) $1,000 Individual $3,000 Family $2,000 Individual $6,000 Family Plan Coinsurance ** 80% 60%

MICHIGAN PUBLIC SCHOOL EMPLOYEES RETIREMENT SYSTEM

MICHIGAN PUBLIC SCHOOL EMPLOYEES RETIREMENT SYSTEM 2015 Health Plan Seminar Medicare Plus Blue is a PPO plan with a Medicare contract. Enrollment in Medicare Plus Blue depends on contract renewal. H9572_S_15MPSERSSem

MICHIGAN PUBLIC SCHOOL EMPLOYEES RETIREMENT SYSTEM 2015 Health Plan Seminar Medicare Plus Blue is a PPO plan with a Medicare contract. Enrollment in Medicare Plus Blue depends on contract renewal. H9572_S_15MPSERSSem

Blue Cross Premier Bronze Extra

An individual PPO health plan from Blue Cross Blue Shield of Michigan. You will have a broad choice of doctors and hospitals within Blue Cross Blue Shield of Michigan s unsurpassed statewide PPO network

An individual PPO health plan from Blue Cross Blue Shield of Michigan. You will have a broad choice of doctors and hospitals within Blue Cross Blue Shield of Michigan s unsurpassed statewide PPO network

A partnership that offers an exclusive insurance product! The Chambers of Commerce in Hamilton County and ADVANTAGE Health Solutions, Inc.

The Chambers of Commerce in Hamilton County and ADVANTAGE Health Solutions, Inc. SM A partnership that offers an exclusive insurance product! CHAMBER OF COMMERCE The Chambers of Commerce in Hamilton County

The Chambers of Commerce in Hamilton County and ADVANTAGE Health Solutions, Inc. SM A partnership that offers an exclusive insurance product! CHAMBER OF COMMERCE The Chambers of Commerce in Hamilton County

State of Michigan. Benefit Comparison Chart & Bi-weekly Insurance Rates

Benefit Comparison Chart & Bi-weekly Insurance Rates For The Benefit Year October 2011 September 2012 Comparison of Health Care Options Disclaimer This is intended as an easy-to-read summary. It is not

Benefit Comparison Chart & Bi-weekly Insurance Rates For The Benefit Year October 2011 September 2012 Comparison of Health Care Options Disclaimer This is intended as an easy-to-read summary. It is not

ALPA COMPASS ACCIDENT AND CRITICAL ILLNESS INSURANCE Frequently Asked Questions (FAQs)

1. What is Compass Critical Illness insurance and who can be covered? 1a. What Critical Illnesses are covered? 1b. Is health screening required or is there a waiting period? 1c. Is there a pre-existing

1. What is Compass Critical Illness insurance and who can be covered? 1a. What Critical Illnesses are covered? 1b. Is health screening required or is there a waiting period? 1c. Is there a pre-existing

Schedule of Benefits for UAW-General Motors Retirees

Schedule of Benefits for UAW-General Motors Retirees Addendum to the Summary Plan Description Published: January 2010 The Committee of the UAW Retiree Medical Benefits Trust is pleased to provide you with

Schedule of Benefits for UAW-General Motors Retirees Addendum to the Summary Plan Description Published: January 2010 The Committee of the UAW Retiree Medical Benefits Trust is pleased to provide you with

*If a spouse is enrolling, a signature must be included on the enrollment form & medical questionnaire

Small Employer Cover Sheet & Checklist New Business Case Information Aetna Small Group Underwriting 4300 Centreway Place, Arlington, TX 76018 P.O. Box 91507 Arlington, TX 76015-0007 Phone (866) 899-4379

Small Employer Cover Sheet & Checklist New Business Case Information Aetna Small Group Underwriting 4300 Centreway Place, Arlington, TX 76018 P.O. Box 91507 Arlington, TX 76015-0007 Phone (866) 899-4379

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC.

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC. CPOS II DEDUCTIBLE, COPAYS/COINSURANCE AND DOLLAR MAXIMUMS and Aligned Deductible

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC. CPOS II DEDUCTIBLE, COPAYS/COINSURANCE AND DOLLAR MAXIMUMS and Aligned Deductible

COVERAGE SCHEDULE. The following symbols are used to identify Maximum Benefit Levels, Limitations, and Exclusions:

Exhibit D-3 HMO 1000 Coverage Schedule ROCKY MOUNTAIN HEALTH PLANS GOOD HEALTH HMO $1000 DEDUCTIBLE / 75 PLAN EVIDENCE OF COVERAGE LARGE GROUP Underwritten by Rocky Mountain Health Maintenance Organization,

Exhibit D-3 HMO 1000 Coverage Schedule ROCKY MOUNTAIN HEALTH PLANS GOOD HEALTH HMO $1000 DEDUCTIBLE / 75 PLAN EVIDENCE OF COVERAGE LARGE GROUP Underwritten by Rocky Mountain Health Maintenance Organization,

