State of Illinois Comparison of Benchmark Options Grouped into the 10 categories of Essential Health Benefits required by the ACA

|

|

|

- Heather Walton

- 8 years ago

- Views:

Transcription

1 State of Illinois Comparison of Benchmark Options Grouped into the 10 categories of Essential Health Benefits required by the ACA Benefit Small Group s State s BCBS BCBS Edge CIGNA QCHP HA IL Entrepreneur 1. Ambulatory patient services a. Primary care to treat illness/injury b. Specialist visits c. Outpatient surgery d. Acupuncture medically necessary only limit 24 visits / yr limit 20 visits / yr e. Chiropractic limit 20 visits / year limit $1,000 / year limit $1,000 / year limit 30 visits / year f. Chemotherapy services * * g. Radiation therapy * * limit 12 visits / yr limit 20 visits / yr limit 12 visits / yr h. Infertility treatment services artificial insemination (AI)/intrauterine insemination (IUI) limit to 4 attempts /live birth; IVF limit to 4 attempts / live birth artificial insemination (AI) and IVF limit to 4 attempts / live birth from the first 4 allows 2 additional attempts artificial insemination (AI) and IVF limit to 4 attempts / live birth from the first 4 allows 2 additional attempts includes AI and ART coverage extent not mentioned. Assumed to include ART and AI, consistent with all other plans coverage extent not mentioned. Assumed to include ART and AI, consistent with all other plans includes AI and ART excludes assisted reproductive technology excludes assisted reproductive technology excludes assisted reproductive technology limit $3,000 / yr i. Sterilization j. Home health care limit 60 visits / year limit 25 visits / yr limit 25 visits / yr limit 50 visits / yr k. Foot care m. Medical contraceptives * n. Dental - diagnostic & preventive o. Dental - basic p. Dental - major * * * 2. Emergency services a. Emergency room - facility b. Emergency room - physician c. Ambulance service - ground and air 3. Hospitalization a. Inpatient medical and surgical care b. Organ & tissue transplants limited to organs specified limited to organs specified c. Bariatric surgery * * medically necessary only medically necessary only medically necessary only d. Anesthesia e. TMJ services limit $3,000 / year f. Breast reconstruction (non-cosmetic) g. Blood transfusions * * * h. Hospice / respite care Respite not mentioned, assume covered respite limit 7 consecutive days every 30 days respite limit 7 consecutive days every 30 days limited to organs specified 4. Maternity and newborn care a. Pre- & postnatal care b. Delivery & inpatient maternity services c. Newborn child coverage 5. Mental health and substance use disorder services, including behavioral health treatment a. Inpatient hospital - mental/behavioral health limit 30 days per year b. Outpatient hospital - mental/behavioral health limit 20 visits per year c. Inpatient hospital - chemical dependency limit 30 days per year d. Outpatient hospital - chemical dependency limit 20 visits per year e. Detoxification * f. Counseling or training in connection with family, sexual, marital, or occupational issues * * 6. Prescription drugs a. Retail b. Mail order c. Generic d. Brand e. Specialty f. Insulin/needles for diabetics g. Tobacco cessation drugs * * * * * * h. Contraceptives i. Fertility drugs * * * j. Growth hormone therapy * * * * * * 7. Rehabilitative and habilitative services and devices a. Inpatient rehabilitation * b. Physical, speech & occupational therapy (outpatient) 20 visits / year for PT limit 60 visits / yr combined for PT & 60 visits / year for PT/OT/ST 20 visits / year for OT 60 visits / year 60 visits / year 75 visits / yr 50 visits / yr OT 20 add'l visits / year for ST 20 visits / year for ST 30 visits / yr for ST c. Massage therapy * * * * limit $15,000 d. Durable medical equipment Limit $2,500 eligible expenses / year e. Prosthetics f. Orthotics * * g. Vision hardware - adults medical condition or accident only medical condition or accident only medical condition or accident only h. Hearing aids - adults i. Cochlear Implants j. Skilled nursing limit $2,500/year, single purchase/ 3 years limit 30 visits of post-cochlear implant aural therapy. limit 60 days / year limit $1,000 / 3 yrs limit $1,250 per ear / 3 yrs limit $1,250 per ear / 3 yrs * * * * limit 120 days/yr limit 120 days/yr limit 30 days but only with Medicare Part A limit $250 per ear / 5 yrs limit 14 days, $700 limit per day

2 State of Illinois Comparison of Benchmark Options Grouped into the 10 categories of Essential Health Benefits required by the ACA Benefit Small Group s State s BCBS BCBS Edge CIGNA QCHP HA IL Entrepreneur k. Habilitative services (not currently defined) * * * Limited to PT/ST/OT for conditions such as autism Limited to PT/ST/OT for conditions such as autism Limited to PT/ST/OT for conditions such as autism 8. Laboratory services a. Lab tests, x-ray services, & pathology b. Imaging / diagnostics (e.g., MRI, CT scan, PET scan) 9. Preventive and wellness services and chronic disease management a. Preventive care b. Immunizations c. Colorectal cancer screening d. Screening mammography e. Routine eye exams (separate office visit) - adults * * $150 / 3 years $150 / 3 years f. Routine hearing exams (separate office visit) - adults * * $150 / year g. Nutritional counseling $250 limit / yr h. Diabetes education * * i. Smoking cessation program 2 attempts / yr, 4 sessions / attempt j. Allergy testing & injections medically necessary only k. Diabetes - medically necessary equip. & supplies * * l. Screening pap tests m. Prostate cancer screening 10. Pediatric services, including oral and vision care a. Preventive care - physician services b. Immunizations c. Metabolic formula & low protein food for inborn errors of metabolism * d. Routine eye exams (separate office visit) * * 1 exam / 2 years e. Routine hearing exams (separate office visit) f. Hearing aids limit $2,500/year, single purchase/3 years $150 / year g. Dental - diagnostic & preventive h. Dental - basic * * $150 / year $150 / 3 years $150 / 3 years $150 / year limit $1,000 / 3 yrs limit $1,250 per ear / yr limit $1,250 per ear / yr i. Dental - major * * * $500 / yr for testing limit $250 per ear / 5 yrs Covered benefit. Any limits on the benefit are noted. Not a covered benefit * Assumption since not specifically stated The data provided in this chart is subject to change as additional federal guidance is provided with regard to EHB

3 State of Illinois Mandated Benefit Coverage by Benchmark Option Small Group s State s Alcoholism Requires coverage for the inpatient treatment of alcoholism. For group policies of 51 or more employees, benefits must comply with the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (Effective October 3, 2009)* and with the Illinois Mental Health Parity Public Act (Effective August 18, 2011). Health insurance policies that provide IP hospital coverage BCBS BCBS Edge CIGNA QCHP HA IL Alcoholism and Substance Abuse Requires coverage of diagnosis, detoxification, and treatment of medical complications of alcoholism to be the same as for any other illness. Alcohol rehabilitation must be covered but may be limited as specified in the Rule. Can be either inpatient or outpatient basis. Rehabilitation services must be included. For group contracts of 51 or more employees, benefits must comply with the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (Effective October 3, 2009)* and with the Illinois Mental Health Parity Public Act (Effective August 18, 2011). * Amino Acid-Based Elemental Formulas Requires coverage of non-prescription and specialized amino acidbased elemental formulas administered either by feeding tube or orally when prescribed by a physician as medically necessary for treatment of eosinophilic disorders and short bowel syndrome. The law does not designate a benefit level. * * * * Autism Spectrum Disorders Requires coverage for diagnosis and treatment of autism spectrum disorders for individuals under age 21. Effective December 12, 2008, group policies and contracts of 51 or more employees, benefits must comply with the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (Effective October 3, 2009).* Effective August 18, 2011, group policies and contracts of 51 or more employees, benefits must comply with the Illinois Mental Health Parity Public Act * * * * * * Breast Cancer Pain Requires coverage for all medically necessary pain medication and pain therapy related to breast cancer on the same terms and conditions generally applicable to coverage for other conditions. * * * * * * * * * Breast Exam Requires coverage of a complete and thorough physical examination of the breast at least every 3 years for women age between ages of 20 and 40; then annually for women age 40 and older. The law does not specify a benefit level. Coverage is required once a nationally recognized exam code is approved. * * * *