UNITED WORLD LIFE INSURANCE COMPANY OMAHA, NEBRASKA A Mutual of Omaha Company OUTLINE OF MEDICARE SUPPLEMENT COVERAGE COVER PAGE

UNITED WORLD LIFE INSURANCE COMPANY OMAHA, NEBRASKA A Mutual of Omaha Company OUTLINE OF MEDICARE SUPPLEMENT COVERAGE COVER PAGE The Commissioner of Insurance of the State of Minnesota has established

UNITED WORLD LIFE INSURANCE COMPANY OMAHA, NEBRASKA A Mutual of Omaha Company OUTLINE OF MEDICARE SUPPLEMENT COVERAGE COVER PAGE The Commissioner of Insurance of the State of Minnesota has established

Aetna Life Insurance Company Hartford, Connecticut 06156

Aetna Life Insurance Company Hartford, Connecticut 06156 Extraterritorial Certificate Rider (GR-9N-CR1) Policyholder: The TLC Companies Group Policy No.: GP-811431 Rider: West Virginia ET Medical Issue

Aetna Life Insurance Company Hartford, Connecticut 06156 Extraterritorial Certificate Rider (GR-9N-CR1) Policyholder: The TLC Companies Group Policy No.: GP-811431 Rider: West Virginia ET Medical Issue

PLAN DESIGN AND BENEFITS Basic HMO Copay Plan 1-10

PLAN FEATURES Deductible (per calendar year) Member Coinsurance Not Applicable Not Applicable Out-of-Pocket Maximum $5,000 Individual (per calendar year) $10,000 Family Once the Family Out-of-Pocket Maximum

PLAN FEATURES Deductible (per calendar year) Member Coinsurance Not Applicable Not Applicable Out-of-Pocket Maximum $5,000 Individual (per calendar year) $10,000 Family Once the Family Out-of-Pocket Maximum

BENEFIT PLAN. What Your Plan Covers and How Benefits are Paid. Prepared Exclusively for Cerner Corporation (Expatriate Employees)

BENEFIT PLAN Prepared Exclusively for Cerner Corporation (Expatriate Employees) What Your Plan Covers and How Benefits are Paid PPO Medical, PPO Dental, Basic Vision and Pharmacy Aetna Life and Casualty

BENEFIT PLAN Prepared Exclusively for Cerner Corporation (Expatriate Employees) What Your Plan Covers and How Benefits are Paid PPO Medical, PPO Dental, Basic Vision and Pharmacy Aetna Life and Casualty

Frequently Asked Questions on Consumer-Driven Health Plan and Health Savings Accounts

Frequently Asked Questions on Consumer-Driven Health Plan and Health Savings Accounts In 2007, Dow Corning implemented a Consumer-Driven Health Plan (CDHP) option that includes a Health Savings Account

Frequently Asked Questions on Consumer-Driven Health Plan and Health Savings Accounts In 2007, Dow Corning implemented a Consumer-Driven Health Plan (CDHP) option that includes a Health Savings Account

BENEFIT PLAN. What Your Plan Covers and How Benefits are Paid. Prepared Exclusively for ConocoPhillips

BENEFIT PLAN Prepared Exclusively for ConocoPhillips What Your Plan Covers and How Benefits are Paid PPO Medical, Pharmacy, and Comprehensive Dental Inpatriate Plan Aetna Life Insurance Company Booklet-Certificate

BENEFIT PLAN Prepared Exclusively for ConocoPhillips What Your Plan Covers and How Benefits are Paid PPO Medical, Pharmacy, and Comprehensive Dental Inpatriate Plan Aetna Life Insurance Company Booklet-Certificate

Plan is available throughout Colorado AVAILABLE

Schedule of Benefits (Who Pays What) Anthem Blue Cross and Blue Shield Name of Carrier BluePreferred for Group Name of Plan F-20-500/6350-90% 15/40/60/30% PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Preferred

Schedule of Benefits (Who Pays What) Anthem Blue Cross and Blue Shield Name of Carrier BluePreferred for Group Name of Plan F-20-500/6350-90% 15/40/60/30% PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Preferred

Kaiser Permanente 2015 Sample Fee List 1 Members in any deductible plan can use this list to help estimate their charges.

Kaiser Permanente 2015 Sample Fee List 1 Members in any deductible plan can use this list to help estimate their charges. COLORADO As your partner in health, we want to help you manage your health care

Kaiser Permanente 2015 Sample Fee List 1 Members in any deductible plan can use this list to help estimate their charges. COLORADO As your partner in health, we want to help you manage your health care

Hospital Confinement Indemnity Insurance

Hospital Confinement Indemnity Insurance Medical BridgeSM 3000 Base / Plan 1 FL Can you afford the out-of-pocket costs not covered by your health insurance? coloniallife.com How will you cover all of your

Hospital Confinement Indemnity Insurance Medical BridgeSM 3000 Base / Plan 1 FL Can you afford the out-of-pocket costs not covered by your health insurance? coloniallife.com How will you cover all of your

MAYFLOWER MUNICIPAL HEALTH GROUP ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ PPO REVIEW OF BENEFITS

Fiscal Year 2015 2016 MAYFLOWER MUNICIPAL HEALTH GROUP ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ PPO REVIEW OF S ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Fiscal Year 2015 2016 MAYFLOWER MUNICIPAL HEALTH GROUP ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ PPO REVIEW OF S ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Additional Information Provided by Aetna Life Insurance Company

Additional Information Provided by Aetna Life Insurance Company Inquiry Procedure The plan of benefits described in the Booklet-Certificate is underwritten by: Aetna Life Insurance Company (Aetna) 151

Additional Information Provided by Aetna Life Insurance Company Inquiry Procedure The plan of benefits described in the Booklet-Certificate is underwritten by: Aetna Life Insurance Company (Aetna) 151

Legacy Medigap SM. Plan A and Plan C. Outline of Medigap insurance coverage and enrollment application for

2015 Medicare Supplement Coverage offered by Blue Cross Blue Shield of Michigan Legacy Medigap SM Outline of Medigap insurance coverage and enrollment application for Plan A and Plan C LEGM_S_LegacyMedigapBrochure

2015 Medicare Supplement Coverage offered by Blue Cross Blue Shield of Michigan Legacy Medigap SM Outline of Medigap insurance coverage and enrollment application for Plan A and Plan C LEGM_S_LegacyMedigapBrochure

Anthem Blue Cross Preferred Provider Organization (PPO)

Anthem Blue Cross Preferred Provider Organization (PPO) 1-877-687-0549 Call Monday through Friday from 8:30 a.m. to 7:00 p.m. Plan Highlights Medical Services at Discounted Rates Anthem Blue Cross has

Anthem Blue Cross Preferred Provider Organization (PPO) 1-877-687-0549 Call Monday through Friday from 8:30 a.m. to 7:00 p.m. Plan Highlights Medical Services at Discounted Rates Anthem Blue Cross has

Medical Plan - Healthfund

18 Medical Plan - Healthfund Oklahoma City Community College Effective Date: 07-01-2010 Aetna HealthFund Open Choice (PPO) - Oklahoma PLAN DESIGN AND BENEFITS PROVIDED BY AETNA LIFE INSURANCE COMPANY -

18 Medical Plan - Healthfund Oklahoma City Community College Effective Date: 07-01-2010 Aetna HealthFund Open Choice (PPO) - Oklahoma PLAN DESIGN AND BENEFITS PROVIDED BY AETNA LIFE INSURANCE COMPANY -

MedicareBlue Supplement

SM MedicareBlue Supplement Plans A, D, F, High Deductible F, and N 2015 Outlines of Coverage Benefit Chart of Medicare Supplement Plans Sold for Effective Dates on or after January 1, 2015 This chart shows

SM MedicareBlue Supplement Plans A, D, F, High Deductible F, and N 2015 Outlines of Coverage Benefit Chart of Medicare Supplement Plans Sold for Effective Dates on or after January 1, 2015 This chart shows

SHIIP Combo Form. 1-855-408-1212 www.ncshiip.com. North Carolina Department of Insurance Wayne Goodwin, Commissioner

SHIIP Combo Form Seniors Health Insurance Information Program North Carolina Department of Insurance Wayne Goodwin, Commissioner 1-855-408-1212 www.ncshiip.com What is SHIIP? Seniors Health Insurance Information

SHIIP Combo Form Seniors Health Insurance Information Program North Carolina Department of Insurance Wayne Goodwin, Commissioner 1-855-408-1212 www.ncshiip.com What is SHIIP? Seniors Health Insurance Information

PLAN DESIGN AND BENEFITS - Tx OAMC 2500 08 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $5,000 Individual $7,500 3 Individuals per $15,000 3 Individuals per Unless otherwise indicated, the Deductible must be met prior to benefits

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $5,000 Individual $7,500 3 Individuals per $15,000 3 Individuals per Unless otherwise indicated, the Deductible must be met prior to benefits

Schedule of Benefits (Who Pays What) HMO Colorado Name of Carrier BlueAdvantage HMO Plan $1,500 Deductible 30/$200D Name of Plan $200D-15/40/60/30%

Schedule of Benefits (Who Pays What) HMO Colorado Name of Carrier BlueAdvantage HMO Plan $1,500 Deductible 30/$200D Name of Plan $200D-15/40/60/30% PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Health maintenance

Schedule of Benefits (Who Pays What) HMO Colorado Name of Carrier BlueAdvantage HMO Plan $1,500 Deductible 30/$200D Name of Plan $200D-15/40/60/30% PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Health maintenance

Health Check HSA. Quality, flexible. Combined with money-saving tax advantages.