4 Small Group s State s BCBS BCBS Edge CIGNA QCHP HA IL Breast Ultrasound Screening Requires coverage for a comprehensive ultrasound screening when a mammogram demonstrates heterogeneous or dense breast tissue when found to be medically necessary by a physician. Benefits must be at least as favorable as for other radiological exams and subject to same dollar limits, deductibles and co-insurance amounts. * * * * * * Breast Implant Removal Cancer Clinical Trial Prohibits the denial of coverage for the removal of breast implants when such removal is medically necessary treatment for sickness or injury. This provision does not apply for implants implanted solely for cosmetic reasons. Prohibits group policies of accident and health insurance from excluding coverage for any routine patient care for insured who is participating in a qualified clinical cancer trial if the policy covers that care for patient not enrolled in a clinical cancer trial. * * * * * * * * * Health policies * * * * * Cancer Drug Parity Cancer Treatment Prescription Drugs Requires that orally-administered cancer medications be covered at same benefit as injected cancer medications to the extent coverage is provided by the policy. If a policy provides prescription drug benefits, it must also provide benefits for any drug that has been prescribed for the treatment of a type of cancer, even if the drug has not been approved for that specific cancer by the FDA. The drug must be approved by the FDA and must be recognized for treatment of the specific cancer for which it has been prescribed. The amendment effective August 14, 2009 provided current reference compendia that may be used. No that provides prescription drug coverage for certain types of cancer may exclude coverage of any drug on the basis that the drug has not been FDA approved for that particular type of cancer if documentation is provided in certain medical reference compendia as to the efficacy of that drug for the form of cancer in question, or if the drug has been recommended for that particular type of cancer in formal clinical studies, the results of which have been published in at least two peer reviewed professional medical journals here or in Great Britain. Health insurance policies * * * * * * * * * * * * * * * * * * Colorectal Cancer Screening Requires coverage for all colorectal cancer examinations and laboratory tests for colorectal cancer, in accordance with professional organizations and the federal government as specified in the law. September 23, Under the federal Affordable Care Act, coverage for colorectal cancer screening using fecal occult blood testing, sigmoidoscopy, or colonoscopy, in adults beginning at age 50 and continuing until age 75 must be provided without any cost-sharing for the enrollee when delivered by in-network providers if the enrollee is covered by a non-grandfathered plan. May not impose greater copays, deductible or waiting periods.

5 Small Group s State s BCBS BCBS Edge CIGNA QCHP HA IL Contraceptives Criminal Sexual Assault Requires coverage for all outpatient contraceptive services and all outpatient contraceptive drugs and devices approved by the Food and Drug Administration. May not impose greater copays, deductible or waiting periods. and group health insurance policies that provide coverage for OP services and prescription drugs * Coverage for criminal sexual assault must be at the same benefit levels as any other emergency or accident care situation. * * * * * * Dental Adjunctive Services Requires coverage for anesthesia and other charges incurred in conjunction with dental care provided in a hospital or ambulatory surgical treatment center to: a young child (under age 6); a person with a medical condition that requires hospitalization for the procedure: or a disabled individual. Does not require coverage of dental services. * * * * Diabetes Self Management Requires coverage for outpatient self-management training and education, and specified equipment and supplies for Type 1 diabetes, Type 2 diabetes and gestational diabetes mellitus. Equipment must be covered to the extent durable medical equipment is covered by the policy. Pharmaceuticals and supplies must be covered to the extent there is coverage for pharmaceuticals and supplies in the policy or in an attached rider. See the law for list of covered supplies and equipment. Law was amended by P.A to expand definition of diabetes self-management training to include services that allow the patient to maintain A1c level within the range of nationally recognized standards of care. * * * * * * Emergency Ambulance Transportation The evidence of coverage must include coverage for emergency transportation by ground or air ambulance. Emergency Care Services The group contract and evidence of coverage must include a specific description of benefits available for emergencies 24 hours a day, 7 days a week. No may limit emergency services within the service area to contracted providers. External Review Requires health insurers and s to provide (1) an internal appeals process for all denied claims and (2) external independent review for claims or pre-authorization requests denied due to medical necessity, appropriateness, health care setting, level of care, or effectiveness. P.A expanded External Review Law to include review of claims denied due to pre-existing condition or rescission of health policy. The amended law requires that the Illinois Department of Insurance assign the independent review organization (IRO) for each external review request. *

6 Small Group s State s Fibrocystic Breast Condition No contract or evidence of coverage may deny or exclude coverage for fibrocystic breast condition in the absence of a breast biopsy demonstrating an increased disposition to the development of breast cancer unless the enrollee's medical history is able to confirm a chronic, relapsing, symptomatic breast condition. BCBS BCBS Edge CIGNA QCHP HA IL * * * * * * * * * HPV Vaccine Requires coverage for the human papillomavirus vaccine. The law does not specify the benefit. September 23, Under the federal Affordable Care Act, coverage must be provided for HPV vaccine without any cost-sharing for the enrollee when delivered by innetwork providers if the enrollee is covered by a non-grandfathered plan. * Habilitative Services for children Requires coverage for medically necessary habilitative services for children under age 19 who have a congenital, genetic or early acquired disorder diagnosed by a physician licensed to practice medicine in all its branches. The law specifies types of health care providers whose services must be covered. Denials based on medical necessity are subject to independent external review. For group policies and contracts of 51 or more employees, benefits must comply with the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (Effective October 3, 2009)* and with the Illinois Mental Health Parity Public Act (Effective August 18, 2011).* * * * * * * Infertility Requires coverage for the diagnosis and treatment of infertility, including coverage for IVF, GIFT, ZIFT. and group health insurance policies for more than 25 full time employees * * excludes ART and fertility drugs excludes ART and fertility drugs excludes ART and fertility drugs Mammograms Requires coverage for (1) a baseline mammogram for women ages 35 to 39 and (2) an annual mammogram for women age 40 or older. Requires coverage for medically necessary mammograms for women under age 40 who have a family history of breast cancer or other risk factors. Effective March 27, includes digital mammography and requires coverage be provided at no cost to the insured. Cost of mammograms shall not be applied to an annual or lifetime maximum benefit. September 23, Under the federal Affordable Care Act, coverage for screening mammography for women, with or without clinical breast examination must be provided every 1-2 years for women aged 40 and older without any cost-sharing for the enrollee when delivered by in-network providers if the enrollee is covered by a non-grandfathered plan. * Coverage includes a comprehensive ultrasound screening of an entire breast or breasts when a mammogram demonstrates medical necessity as described.

7 Small Group s State s BCBS BCBS Edge CIGNA QCHP HA IL Mastectomy Post Mastectomy Care Requires coverage for inpatient hospital stay following a mastectomy for a length of time the attending physician determines is medically necessary in accordance with protocols and guidelines based on sound scientific evidence and upon evaluation of the patient. If the patient is discharged early, a post-discharge physician office visit must be available to her within 48 hours and must be covered by the policy. and group that provide benefits for surgical coverage. * * Mastectomy - Reconstruction Requires coverage for prosthetic devices or reconstructive surgery incident to a mastectomy. When a mastectomy is performed and no evidence of malignancy is found, the offered coverage is limited to prosthetic devices and reconstructive surgery within two years of the mastectomy date. In addition to reconstruction on the affected breast, this law requires surgery and reconstruction of the other breast (the one the mastectomy was not performed on) to produce a symmetrical appearance. Also requires coverage for prostheses and treatment for physical complications at all stages of mastectomy, including lymphedemas. and group that provide coverage for mastectomies. * * Maternity Maternity Complications of Pregnancy Requires coverage for maternity care including prenatal and postnatal care and care for complication of pregnancy. Requires coverage for treatment of complications of pregnancy. * Group insurance policies * * * Maternity Post Parturition Care Requires coverage for a minimum of 48 hours inpatient hospital stay following a vaginal delivery and 96 hours following a caesarian section for both mother and newborn. A shorter length of stay may be provided under certain conditions and if a post-discharge office visit or in-home nurse visit is provided and covered. Coverage must include prenatal and post-natal care and complications of pregnancy for mother as well as care of newborn. and group that provide maternity coverage. * Maternity Prenatal HIV Testing Requires coverage for prenatal HIV testing ordered by an attending physician licensed to practice medicine in all branches, physician assistant or advanced practice registered nurse. * * * * * * * * *

8 Small Group s State s Mental Health Serious Mental Illness Requires coverage of serious mental illness under the same terms and conditions as coverage for other illnesses and diseases. The law defines serious mental illnesses to include the following: schizophrenia; paranoid and other psychotic disorders; bipolar disorders (hypomanic, manic, depressive, and mixed); major depressive disorders (single episode or recurrent); schizoaffective disorders (bipolar or depressive); pervasive developmental disorders; obsessive-compulsive disorders; depression in childhood and adolescence; panic disorder; post-traumatic stress disorders (acute, chronic, or with delayed onset); and anorexia nervosa and bulimia nervosa. For group policies and contracts of 51 or more employees, benefits must comply with the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (Effective October 3, 2009).* P.A adds substance use disorder as required coverage. Adds parity provisions which prohibit more restrictive financial requirements, treatment limitations, annual limits and lifetime limits for mental illness or substance use disorder than those applied to substantially all other hospital and medical benefits covered under the policy thereby removing previously allowed limits. and group that provide coverage for hospital or medical expenses. Does NOT apply to employer groups with 50 or fewer employees. BCBS BCBS Edge CIGNA QCHP HA IL * * * * Mental Health s Requires coverage for ten (10) days inpatient mental health care per year. Also requires coverage of twenty (20) individual outpatient mental health care visits per enrollee per year, as appropriate for evaluation, short-term treatment and crisis intervention services. Care in a day hospital, residential non-hospital or intensive outpatient mode may be substituted on a two-to-one basis for inpatient hospital services as deemed appropriate by the primary care physician. Group outpatient mental health care visits may be substituted on a two-toone basis for individual mental health care visits as deemed appropriate by the primary care physician. For group policies and contracts of 51 or more employees, benefits must comply with the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (Effective October 3, 2009).* P.A adds substance use disorder as required coverage. Adds parity provisions which prohibit more restrictive financial requirements, treatment limitations, annual limits and lifetime limits for mental illness or substance use disorder than those applied to substantially all other hospital and medical benefits covered under the policy thereby removing previous allowed limits. Previously applied to all group and contracts. n/a * * * * * * * * * The coverage must meet the minimum requirements of the Mental Health Parity Act. Please see Division Bulletin The benefit for serious mental illness, based on medical necessity, in addition to requiring 45 days of inpatient treatment also requires 60 outpatient visits and an additional 20 outpatient visits for speech therapy for the treatment of pervasive developmental disorders. Benefits for serious mental illness are not applicable for small group.

9 Small Group s State s Multiple Sclerosis Preventative Physical Therapy Requires coverage for medically necessary preventative physical therapy for insureds diagnosed with multiple sclerosis if prescribed by a physician. Coverage must be the same as physical therapy under the policy for other conditions. Coverage limitations, deductibles, coinsurance features, etc. must be provided the same as any other illness. BCBS BCBS Edge CIGNA QCHP HA IL * * * * * * Organ Transplants Sets forth guidelines under which experimental or investigational organ transplantation procedures can be denied. No contract or evidence of coverage may deny reimbursement for an organ transplant as experimental or investigational unless supported by appropriate, required documentation. Organ Transplants Immunosuppressive Drugs A policy that covers immunosuppressant drugs may not limit, reduce, or deny coverage of those drugs if, prior to the limitation, reduction or denial of coverage: 1) the insured was using the drug; 2) the insured was covered under the policy; and 3) the drug was covered under the policy. * * * * * * * * * Osteoporosis Requires coverage for medically necessary bone mass measurement and the diagnosis and treatment of osteoporosis on the same terms and conditions that generally apply to other medical conditions. September 23, Under the federal Affordable Care Act, coverage for routine screening for women age 65 and older (or beginning at age 60 for women at increased risk for osteoporotic fractures) must be provided without any cost-sharing for the enrollee when delivered by in-network providers if the enrollee is covered by a nongrandfathered plan. * * * Outpatient Rehabilitative Therapy Ovarian Cancer Testing Pap Smears Coverage must include, but is not limited to, speech, physical and occupational therapy for up to 60 treatments per year. * * * Requires coverage for surveillance tests for ovarian cancer for female insureds who are at risk for ovarian cancer. Requires coverage for an annual cervical smear or pap smear for females. September 23, Under the federal Affordable Care Act, coverage for cervical cancer screening for women who have been sexually active and have a cervix must be provided without any costsharing for the enrollee when delivered by in-network providers if the enrollee is covered by a non-grandfathered plan. only up to 50 visits * * * * * * Prescription Inhalants Requires coverage of prescription inhalants for persons with asthma or other life-threatening bronchial ailments, as often as needed, if medically appropriate and prescribed by the attending physician. Policy restrictions, placed on refill limitations, do not apply. an group that provide coverage for prescription drugs. * * * * * * * *

10 Small Group s State s Preventive Health Services (Including Well Child Care) Requires coverage of preventive health services as appropriate for the patient population, including a health evaluation program and immunizations to prevent or arrest the further manifestation of human illness or injury. September 23, Under the federal Affordable Care Act, coverage for (1) preventive health services with rating of A or B in current recommendations of the State Preventive Service Task Force; (2)immunizations for routine use as recommended by the Advisory Committee on Immunization Practices of the Centers for Disease Control and Prevention; and (3) preventive care and screening for infants, children and adolescents as recommended by the Health Resources and Services Administration must be provided without any cost-sharing for the enrollee when delivered by in-network providers if the enrollee is covered by a non-grandfathered plan. BCBS BCBS Edge CIGNA QCHP HA IL Prostate Specific Antigen Testing Requires coverage for an annual digital rectal examination and a prostate specific antigen test for male insureds upon recommendation of a physician for asymptomatic men age 50 and over, African American men age 40 and over, men age 40 and over with family history. Prosthetic and Orthotic Devices Reconstructive Breast Surgery For policies issued or renewed on or after December 1, 2010, requires coverage for prosthetic and customized orthotic devices that is no less favorable than the terms and conditions applicable to substantially all medical and surgical benefits provided under the plan or coverage. Coverage requirements include reconstruction of the breast upon which the mastectomy is performed, surgery and reconstruction of the other breast to produce a symmetrical appearance and prostheses and treatment for physical complications at all stages of mastectomy, including lymphedemas. Written notice of the availability of this coverage must be delivered to the enrollee upon enrollment and annually thereafter. * * * * * Shingles Vaccine Requires coverage for federally approved shingles vaccine when ordered by a physician for an enrollee who is age 60 or older. September 23, Under the federal Affordable Care Act, coverage for shingles vaccine for people age 60 years and older must be provided without any cost-sharing for the enrollee when delivered by in-network providers if the enrollee is covered by a nongrandfathered plan. * Under the Influence Prohibits exclusion of coverage for emergency or other medical, hospital or surgical expenses incurred as a result of and related to an injury acquired while the individual is intoxicated or under the influence of a narcotic. Managed care plans * * * * * * * * * * Group policies subject to the federal Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 may not impose financial requirements (e.g., deductibles, co-payments, or coinsurance) or treatment limitations (e.g., limits on the frequency of treatment, number of visits, or days of coverage) for the treatment of mental health or substance use disorders that are more restrictive than those applied to medical and surgical benefits. For example, a group policy that did not contain a limit on the number of outpatient visits for medical/surgical benefits could not limit the number of outpatient visits for mental health or substance use disorder benefits.