Health Check HSA Quality, flexible Combined with money-saving tax advantages. Blue Cross and Blue Shield quality coverage that combines with a tax-deductible, tax-free health savings account: That s Health

Health Check HSA Quality, flexible Combined with money-saving tax advantages. Blue Cross and Blue Shield quality coverage that combines with a tax-deductible, tax-free health savings account: That s Health

MedicareBlue Supplement SM

MedicareBlue Supplement SM Important Information about the enclosed premiums and Medicare deductibles and cost-sharing amounts The MedicareBlue Supplement information enclosed in this Outline of Coverage

MedicareBlue Supplement SM Important Information about the enclosed premiums and Medicare deductibles and cost-sharing amounts The MedicareBlue Supplement information enclosed in this Outline of Coverage

New York Small Group Indemnity Aetna Life Insurance Company Plan Effective Date: 10/01/2010. PLAN DESIGN AND BENEFITS - NY Indemnity 1-10/10*

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $7,500 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $7,500 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

Understanding Health Insurance. Your Guide to the Affordable Care Act

Understanding Health Insurance Your Guide to the Affordable Care Act Summary Health insurance may seem like a luxury if you are on a tight budget. But protecting your health and your family is one of the

Understanding Health Insurance Your Guide to the Affordable Care Act Summary Health insurance may seem like a luxury if you are on a tight budget. But protecting your health and your family is one of the

Kaiser Permanente 2016 Sample Fees List 1

Kaiser Permanente 2016 Sample Fees List 1 SOUTHERN CALIFORNIA Knowing how much you can expect to pay for care and services can give you peace of mind. This Sample Fees List shows you estimated fees for

Kaiser Permanente 2016 Sample Fees List 1 SOUTHERN CALIFORNIA Knowing how much you can expect to pay for care and services can give you peace of mind. This Sample Fees List shows you estimated fees for

health insurance Starting at $62.50 per month

health insurance Starting at $62.50 per month Exclusive student health plan for: Academic Year 2012 2013 Student Blue benefit plan information outlined within this booklet is subject to approval from the

health insurance Starting at $62.50 per month Exclusive student health plan for: Academic Year 2012 2013 Student Blue benefit plan information outlined within this booklet is subject to approval from the

Consumer Driven Health Plan (CDHP) with Health Savings Account (HSA)

Consumer Driven Health Plan (CDHP) with Health Savings Account (HSA) Michigan State University 2014 Open Enrollment Blue Care Network is a nonprofit corporation and independent licensee of the Blue Cross

Consumer Driven Health Plan (CDHP) with Health Savings Account (HSA) Michigan State University 2014 Open Enrollment Blue Care Network is a nonprofit corporation and independent licensee of the Blue Cross

Schedule of Benefits (Who Pays What) Anthem Blue Cross and Blue Shield Name of Carrier BlueClassic for District 49 Name of Plan 25-50-1500/3000-80%

Schedule of Benefits (Who Pays What) Anthem Blue Cross and Blue Shield Name of Carrier BlueClassic for District 49 Name of Plan 25-50-1500/3000-80% PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Preferred Provider

Schedule of Benefits (Who Pays What) Anthem Blue Cross and Blue Shield Name of Carrier BlueClassic for District 49 Name of Plan 25-50-1500/3000-80% PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Preferred Provider

LOCKHEED MARTIN AERONAUTICS COMPANY PALMDALE 2011 IAM NEGOTIATIONS UNDER AGE 65 LM HEALTHWORKS SUMMARY

Annual Deductibles, Out-of-Pocket Maximums, Lifetime Maximum Benefits Calendar Year Deductible Calendar Year Out-of- Pocket Maximum Lifetime Maximum Per Individual Physician Office Visits Primary Care

Annual Deductibles, Out-of-Pocket Maximums, Lifetime Maximum Benefits Calendar Year Deductible Calendar Year Out-of- Pocket Maximum Lifetime Maximum Per Individual Physician Office Visits Primary Care

CLINICAL PRIVILEGES- NURSE MIDWIFE

Name: Page 1 Initial Appointment Reappointment Department Specialty Area All new applicants must meet the following requirements as approved by the governing body effective: Applicant: Check off the Requested

Name: Page 1 Initial Appointment Reappointment Department Specialty Area All new applicants must meet the following requirements as approved by the governing body effective: Applicant: Check off the Requested

California Small Group MC Aetna Life Insurance Company

PLAN FEATURES Deductible (per calendar year) $3,000 Individual $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate separately

PLAN FEATURES Deductible (per calendar year) $3,000 Individual $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate separately

BRYN MAWR COLLEGE MEDICAL INSURANCE BENEFITS COMPARISON EFFECTIVE NOVEMBER 1, 2009

BENEFITS Description of Plan Annual Deductible (January - December) - Individual - Family PERSONAL CHOICE PPO BRYN MAWR COLLEGE KEYSTONE HEALTH PLAN EAST KEYSTONE POS Provides comprehensive health Provides

BENEFITS Description of Plan Annual Deductible (January - December) - Individual - Family PERSONAL CHOICE PPO BRYN MAWR COLLEGE KEYSTONE HEALTH PLAN EAST KEYSTONE POS Provides comprehensive health Provides