Hawaii Benchmarks Benefits under the Affordable Care Act (ACA)

Hawaii Benchmarks Benefits under the Affordable Care Act (ACA) 10/2012 Coverage for Newborn and Foster Children Coverage Outside the Provider Network Adult Routine Physical Exams Well-Baby and Well-Child

Hawaii Benchmarks Benefits under the Affordable Care Act (ACA) 10/2012 Coverage for Newborn and Foster Children Coverage Outside the Provider Network Adult Routine Physical Exams Well-Baby and Well-Child

Summary of Services and Cost Shares

Summary of Services and Cost Shares This summary does not describe benefits. For the description of a benefit, including any limitations or exclusions, please refer to the identical heading in the Benefits

Summary of Services and Cost Shares This summary does not describe benefits. For the description of a benefit, including any limitations or exclusions, please refer to the identical heading in the Benefits

Illinois Insurance Facts Illinois Department of Insurance

Illinois Insurance Facts Illinois Department of Insurance Women s Health Care Issues Revised August 2012 Note: This information was developed to provide consumers with general information and guidance

Illinois Insurance Facts Illinois Department of Insurance Women s Health Care Issues Revised August 2012 Note: This information was developed to provide consumers with general information and guidance

California PCP Selected* Not Applicable

PLAN FEATURES Deductible (per calendar ) Member Coinsurance * Not Applicable ** Not Applicable Copay Maximum (per calendar ) $3,000 per Individual $6,000 per Family All member copays accumulate toward

PLAN FEATURES Deductible (per calendar ) Member Coinsurance * Not Applicable ** Not Applicable Copay Maximum (per calendar ) $3,000 per Individual $6,000 per Family All member copays accumulate toward

IN-NETWORK MEMBER PAYS. Out-of-Pocket Maximum (Includes a combination of deductible, copayments and coinsurance for health and pharmacy services)

HMO-OA-CNT-30-45-500-500D-13 HMO Open Access Contract Year Plan Benefit Summary This is a brief summary of benefits. Refer to your Membership Agreement for complete details on benefits, conditions, limitations

HMO-OA-CNT-30-45-500-500D-13 HMO Open Access Contract Year Plan Benefit Summary This is a brief summary of benefits. Refer to your Membership Agreement for complete details on benefits, conditions, limitations

Greater Tompkins County Municipal Health Insurance Consortium

WHO IS COVERED Requires both Medicare A & B enrollment. Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement None None Medical Benefit Management Program Not

WHO IS COVERED Requires both Medicare A & B enrollment. Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement None None Medical Benefit Management Program Not

PLAN DESIGN AND BENEFITS POS Open Access Plan 1944

PLAN FEATURES PARTICIPATING Deductible (per calendar year) $3,000 Individual $9,000 Family $4,000 Individual $12,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being

PLAN FEATURES PARTICIPATING Deductible (per calendar year) $3,000 Individual $9,000 Family $4,000 Individual $12,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being

FEATURES NETWORK OUT-OF-NETWORK

Schedule of Benefits Employer: The Vanguard Group, Inc. ASA: 697478-A Issue Date: January 1, 2014 Effective Date: January 1, 2014 Schedule: 3B Booklet Base: 3 For: Choice POS II - 950 Option - Retirees

Schedule of Benefits Employer: The Vanguard Group, Inc. ASA: 697478-A Issue Date: January 1, 2014 Effective Date: January 1, 2014 Schedule: 3B Booklet Base: 3 For: Choice POS II - 950 Option - Retirees

Member s responsibility (deductibles, copays, coinsurance and dollar maximums)

MICHIGAN CATHOLIC CONFERENCE January 2015 Benefit Summary This is intended as an easy-to-read summary and provides only a general overview of your benefits. It is not a contract. Additional limitations

MICHIGAN CATHOLIC CONFERENCE January 2015 Benefit Summary This is intended as an easy-to-read summary and provides only a general overview of your benefits. It is not a contract. Additional limitations

Iowa Wellness Plan Benefits Coverage List

Iowa Wellness Plan Benefits Coverage List Service Category Covered Duration, Scope, exclusions, and Limitations Excluded Coding 1. Ambulatory Services Primary Care Illness/injury Physician Services Should

Iowa Wellness Plan Benefits Coverage List Service Category Covered Duration, Scope, exclusions, and Limitations Excluded Coding 1. Ambulatory Services Primary Care Illness/injury Physician Services Should

Alternative Benefit Plan (ABP) ABP Cost-Sharing & Comparison to Standard Medicaid Services

Alternative Benefit Plan (ABP) ABP Cost-Sharing & Comparison to Standard Medicaid Services Most adults who qualify for the Medicaid category known as the Other Adult Group receive services under the New

Alternative Benefit Plan (ABP) ABP Cost-Sharing & Comparison to Standard Medicaid Services Most adults who qualify for the Medicaid category known as the Other Adult Group receive services under the New

PLAN DESIGN AND BENEFITS Basic HMO Copay Plan 1-10

PLAN FEATURES Deductible (per calendar year) Member Coinsurance Not Applicable Not Applicable Out-of-Pocket Maximum $5,000 Individual (per calendar year) $10,000 Family Once the Family Out-of-Pocket Maximum

PLAN FEATURES Deductible (per calendar year) Member Coinsurance Not Applicable Not Applicable Out-of-Pocket Maximum $5,000 Individual (per calendar year) $10,000 Family Once the Family Out-of-Pocket Maximum

California Small Group MC Aetna Life Insurance Company

PLAN FEATURES Deductible (per calendar year) $3,000 Individual $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate separately

PLAN FEATURES Deductible (per calendar year) $3,000 Individual $6,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate separately

Illinois Insurance Facts Illinois Department of Insurance Coverage for the Diagnosis and Treatment of Breast Conditions

Illinois Insurance Facts Illinois Department of Insurance Coverage for the Diagnosis and Treatment of Breast Conditions Revised May 2015 Note: This information was developed to provide consumers with general

Illinois Insurance Facts Illinois Department of Insurance Coverage for the Diagnosis and Treatment of Breast Conditions Revised May 2015 Note: This information was developed to provide consumers with general

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview of your benefits.

University of Michigan Group: 007005187-0000, 0001 Comprehensive Major Medical (CMM) Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview of your benefits.

SMALL GROUP PLAN DESIGN AND BENEFITS OPEN CHOICE OUT-OF-STATE PPO PLAN - $1,000

PLAN FEATURES PREFERRED CARE NON-PREFERRED CARE Deductible (per calendar year; applies to all covered services) $1,000 Individual $3,000 Family $2,000 Individual $6,000 Family Plan Coinsurance ** 80% 60%

PLAN FEATURES PREFERRED CARE NON-PREFERRED CARE Deductible (per calendar year; applies to all covered services) $1,000 Individual $3,000 Family $2,000 Individual $6,000 Family Plan Coinsurance ** 80% 60%

Illinois Insurance Facts Illinois Department of Insurance Mental Health and Substance Use Disorder Coverage

Illinois Insurance Facts Illinois Department of Insurance Mental Health and Substance Use Disorder Coverage Revised October 2012 Note: This information was developed to provide consumers with general information

Illinois Insurance Facts Illinois Department of Insurance Mental Health and Substance Use Disorder Coverage Revised October 2012 Note: This information was developed to provide consumers with general information

PLAN DESIGN AND BENEFITS HMO Open Access Plan 912

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $2,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $2,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services

LOCKHEED MARTIN AERONAUTICS COMPANY PALMDALE 2011 IAM NEGOTIATIONS UNDER AGE 65 LM HEALTHWORKS SUMMARY

Annual Deductibles, Out-of-Pocket Maximums, Lifetime Maximum Benefits Calendar Year Deductible Calendar Year Out-of- Pocket Maximum Lifetime Maximum Per Individual Physician Office Visits Primary Care