PLAN DESIGN AND BENEFITS - Tx OAMC Basic 2500-10 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $4,000 Individual $7,500 Family $12,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $4,000 Individual $7,500 Family $12,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

Preventive Care Recommendations THE BASIC FACTS

Preventive Care Recommendations THE BASIC FACTS MULTIPLE SCLEROSIS Carlos Healey, diagnosed in 2001 The Three Most Common Eye Disorders in Multiple Sclerosis Blood Pressure & Pulse Height & Weight Complete

Preventive Care Recommendations THE BASIC FACTS MULTIPLE SCLEROSIS Carlos Healey, diagnosed in 2001 The Three Most Common Eye Disorders in Multiple Sclerosis Blood Pressure & Pulse Height & Weight Complete

Coventry Health and Life Insurance Company PPO Schedule of Benefits

State(s) of Issue: Oklahoma PPO Plan: OI08C30050 30 Coventry Health and Life Insurance Company PPO Schedule of Benefits Covered Services Contract Year Deductible For All Eligible Expenses (unless otherwise

State(s) of Issue: Oklahoma PPO Plan: OI08C30050 30 Coventry Health and Life Insurance Company PPO Schedule of Benefits Covered Services Contract Year Deductible For All Eligible Expenses (unless otherwise

Coverage for preventive care

Coverage for preventive care Understanding your preventive care coverage Preventive care, like screenings and immunizations, helps you and your family stay healthier and can help lower your overall out-of-pocket

Coverage for preventive care Understanding your preventive care coverage Preventive care, like screenings and immunizations, helps you and your family stay healthier and can help lower your overall out-of-pocket

PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80

Georgia Health Network Option (POS Open Access) PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80 PLAN FEATURES PARTICIPATING PROVIDERS NON-PARTICIPATING PROVIDERS Deductible (per calendar year)

Georgia Health Network Option (POS Open Access) PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80 PLAN FEATURES PARTICIPATING PROVIDERS NON-PARTICIPATING PROVIDERS Deductible (per calendar year)

Preventive health guidelines As of May 2014

To learn more about your plan, please see anthem.com/ca. To learn more about vaccines, please see the Centers for Disease Control and Prevention (CDC) website: cdc.gov. Preventive health guidelines As

To learn more about your plan, please see anthem.com/ca. To learn more about vaccines, please see the Centers for Disease Control and Prevention (CDC) website: cdc.gov. Preventive health guidelines As

Business Life Insurance - Health & Medical Billing Requirements

PLAN FEATURES Deductible (per plan year) $2,000 Employee $2,000 Employee $3,000 Employee + Spouse $3,000 Employee + Spouse $3,000 Employee + Child(ren) $3,000 Employee + Child(ren) $4,000 Family $4,000

PLAN FEATURES Deductible (per plan year) $2,000 Employee $2,000 Employee $3,000 Employee + Spouse $3,000 Employee + Spouse $3,000 Employee + Child(ren) $3,000 Employee + Child(ren) $4,000 Family $4,000

PLAN DESIGN AND BENEFITS - New York Open Access EPO 1-10/10

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $3,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $3,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

Lumenos HIA Lumenos HIA Plus. Getting healthy. Staying healthy. And saving money while you do it.

A consumer-driven health plan designed to help individuals and families control their out-of-pocket health expenses Getting healthy. Staying healthy. And saving money while you do it. MCEBR550A (3/09)

A consumer-driven health plan designed to help individuals and families control their out-of-pocket health expenses Getting healthy. Staying healthy. And saving money while you do it. MCEBR550A (3/09)

Supplemental Coverage Option 2 + 1

Supplemental Coverage Option 2 + 1 Supplemental coverage gives you total health protection Our Blues Supplemental coverage fills in many of the Medicare gaps like deductible, and copayment amounts that

Supplemental Coverage Option 2 + 1 Supplemental coverage gives you total health protection Our Blues Supplemental coverage fills in many of the Medicare gaps like deductible, and copayment amounts that

Greater Tompkins County Municipal Health Insurance Consortium

WHO IS COVERED Requires both Medicare A & B enrollment. Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement None None Medical Benefit Management Program Not

WHO IS COVERED Requires both Medicare A & B enrollment. Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement None None Medical Benefit Management Program Not

STEPPING INTO MEDICARE. Invaluable help from the name you know and trust Blue Cross and Blue Shield of Illinois

STEPPING INTO MEDICARE Invaluable help from the name you know and trust Blue Cross and Blue Shield of Illinois Blue Cross and Blue Shield of Illinois offers a great array of plans that pick up where Medicare

STEPPING INTO MEDICARE Invaluable help from the name you know and trust Blue Cross and Blue Shield of Illinois Blue Cross and Blue Shield of Illinois offers a great array of plans that pick up where Medicare

Annually for adults ages 55 80 years with 30 pack/year smoking history and currently smoke or quit within the past 15 years Hepatitis B screening