Annual Deductibles, Out-of-Pocket Maximums, Lifetime Maximum Benefits Calendar Year Deductible Calendar Year Out-of- Pocket Maximum Lifetime Maximum Per Individual Physician Office Visits Primary Care

Summary of PNM Resources Health Care Benefits Active Employees 2011

of PNM Resources Health Care Benefits Active Employees 2011 The following charts show deductibles, limits, benefit levels and amounts for the PNM Resources medical, dental and vision programs. For more

of PNM Resources Health Care Benefits Active Employees 2011 The following charts show deductibles, limits, benefit levels and amounts for the PNM Resources medical, dental and vision programs. For more

Greater Tompkins County Municipal Health Insurance Consortium

WHO IS COVERED Requires Covered Member to be Enrolled in Both Medicare Parts A & B Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement Not Applicable Not Applicable

WHO IS COVERED Requires Covered Member to be Enrolled in Both Medicare Parts A & B Type of Coverage Offered Single only Single only MEDICAL NECESSITY Pre-Certification Requirement Not Applicable Not Applicable

PLAN DESIGN AND BENEFITS - Tx OAMC 2500 08 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $5,000 Individual $7,500 3 Individuals per $15,000 3 Individuals per Unless otherwise indicated, the Deductible must be met prior to benefits

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $5,000 Individual $7,500 3 Individuals per $15,000 3 Individuals per Unless otherwise indicated, the Deductible must be met prior to benefits

California Small Group MC Aetna Life Insurance Company

PLAN FEATURES Deductible (per calendar year) $1,000 per member $1,000 per member Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate

PLAN FEATURES Deductible (per calendar year) $1,000 per member $1,000 per member Unless otherwise indicated, the Deductible must be met prior to benefits being payable. All covered expenses accumulate

PLAN DESIGN AND BENEFITS - Tx OAMC Basic 2500-10 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $4,000 Individual $7,500 Family $12,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $4,000 Individual $7,500 Family $12,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

Blue Cross Premier Bronze Extra

An individual PPO health plan from Blue Cross Blue Shield of Michigan. You will have a broad choice of doctors and hospitals within Blue Cross Blue Shield of Michigan s unsurpassed statewide PPO network

An individual PPO health plan from Blue Cross Blue Shield of Michigan. You will have a broad choice of doctors and hospitals within Blue Cross Blue Shield of Michigan s unsurpassed statewide PPO network

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

CENTRAL MICHIGAN UNIVERSITY - Premier Plan (PPO1) 007000285-0002 0004 Effective Date: July 1, 2015 Benefits-at-a-Glance This is intended as an easy-to-read summary and provides only a general overview

CA Group Business 2-50 Employees

PLAN FEATURES Network Primary Care Physician Selection Deductible (per calendar year) Member Coinsurance Copay Maximum (per calendar year) Lifetime Maximum Referral Requirement PHYSICIAN SERVICES Primary

PLAN FEATURES Network Primary Care Physician Selection Deductible (per calendar year) Member Coinsurance Copay Maximum (per calendar year) Lifetime Maximum Referral Requirement PHYSICIAN SERVICES Primary

PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80

Georgia Health Network Option (POS Open Access) PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80 PLAN FEATURES PARTICIPATING PROVIDERS NON-PARTICIPATING PROVIDERS Deductible (per calendar year)

Georgia Health Network Option (POS Open Access) PLAN DESIGN AND BENEFITS Georgia 2-100 HNOption 13-1000-80 PLAN FEATURES PARTICIPATING PROVIDERS NON-PARTICIPATING PROVIDERS Deductible (per calendar year)

Senate Bill 91 (2011) Standard Plan - EHB and Cost Share Matrix - Updated for 2016 ***NOT INTENDED AS A STATEMENT OF COVERAGE***

Deductible Medical: $1,250; Medical: $2,500; Integrated Medical/Rx: Rx: $0 Rx: $0 $5,000 Maximum OOP Combined Medical Combined Medical Combined Medical and and Drug: $6,350 and Drug: $6,350 Drug: $6,350

Deductible Medical: $1,250; Medical: $2,500; Integrated Medical/Rx: Rx: $0 Rx: $0 $5,000 Maximum OOP Combined Medical Combined Medical Combined Medical and and Drug: $6,350 and Drug: $6,350 Drug: $6,350

BENEFIT PLAN. What Your Plan Covers and How Benefits are Paid. Appendix A. Prepared Exclusively for The Dow Chemical Company

Appendix A BENEFIT PLAN Prepared Exclusively for The Dow Chemical Company What Your Plan Covers and How Benefits are Paid Choice POS II (MAP Plus Option 2 - High Deductible Health Plan (HDHP) with Prescription

Appendix A BENEFIT PLAN Prepared Exclusively for The Dow Chemical Company What Your Plan Covers and How Benefits are Paid Choice POS II (MAP Plus Option 2 - High Deductible Health Plan (HDHP) with Prescription

Bates College Effective date: 01-01-2010 HMO - Maine PLAN DESIGN AND BENEFITS PROVIDED BY AETNA HEALTH INC. - FULL RISK PLAN FEATURES

PLAN FEATURES Deductible (per calendar year) $500 Individual $1,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Once Family Deductible is met, all family

PLAN FEATURES Deductible (per calendar year) $500 Individual $1,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Once Family Deductible is met, all family

Medical Plan - Healthfund

18 Medical Plan - Healthfund Oklahoma City Community College Effective Date: 07-01-2010 Aetna HealthFund Open Choice (PPO) - Oklahoma PLAN DESIGN AND BENEFITS PROVIDED BY AETNA LIFE INSURANCE COMPANY -

18 Medical Plan - Healthfund Oklahoma City Community College Effective Date: 07-01-2010 Aetna HealthFund Open Choice (PPO) - Oklahoma PLAN DESIGN AND BENEFITS PROVIDED BY AETNA LIFE INSURANCE COMPANY -

Cost Sharing Definitions

SU Pro ( and ) Annual Deductible 1 Coinsurance Cost Sharing Definitions $200 per individual with a maximum of $400 for a family 5% of allowable amount for inpatient hospitalization - or - 50% of allowable

SU Pro ( and ) Annual Deductible 1 Coinsurance Cost Sharing Definitions $200 per individual with a maximum of $400 for a family 5% of allowable amount for inpatient hospitalization - or - 50% of allowable

Coverage level: Employee/Retiree Only Plan Type: EPO

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan documents at www.dbm.maryland.gov/benefits or by calling 410-767-4775

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan documents at www.dbm.maryland.gov/benefits or by calling 410-767-4775

New York Small Group Indemnity Aetna Life Insurance Company Plan Effective Date: 10/01/2010. PLAN DESIGN AND BENEFITS - NY Indemnity 1-10/10*

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $7,500 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible (per calendar year) $2,500 Individual $7,500 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

COVERAGE SCHEDULE. The following symbols are used to identify Maximum Benefit Levels, Limitations, and Exclusions:

Exhibit D-3 HMO 1000 Coverage Schedule ROCKY MOUNTAIN HEALTH PLANS GOOD HEALTH HMO $1000 DEDUCTIBLE / 75 PLAN EVIDENCE OF COVERAGE LARGE GROUP Underwritten by Rocky Mountain Health Maintenance Organization,

Exhibit D-3 HMO 1000 Coverage Schedule ROCKY MOUNTAIN HEALTH PLANS GOOD HEALTH HMO $1000 DEDUCTIBLE / 75 PLAN EVIDENCE OF COVERAGE LARGE GROUP Underwritten by Rocky Mountain Health Maintenance Organization,

PLAN DESIGN AND BENEFITS - Tx OAMC 1500-10 PREFERRED CARE

PLAN FEATURES Deductible (per calendar year) $1,500 Individual $3,000 Individual $4,500 Family $9,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

PLAN FEATURES Deductible (per calendar year) $1,500 Individual $3,000 Individual $4,500 Family $9,000 Family 3 Individuals per Family 3 Individuals per Family Unless otherwise indicated, the Deductible

PLAN DESIGN AND BENEFITS - New York Open Access EPO 1-10/10

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $3,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

PLAN FEATURES Deductible (per calendar year) $1,000 Individual $3,000 Family Unless otherwise indicated, the Deductible must be met prior to benefits being payable. Member cost sharing for certain services,

Health Insurance Benefit Mandates in California State and Federal Law November 30, 2012

Health Benefit s in State and Federal Law November 30, 2012 This document has been prepared by the Health Benefits Review Program (CHBRP). CHBRP responds to requests from the Legislature to provide independent

Health Benefit s in State and Federal Law November 30, 2012 This document has been prepared by the Health Benefits Review Program (CHBRP). CHBRP responds to requests from the Legislature to provide independent

PLAN DESIGN AND BENEFITS AETNA LIFE INSURANCE COMPANY - Insured

PLAN FEATURES Deductible (per calendar year) Individual $750 Individual $1,500 Family $2,250 Family $4,500 All covered expenses accumulate simultaneously toward both the preferred and non-preferred Deductible.