Preventive Care Schedule Effective January 1, 2016 Highmark Blue Cross Blue Shield Express Scripts The plan pays for preventive care only when given by a network provider. Certain vaccines are available

Preventive Care Schedule Effective January 1, 2016 Highmark Blue Cross Blue Shield Express Scripts The plan pays for preventive care only when given by a network provider. Certain vaccines are available

Preventive Health Services

understanding Preventive Health Services For the most current version of this document, visit www.wellwithbluemt.com or www.bcbsmt.com. Preventive health services include evidence-based screenings, immunizations,

understanding Preventive Health Services For the most current version of this document, visit www.wellwithbluemt.com or www.bcbsmt.com. Preventive health services include evidence-based screenings, immunizations,

SUMMARY OF CONTRACT CHANGES

SUMMARY OF CONTRACT CHANGES Alaska Insured Non-Grandfathered Group Plans (51-99 employees) For renewals from January 1, 2014 to December 1, 2014 Premera Blue Cross Blue Shield of Alaska has made changes

SUMMARY OF CONTRACT CHANGES Alaska Insured Non-Grandfathered Group Plans (51-99 employees) For renewals from January 1, 2014 to December 1, 2014 Premera Blue Cross Blue Shield of Alaska has made changes

IL Small Group PPO Aetna Life Insurance Company Plan Effective Date: 04/01/2009 PLAN DESIGN AND BENEFITS- PPO HSA HDHP $2,500 100/80 (04/09)

PLAN FEATURES OUT-OF- Deductible (per calendar ) $2,500 Individual $5,000 Individual $5,000 Family $10,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable.

PLAN FEATURES OUT-OF- Deductible (per calendar ) $2,500 Individual $5,000 Individual $5,000 Family $10,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable.

Wellesley College Health Insurance Program Information

Wellesley College Health Insurance Program Information Beginning August 15, 2013 Health Services All Wellesley College students, including Davis Scholars and Exchange students are encouraged to seek services

Wellesley College Health Insurance Program Information Beginning August 15, 2013 Health Services All Wellesley College students, including Davis Scholars and Exchange students are encouraged to seek services

Bates College Effective date: 01-01-2010 HMO - Maine PLAN DESIGN AND BENEFITS PROVIDED BY AETNA HEALTH INC. - FULL RISK PLAN FEATURES

PLAN FEATURES Deductible (per calendar year) $500 Individual $1,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Once Family Deductible is met, all family

PLAN FEATURES Deductible (per calendar year) $500 Individual $1,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Once Family Deductible is met, all family

Kraft Foods Group, Inc. Retiree Medical and Prescription Plan Summary High Deductible Health Plan

General Provisions Deductible (eligible medical and prescription drug expenses apply to the deductible) Kraft Foods Group, Inc. Retiree Medical and Prescription Plan Summary Care can be obtained in-network

General Provisions Deductible (eligible medical and prescription drug expenses apply to the deductible) Kraft Foods Group, Inc. Retiree Medical and Prescription Plan Summary Care can be obtained in-network

PPO Choice. It s Your Choice!

Offered by Capital Advantage Insurance Company A Capital BlueCross Company PPO Choice It s Your Choice! Issued by Capital Advantage Insurance Company, a Capital BlueCross subsidiary. Independent licensees

Offered by Capital Advantage Insurance Company A Capital BlueCross Company PPO Choice It s Your Choice! Issued by Capital Advantage Insurance Company, a Capital BlueCross subsidiary. Independent licensees

Colorado Springs Health Partners INDIVIDUAL & FAMILY PLANS. MK647-A-R10/01/14þ

Colorado Springs Health Partners INDIVIDUAL & FAMILY PLANS MK647-A-R10/01/14þ WE UNDERSTAND COLORADO. WE UNDERSTAND YOU. Rocky Mountain Health Plans, a Colorado-based, not-for-profit health plan, understands

Colorado Springs Health Partners INDIVIDUAL & FAMILY PLANS MK647-A-R10/01/14þ WE UNDERSTAND COLORADO. WE UNDERSTAND YOU. Rocky Mountain Health Plans, a Colorado-based, not-for-profit health plan, understands

2016 HealthFlex Plan Comparison: PPO B1000 with HRA and HDHP H1500 with HSA

Caring For Those Who Serve 1901 Chestnut Avenue Glenview, Illinois 60025-1604 1-800-851-2201 www.gbophb.org 2016 HealthFlex Plan Comparison: PPO B1000 with HRA and HDHP H1500 with HSA Please note: This

Caring For Those Who Serve 1901 Chestnut Avenue Glenview, Illinois 60025-1604 1-800-851-2201 www.gbophb.org 2016 HealthFlex Plan Comparison: PPO B1000 with HRA and HDHP H1500 with HSA Please note: This

Health Insurance Shopper s Guide Information to help you choose a health plan for you and your family.

Health Insurance Shopper s Guide Information to help you choose a health plan for you and your family. who needs Nobody knows the future. But you can plan for it and protect yourself and your family with

Health Insurance Shopper s Guide Information to help you choose a health plan for you and your family. who needs Nobody knows the future. But you can plan for it and protect yourself and your family with

Gold 750 PCP. Balance Gold 750 PCP 49831WA1660002 035382 (02-2016)

Gold 750 PCP Balance Gold 750 PCP 49831WA1660002 035382 (02-2016) INTRODUCTION Welcome Thank you for choosing Premera Blue Cross (Premera) for your healthcare coverage. This benefit booklet tells you about

Gold 750 PCP Balance Gold 750 PCP 49831WA1660002 035382 (02-2016) INTRODUCTION Welcome Thank you for choosing Premera Blue Cross (Premera) for your healthcare coverage. This benefit booklet tells you about

HCR 101: Your Guide to Understanding Healthcare Reform

HCR 101: Your Guide to Understanding Healthcare Reform Are You Ready for Healthcare Reform? By now, you ve probably been hearing a lot about the Affordable Care Act (also known as healthcare reform or

HCR 101: Your Guide to Understanding Healthcare Reform Are You Ready for Healthcare Reform? By now, you ve probably been hearing a lot about the Affordable Care Act (also known as healthcare reform or

Boston College Student Blue PPO Plan Coverage Period: 2015-2016

Boston College Student Blue PPO Plan Coverage Period: 2015-2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual and Family Plan Type: PPO This is only a

Boston College Student Blue PPO Plan Coverage Period: 2015-2016 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual and Family Plan Type: PPO This is only a

California PCP Selected* Not Applicable

PLAN FEATURES Deductible (per calendar ) Member Coinsurance * Not Applicable ** Not Applicable Copay Maximum (per calendar ) $3,000 per Individual $6,000 per Family All member copays accumulate toward

PLAN FEATURES Deductible (per calendar ) Member Coinsurance * Not Applicable ** Not Applicable Copay Maximum (per calendar ) $3,000 per Individual $6,000 per Family All member copays accumulate toward

LEARN. Your guide to health insurance

LEARN Your guide to health insurance Table of Contents Why health insurance is important...1 How the Affordable Care Act affects you...2 See if you may qualify for a subsidy...4 Types of health plans...6

LEARN Your guide to health insurance Table of Contents Why health insurance is important...1 How the Affordable Care Act affects you...2 See if you may qualify for a subsidy...4 Types of health plans...6

PLAN DESIGN AND BENEFITS AETNA LIFE INSURANCE COMPANY - Insured

PLAN FEATURES Deductible (per calendar year) Individual $750 Individual $1,500 Family $2,250 Family $4,500 All covered expenses accumulate simultaneously toward both the preferred and non-preferred Deductible.

PLAN FEATURES Deductible (per calendar year) Individual $750 Individual $1,500 Family $2,250 Family $4,500 All covered expenses accumulate simultaneously toward both the preferred and non-preferred Deductible.

MAP TO MEDICARE. H2461 101314 T01 CMS Accepted 10/21/2014 S5743 101414 K01 MN CMS Accepted 10/21/2014

2015 MAP TO MEDICARE H2461 101314 T01 CMS Accepted 10/21/2014 S5743 101414 K01 MN CMS Accepted 10/21/2014 MAP TO MEDICARE What is Medicare?...1 Part A: Hospital coverage...2 Part B: Medical coverage....3

2015 MAP TO MEDICARE H2461 101314 T01 CMS Accepted 10/21/2014 S5743 101414 K01 MN CMS Accepted 10/21/2014 MAP TO MEDICARE What is Medicare?...1 Part A: Hospital coverage...2 Part B: Medical coverage....3

Clear Creek Amana Community School District

Clear Creek Amana Community School District Clear Creek Amana CSD Plan Comparison Plan Design Purchasing Plan Buy Down Option 1: Wellmark Alliance Select Wellmark Alliance Select Buy Down Option 2: Wellmark

Clear Creek Amana Community School District Clear Creek Amana CSD Plan Comparison Plan Design Purchasing Plan Buy Down Option 1: Wellmark Alliance Select Wellmark Alliance Select Buy Down Option 2: Wellmark

HBS PPO Enhanced Plan B1 Benefits-at-a-Glance Trinity Health

HBS PPO Enhanced Plan B1 Benefits-at-a-Glance Trinity Health Deductible, Copays/Coinsurance and Dollar Maximums Deductible - per calendar year Tier 1 Tier 2 Tier 3 PPO In-Network Facility Trinity Health

HBS PPO Enhanced Plan B1 Benefits-at-a-Glance Trinity Health Deductible, Copays/Coinsurance and Dollar Maximums Deductible - per calendar year Tier 1 Tier 2 Tier 3 PPO In-Network Facility Trinity Health

Blue Care Elect Preferred 90 Copay Coverage Period: on or after 09/01/2015

Blue Care Elect Preferred 90 Copay Coverage Period: on or after 09/01/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual Only Plan Type: PPO This is only

Blue Care Elect Preferred 90 Copay Coverage Period: on or after 09/01/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual Only Plan Type: PPO This is only

Colorado Health Benefit Plan Description Form Anthem Blue Cross and Blue Shield Name of Carrier PPO $25/50 Copay $1,000D Name of Plan

Colorado Health Benefit Plan Description Form Anthem Blue Cross and Blue Shield Name of Carrier PPO $25/50 Copay $1,000D Name of Plan PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Preferred provider plan 2.