PLAN FEATURES Deductible (per calendar year) Individual $750 Individual $1,500 Family $2,250 Family $4,500 All covered expenses accumulate simultaneously toward both the preferred and non-preferred Deductible.

Benefit Summary - A, G, C, E, Y, J and M

Benefit Summary - A, G, C, E, Y, J and M Benefit Year: Calendar Year Payment for Services Deductible Individual $600 $1,200 Family (Embedded*) $1,200 $2,400 Coinsurance (the percentage amount the Covered

Benefit Summary - A, G, C, E, Y, J and M Benefit Year: Calendar Year Payment for Services Deductible Individual $600 $1,200 Family (Embedded*) $1,200 $2,400 Coinsurance (the percentage amount the Covered

Business Life Insurance - Health & Medical Billing Requirements

PLAN FEATURES Deductible (per plan year) $2,000 Employee $2,000 Employee $3,000 Employee + Spouse $3,000 Employee + Spouse $3,000 Employee + Child(ren) $3,000 Employee + Child(ren) $4,000 Family $4,000

PLAN FEATURES Deductible (per plan year) $2,000 Employee $2,000 Employee $3,000 Employee + Spouse $3,000 Employee + Spouse $3,000 Employee + Child(ren) $3,000 Employee + Child(ren) $4,000 Family $4,000

Commercial. Individual & Family Plan. Health Net California Farm Bureau and PPO. Insurance Plans. Outline of Coverage and Exclusions and Limitations

Commercial Individual & Family Plan Health Net California Farm Bureau and PPO Insurance Plans Outline of Coverage and Exclusions and Limitations Table of Contents Health Plans Outline of coverage 1 Read

Commercial Individual & Family Plan Health Net California Farm Bureau and PPO Insurance Plans Outline of Coverage and Exclusions and Limitations Table of Contents Health Plans Outline of coverage 1 Read

Services and supplies required by Health Care Reform Age and frequency guidelines apply to covered preventive care Not subject to deductible if PPO

Page 1 of 5 Individual Deductible Calendar year $400 COMBINED Individual / Family OOP Calendar year $4,800 Individual $12,700 per family UNLIMITED Annual Maximum July 1 st to June 30 th UNLIMITED UNLIMITED

Page 1 of 5 Individual Deductible Calendar year $400 COMBINED Individual / Family OOP Calendar year $4,800 Individual $12,700 per family UNLIMITED Annual Maximum July 1 st to June 30 th UNLIMITED UNLIMITED

100% Fund Administration

FUND FEATURES HealthFund Amount $500 Employee $750 Employee + Spouse $750 Employee + Child(ren) $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at which the Fund

FUND FEATURES HealthFund Amount $500 Employee $750 Employee + Spouse $750 Employee + Child(ren) $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at which the Fund

PREFERRED CARE. All covered expenses, including prescription drugs, accumulate toward both the preferred and non-preferred Payment Limit.

PLAN FEATURES Deductible (per plan year) $300 Individual $300 Individual None Family None Family All covered expenses, excluding prescription drugs, accumulate toward both the preferred and non-preferred

PLAN FEATURES Deductible (per plan year) $300 Individual $300 Individual None Family None Family All covered expenses, excluding prescription drugs, accumulate toward both the preferred and non-preferred

$6,350 Individual $12,700 Individual

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible $5,000 Individual $10,000 Individual $10,000 Family $20,000 Family All covered expenses accumulate separately toward the preferred or non-preferred Deductible.

PLAN FEATURES IN-NETWORK OUT-OF-NETWORK Deductible $5,000 Individual $10,000 Individual $10,000 Family $20,000 Family All covered expenses accumulate separately toward the preferred or non-preferred Deductible.

Western Health Advantage: City of Sacramento HSA ABHP Coverage Period: 1/1/2016-12/31/2016

Coverage For: Self Plan Type: HMO This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.westernhealth.com or

Coverage For: Self Plan Type: HMO This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.westernhealth.com or

Preauthorization Requirements * (as of January 1, 2016)

OFFICE VISITS Primary Care Office Visits Primary Care Home Visits Specialist Office Visits No Specialist Home Visits PREVENTIVE CARE Well Child Visits and Immunizations Adult Annual Physical Examinations

OFFICE VISITS Primary Care Office Visits Primary Care Home Visits Specialist Office Visits No Specialist Home Visits PREVENTIVE CARE Well Child Visits and Immunizations Adult Annual Physical Examinations

My Health Alliance Standard PPO Plan

My Health Alliance Standard PPO Plan COVERED BENEFITS AND LIMITATIONS The following health care services are covered under this Policy subject to the Copayments, Coinsurance, Deductibles and Plan Year

My Health Alliance Standard PPO Plan COVERED BENEFITS AND LIMITATIONS The following health care services are covered under this Policy subject to the Copayments, Coinsurance, Deductibles and Plan Year

UnitedHealthcare Choice Plus. UnitedHealthcare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Health Savings Account (HSA) Plan 7PD of Educators Benefit Services, Inc. Enrolling Group Number: 717578

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Health Savings Account (HSA) Plan 7PD of Educators Benefit Services, Inc. Enrolling Group Number: 717578

PPO Schedule of Payments (Maryland Large Group) Qualified High Deductible Health Plan National QA2000-20

PPO Schedule of Payments (Maryland Large Group) Qualified High Health Plan National QA2000-20 Benefit Year Individual Family (Amounts for Participating and s services are separated in calculating when

PPO Schedule of Payments (Maryland Large Group) Qualified High Health Plan National QA2000-20 Benefit Year Individual Family (Amounts for Participating and s services are separated in calculating when

National PPO 1000. PPO Schedule of Payments (Maryland Small Group)

PPO Schedule of Payments (Maryland Small Group) National PPO 1000 The benefits outlined in this Schedule are in addition to the benefits offered under Coventry Health & Life Insurance Company Small Employer

PPO Schedule of Payments (Maryland Small Group) National PPO 1000 The benefits outlined in this Schedule are in addition to the benefits offered under Coventry Health & Life Insurance Company Small Employer

UnitedHealthcare Choice Plus. UnitedHealthcare Insurance Company. Certificate of Coverage

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Plan 7EG of Educators Benefit Services, Inc. Enrolling Group Number: 717578 Effective Date: January 1, 2012

UnitedHealthcare Choice Plus UnitedHealthcare Insurance Company Certificate of Coverage For the Plan 7EG of Educators Benefit Services, Inc. Enrolling Group Number: 717578 Effective Date: January 1, 2012

THE MITRE CORPORATION PPO High Deductible Plan with a Health Saving Account (HSA)

THE MITRE CORPORATION PPO High Deductible Plan with a Health Saving Account (HSA) Effective Date: 01-01-2016 PLAN FEATURES Annual Deductible $1,500 Employee $3,000 Employee $3,000 Employee + 1 Dependent

THE MITRE CORPORATION PPO High Deductible Plan with a Health Saving Account (HSA) Effective Date: 01-01-2016 PLAN FEATURES Annual Deductible $1,500 Employee $3,000 Employee $3,000 Employee + 1 Dependent

Individual. Employee + 1 Family

FUND FEATURES HealthFund Amount Individual Employee + 1 Family $750 $1,125 $1,500 Amount contributed to the Fund by the employer is reflected above. Fund Amount reflected is on a per calendar year basis.

FUND FEATURES HealthFund Amount Individual Employee + 1 Family $750 $1,125 $1,500 Amount contributed to the Fund by the employer is reflected above. Fund Amount reflected is on a per calendar year basis.

Employee + 2 Dependents

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance Percentage at

BridgeSpan Health Company: BridgeSpan Oregon Standard Gold Plan MyChoice Northwest

BridgeSpan Health Company: BridgeSpan Oregon Standard Gold Plan MyChoice Northwest Summary of Benefits and Coverage: What this Plan Covers & What it Costs Questions: Call 1 (855) 857-9943 or visit us at

BridgeSpan Health Company: BridgeSpan Oregon Standard Gold Plan MyChoice Northwest Summary of Benefits and Coverage: What this Plan Covers & What it Costs Questions: Call 1 (855) 857-9943 or visit us at

What is the overall deductible? Are there other deductibles for specific services?

: MyPriority POS RxPlus Silver 1800 Coverage Period: Beginning on or after 01/01/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Subscriber/Dependent Plan Type:

: MyPriority POS RxPlus Silver 1800 Coverage Period: Beginning on or after 01/01/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Subscriber/Dependent Plan Type:

Unlimited except where otherwise indicated.

PLAN FEATURES Deductible (per calendar year) $1,250 Individual $5,000 Individual $2,500 Family $10,000 Family All covered expenses including prescription drugs accumulate separately toward both the preferred

PLAN FEATURES Deductible (per calendar year) $1,250 Individual $5,000 Individual $2,500 Family $10,000 Family All covered expenses including prescription drugs accumulate separately toward both the preferred

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/15-6/30/16

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/15-6/30/16 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/15-6/30/16 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

Regence BlueCross BlueShield of Oregon: Regence Oregon Standard Bronze Plan Coverage Period: Beginning on or after 01/01/2014

Regence BlueCross BlueShield of Oregon: Regence Oregon Standard Bronze Plan Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: Beginning on or after 01/01/2014 Coverage

Regence BlueCross BlueShield of Oregon: Regence Oregon Standard Bronze Plan Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: Beginning on or after 01/01/2014 Coverage

PDS Tech, Inc Proposed Effective Date: 01-01-2012 Aetna HealthFund Aetna Choice POS ll - ASC

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance 100% Percentage

FUND FEATURES HealthFund Amount $500 Individual $1,000 Employee + 1 Dependent $1,000 Employee + 2 Dependents $1,000 Family Amount contributed to the Fund by the employer Fund Coinsurance 100% Percentage

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/14-6/30/15

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/14-6/30/15 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

S c h o o l s I n s u r a n c e G r o u p Health Net Plan Comparison Fiscal Year 7/1/14-6/30/15 This information sheet is for reference only. Please refer to Evidence of Coverage requirements, limitations

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.cfhp.com or by calling 1-800-434-2347. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.cfhp.com or by calling 1-800-434-2347. Important Questions

PLAN DESIGN AND BENEFITS - PA Health Network Option AHF HRA 1.3. Fund Pays Member Responsibility

HEALTHFUND PLAN FEATURES HealthFund Amount (Per plan year. Fund changes between tiers requires a life status change qualifying event.) Fund Coinsurance (Percentage at which the Fund will reimburse) Fund

HEALTHFUND PLAN FEATURES HealthFund Amount (Per plan year. Fund changes between tiers requires a life status change qualifying event.) Fund Coinsurance (Percentage at which the Fund will reimburse) Fund

Aetna Life Insurance Company

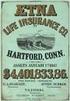

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN GP-861472 This Amendment is effective

Aetna Life Insurance Company Hartford, Connecticut 06156 Amendment Policyholder: Group Policy No.: Effective Date: UNIVERSITY OF PENNSYLVANIA POSTDOCTORAL INSURANCE PLAN GP-861472 This Amendment is effective

Important Questions Answers Why this Matters: What is the overall deductible?

Important Questions Answers Why this Matters: What is the overall deductible? Are there other deductibles for specific services? Is there an out of pocket limit on my expenses? What is not included in

Important Questions Answers Why this Matters: What is the overall deductible? Are there other deductibles for specific services? Is there an out of pocket limit on my expenses? What is not included in

Plans. Who is eligible to enroll in the Plan? Blue Care Network (BCN) Health Alliance Plan (HAP) Health Plus. McLaren Health Plan

Who is eligible to enroll in the Plan? All State of Michigan Employees who reside in the coverage area determined by zip code. All State of Michigan Employees who reside in the coverage area determined

Who is eligible to enroll in the Plan? All State of Michigan Employees who reside in the coverage area determined by zip code. All State of Michigan Employees who reside in the coverage area determined

Aetna Whole Health Houston, TX: ES Coverage Period: 01/01/2014 12/31/2014

This is only a summary. Please read the FEHB Plan brochure RI 73-873 that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth in

This is only a summary. Please read the FEHB Plan brochure RI 73-873 that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth in

Important Questions Answers Why this Matters: What is the overall deductible?

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.uhs.wisc.edu/ship or by calling 1-866-796-7899. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.uhs.wisc.edu/ship or by calling 1-866-796-7899. Important

Additional Information Provided by Aetna Life Insurance Company

Additional Information Provided by Aetna Life Insurance Company Inquiry Procedure The plan of benefits described in the Booklet-Certificate is underwritten by: Aetna Life Insurance Company (Aetna) 151

Additional Information Provided by Aetna Life Insurance Company Inquiry Procedure The plan of benefits described in the Booklet-Certificate is underwritten by: Aetna Life Insurance Company (Aetna) 151

$0 See the chart starting on page 2 for your costs for services this plan covers. Are there other deductibles for specific

This is only a summary. If you want more detail about your medical coverage and costs, you can get the complete terms in the policy or plan document at www.teamsters-hma.com or by calling 1-866-331-5913.

This is only a summary. If you want more detail about your medical coverage and costs, you can get the complete terms in the policy or plan document at www.teamsters-hma.com or by calling 1-866-331-5913.

DRAKE UNIVERSITY HEALTH PLAN

DRAKE UNIVERSITY HEALTH PLAN Effective Date: 1/1/2015 This is a general description of coverage. It is not a statement of contract. Actual coverage is subject to terms and the conditions specified in the

DRAKE UNIVERSITY HEALTH PLAN Effective Date: 1/1/2015 This is a general description of coverage. It is not a statement of contract. Actual coverage is subject to terms and the conditions specified in the

PARTICIPATING PROVIDERS / REFERRED Deductible (per calendar year)

Your HMO Plan Primary Care Physician - You choose a Primary Care Physician. The Aetna HMO Deductible provider network gives you access to a wide selection of Primary Care Physicians ( PCP's) and Specialists

Your HMO Plan Primary Care Physician - You choose a Primary Care Physician. The Aetna HMO Deductible provider network gives you access to a wide selection of Primary Care Physicians ( PCP's) and Specialists

What is the overall deductible?