Colorado Health Benefit Plan Description Form Anthem Blue Cross and Blue Shield Name of Carrier PPO $25/50 Copay $1,000D Name of Plan PART A: TYPE OF COVERAGE 1. TYPE OF PLAN Preferred provider plan 2.

SUMMARY OF COVERAGE AND DISCLOSURE OF INFORMATION

SUMMARY OF COVERAGE AND DISCLOSURE OF INFORMATION Medicare Supplement and Medicare Select Plans Basic Medicare Supplement Basic Medicare Select: Senior Gold Extended Basic Supplement Blue Cross and Blue

SUMMARY OF COVERAGE AND DISCLOSURE OF INFORMATION Medicare Supplement and Medicare Select Plans Basic Medicare Supplement Basic Medicare Select: Senior Gold Extended Basic Supplement Blue Cross and Blue

What if you or a family member were hospitalized tomorrow...

What if you or a family member were hospitalized tomorrow... could you pay for your out-of-pocket treatment expenses, plus cover daily living expenses? CAR GROCERIES BILLS PRESCRIPTIONS Group Indemnity

What if you or a family member were hospitalized tomorrow... could you pay for your out-of-pocket treatment expenses, plus cover daily living expenses? CAR GROCERIES BILLS PRESCRIPTIONS Group Indemnity

HEALTH CARE REFORM. Preventive Care. BlueCross BlueShield of South Carolina and BlueChoice HealthPlan of South Carolina

HEALTH CARE REFORM Preventive Care BlueCross BlueShield of South Carolina and BlueChoice HealthPlan of South Carolina Preventive Care There was a time when an apple a day was the best preventive care advice

HEALTH CARE REFORM Preventive Care BlueCross BlueShield of South Carolina and BlueChoice HealthPlan of South Carolina Preventive Care There was a time when an apple a day was the best preventive care advice

Health Insurance Matrix 01/01/16-12/31/16

Employee Contributions Family Monthly : $121.20 Bi-Weekly : $60.60 Monthly : $290.53 Bi-Weekly : $145.26 Monthly : $431.53 Bi-Weekly : $215.76 Monthly : $743.77 Bi-Weekly : $371.88 Employee Contributions

Employee Contributions Family Monthly : $121.20 Bi-Weekly : $60.60 Monthly : $290.53 Bi-Weekly : $145.26 Monthly : $431.53 Bi-Weekly : $215.76 Monthly : $743.77 Bi-Weekly : $371.88 Employee Contributions

IN-NETWORK MEMBER PAYS. Out-of-Pocket Maximum (Includes a combination of deductible, copayments and coinsurance for health and pharmacy services)

HMO-OA-CNT-30-45-500-500D-13 HMO Open Access Contract Year Plan Benefit Summary This is a brief summary of benefits. Refer to your Membership Agreement for complete details on benefits, conditions, limitations

HMO-OA-CNT-30-45-500-500D-13 HMO Open Access Contract Year Plan Benefit Summary This is a brief summary of benefits. Refer to your Membership Agreement for complete details on benefits, conditions, limitations

Basic, including 100% Part B coinsurance. Foreign Travel Emergency

BLUE CROSS AND BLUE SHIELD OF SOUTH CAROLINA An Independent Licensee of the Blue Cross and Blue Shield Association OUTLINE OF MEDICARE SUPPLEMENT COVERAGE COVER PAGE 1 of 2: BENEFIT PLANS A, C, L and N

BLUE CROSS AND BLUE SHIELD OF SOUTH CAROLINA An Independent Licensee of the Blue Cross and Blue Shield Association OUTLINE OF MEDICARE SUPPLEMENT COVERAGE COVER PAGE 1 of 2: BENEFIT PLANS A, C, L and N

T - preventive services in context, this appendix

Appendix E: Current Coverage of Clinical Preventive Health Care Services in Public and Private Insurance o put the debate OVer insurance for T - preventive services in context, this appendix describes

Appendix E: Current Coverage of Clinical Preventive Health Care Services in Public and Private Insurance o put the debate OVer insurance for T - preventive services in context, this appendix describes

Preventive health guidelines As of May 2015

Preventive health guidelines As of May 2015 What is your plan for better health? Make this year your best year for wellness. Your health plan may help pay for tests to find disease early and routine wellness

Preventive health guidelines As of May 2015 What is your plan for better health? Make this year your best year for wellness. Your health plan may help pay for tests to find disease early and routine wellness