Regence BlueCross BlueShield of Oregon: HSA 2.0 Coverage Period: 07/01/2013-06/30/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual & Eligible Family

Regence BlueCross BlueShield of Oregon: HSA 2.0 Coverage Period: 07/01/2013-06/30/2014 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual & Eligible Family

You can see the specialist you choose without permission from this plan.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.pekininsurance.com or by calling 1-800-371-9622. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.pekininsurance.com or by calling 1-800-371-9622. Important

International Student Health Insurance Program (ISHIP) 2014-2015

2014 2015 Medical Plan Summary for International Students Translation Services If you need an interpreter to help with oral translation services, you may contact the LifeWise Customer Service team at 1-800-971-1491

2014 2015 Medical Plan Summary for International Students Translation Services If you need an interpreter to help with oral translation services, you may contact the LifeWise Customer Service team at 1-800-971-1491

Schedule of Benefits HARVARD PILGRIM LAHEY HEALTH VALUE HMO MASSACHUSETTS MEMBER COST SHARING

Schedule of s HARVARD PILGRIM LAHEY HEALTH VALUE HMO MASSACHUSETTS ID: MD0000003378_ X Please Note: In this plan, Members have access to network benefits only from the providers in the Harvard Pilgrim-Lahey

Schedule of s HARVARD PILGRIM LAHEY HEALTH VALUE HMO MASSACHUSETTS ID: MD0000003378_ X Please Note: In this plan, Members have access to network benefits only from the providers in the Harvard Pilgrim-Lahey

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.gpatpa.com or by calling 915-887-3420. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.gpatpa.com or by calling 915-887-3420. Important Questions

PLAN DESIGN & BENEFITS - CONCENTRIC MODEL

PLAN FEATURES Deductible (per calendar year) Rice University None Family Member Coinsurance Applies to all expenses unless otherwise stated. Payment Limit (per calendar year) $1,500 Individual $3,000 Family

PLAN FEATURES Deductible (per calendar year) Rice University None Family Member Coinsurance Applies to all expenses unless otherwise stated. Payment Limit (per calendar year) $1,500 Individual $3,000 Family

You can see the specialist you choose without permission from this plan.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.pekininsurance.com or by calling 1-800-322-0160. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.pekininsurance.com or by calling 1-800-322-0160. Important

State Health Plan: Savings Plan Coverage Period: 01/01/2015-12/31/2015

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.eip.sc.gov or by calling 1-888-260-9430. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.eip.sc.gov or by calling 1-888-260-9430. Important Questions

Aetna HealthFund Health Reimbursement Account Plan (Aetna HealthFund Open Access Managed Choice POS II )

Health Fund The Health Fund amount reflected is on a per calendar year basis. If you do not use the entire fund by 12/31/2015, it will be moved into a Limited-Purpose Flexible Spending Account. Health

Health Fund The Health Fund amount reflected is on a per calendar year basis. If you do not use the entire fund by 12/31/2015, it will be moved into a Limited-Purpose Flexible Spending Account. Health

Summary of Benefits Community Advantage (HMO)

Summary of Benefits Community Advantage (HMO) January 1, 2015 - December 31, 2015 This booklet gives you a summary of what we cover and what you pay. It doesn't list every service that we cover or list

Summary of Benefits Community Advantage (HMO) January 1, 2015 - December 31, 2015 This booklet gives you a summary of what we cover and what you pay. It doesn't list every service that we cover or list

Important Questions Answers Why this Matters: What is the overall deductible? Are there other deductibles for specific services?

: VIVA HEALTH Access Plan Coverage Period: 01/01/2015 12/31/2015 This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document

: VIVA HEALTH Access Plan Coverage Period: 01/01/2015 12/31/2015 This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document

Coverage for: Individual, Family Plan Type: PPO. Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bbsionline.com or by calling 1-866-927-2200. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.bbsionline.com or by calling 1-866-927-2200. Important

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.pplusic.com or by calling 608-282-8900 (1-800-545-5015).

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.pplusic.com or by calling 608-282-8900 (1-800-545-5015).

Bowling Green State University : Plan B Summary of Benefits and Coverage: What This Plan Covers & What it Costs

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at MedMutual.com/SBC or by calling 800.540.2583. Important Questions

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at MedMutual.com/SBC or by calling 800.540.2583. Important Questions

Student Health Insurance Plan Insurance Company Coverage Period: 07/01/2015-06/30/2016

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.studentplanscenter.com or by calling 1-800-756-3702.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.studentplanscenter.com or by calling 1-800-756-3702.

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.studentplanscenter.com or by calling 1-800-756-3702.

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.studentplanscenter.com or by calling 1-800-756-3702.

Lesser of $200 or 20% (surgery) $10 per visit. $35 $100/trip $50/trip $75/trip $50/trip

HOSPITAL SERVICES Hospital Inpatient : Paid in full, Non-network: Hospital charges subject to 10% of billed charges up to coinsurance maximum. Non-participating provider charges subject to Basic Medical

HOSPITAL SERVICES Hospital Inpatient : Paid in full, Non-network: Hospital charges subject to 10% of billed charges up to coinsurance maximum. Non-participating provider charges subject to Basic Medical

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at https://www.cs.ny.gov/employee-benefits or by calling 1-877-7-NYSHIP

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at https://www.cs.ny.gov/employee-benefits or by calling 1-877-7-NYSHIP

[2015] SUMMARY OF BENEFITS H1189_2015SB

![[2015] SUMMARY OF BENEFITS H1189_2015SB [2015] SUMMARY OF BENEFITS H1189_2015SB](/thumbs/32/15705129.jpg) [2015] SUMMARY OF BENEFITS H1189_2015SB Section I You have choices in your health care One choice is to get your Medicare benefits through Original Medicare (fee-for-service Medicare). Original Medicare

[2015] SUMMARY OF BENEFITS H1189_2015SB Section I You have choices in your health care One choice is to get your Medicare benefits through Original Medicare (fee-for-service Medicare). Original Medicare

Important Questions Answers Why this Matters:

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthoptions.org or by calling 1-855-624-6463. Important

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document at www.healthoptions.org or by calling 1-855-624-6463. Important

Important Questions Answers Why this Matters:

Student Employee Health Plan: NYS Health Insurance Program Coverage Period: 01/01/2015 12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family

Student Employee Health Plan: NYS Health Insurance Program Coverage Period: 01/01/2015 12/31/2015 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family

SERVICES IN-NETWORK COVERAGE OUT-OF-NETWORK COVERAGE

COVENTRY HEALTH AND LIFE INSURANCE COMPANY 3838 N. Causeway Blvd. Suite 3350 Metairie, LA 70002 1-800-341-6613 SCHEDULE OF BENEFITS BENEFITS AND PRIOR AUTHORIZATION REQUIREMENTS ARE SET FORTH IN ARTICLES

COVENTRY HEALTH AND LIFE INSURANCE COMPANY 3838 N. Causeway Blvd. Suite 3350 Metairie, LA 70002 1-800-341-6613 SCHEDULE OF BENEFITS BENEFITS AND PRIOR AUTHORIZATION REQUIREMENTS ARE SET FORTH IN ARTICLES

SUMMARY OF BENEFITS. Cigna Health and Life Insurance Co. Laramie County School District 2 Open Access Plus Base - Effective 7/1/2015

SUMMARY OF BENEFITS Cigna Health and Life Insurance Co. Laramie County School District 2 Open Access Plus Base - Effective General Services In-Network Out-of-Network Physician office visit Urgent care

SUMMARY OF BENEFITS Cigna Health and Life Insurance Co. Laramie County School District 2 Open Access Plus Base - Effective General Services In-Network Out-of-Network Physician office visit Urgent care

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC.

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC. CPOS II DEDUCTIBLE, COPAYS/COINSURANCE AND DOLLAR MAXIMUMS and Aligned Deductible

HEALTH SAVINGS PPO PLAN (WITH HSA) - COLUMBUS PROVIDED BY AETNA LIFE INSURANCE COMPANY EFFECTIVE JANUARY 1, 2016 AETNA INC. CPOS II DEDUCTIBLE, COPAYS/COINSURANCE AND DOLLAR MAXIMUMS and Aligned Deductible

Important Questions Answers Why this Matters:

33653ME010030915 Community Balance H S A Coverage Period: [1/1/2016-12/31/2016] This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy

33653ME010030915 Community Balance H S A Coverage Period: [1/1/2016-12/31/2016] This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy